dszc

Baytex Energy (OTCPK:BTEGF) has been in debt reduction mode for almost as long as I have written about the company on Seeking Alpha. The latest commodity price environment has considerably accelerated those debt reduction plans. Almost unnoticed is the fact that improving technology has allowed some production growth even though none was planned. This is happening even though the focus of some free cash flow is still on debt reduction and share buybacks.

It is a typical pattern for the industry in general that has a very low resistance to high commodity prices. Even though the market demands a better balance sheet and return of some excess cash to shareholders, rarely can this industry resist some production growth during the good times. Even without the current emphasis on dividends and share buybacks, past cycles have featured "accidental growth" that sooner or later actually became upfront growth goals throughout the industry. One way or another production would head forward enough to bring about the next cyclical decline.

Any cyclical industry faces the challenge that each company has a profitable interest in growing even though the whole industry needs to use discipline to stop the next cyclical oversupply phase. The problem is that what is good for the industry is not good for each individual company.

For the time being, oil remains under-supplied and the outlook is good for commodity prices. But it is important to note that production growth is beginning to edge its way into actual results even if officially it is "by accident". No one in the current atmosphere is going to admit they intentionally grew production. What they did is not factor in the effects of technology advances (and they probably did that intentionally). This stage has happened so many times that it should be predictable.

Baytex Advantage

Baytex Energy has a profit advantage that many others lack as the cycle proceeds. Management found a play that is far more profitable than the production mix. Therefore, earnings will not only grow because production inches upwards, but earnings will also grow because more profitable production will be substituted for less profitable production. That substitution will point towards a company outperformance during the next full cycle at least.

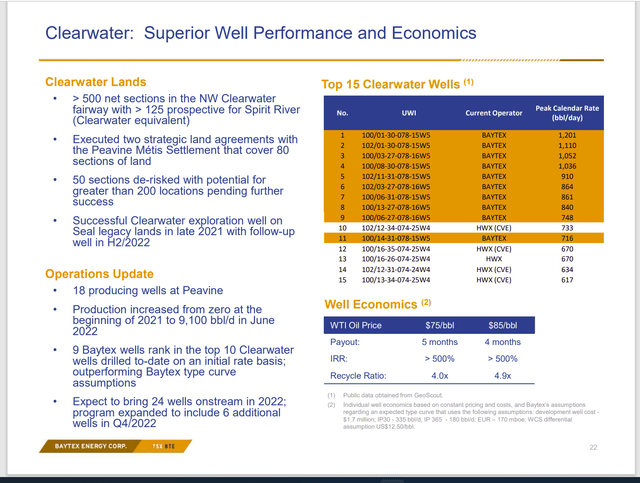

Baytex Energy Overview Of Clearwater Characteristics (Baytex Energy September 2022, Corporate Presentation)

Baytex Energy found a heavy oil interval that is far more profitable at any pricing point than many prospects probably in all of North America. This heavy oil play has reduced the legacy acreage to maintenance type activity while allocating heavy oil expenditures to this play.

Heavy oil profits are far more volatile than is the light oil profits because heavy oil is a discount product. That discount can widen during times of weak pricing to really narrow any gross profit margins or even eliminate them entirely. In the past, heavy oil production is usually among the first products shut-in to wait out an industry recovery. The low breakeven of this project makes that scenario unlikely. But the profit volatility is still a risk of even the most profitable discoveries.

In the meantime, the substitution of production from this discovery for legacy production that is less profitable will lead to profit growth in excess of production growth.

