After losing an arbitration decision, Qualcomm (QCOM) has agreed to pay BlackBerry (BBRY) $940 million as legal settlement by May 31. This is to refund BlackBerry’s overpayment of royalty fees to Qualcomm. BlackBerry made advance royalty payments on Qualcomm’s patents. Qualcomm argued it was nonrefundable but BlackBerry won the battle because it really isn’t manufacturing the phones involving those prepaid royalty fees.

This victory is John Chen’s best accomplishment to date. He now also has $940 million more money to fund acquisitions which could bolster BlackBerry’s software business. The refund from Qualcomm should not be used to pay off debts or share buybacks. It should all be used to improve BlackBerry’s position in the Software-as-a-Service [SaaS] industry.

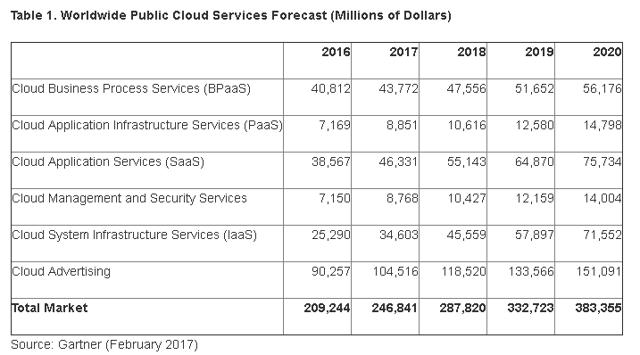

BES is no longer enough for BlackBerry to fully benefit from the fast-growing SaaS, BPaaS, and Cloud Management/Services industries. Gartner’s forecast chart below revealed SaaS, worth $46.33 billion this year, is only second to cloud advertising in annual revenue generated.

I do not think BlackBerry has the know-how or experience to get involved in cloud advertising. On the other hand, BlackBerry has decades-long track-record of being a software vendor with its BES product.

BES falls under Cloud Management and Security Services. It’s a much smaller business segment than SaaS. Going forward, Chen will likely steer BlackBerry to SaaS because that is where the bigger opportunity lies.

BBM Enterprise Is Just A Stepping Stone To Collaboration SaaS

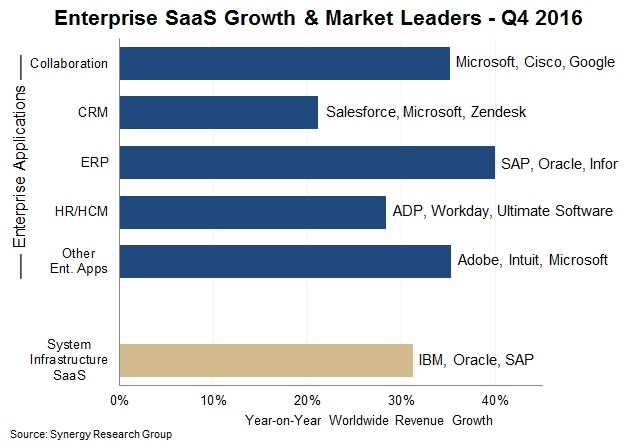

BlackBerry needs new products to remold itself to be more like Microsoft (MSFT), Google (GOOG), and Adobe (ADBE). Microsoft’s Office Suite/Skype/Dynamics made it the top dog in enterprise SaaS. There are several categories in SaaS. BlackBerry has several options to choose from.

Microsoft and Google rule enterprise Collaboration software thanks to their Skype/Office and G Suite software. BlackBerry Messenger could be marketed as an alternative to Cisco (CSCO) Jabber, Skype for Business and Google’s new Meet enterprise communication app. Make BBM Enterprise as user-friendly like Slack and it could prove to be a winner.

Whatever happens, BlackBerry should focus on just one segment of the SaaS industry. Collaboration software is my bet because of BBM Enterprise. However, the $940 million refund from Qualcomm can also be used to build up BlackBerry’s presence in CRM or ERP. It doesn’t really matter as long as BlackBerry diversifies outside its BES cloud security comfort zone.

Collaboration SaaS means team communication plus team-based productivity. Microsoft’s emergence as the king of SaaS is that it wisely bundled Skype for Business, Yammer, and Microsoft Teams with Office 365 Business monthly packages.

