Minneapolis Skyline

Josh Wuflestad

In our last update on Artis Real Est In Tr (ARESF, TSX:AX.UN:CA), we saw potential for upside in the diversified real estate investment trust, or REIT, and felt asset sales would save the day. We did not hold out much hope for the strategic review, but backed the NAV derived from the industrial side to prevent further price declines. Specifically, we said,

Artis will get this ratio of unencumbered assets to unsecured debt to over 2.0X by then and that should allow them to place some longer-dated debt in place. Beyond that, Artis needs to keep its head down and keep selling assets. Even small hits under their IFRS value are fine as the market is valuing it at a 60% discount to its NAV. Once the debt maturities are addressed, selling a $1 asset for 90 cents can still make sense if they buy their own units back at 50 cents on the dollar. While we are rating the common shares a Buy, our caveat here is that we are still only long the preferred shares.

Source: "Retail Asset Sales Reduce Risk Further For This 10.9% Yielder."

The preferred shares we referred to were Artis Real Estate Investment Trust PREF SHS I (AX.PR.I:CA), which we bought in late October last year. The company recently reported its Q4 2023 results and announced a few things that have made us reconsider our stance.

Q4 2023

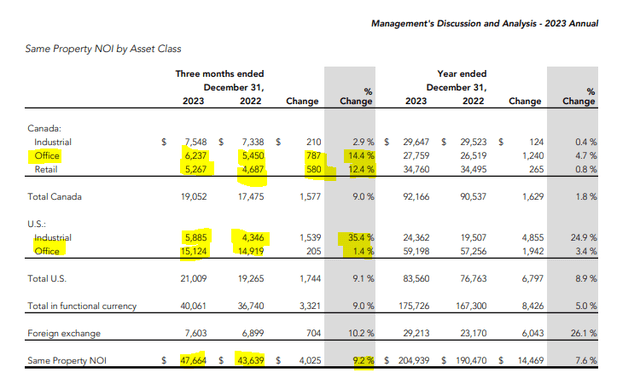

If you examined the Q4 2023 numbers from a same property net operating income ("NOI") perspective, you would think analysts would be raving mad not to put a "strong buy" on this. The gains were across the board in all three segments and in both countries. The most fascinating aspect was the 14.4% increase in office (yes office!) NOI in Canada.

Artis Q4-2023 Financials

We will note here that the U.S. office is far larger, and that did not do as well, but almost anyone will take a 1.4% gain there. U.S. industrial was another matter altogether and delivered a breathtaking 35.4%.

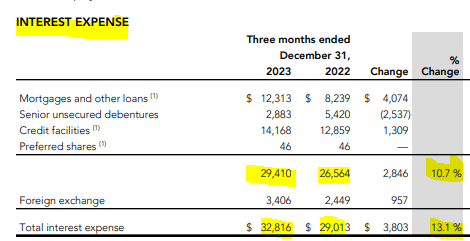

If you expected all of that NOI growth to deliver an improvement to funds from operations (FFO) and adjusted FFO (AFFO), you were sorely disappointed. The reason was that the above was the same property NOI, and the total NOI was impacted by asset sales over the last 12 months. But more importantly, interest expense continued its vertical ascent and was up another 13.1% year-over-year.

Artis Q4-2023 Financials

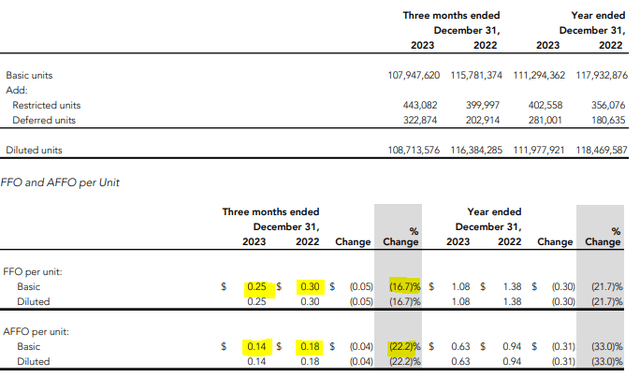

FFO per unit was down 16.7% and AFFO per unit was down 22.2%. Both are quite remarkable in light of the heavy (6%) reduction of units outstanding via buybacks.

Artis Q4-2023 Financials

So, we are still feeling the fallout from the former policy of having the shortest debt maturity stack in the Canadian REIT universe, coupled with a high exposure to floating rates. One other point to note is that the AFFO run rate is now below the quarterly distribution rate.