Light Oil Competition

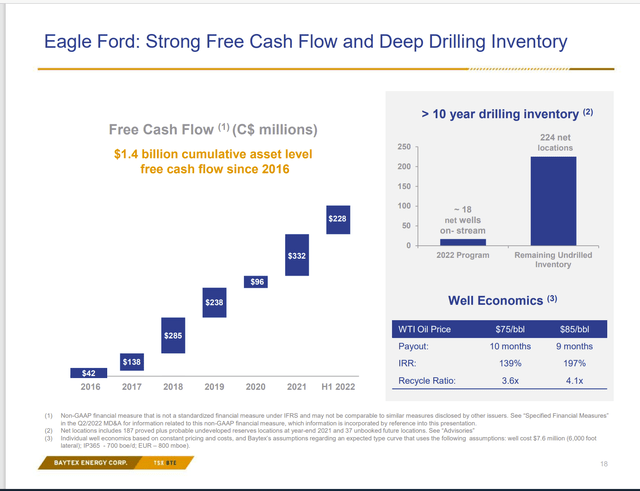

The Eagle Ford acreage is probably the only acreage in the company portfolio that competes in terms of profitability with the Clearwater acreage. The Eagle Ford has the advantage of producing light oil that is not subject to the discount issues of heavy oil. So, the cash flow is considered less volatile throughout the industry cycle. Light oil is generally less profitable than heavy oil during the boom times. But it is more profitable during the critical downcycle than is heavy oil. That makes the cash flow from light oil generally very important.

Baytex Energy Presentation Of Eagle Ford Profit And Cash Flow Characteristics (Baytex Energy September 2022, Corporate Presentation)

Management needs to balance the situation between light oil and heavy oil production to assure a reasonable pathway through any cycle downturn. The Eagle Ford properties have another operator. Therefore, the company does not control the pace of development. Long-term, until Clearwater became a consideration, the Eagle Ford was overall the most profitable project in the company portfolio. It will likely remain among the least volatile in terms of profits during the industry cycle.

Without light oil production management could be in a cyclical downturn situation needing to shut-in all production of heavy oil to reduce losses. But then cash flow is needed from something and that something is likely light oil production.

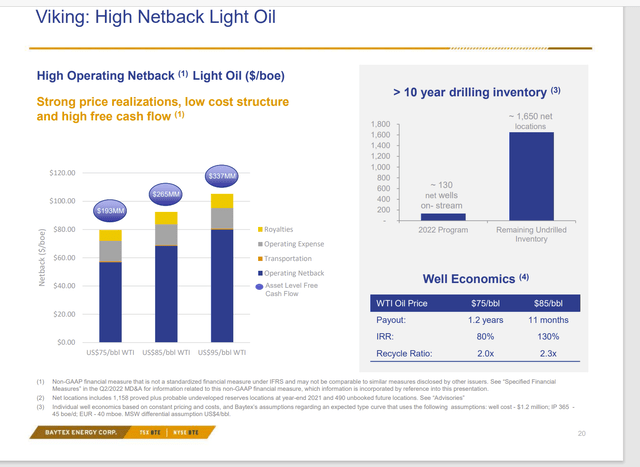

Baytex Energy Presentation Of Light Oil Profitability And Cash Flow Potential (Baytex Energy September 2022, Investor Presentation)

To maintain some control of the production mix of light oil production, Baytex Energy does produce light oil from some Canadian leases that have a higher breakeven point. Since light oil is often not discounted and sometimes sells at a premium, these properties often cash flow during a downturn to provide additional cash flow.

The Future

Baytex has a light oil discovery that the company has been working on for some years to get the costs to a point where it makes sense for "mass production". If and when that happens, there is still more potential for better profitability.

What separates this company from many in the industry is the profitability of the Clearwater play along with the ability to develop that play now in a way that materially affects profitability. Such an ability leads to stock price outperformance in the industry in the future. Furthermore, the company now has a lot of Clearwater acreage so that production will be material for a long time to come.

Management will likely keep the legacy acreage because it is so hard to tell the effect of the next technology advance. But the capital will be directed to growing light oil and Clearwater production for the future.

Debt reduction remains a priority. Management has elected to do share repurchases probably because the last few downturns were far too unpleasant enough for management to commit to a dividend. A dividend is likely down the road though as free cash flow increases and long-term debt continues to decline.

This is one of the few companies I follow with a meaningful chance to increase profitability at just about any oil pricing point that one can forecast for the near future. Other companies are linked to WTI pricing with really no hope of changing long term profitability.

Keeping up with technology improvements is mandatory in this industry because profitability needs to be maintained. As industry costs decline, then so does pricing to maintain that margin. Sometimes the cycle itself hides that relationship. But long term, margins generally remain the same. It is costs that keep declining to make more oil profitable to produce.