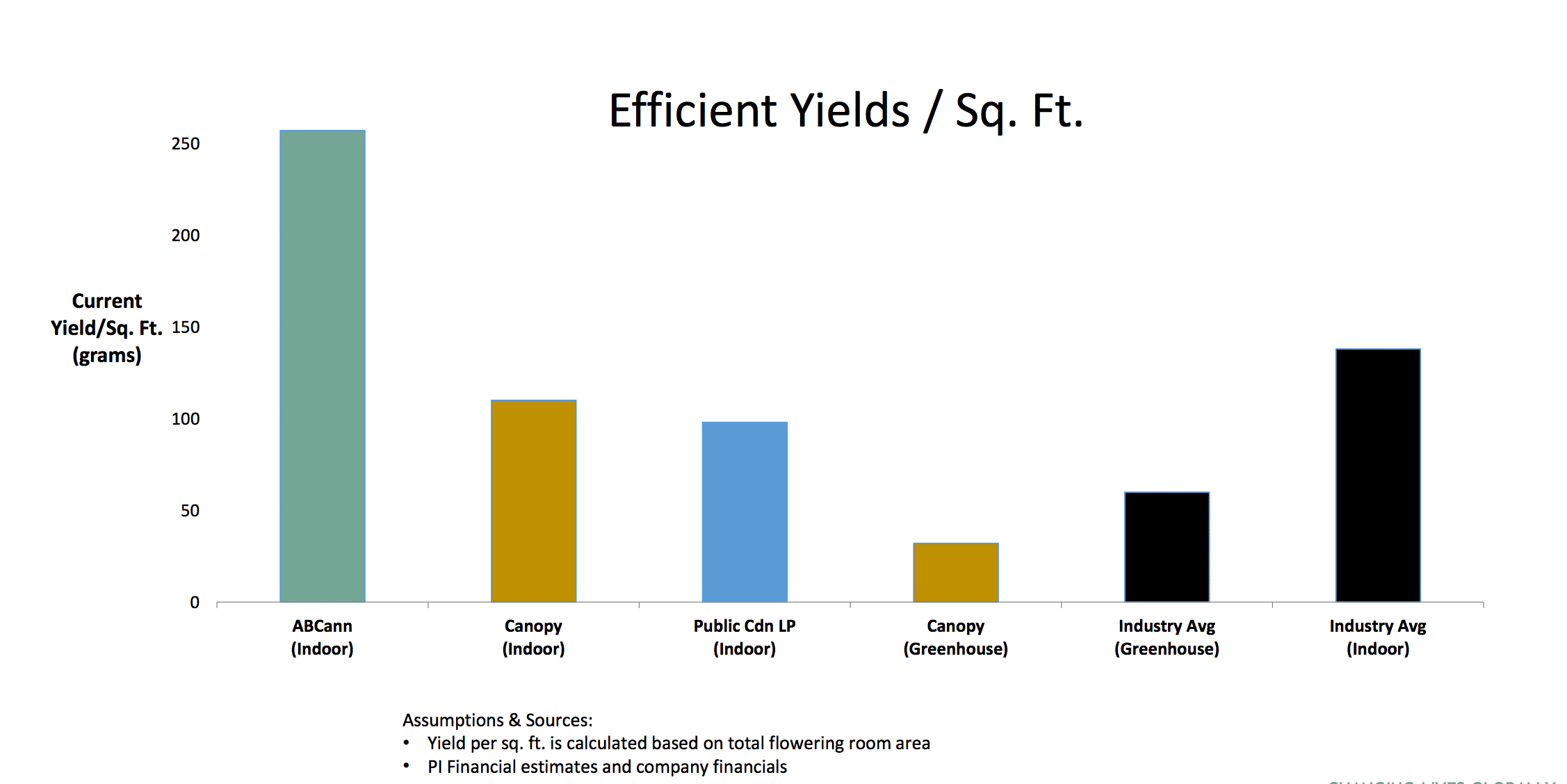

ABcann Is In The Best Position For Huge Gains!Before going public these guys have been supplying other producers with their consistent premium grade cannabis that sells for $10 to $14 per gram - industry average is $8/gram! They've also partnered with the University of Guelph over the last 3 years to grow cannabis in their "controlled environmental systems research facility'. Their research has provided them a growing technology that yields an industry high of 250 - 300 grams/sq ft - the industry average is 150/sq ft. Simple math automatically implies that ABcann could easily be amongst the top 5 producers within 18 months.

