(Editor’s note: There is much greater volume on the TSE under the ticker ZAR).

The recent departure of Chief Financial Officer Jeffrey Post from Zargon Oil & Gas (OTCPK:ZARFF) weighed on the thinly-traded issue's price to some extent following the announcement, sending the issue's price down perhaps 5 percent on slightly higher-than-average trading volume.

For a microcap junior producer, even one that has survived so long in such a topsy-turvy environment over the decades as Zargon has, such a drop was just another day at the office. More important than daily technical moves is the overall outlook of the company, a company which has made definite overtures toward a 'strategic alternative' process.

So far, the 'strategic alternative' process has resulted in the sale of two properties - the entire catalog of its Southeast Saskatchewan properties, which drew proceeds of C$89.5million, and its Killam property, which netted C$4.0million.

Pro forma these sales, the company now finds itself in a much stronger position than before. Zargon's current net debt of roughly C$31million, contrasted against its previous debt of roughly C$120million, puts the company in a much stronger financial position than before the sales occurred.

As in my previous article, Zargon Oil And Gas Is Now Deeply Undervalued, Here's Why, I noted that the company's decision to divest a small portion of its assets to eliminate a large portion of its debt was an extremely wise decision on many points. Now, with additional information available, there is even more reason to believe that the company is even more undervalued than before.

Valuing The Remaining Assets

Before receiving strong evidence on how to value Zargon's Enhanced Oil Recovery Project, I had made my assumptions based on valuing this project at zero. Of course, I knew that this project was worth far more than zero. But without a firm grasp on the fundamentals, I reasoned that if the rest of the company would still return a significant profit if the EOR project was completely worthless, then any value assigned to the EOR project would just be extra icing on the cake.

As it turns out, there is finally a relative piece of information that gives insight on how to value the EOR project. Whitecap Resources' (OTC:SPGYF) (TSE: WCP) recent acquisition of a very similar EOR asset gives us good insight on what a fair return price on Zargon's well-developed EOR asset might return on the open market.

Whitecap paid C$595million for 11,600boe/d (98% oil) which is 78% operated, has an estimated 5% decline, and a C$7.52 per barrel of reserves. Given these metrics, we can conservatively estimate a value of about C$30million for Zargon's EOR project, which returns about 570boe/d at present and is 100% operated. The project's growth potential should not be ignored - projections from 2014 indicated that the EOR project could easily hit 1,600boe/d with additional capital injections. Such a buildup would prove lucrative in a higher price environment.

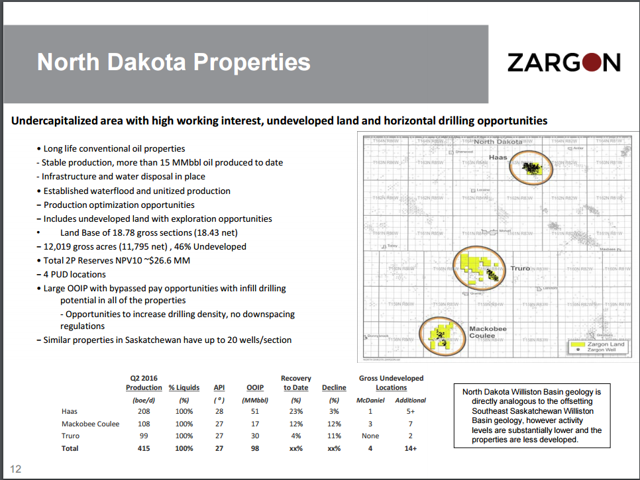

Although Zargon was able to divest its Southeast Saskatchewan properties for a good price, the company still retains just under 400boe/d of nearly 100% oil-producing properties in North Dakota.

An overview of Zargon's North Dakota assets. From thecorporate presentation.

Some nearby sales point to what could be a good valuation methodology for these properties. The recent Continental Resources' (NYSE:CLR) sale of 68,000 acres in North Dakota and 12,000 acres in Montana produced 2,800boepd of production, which brings us to a sale price of about $79,000/boepd and $2,775/acre.

Another recent sale, this time to Oasis Petroleum (NYSE:OAS), concerned the transaction of 55,000 net acres and 12,400boepd production in the Williston Basin. These properties were bought at the cost of $63,300/boepd and $15.64/bbl of 1P reserves at 77% oil.

This would allow us to assign a very conservative value of at least C$20million to the North Dakota assets, or C$7.40/bbl of proved/probable resources and C$50,000/bbl of value to the existing production, given Zargon's smaller footprint in the area. However, it's likely it could get a fair bit more than that.

