Summary - The debt priority is finally declining.

- The emphasis on shareholder returns is climbing.

- Clearwater production growth will lower the corporate breakeven while increasing corporate profitability.

- The Eagle Ford properties can now service the United States denominated debt themselves. That probably means in practical terms there are no currency gains and losses.

- Per share growth will likely exceed production growth due to Clearwater profitability and share repurchases.

- This idea was discussed in more depth with members of my private investing community, Oil & Gas Value Research. Learn More »

imaginima Baytex Energy (

OTCPK:BTEGF) (TSX:

BTE:CA) has been digging itself out of debt for some years. This Canadian company (that reports

in Canadian dollars unless otherwise noted) had used too much debt for an acquisition right before oil prices dove back in 2015. To its credit, management survived that deal to the point where the company made major financial strides in the current environment.

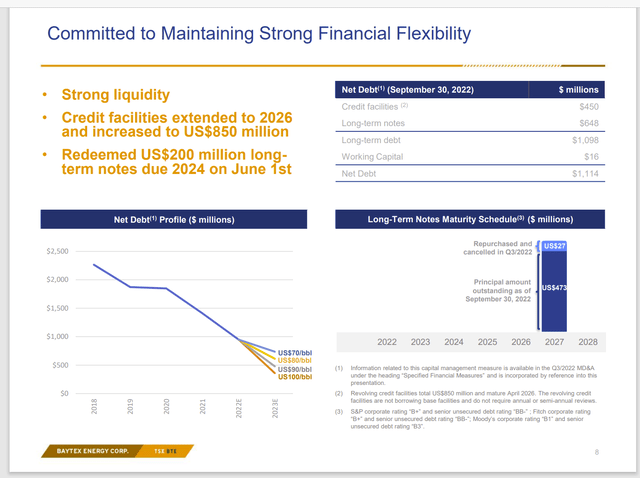

Baytex Energy Presentation Of Debt Strategy And Progress Made (Baytex Energy January 2023, Investor Presentation) As shown above

Baytex Energy Presentation Of Debt Strategy And Progress Made (Baytex Energy January 2023, Investor Presentation) As shown above, management repaid more debt in the current year than it has repaid in several years before the current year. That has left the company in the best financial position in years. Management will slow the debt repayment somewhat. But declining debt levels will still be a major priority for some time to come.

In the meantime, the new budget for fiscal year 2023 allows for some shareholder returns and some production growth. That should indicate to shareholders that the "debt noose" is loosening. However, management wisely wants a low debt ratio during times of weak commodity prices. So, the debt priority will continue until the company has conservative debt ratios using considerably lower pricing assumptions.

It should be noted that debt is probably at the level that the Eagle Ford properties, which are in the United States, could probably service the debt which is American denominated. Accounting forces everything into Canadian dollars and can show gains and losses. But the actual truth of the matter is that the Eagle Ford leases probably make enough American dollar profits to take care of the debt that is denominated in United States dollars all by itself. The bank line debt really has no mandatory repayments at the current time.

There was a time when the Canadian dollar was weakening and at the same time was needed to help manage the debt load. In the current robust commodity price environment, that does not appear to be the case. But it can certainly be a future risk. In practical terms, the income in Canada adds to the safety of the outstanding debt (for investment ratings purposes).

Management Financial Strategy The revised debt structure shown above allows management to either repay the bank line or repurchase debt at a discount. The market has been at times stubborn in insisting on a discount. Rising interest rates during a time of relatively strong commodity prices have given management the relatively rare opportunity to retire significant amounts of debt at a discount.

The other thing is that the company has the financial strength rating to avoid a restriction as part of the bank line that would not allow a lot of debt to be repurchased at a discount.

Management will also be using some cash flow to repurchase shares. Management has long believed that the share price is way too cheap. But only recently have finances allowed a significant share repurchase program. This program will augment the proposed slow growth to provide a per share growth in earnings that is greater than the production growth shown above.

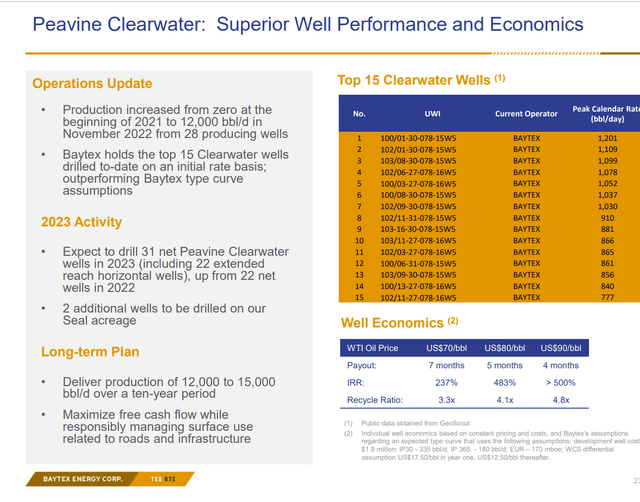

Clearwater Clearwater is the fastest growing part of the production portfolio. It is also the most profitable part of the company. Management is taking advantage of this by growing this part of the production at the expense of legacy heavy oil production that is far less profitable. This strategy will also aid per share earnings growth for investors.