ABcann is currently involved in supplying cannabis and R&D with an Israeli company that has invented the "Syque" - the world's first selective-dose pharmaceutical grade medicinal plant inhaler. Teva a $32 billion dollar market cap company will be distributing the Syque.

"After visiting ABcann's production facility in Canada, I personally witnessed that their production technologies put them in a class with the best in the world in their ability to produce standardized pharmaceutical grade cannabis.”

Perry Davidson Founder, Syqe Medical

So much more going for ABcann than any other cannabis play right now! I wouldn't be surprised that ABcann gets taken over real soon as many producers need ABcann's growing technology since most are struggling to mainatain lower yield crops with chemicals and pesticides!

A definite good read:

Abcann: One of the Most Advanced Licensed Producers

Canada is about to become the epicenter of one of the fastest growing and extremely profitable industries in the world.

Starting next year, our nation is expected to give itself an economic boost estimated to be worth more than $22 billion a year.

The lead up to this economic boost has already made millionaires upon millionaires for those already invested in its growth.

It’s precisely why I have placed more bets in this sector over the last year (and more this year) than any other sector.

It’s why I have been telling others to do the same.

You guessed it: I am talking about Marijuana. Weed. Cannabis.

image: https://www.equedia.com/wp-content/uploads/2017/05/marijuana.jpg

Whatever you want to call it, this green rush is paving the way for a massive economic boom – not just in Canada, but all around the world.

The globalization of marijuana has yet to even scratch the surface of its economic potential.

More importantly, that means the potential profits from this new industry haven’t even come close to being understood.

It’s no wonder politicians and even tech moguls like Microsoft are placing big bets on it.

Even Silicon Valley is going nuts:

Via Pitchbook:

“… after already setting a new high last year, VCs (Venture Capitalists) are on pace to make a record number of new deals in the cannabis industry during 2017.”

One look through Angel List, one of the largest websites for startups and investors, and you can see hundreds of big name tech moguls and investors interested in the space.

Even investors from the biggest VC firms in the world, like Sequoia Capital, are interested.

Billionaires are also on the green rush.

Take VC Peter Thiel (PayPal co-founder and serial investor) who staked $75 million on a marijuana venture firm at a whopping $425 million valuation through his Founders Fund.

How about George Soros who previously waged a campaign to legalize pot in Uruguay*. He also spent millions on legalization in the U.S.

(*His efforts paved the way for Uruguay to become the first country to completely legalize marijuana.)

How about Sean Parker of Napster and Facebook fame who not only invested in the marijuana sector but has also raised millions of dollars lobbying for legalization.

And yes, politicians are doing the same.

Take Gary Johnson, a former governor and presidential candidate who has turned into the CEO of a marijuana Company.

For many years, Big Pharma has been rallying against marijuana as it’s an immediate threat to many of the meds on the market today.

But now, it appears the battle is almost lost as Big Pharma has begun to join in the green rush.

Even pharmacies such as Shoppers Drug Mart want in on the action.

You get the point.

But the best part is you don’t have to be a serial VC with deep Silicon Valley connections, a billionaire, nor have political connections to be part of this economic boom.

Bigger Than You Think

In just a few years, marijuana is expected to create more than 250,000 jobs in the U.S. alone.

According to Forbes, the number of jobs the marijuana industry will create is “more than the expected jobs from manufacturing, utilities or even government jobs, according to the Bureau of Labor Statistics.”

In fact, sales of marijuana in the U.S. are expected to more than triple:

Via Forbes:

“The legal cannabis market was worth an estimated $7.2 billion in 2016 and is projected to grow at a compound annual rate of 17%.

Medical marijuana sales are projected to grow from $4.7 billion in 2016 to $13.3 billion in 2020.

