RAPAPORT PRESS RELEASE, November 7, 2023, Las Vegas… Diamond prices showed a more moderate decline in October amid holiday demand and a reduction in rough supply.

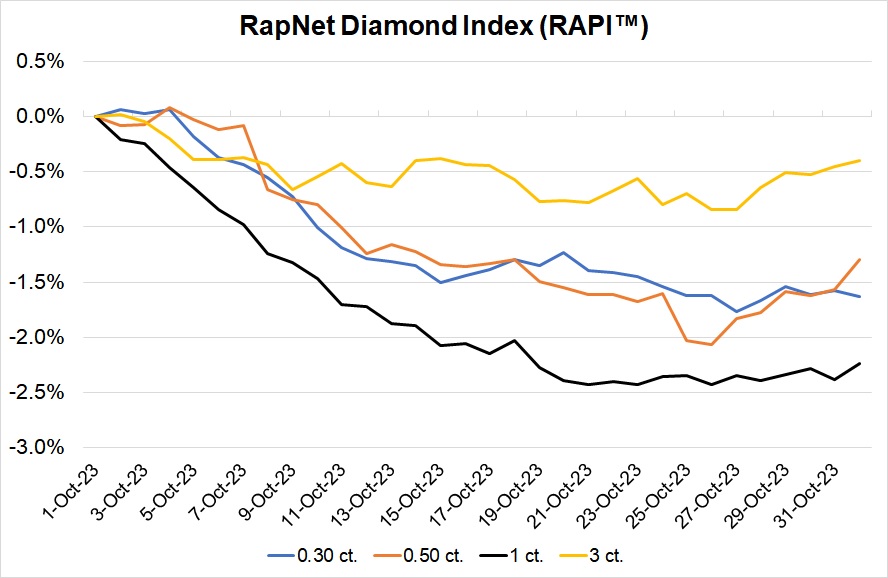

The RapNet Diamond Index (RAPI™) for 1-carat diamonds fell 2.2%, less than September’s 5.2% slump. The index for 0.30 carats dropped by 1.6%, 0.50 carats by 1.3%, and 3 carats by 0.4%.

© Copyright 2023, Rapaport USA Inc.

© Copyright 2023, Rapaport USA Inc.

Prices for rounds showed positive trends following a year of declines. RAPI for 1-carat stones gained 0.1% between October 24 and November 1. While the index for 0.30-carat goods slipped 0.1%, that of 0.50-carat diamonds — the weakest category since the start of 2023 — increased 0.3%, and the 3-carat RAPI rose 0.4%.

Rounds continued to stabilize in the first week of November. The decline in fancy shapes persisted in some areas, with VS doing better than other clarities.

In early October, Indian manufacturers worked to reduce inventories in anticipation of a weak holiday season, competition from synthetics, and further price drops. Many offloaded Russian diamonds ahead of likely Group of Seven (G7) sanctions.

The situation improved later in the month as US jewelers began their holiday purchases, seeking goods before India’s Diwali break. Surat factories will close for at least a month starting November 12, though Mumbai sales offices will be open for some of that time.

India’s two-month voluntary freeze on rough imports, which went into effect October 15, reduced pressure on inventories and liquidity. Miners’ flexibility also helped, with De Beers allowing sightholders to refuse all rough allocations at its last two sales of the year.

The industry debated ways to ban imports of Russian diamonds into G7 countries. Any measures will likely go into effect in early 2024. Rapaport has also released the US Diamond Protocol, which will restrict US imports of Russian diamonds.

The holiday outlook is mixed, as economic worries in the US and China have impacted consumer confidence. Budget-focused shoppers will likely show a further shift to synthetics, denting sales of 1- to 2-carat naturals. The extent of this trend will determine how fast the industry recovers.

Rapaport Media Contacts: media@rapaport.com

US: Sherri Hendricks +1-702-893-9400

International: Naomi Elbinger +1-718-521-4976

About the RapNet Diamond Index (RAPI™): The RAPI is the average asking price in hundred $/ct. of the 10% best-priced diamonds, for each of the top 25 quality round diamonds (D-H, IF-VS2, GIA-graded, RapSpec-A3 and better) offered for sale on RapNet® (www.rapnet.com). Additional information is available at www.rapaport.com