Outlook

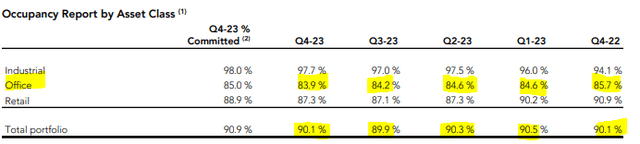

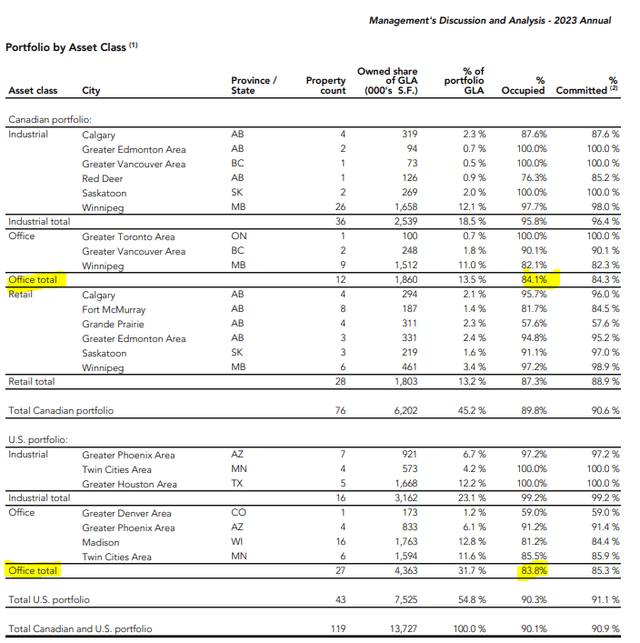

Overall occupancy levels were up slightly quarter-over-quarter, while office occupancy levels declined. This has been a trend now for a few quarters, and one reason that Artis is struggling to get the market to appreciate the value.

Artis Q4-2023 Financials

This problem is about the same, whether you look at Canada or the U.S.

Artis Q4-2023 Financials

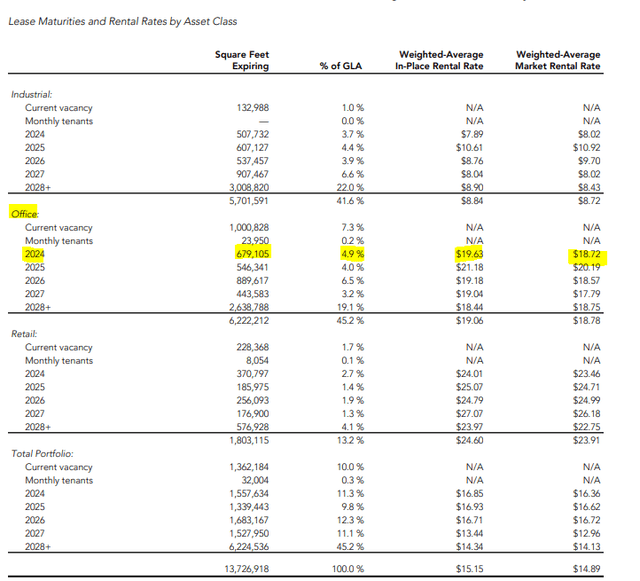

The good part is that only about 4.9% of the total gross leasable area (10% of office segment), come up for renewal in 2024 and market rents are slightly below where the company's rent roll stands.

Artis Q4-2023 Financials

So the office should be ok, for now, and existential risks remain low. The office is still a high enough percentage of the total that the REIT is unlikely to go up a lot in the present climate.

Artis Q4-2023 Financials

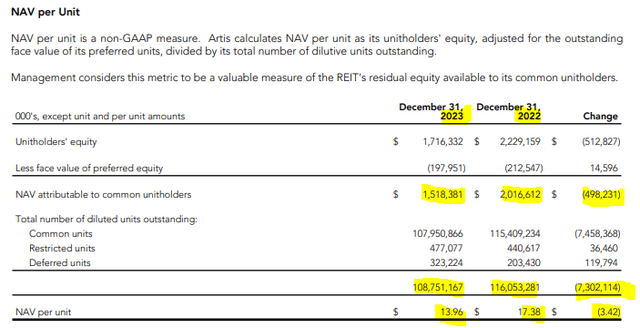

NAV Decline

NAV is extremely subjective, and we have often criticized the cap rates used in estimating it. The delta though is nonetheless useful to see how the value is progressing in the eyes of the company. In the case of Artis, things did not look good. Over the last 12 months, NAV has dropped by about 20%.

Artis Q4-2023 Financials

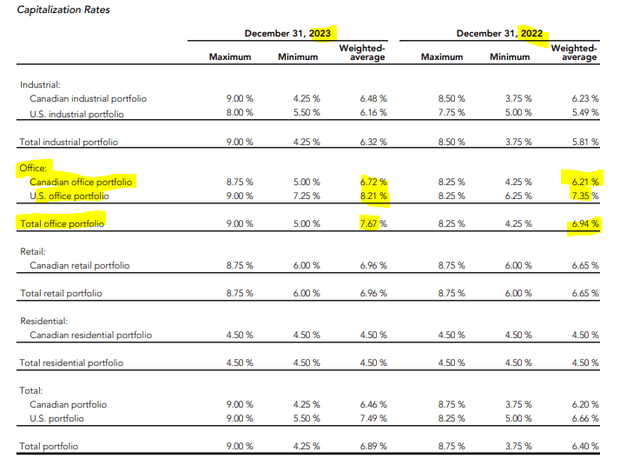

A lot of the drop actually occurred last quarter as the REIT expanded estimated cap rates on all three types of properties.