Adult recreational sales are estimated to jump from $2.6 billion in 2016 to $11.2 billion by 2020.”

But here’s the thing…

The BIGGEST opportunity right now isn’t even in the United States.

It’s right here in Canada.

In this Letter, I am not only going to introduce you to why we’re still at the ground floor of this booming sector, but I am going to share with you the next big marijuana IPO that I believe is about to break out.

And it all begins today.

But first…

Ready to BOOM

It is estimated that sales of marijuana and oils in Canada last year will amount to somewhere between $180-240 million – that doesn’t even factor in paraphernalia or other downstream products.

But that’s nothing compared to what it could become.

As I mentioned in a previous Letter, Deloitte estimates that the legal marijuana

market could be worth more than $22 billion within the next few years.

That’s around a 10,000% increase from where it is today.

And just a few weeks ago, these massive gains became within reach.

Earlier this month, Canada announced it would become the first G7 country to legalize marijuana.

image: https://www.equedia.com/wp-content/uploads/2017/05/canadamarijuanaslim.jpg

This is MASSIVE news.

Through the proposed Cannabis Act, Canada is expected to legalize marijuana for recreational use by no later than July 2018.

So, while it remains illegal now, the legislative process is in full motion.

And almost everyone expects it to pass*.

(*Of course, this also means that when and if the legislation passes, we could witness yet another spike in marijuana stocks)

But even with the passing of legislation, Canada’s $22 billion economic potential may just be the tip of the iceberg.

That’s because Canada is set to become…

The Marijuana Capital of the World

Canada has been the mining capital of the world for many years.

The number of millionaires and billionaires this country has created in the mining space are second to none.

Back in 2013, I wrote:

“The Toronto Stock Exchange (TSX) and the TSX Venture Exchange are home to 58 per cent of the world’s public mining companies.

… In 2012, 70% of the equity capital raised globally for mining companies was raised on TSX and the TSX Venture in 2012.”

Why is this significant?

Because Canada isn’t even one of the top five biggest mining countries in the world.

Yet, just a few years ago, our nation hosted more than 58% of the world’s public mining companies and more than 70% of the equity capital raised globally for mining companies was done right here in Canada!

That same global investment trend and capital inflow for marijuana are now being fueled directly into Canada and nearly $1 billion of capital have been raised in the last 12 months alone.

This represents the single biggest capital market for marijuana today.

That’s because Canada remains one of the safest way for global investors to invest in marijuana.

For example, in the United States, marijuana remains illegal on a federal level.

That means the big banks won’t touch it. That’s why in the eight U.S. states where it’s legal, deals are almost done entirely in cash.

Meanwhile, Canada is already home to several large marijuana corporations that not only trade on the Toronto Stock Exchange and the TSX Venture but are fast becoming the global marijuana experts.

With Canada likely becoming the first G7 country to legalize marijuana on a recreational level, that same global investment trend we saw for mining is now coming for marijuana.

That means Companies that have a global approach and the best technology and production protocols stand the best chance to capture the international market and its investment dollars.

In just a bit, I’ll introduce you to one unknown Company that has the best of both worlds.

Where to Look

There is no question that the marijuana boom is set to create a whole new class of marijuana millionaires.

In fact, I am sure many of us have all made money investing in marijuana stocks already. But I think there is much more to come.

With so many publicly listed Licensed Producers to choose from and so many marijuana stocks having potentially already priced in legalization, where should one look to invest now?

Over the last year, I have been aggressively looking at and investing in marijuana plays – some public, some private.

I’ve visited numerous companies and have seen the operations of companies not only in Canada but in the U.S. as well.

There are many that I like.

But I must admit: many of them could be considered overvalued right now.

It’s not because I don’t believe that current valuations will one day match their revenue and potential.

It’s because almost all of them are being valued only by the potential of future sales. While that’s okay because that’s what the market should be – an indicator of future expectations – it’s far from the only thing we should be looking at when valuing these companies.

Not Everyone is Doing it Right

We’re still in the very early stages of the marijuana boom cycle.

And while millions of dollars have been raised to increase growing capacity, many of the licensed producers have yet to figure out how to scale efficiently while maintaining consistency in the quality of their product.

