Please Note: Blog posts are not selected, edited or screened by Seeking Alpha editors.

Having been a TSX Venture trader for more than a decade, I've seen plenty of quick movers. Stocks that can gain 500% or more in the span of a few days. But the sheer volume of stocks that have moved heavily in a short period of time as well as ones that have sustained a large move over a longer period of time is something that I haven't seen before. It's attracting a lot of shorters and producing a lot of short squeezes on shorts that have jumped in too quickly or on the wrong stock.

Here are three stocks that I think are due for epic short squeezes in the near future. There are probably plenty more, but these are three that I own and have varying degrees of familiarity with their respective stories. It's good for investors to know that I own these three stocks, because, you know, people apparently need to have their hands held and be treated like little children who can't figure out for themselves that pretty much every investment writer out there is going to have their own agenda.

Saint Jean Carbon

Saint Jean Carbon Inc. (OTCQB:TORVF)(SJL.V) had a wild ride this week upon announcing a deal with Panasonic and later clarifying that deal. There were some doubts over the language in the original press release, particularly with the line "The order is part of an offtake agreement to supply multiple tonnes of anode material monthly for a number of years" which made it appear to some people that the offtake agreement was signed when it hasn't been made official yet at this time.

I first traded the stock successfully while it was a hot potato, then decided to open a longer term position on Friday after the clarifying news release knocked the momentum out of the stock and it closed down 41% to 15 cents. SJL has well over 200 million fully diluted shares outstanding with a bunch of warrants at 5 and 6 cents that will likely be exercised with the stock price well above that level.

Given this trial order with Panasonic and interesting technology, I personally found the $30 to $40 million market cap a fair price to pay in order to speculate on the outcome of this deal. The first order is expected to be shipped by May 25th and the clarified press release states that "Both companies are working to finalize the proposed offtake agreement as soon as possible". So if the stock price shaved off 11 cents on Friday because people thought the offtake agreement was active when it wasn't, wouldn't this be basis to suggest that the SJL will move back up at least 11 cents upon the announcement that the offtake agreement has been finalized?

SJL traded extremely heavily during the week and attracted a lot of detractors on its way up as people weren't clear about the terms of the deal as well as many on the way down who posed as shareholders scorned by chasing SJL over 30 cents. Looking at the IIROC short trade marker data, it would seem that different motives were at play:

We can see that between February 16th and March 1st a total of 20,820,000 volume worth of trades were marked as short sells, 30% of all volume. This comprised only 17% of total trades so the average short size was nearly double that of an average long trade. We can probably assume that the bulk, if not all of it, took place this past week after the Panasonic deal was first announced. IIROC only marks the short sales when they open. They do not mark them when they are covered so we don't know the open short position just by looking at this data. In another pathetic attempt to squeeze money out of investors while withholding important information, the TSX requires payment to view short positions of all Venture-listed stocks. The NASDAQ and even the CSE report outstanding short volume on all of their listings and displays them for free twice a month. Shame on the TSX.

Now while the more than 20 million short-marked trades represent volume only, we can still assume that a big chunk of it was outstanding positions, or at least was while SJL rocketed to 35 cents. Notice that the 20.82 million in volume represented only $2.475 million in value. That means the average short-marked trade occurred at 11.9 cents per share on a stock that hit a high of 35 cents on March 1st. Some of these shorts may have been forced to cover at 100-200% losses - ouch! No wonder so many of them are grouchy and really want to trash the stock.

Shareholders who sold their stock above 30 cents generally didn't win on the backs of other investors buying at higher prices, they won on the broken backs of shorts. There probably are some people who rushed in above 30 cents trying to cash in on a momentum play who were derailed by Friday's clarifying news release and who feel genuine anger. But for investors with a mindset like mine, one that knows the high risks of this prospective technology but also sees high potential rewards and two near-term catalysts - the Panasonic offtake deal closing and the first trial shipment - there is not too much to be angry about. It's an opportunity to buy in at a cheaper price.