Baytex Presentation Of Clearwater Advantages And Strategy (Baytex Energy January 2023, Corporate Presentation)

Baytex Presentation Of Clearwater Advantages And Strategy (Baytex Energy January 2023, Corporate Presentation) Clearly these wells are easily the most profitable in the portfolio given the currently strong commodity price environment. The risk is that the discount for this product from light oil can increase to the point that heavy oil has no cash flow and needs to be shut-in until a pricing recovery begins. Clearwater has an unusually low breakeven point. However, the discounted product risk in a cyclical downturn demands either no debt and lots of cash on the balance sheet or a balance with production of premium products that command stronger pricing in a downturn.

Management appears to be pursuing both objectives by repaying debt and allocating most of the budget to light oil production. Light oil production has gotten this company through previous industry downturns. So, the emphasis on light oil production in the budget is understandable.

But Clearwater wells do payback quickly and management has the ability to hedge this production to ensure a reasonable profit when paybacks are a short as shown above. This gives management every incentive to grow production of heavy oil solely through the Clearwater acreage.

The other heavy oil acreage will likely be maintained because technology keeps moving forward. It could well be that the legacy acreage will at some point compete for capital dollars with this acreage. Right now, that is clearly not the case.

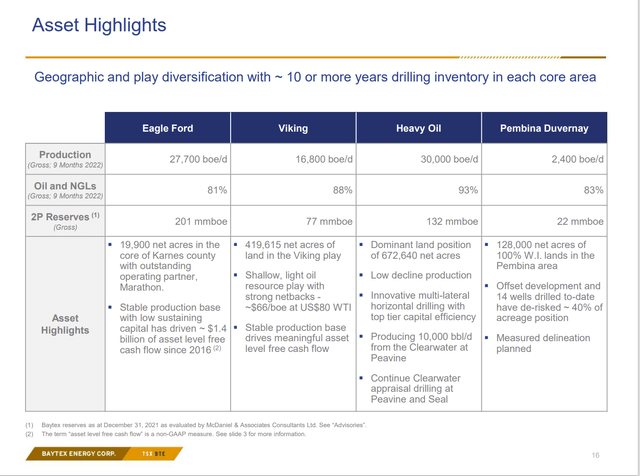

Light Oil The company has several light oil prospects. This relatively premium product has stronger pricing during downturns. Therefore, it usually cash flows when heavy oil does not. That cash flow safety net can be very valuable during times of weak pricing.

Baytex Energy Presentation Of Major Leaseholding Characteristics (Baytex Energy January 2023, Corporate Presentation)

Baytex Energy Presentation Of Major Leaseholding Characteristics (Baytex Energy January 2023, Corporate Presentation) Of the light oil plays, the Eagle Ford probably receives some of the best pricing and has some of the lowest costs in the portfolio. That makes this a very competitive basin with Clearwater due to the light oil production. Heavy oil is often more profitable in the current environment. But the Eagle Ford is often more profitable than a lot of heavy oil prospects during a downturn.

The Viking is a light oil prospect that has somewhat higher costs when the Canadian dollar is on par with the United States dollar. That is not the case right now. Management has often listed the breakeven for Viking wells in the C$40 range. As long as the Canadian dollar is relatively weak, that is probably a good deal. The premium light oil pricing makes this a priority for the company to assure a minimum cash flow during downturns.

The last light oil play is the Pembina Duvernay. This discovery probably needs some work to bring the costs down. Right now, the wells appear to be expensive compared to the initial flow rates. Management has been working on this discovery for a few years. It appears it will take a few more years before this is ready for development.

The Future The rapid growth of Clearwater production is likely to continue. These leases are currently the most profitable by far in the company portfolio. The recent emergence of this interval as the most profitable is evidence that the industry has yet to reach "all" the potential resources as long as technology continues to move forward. Investors can expect more of these basins to appear in the future.

The growth of Clearwater combined with the share repurchases and the slow production growth will probably provide per share earnings growth around 10% or slightly more for the foreseeable future. That growth will happen at all the commodity pricing points.

The Clearwater growth also lowers the corporate breakeven point because Clearwater is the lowest cost project in the company portfolio. Production has already grown to 10,000 BOED. The economics of the play indicate that rapid growth should be a priority for the foreseeable future.

The remaining growth will likely be in the light oil plays. Legacy heavy oil cannot really compete for capital dollars. But there is no reason to give up because changing technology could make the legacy production competitive at some point in the future.

In any event, the past focus on debt repayment is gradually giving way to a return to growth and shareholder returns. The change in emphasis is likely to continue well into the future.