Many of them have gone with the approach of “build big” before “build for quality.”

Being that marijuana is a notoriously difficult crop to grow at scale, scaling up before the problems are solved can be a dangerous game.

image: https://www.equedia.com/wp-content/uploads/2017/05/dangerouspesticides.jpg

For example, we have already witnessed numerous recalls due to pesticides from some of the biggest marijuana companies in Canada today.

And just yesterday, we saw yet another big name do the same.

It’s no secret that pesticides are one of the biggest issues when it comes to growing marijuana.

Via Steep Hill:

“Steep Hill, the global leader in cannabis testing and analytics, published an early report on the prevalence of pesticide contamination in the medical cannabis supply chain in California.

According to the lab’s new technology and recently launched “quantified pesticide analysis,” 84.3% of cannabis samples submitted in Steep Hill’s Berkeley lab tested positive for pesticide residues.”

Just how dangerous is this?

“…Myclobutanil, typically sprayed on California grapes, almonds and strawberries, is legally listed as a “general use pesticide,” but heating up the chemical, as is the case when smoking cannabis, converts Myclobutanil into Hydrogen Cyanide.

Hydrogen Cyanide is a Schedule 3 substance under the Chemical Weapons Convention.

Of paramount concern is the extremely high level of Myclobutanil detected in cannabis samples tested by Steep Hill, which is in excess of 65% of all samples.”

Hydrogen cyanide is poisonous and can be lethal in large doses.

That’s why it’s even used in chemical weapons.

Via Cyanide Code:

“A hydrogen cyanide concentration in the range of 100-200 ppm in air will kill a human within 10 to 60 minutes. A hydrogen cyanide concentration of 2000 ppm (about 2380 mg/m3) will kill a human in about 1 minute.”

Scary stuff.

In other words, what marijuana users believe may be curing their ailments, may actually be killing them.

The Need for Pesticides?

Growing marijuana at scale represents numerous problems – even more so than simply growing fruits and veggies.

The humidity and temperature required for growing marijuana represent a breeding ground for pests, fungi, and mold – many which are very hard to deal with once they appear.

Worst of all, these pests can spread like wildfire.

image: https://www.equedia.com/wp-content/uploads/2017/05/marijuanabugs.jpg

One bad crop and a producer can lose millions of dollars overnight.

The use of pesticides may sound scary, but its the most cost-effective and efficient way of eliminating pests.

But what if you didn’t have to rely on pesticides?

What if there was a proprietary growing process that helps to prevent pests before they even appear?

There is.

And one Company has figured it out.

You see, this Company spent years in the lab and raised over $43 million since incorporation to develop a standardized production practice that is considered to produce one of the most consistent pharma-grade products on the market.

It’s computer-controlled growing environment monitors and controls several growing variables that not only maximizes growth but avoids plant disease.

That means the Company is not only able to grow everything organically and without the use of pesticides but it produces one of the highest yields per square feet (sq. ft.) of any of the Licensed Producers (LP) today.

It’s no wonder it has one of the highest customer retention rates in the industry.

So, while other LP’s are busy still learning how to grow while losing money with recalls, this Company has figured it out and is now on the verge of expansion.

An expansion that could one day make it one of the largest Licensed Producers on the market.

Best of all, it’s expansion plans include a global strategy that is already in motion.

And the Company becomes public today…

ABcann Global Corp.

(TSX Venture: ABCN)

Having grown up in British Columbia, I am no stranger to what marijuana users want.

There is a reason people from around the world have dubbed premium marijuana as “BC Bud.”

Marijuana users from around the world have specifically come to BC, Canada to experience the premium marijuana products that BC offers.

Why is this important?

Because while everyone is focused on growing mass amounts of recreational products, what they forget is that eventually – and very quickly – people will gravitate towards the best.

And ABcann’s product is considered by many in the industry as one of the best in the business.

This is important not just for sales, but for a much bigger reason. One that could make ABcann the leader of a multi-billion dollar international market.

More on this in a bit.

Plants for Medicine

Many successful companies begin as a result of a need from its founders.