Artis Q4-2023 Financials

NAV was $15.26 in the last quarter, and it is a remarkable change considering the general easing of credit conditions from Q3-2023 to Q4-2023.

Strategic Review

The bulls were perhaps disappointed that the strategic review was basically called off and the piecemeal sale process was continued.

Over the past several months, the Special Committee and the Board have been working with the REIT's financial advisors to explore options available to unlock and maximize value for unitholders, including the potential sale of the REIT. In the current market, Artis and its advisors do not believe that there is a buyer prepared to acquire the REIT at a reasonable value relative to management's latest published NAV per unit of $13.96. There continues to be a healthy appetite in the private transaction environment for quality retail and industrial assets. There is also buyer interest for certain office assets, but office buyers in general are expecting bargain prices or vendor financing, neither of which are compatible with Artis's desire to generate financial liquidity from dispositions. Since the announcement of the strategic review, Artis has completed or entered into unconditional agreements for $161,896 of office sales at values and on terms that were acceptable to the REIT, and will continue to consider further office dispositions. In addition, Artis has completed or entered into unconditional sale agreements for $256,200 of retail assets and $55,495 of industrial assets. This equates to $473,591 of asset sales (in line with the REIT's IFRS values reported at December 31, 2023), including unconditional transactions, since August 2, 2023

Source: Artis Q4 2023 Financials.

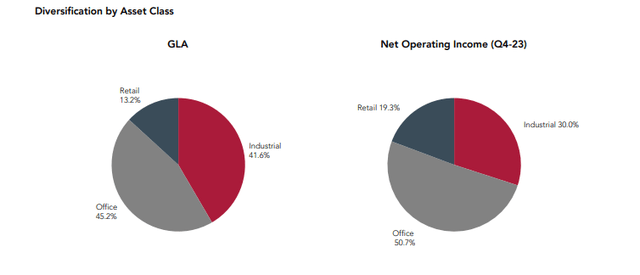

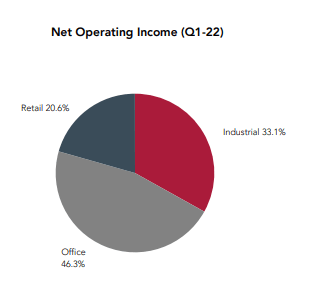

This was not surprising news to us as the buyer would have to take on substantial office assets and there is really no demand for those at present. The REIT can probably sell $0.5 billion of assets in the next 12 months and that should help with the deleveraging process. These are likely to be more focused on industrial and retail assets versus office. That process should once again push up the percentage of NOI that is coming from office. Currently, 50.7% of NOI is coming from the office. 8 quarters back, this was 46.3%.

Artis Q1-2022 Financials

Verdict

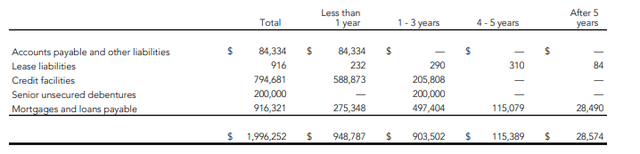

The problem here remains that Artis will get into trouble if financial conditions tighten rapidly. The weighted average debt maturity still looks awful and the bulk of the $2 billion is concentrated right at the "under 1 year" mark.

Artis Q4-2023 Financials

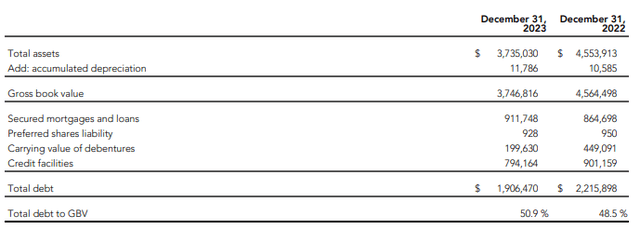

Over the last 12 months (from Q4 2022 to Q4 2023), total debt has dropped by about $310 million, but debt to gross book value has actually increased.

Artis Q4-2023 Financials

For a clear final lap, this ratio needs to be under 45% considering the mix of assets, and we are not getting there, at least based on the last check. While we see the stock as undervalued, we believe this is one of the high-risk plays. Even amongst diversified Canadian REITs, BTB Real Estate Investment Trust (BTB.UN:CA) has a far longer debt maturity profile and is therefore safer. For H&R Real Estate Investment Trust (HR.UN:CA) the debt levels are way lower and the relative liquidity is amazing. We also see a creeping threat of a distribution cut for Artis in the next 12 months, so investors need to be aware that that could happen. We exited the preferreds at a nice profit, but if we had a take a position today, it would be in the preferreds.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult a professional who knows their objectives and constraints.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.