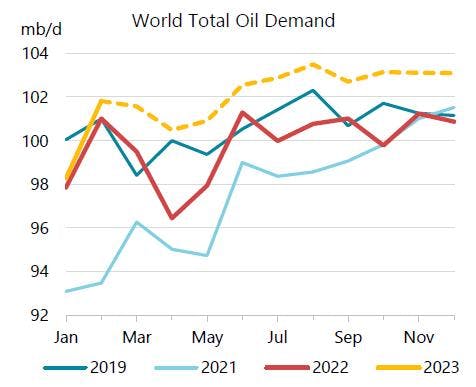

IEA raises 2023 oil demand forecast as China rebounds strongIt seems that the media is trying to spin a story that Oil demand this year is heading lower but what I see is a pool of sellers who will be caught off guard and are recklessly creating their own downfall. Anyone could have predicted that this week would see the market confused once again due to the FED yet we survived the Banking Crises, Debt Ceiling Crises, and now the final hurdle FED Rate Hike decision I see things completely differently where Oil is heading after the dust settles seeing no reason in punishing CPG, BTE, and ATH however the market will see short sellers scrambling exiting their positions in the coming months and it will be the same fools who will be the driver of higher Oil prices to come. IEA May report will be received for what it's worth once China reports any trend reversal that will satisfy the markets in the second half of 2023 on the bright side all this downward pressure with Oil Prices will cause Inflation to drop lower with that the markets will rally. Saudi must be livid that Russia is trying to benefit from their cuts increasing Oil sales causing me to believe that actions against Russia will come and when it does Oil will be heading higher.

IEA raises 2023 oil demand forecast as China rebounds strongly | Oil & Gas Journal (ogj.com)