In this case, it was a life-changing event from founder Ken Clement that spurred the beginning of ABcann.

This is important because ABcann’s origin is what sets them apart from many of the Licensed Producers today.

In September 2002, Ken’s son was born without an esophagus.

His son spent many years in the hospital enduring reconstructive surgeries.

During this time, Ken was introduced to plant-based supplements by a nurse, and now a dear friend.

These supplements helped to expedite his son’s healing process, but had it not been for the advice of his friend, the experience may have been much more difficult.

Doctors would have never prescribed or suggested these plant-based supplements.

Through his experience, Ken caught sight of an obstacle for physicians; without clinical trials, the anecdotal evidence supporting natural medicine would never be taken seriously – even if the profound healing effects of certain plants were real.

It became Ken’s obsession to grow “plants for medicine.”

In 2013, he got his shot.

The Government of Canada implemented the Marihuana for Medical Purposes Regulations (MMPR) that created conditions for a commercial industry responsible for the production and distribution of marijuana for medical purposes.

Ken went to work and convinced the Napanee city council of Ontario to allow a medical cannabis operation.

As a result, in March 2014, ABcann became one of the first companies to receive its cultivation license.

Putting Science First

Plants have long been used as medicine in many parts of the world and for thousands of years.

But to be taken seriously and to harness its modern medicinal benefits, consistency is vital.

That means the growth cycle of the plant must be monitored in an advanced and highly controlled fashion in order to produce a standardized product.

So, while other Licensed Producers raised money to simply grow weed in large amounts, ABcann went a different approach.

The University of Guelph

In January 2014, ABcann and the Controlled Environment Systems Research Facility (CESRF) at the University of Guelph officially entered into a research collaboration designed to address the optimum environment control “recipe” for cannabis production.

This research was led by Dr. Mike Dixon, a professor in the School of Environmental Sciences and Director of CESRF and program.

image: https://www.equedia.com/wp-content/uploads/2017/05/University-of-Guelph-Research.png

Their objective was to design and develop a standardized production practice yielding a standardized medicinal commodity worthy of pharmaceutical status.

And that’s precisely what they have done.

Over the last few years, ABcann spent its resources on research and development, perfecting its growing process.

“The challenge is to reliably homogenize the environmental experience for the plants, so they all behave the same and produce the same medicinal compounds. The only way to achieve that is to grow plants in a very precisely controlled, predictable and reproducible manner.” – Michael Dixon, University of Guelph

Today, every variable in ABcann’s growing, curing and harvesting process is controlled and monitored by computers and feature the most advanced technologies and procedures that I have ever seen in a marijuana growing facility.

image: https://www.equedia.com/wp-content/uploads/2017/05/water-purification-abcann-300x300.jpg

Everything from air quality, CO2 levels, oxygen levels, water quality and volume, light spectrum and cycles, temperature and humidity, plant nutrition and the curing process is monitored and adjusted by computers.

Everything from air quality, CO2 levels, oxygen levels, water quality and volume, light spectrum and cycles, temperature and humidity, plant nutrition and the curing process is monitored and adjusted by computers.

One small dip in the CO2 levels in a room and the computer automatically corrects it. One small drop in the temperature or humidity and the computers correct that, too.

This proprietary growing system results in less water and energy, no mold or bacteria, and significant fertilizer and electrical savings – all leading to lower costs of production.

But more importantly, ABcann’s products are all certified organic, and grown without the use of pesticides.

The process is so intricate that the system can even replicate the natural environment of any geographic location – even during specific times of days.

Growing an Afghan Kush strain? Just tell the system to replicate the exact environment of the Hindi Kush mountain ranges in Afghanistan.

The result?

One of the highest yields per square feet – nearly doubling the industry average.

image: https://www.equedia.com/wp-content/uploads/2017/05/abcann-yields.png

It’s no wonder ABcann has grown its patient base by 30%, month over month since September 2016.

But not only are the patients growing, they’re staying.

ABcann has one of the highest customer retention rates in the country, with a re-order rate of 94.7%.

Take a look at their corporate video which explains their dedication to the science behind their process:

The Vanluven Facility

ABcann’s primary operation is a 14,500-sq. ft. facility in Napanee, Ontario.