Now who would really have a reason to be angry or feign anger over Friday's news release? Could it be the shorts who had to cover at -100% or worse losses? How about the shorts who have open positions in the low teens and desperately want to cover with no losses? I've seen comments about how CEO Paul Ogilvie is a lazy person or seedy character without providing a shred of evidence. I've also seen commentary that dives into SJL's news releases deeper than Sherlock Holmes would a crime scene.

When people throw everything AND the kitchen sink at SJL to throw doubt around this play it gets me thinking. I know the mindset of a short because I AM a short under the right circumstances. I relentlessly trashed Valeant Pharmaceuticals (NYSE:VRX) throughout Q4 2015 when the stock was trading at around $100 U.S. Earlier that year, Penn West(NYSE:PWE)(PWT.TO) and Lightstream (OTC:LSTMF)(LTS.TO) were two oil companies that I said were headed towards restructuring. I even got quoted in the Globe & Mail for it. So far I'm scoring one of out the two on those bold restructuring calls.

For anyone who thinks I am cherry picking results, I am a bit. But you are free to check out my rank on TipRanks where I am in the top 15% of all financial commentators, with a pretty even distribution between long and short calls on a variety of stocks. My short calls are the one that dominate my performance. However, take note that these results don't include my recent lucky streak on long positions on TSX Venture stocks:

For any bearish commentators around SJL, I suggest that investors at least look up the history of those individuals to see if their calls are worth their weight. Especially if their articles are loaded with South Park references, swears and are meant for "Millennial investors", whatever that means. Because, you know, Millennials with their high structural unemployment, high student debt and who are being squeezed out of the housing market due to out of control real estate prices are TOTALLY the demographic to be catering to for investment advice, with their massive disposable incomes and all.

A short bet that a seedy house of cards like Valeant was about to collapse or that overleveraged oil companies were about to go under is a lot different than a short on a company like SJL. SJL has a binary outcome. Either the Panasonic deal goes through and the stock moves up who knows how high or it doesn't and the stock goes back to where it was before in the 3 to 7 cent range. With this clarification, the TSX Venture Exchange has likely scoured SJL's recent press releases and agrees that SJL is speaking with Panasonic, at least to a level that Panasonic can be mentioned in a press release. So there is no fraud going on here.

To me, the short trade on SJL just doesn't make any sense. A short risks unlimited downside shorting an event-based penny stock where the best case scenario is picking up a few pennies should the deal fall through and company has to go back to the drawing board. I think shorts are very well aware that they are on the wrong side of an asymmetrical return range and are desperate to put as much bearish commentary out on the stock as possible so they can cover as soon as possible at as low of a price as possible before any positive news could come out.

Here's what I think will happen. Shorts will keep their positions open in hopes that the stock drifts downwards while it's in a quieter period. Eventually they will have to cover and it's wise to do it sooner rather than later before an update to the Panasonic deal. That should bring about enough buy volume to cause a mini-squeeze, maybe to 20 or more cents. A few brave souls who are convinced that the Panasonic deal will fall through might try to hold a short position until the company releases information that supports that outcome. If they are wrong and SJL is successful in procuring Panasonic as a client, the stock will likely run well in excess of 100% and good luck trying to cover a short in that craziness.

One mitigating factor to a short squeeze could be that it is warrant holders who are the driving force behind the short volume. Instead of covering on the market, they will cover their short position through the exercise of the warrants. The silver lining to this is that it will limit future dilution as it will eliminate the warrants and bring much-needed cash into the company's coffers.

I have set up a group on Facebook for investors interested in SJL and similar type of companies generally in the advanced battery space called the "I hope my dinky little TSX company gets bought out by Tesla Investors Group":

https://www.facebook.com/groups/1852399928348312/

I didn't want to make a group exclusively for SJL since the nature of these companies means that there will be long periods of time with no news. I also intend to talk about other investments in this group like Stans Energy (HRE.V) and Manganese X (MN.V).