Staggeringly Low Market Cap

The market hasn't fully caught up to Zargon's improved prospects yet. My aforementioned article helped raise awareness of the seemingly forgotten company, and the price still sits at about 30% above where it was when I released the article. Yet following a pullback in Zargon's share price despite a steady increase in oil prices, it remains severely undervalued.

While a market valuation of somewhat less than the company's divestiture value would be reasonable due to the uncertainty of such transactions and the continued instability of the oil market, Zargon's current enterprise value is no more than C$53 million at the moment, based on a share price of $C.73/share.

Yet we have clearly seen above that the combined value of the EOR project and the North Dakota assets is about C$50million now, if we are being conservative.

In other words, were Zargon to divest both the EOR project and the North Dakota assets for something resembling their value as indicated above, investors would get the rest of the company basically for free.

Given that the rest of the company consists of 1,700boepd of production from its Alberta plains assets, which production consists of roughly 70% oil and liquids, investors stand to reap a significant reward if even one of these assets are sold.

The final elimination of the remaining debt alone would skyrocket the stock price (if investors were paying attention, that is). Given the current market cap of C$22million, selling the EOR project for enough money to retire the remaining debt, and conservatively valuing the remaining assets at a low C$40,000/boepd would return a marketable value of C$84million for the remainder of the company - or, C$2.75/share. This measure does not calculate the value of the C$279 million in corporate tax pools, and gives a very conservative value to the remaining assets.

Free Cash Flow And The Improving Price Of Oil

Zargon's situation was admittedly dire in the throes of the oil price glut, where prices as low as $26/bbl could not be mitigated by a favorable exchange rate. Zargon's collective debt at the time, north of C$120million, was a heavy load for the company to bear without the benefit of significant favorable hedging. The question of bankruptcy loomed overhead.

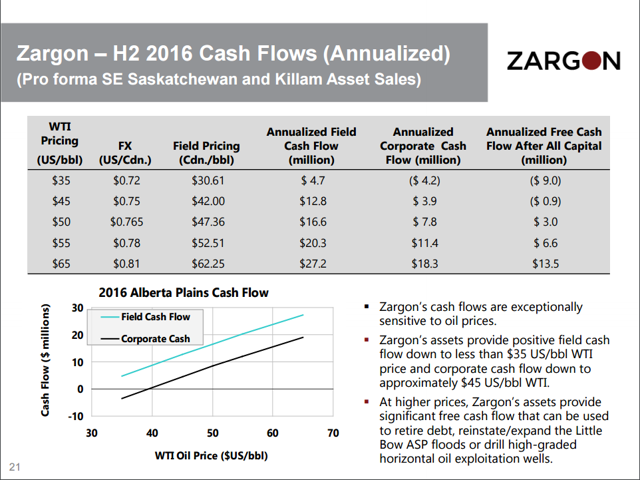

With the divestiture of the aforementioned properties and significant oil price improvements, Zargon's outlook in the near term proved to be much more favorable. Besides reduced interest payments and lowered administrative expenses brought about by debt repayment and a corporate restructuring, the recent increase in oil prices means that Zargon can now be cash-positive throughout the rest of 2016. Review the slide from the corporate presentation:

An overview of Zargon's cash flow projections at various price points. From thecorporate presentation.

At the time, $50/bbl oil seemed like a lofty favor to ask of a glutted market. But the recent capitulation of OPEC and Zargon's lowered credit obligations mean that the company does not have to accept a fire sale price on its assets in order to satisfy obligations. While this might be frustrating to quick-sale investors looking for a fast return, it demonstrates a long-term advantage in that Zargon can carefully shop its assets in order to receive the best possible pricing. And in the event of a sudden and significant price turnaround in oil, Zargon could theoretically put down stakes and resume operations as before with its remaining asset base.

Summary

Although the increased awareness following my previous article certainly helped Zargon's share price improve, the issue still trades at levels drastically below its marketable value.

Many companies trade below their book value - or even their liquidation value - and are still not worth investing in. Some of these companies lack a catalyst to drive a change in price, some are just poorly managed, and some are doomed to simply remain unprofitable.

Zargon is none of these. Zargon is well-managed and has managed to survive a difficult industry for many years. Furthermore, the company has a catalyst - it has expressed a significant interest in going forward with its strategic alternatives process, and there are still plenty of buyers in the oil patch.

Zargon's depressed share price and significant asset base, coupled with the recent forward motion on their strategic alternatives review, continues to make Zargon a very compelling value play even at current and much higher price levels.

I continue to recommend Zargon as a clear and strong value play.