However, it would be better to describe the facility as a research lab that monitors and maintains every variable that impacts the growth of a cannabis plant.

I am not kidding, it really is like walking into a research lab.

image: https://www.equedia.com/wp-content/uploads/2017/05/abcann-air-shower.jpg

For example, an air shower is used by personnel to reduce contaminants before entering any bloom room.

For example, an air shower is used by personnel to reduce contaminants before entering any bloom room.

Even the water is purified before it enters the growing chambers.

Current production capacity is 1,000 kg per year using two bloom rooms, but expansion is already underway to expand this to 2,000 kg per year with two more rooms.

Furthermore, a fifth room is expected to be built for further research and development, with one of the first projects being used to optimize a double layered bloom room to be used in future expansion.

More on this in a bit.

Keep in mind that while 14,500 sq. ft. and 2,000 kg of production a year may appear small when compared to the other LP’s, it’s just the beginning.

A very small beginning when compared to what ABcann could soon become…

The Mother Lode: The Kimmett Facility

Kimmett is situated just 600 metres from its Vanluven facility.

However, because Kimmett has a different address than the originally licensed facility, it must apply for a second license from Health Canada.

Health Canada has already granted ABcann a license to build out their facility at Kimmett and management expects a full cultivation/sales license next year.

This is standard practice as Health Canada is required to inspect the facility before handing out a license.

But when it does, Kimmett could become the mother lode.

A massive 65-acre, 100%-owned mother lode that could one day accommodate an estimated 1.2 million sq. ft. of additional buildings.

image: https://www.equedia.com/wp-content/uploads/2017/05/Land-Package-1024x617.png

For now, the initial building at Kimmett will be a 71,000-sq. ft. facility with a capacity to produce an additional 20,000/kg per year using the new double-layer construction ABcann is working on.

But imagine what the Company could become if it one day utilized its 65-acre property to build out a massive 1.2 million sq. ft. facility.

Let’s do some back-of-the-napkin math.

ABcann has the potential to produce 20,000/kg for every 71,000-sq. ft.

Based on a 1.2 million-sq. ft. facility, that would imply a potential production of 338,000 kg per year.

Back-of-the-napkin math shows ABcann has the future potential of producing a whopping 338,000 k/g of cannabis per year!

Even at the low end of $5/gram*, ABcann could one day have annual revenues of $1,690,000,000!

Yes, nearly $1.7 billion!

*ABcann currently sells 13 products that consist of 7 strains, with prices ranging from $5/gram to $14/gram.

Of course, lots of work is needed to reach this lofty assumption.

But if the Company executes on its expansion plans, it would not only make ABcann one of the largest players in the Canadian marijuana space, but it would have an extreme advantage with its industry-leading high-yield production methods and consistent medical grade quality.

In other words, not only has ABcann figured out how to grow marijuana properly, it has the production potential to become one of the largest Licensed Producers in Canada.

But there’s one more factor that could set ABcann apart.

Remember earlier when I talked about the global market and how Canada will become the epicenter of marijuana?

The Global Opportunity

The real value of an LP is locked in the international market. In particular, the global medical marijuana space.

In order to play in that space, you have to be extremely medicinally focused with a scientific approach.

That’s because the key to a global strategy isn’t just about how much marijuana you can export – countries will eventually learn the skill sets to do it themselves.

The key is how consistent your product is, the types of products you develop, and the scientific research behind the operations.

Take Israel, for example.

Israel’s overall marijuana market, while growing, is tiny compared to the amount of investment dollars that have gone into researching the medical marijuana market.

According to iCAN, a private cannabis research hub in Israel, the U.S., and other firms invested about $100 million in the last year alone to license Israeli medical marijuana patents, cannabis agro-tech startups and firms developing delivery devices such as inhalers.

Furthermore, iCAN expects marijuana-related investments in Israel to grow ten-fold and reach $1 billion over the next two years.

So, while everyone is focused on the recreational marijuana market in Canada, the big business is actually in the medical space.

In fact, the medical marijuana market in the U.S. alone could be worth over $20 billion in just a few years according to the Guardian, and over $50 billion globally.