Google’s G Suite business bundle also comes with software for cooperative document creation and file sharing. BBM Enterprise therefore is lacking the necessary cloud office productivity suite. BBM Enterprise should be packaged with cloud friendly document creation software suite. Without it, BBM Enterprise is just another niche app that is unlikely to generate any substantial revenue.

The future direction of BlackBerry’s entry in SaaS should be based on what is already popular. Here’s a list of the most used cloud computing applications/services. Office 365 is number one, G Suite is number 5. You want to make a big splash in SaaS, you challenge the leaders.

There are smaller firms like Kingsoft and Polaris who are thriving building cheaper alternatives to Office 365 and Google G Suite. Kingsoft’s success with WPS Office (1.25 billion installations) showed there are customers out there that aren’t captured customers of Microsoft and Google. Polaris Office also tout 900 million mobile and PC installations.

My point is that BlackBerry could also do a thriving business competing with Microsoft Office 365 and G Suite. Just emulate what Polaris and Kingsoft did - they copied the user interface/user experience design of Microsoft Office. The world has been inculcated with Microsoft Office for so long that the only way to compete with it is to copy its Graphical User Interface [GUI] design. This is to make Microsoft Office users have an easy time transitioning to a rival product.

Final Thoughts

Mr. Chen’s failure to make BlackBerry’s old hardware phone business profitable can be easily forgiven if he can make BlackBerry a decent SaaS player. Going forward, I hope Mr. Chen uses the $940 million to create a BlackBerry Office collaboration/productivity suite. If he isn’t daring enough to challenge Microsoft, he can instead use the money to expedite BlackBerry’s anti-hack software for cars.

I believe renting out a $10/month anti-hack software service for cars qualifies as a SaaS product. People cannot be productive if their smart cars or connected vehicles keeps getting infected with malware, spyware, or ransomware.

BlackBerry, with the backing of over 100 QNX OS customers, could become the McAfee antivirus solution provider for car owners. QNX is the go-to choice for in-vehicle infotainment. BlackBerry could also become the go-to provider for in-vehicle software security.

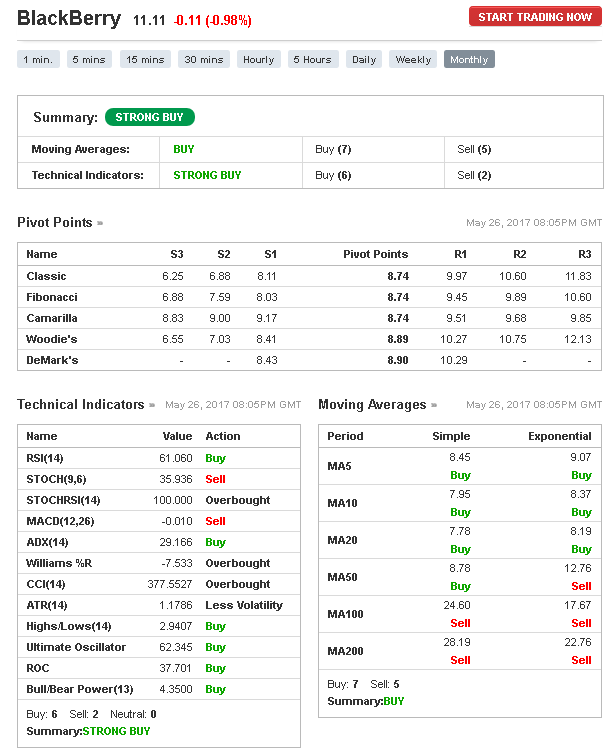

I’m long BBRY. The monthly technical indicators and moving averages are signaling a buy for BBRY too.

(Source: Investing.com)

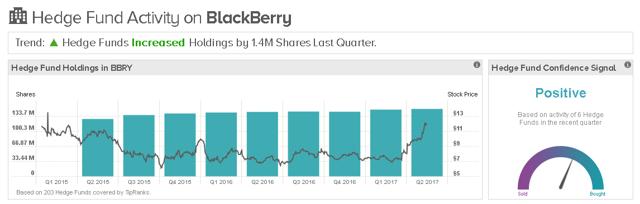

Hedge fund managers also have a positive sentiment for BlackBerry. They’ve been increasing their exposure to BBRY since Q4 2016. More often than not, small retail investors can make profit by shadowing the moves of hedge fund managers.

(Source: TipRanks)

Disclosure: I am/we are long BBRY, GOOG, MSFT.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.