Durango Resources

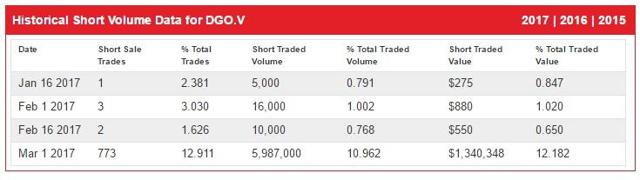

Durango Resources Inc. (OTC:ATOXF) (DGO.V) has also moved up a lot lately due to the three offers on its Trove Property as disclosed by the company. I have written plenty about Durango and these offers hereand here. Here is a summary of the short-marked trades as of March 1st:

We see that the short volume spiked during the last two weeks, though only a little over 10% of all trades. Unlike SJL, DGO shorts aren't under water as the average short price works out to be 22.4 cents and the stock closed at 19.5 cents on Friday. I would suggest that some of the volume we have seen over the past couple of days was short covering. However, if one of these deals is made public and supports greater than a $6 million market cap or if a fourth bidder is announced, the stock price could spike up and squeeze out any remaining shorts in the process, adding fuel to the fire on any buying momentum.

I have set up a group on Facebook for investors interested in Durango and the outcome of these three offers at Trove:

https://www.facebook.com/groups/1829696320630644/

First Global Data

Unlike the first two stocks which are more speculative positions for me, I speak with much greater authority and confidence on First Global Data (OTC:FGBDF)(FGD.V). It's in my investment wheelhouse of fintech, has already shown profits and I have written numerous blogs on the company through a lot of research and personal contact with the CEO. My position in FGD is far larger than my position on SJL or DGO.

Here is a summary of the short-marked trades as of March 1st:

Short volume dropped from 13.5 million over the first two weeks of February to 8.2 million for the latter two weeks, but has actually increased from 22% to 27% of total traded volume. As the stock rises in price, volume will decline as it takes less volume to fill the same dollar investment in a trade. Despite short volume declining 40% period-to-period, the dollar value of those trades declined only 25% from $8.7 million to $6.5 million. For those of you who skipped the first two sections and went straight for my commentary on FGD, I remind you that this isn't necessarily open short positions, but trades marked as shorts during the time period which may have been covered or may still be open.

The shorts keep on bringing it despite having lost badly in the first half of February as the average price of a short trade was 64.3 cents and FGD hit a high of 95 cents recently. The shorts in the second week of February are fairing a bit better, more or less breakeven as the stock closed at $0.80 before being halted all day on Friday.

FGD has come into some administrative issues as the TSX Venture Exchange rejected the latest private placement at $0.50. The company stated that it is considering a new private placement at a higher price and I believe that the halt may be for facilitating that deal. Once that deal closes and the stock trades again I think it will continue its move upwards, once again leaving shorts in a squeezed position.

I have set up a group on Facebook for investors interested in First Global Data:

https://www.facebook.com/groups/377851355894645/

Conclusion

As a shareholder of all three of the above companies, I feel comfortable with my investments. Once again making note that my position in FGD is far greater than the other two. They all are speculative investments to various degrees, but none of the bearish arguments put forth by shorts have gotten me to reconsider my stance. I will continue to hold these stocks through news events, unless they run to a price that I feel no longer represents a good risk-to-reward scenario. A short squeeze could help fuel that fire.

I wrote this article with strategic intent. SJL is one of the most heavily traded stocks recently with many, many eyeballs on it. DGO has gotten a lot of attention as well. FGD has been a steady climber and my articles on the company have been garnering a lot of attention from investors interested in high-growth fintech plays. All three stocks cater to very different crowds which means interested investors in one of these stocks may be introduced to the other two for the first time here. If those investors also come to the same conclusion as I have that all three of these stocks represent good speculative investments at their current prices, this could add to buying pressure. Let's go burn some shorts!

Disclosure: I am/we are long FGBDF, ATOXF, TORVF.