That’s because medical marijuana represents a market that’s slowly being recognized in the field of medicine, but lacks a universal clinical standard.

Via Reuters:

“…Medical cannabis is a relatively new field with no universal clinical standard.

Israel aims to fill the void by combining its expertise in agriculture, technology, and cannabis-based medicine, said Yuval Landschaft, head of the health ministry’s medical cannabis unit (IMCA).

“In the United States, for example, they use recreational marijuana for medical use – that’s like making chicken soup when you have a cold,” Landschaft told Reuters. “We’re the ones making the antibiotics.”

Big Support from Marijuana Leaders

In order to be a leader in the medicinal marijuana space, you need a high-quality product grown in a lab with serious controls.

And ABcann is a leader when it comes to medical grade marijuana.

So much so, in fact, that it has attracted the attention of Israel-based Syqe Medical (Syqe), which has been testing ABcann’s product for potential inclusion in its innovative inhaler device due to the consistency of ABcann’s products.

This is important because Syqe isn’t just a small start-up – it’s a Company that has already partnered with not only the world’s biggest maker of generic drugs but also has investment from one of the world’s largest tobacco groups.

image: https://www.equedia.com/wp-content/uploads/2017/05/Syqe-inhaler-and-the-cartridge-A-1024x576.jpg

Via FT:

Via FT:

“…Start-up Syqe has developed a handheld inhaler, equipped with a disposable cartridge that dispenses marijuana in precise doses, down to the milligram.

Israel’s Teva Pharmaceuticals, the world’s biggest maker of generic drugs, recently signed an agreement with Syqe to distribute its product in Israel.

Philip Morris, the tobacco group, invested $20m in the company in early 2016 and is studying its technology as one way to reduce the danger caused by smokers of traditional tobacco products when they combust.”

ABcann has not only successfully shipped product to Syqe in Israel but is involved in ongoing testing and R & D.

I am sure more information will eventually be released on this relationship, but until then, here is what Syqe Founder Perry Davidson had to say about ABcann:

“After visiting ABcann’s production facility in Canada, I personally witnessed that their production technologies put them in a class with the best in the world in their ability to produce standardized pharmaceutical grade cannabis.” – Perry Davidson, Syqe Medical Founder

You may be thinking: How did Israel become the leader in marijuana research?

Via FT:

“…Israel’s head start in the field, like many of its other new industries, had a basis in academic research. Raphael Mechoulam, a chemist at Jerusalem’s Hebrew University, was a pioneer in isolating cannabinoids, the group of active compounds present in cannabis.”

A pioneer would be an understatement. Raphael was the first to isolate the THC compound and has over 25 academic awards including the Rothschild Prize in Chemical Sciences and Physical Sciences in 2012.

Why is this important for ABcann?

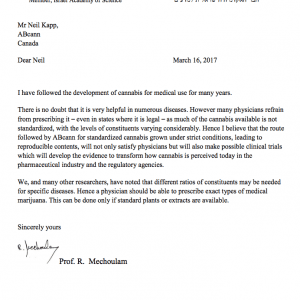

Because Raphael Mechoulam, known as the father of Cannabis, also sits on the medical advisory board for ABcann.

image: https://www.equedia.com/wp-content/uploads/2017/05/Raphael-Letter-300x300.png

Here’s what Raphael had to say about ABcann:

Here’s what Raphael had to say about ABcann:

“I believe that the route followed by ABcann for standardized cannabis grown under strict conditions, leading to reproducible contents, will not only satisfy physicians but will also make possible clinical trials which will develop the evidence to transform how cannabis is perceived today in the pharmaceutical industry and the regulatory agencies.”

ABcann’s process is supported by both Syqe and the father of Cannabis, which means in a global strategy, its standards of practice certainly stands out.

This is important because as other nations around the world begin to adopt cannabis, they may be looking to ABcann for help.

The German Opportunity

Take Germany for example, who just passed legislation on the legalization of marijuana.

Germany will begin by issuing ten initial licenses but under strict criteria.

ABcann will be applying for one of these licenses.

Given ABcann’s standard of practice and having already shown three years of required production, one would suspect that ABcann could be a priority for one of Germany’s ten initial licenses.

Now, this is just a guess, but wouldn’t it make sense for Germany to allow a partner that not only has the required three years of licensed production, but also the support from the Father of Cannabis and Syqe?

Furthermore, ABcann has assembled an impressive group which not only includes Raphael Mechoulam, but also board member Paul Lucas, the former CEO (for 18 years) of GlaxoSmithKline Canada.

Valuation Comparison

There are many marijuana stocks to choose from and as I already mentioned, I believe many are overvalued.

That’s because investors are valuing these companies simply based on how many square feet they have, how much they have in funded capacity, what their revenues could be, and even ironically how high their share prices are.

But that doesn’t factor in some of the most important factors.

For example, if you have 100,000 sq. ft. but you operate four times more efficiently, have less recalls, and a premium medical grade product, shouldn’t you be valued higher?

Conversely, if you have 100,000 sq. ft. but don’t operate efficiently and have a number of recalls, shouldn’t you be valued lower?

ABcann, while slower to go public than some of its competitors, is now doing so from a position of strength and ability.

It has not only figured out its process, but has custom, scalable growing chambers with proprietary LED lighting and procedures, which can not only be replicated in their expansion plans, but anywhere in the world.

Meanwhile, many listed marijuana companies don’t have precise strategies but have fueled their valuation based on hype. They acquire patients for big money, yet their facilities don’t even produce enough product to meet their demands.

Some will tell the world they have a big building and announce large expansion plans, even though they haven’t figured out how to consistently grow a proper batch.

That’s why many of the LP’s have resorted to buying product from other LP’s because they’ve paid a premium for patients (patients who may not stick around).

For most of these larger than life producers, it won’t be easy to go backward and suddenly build IP – if you can’t do it on a small scale and are having trouble now, how will you succeed when you’re dealing with massive expansion plans?

ABcann, on the other hand, did things differently.

The ABcann Difference

ABcann dialed in their niche of growing medical grade products, dialed in their IP, and focused on efficiency, quality, and consistency.

They didn’t just jump straight into a massive 100,000 sq. ft. facility. They didn’t pay for a massive amount of patients just to say they have a lot of patients.

They simply figured it out and are now finally ready to scale.

Since ABcann began selling products in June of last year, the company can’t keep up with demand. It’s now growing at a rate of 30 per cent, month-over-month, with a customer retention rate of 94.7 per cent.

And in addition to its individual patients, ABcann has become an important supplier to larger companies, such as Syqe, within the global cannabis industry.

“Our patient demand at the start of the year has exploded…To keep up, we need to expand, now! That’s the reason we are going public.

…We will become one of the biggest companies in the country” – Ken Clement, founder and executive chairman.

ABcann already grows one of the best and most consistent organic, non-pesticide products in Canada.

But if the Company executes on its plans, it could – as Ken Clement believes – become one of the biggest marijuana companies in the country.

I am not sure where ABcann shares will open when it begins trading today, but the last price of the financing was done at C$0.80.

PI Financial (PI) just launched coverage on ABcann with a C$2.25 price target based on funded capacity.

However, when you consider that the industry the average EV/EBITDA multiple for MMJ producers is a whopping 33.5x, according to PI, this target could be significantly higher based on ABcann’s estimated fiscal year 2019 EBITDA.

I believe ABcann represents one of the strongest marijuana growth stories and one of the more attractive licensed producers on the market today.

That’s why I expect ABcann will open higher than its last financing price of $0.80. Where it ends up, I can’t say.

But it’s certainly undervalued at $0.80 when compared to its peers.

If ABcann catches up to its peers in terms of valuation, it will be trading significantly higher.

image: https://www.equedia.com/wp-content/uploads/2017/05/Valuatinon-Comp-Abcann-1024x454.jpg

Lastly, let’s play devil’s advocate and assume that Canada might not legalize recreational marijuana next year.

If that is the case, would you want to be invested in a company that grows for quantity, or a company that grows for quality under strict medical standards?

I would pick the latter. And that latter is ABcann.