Understand why oil company prices are now going upas I was teeling you all, the arabs want oil prices to stay around $65 for a week or two. Shale needs $60 to break even and the phone calls to the banks wont work with a $5 difference. A few weeks will let shale turn off lights send everyone home. Traders are starting to see this. Remember - the saudi strategy is real demand with real supply. That big inventory figure today only strenghtens the arab resolve to extend production cuts. Now read why i am saying that IEA is always wrong in setting balances perceptions ---

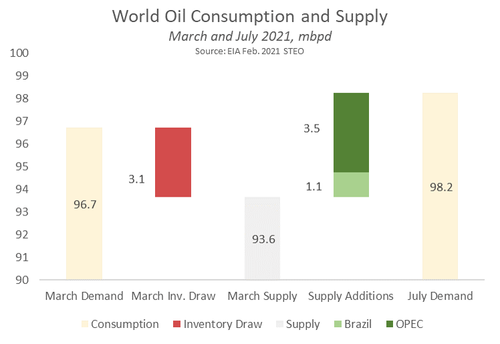

see in yellow below In its February Short Term Energy Outlook (STEO), the EIA forecasts this month's world oil consumption at 96.7 million barrels per day (mbpd). The oil supply, however, is much lower, only 93.6 mbpd, with the difference of 3.1 mbpd of necessity being drawn from crude oil and refined product inventories. By historical standards, a sustained draw of 3 mbpd is large, and we would expect prices to be rising under such circumstances.

The EIA sees demand continuing to recover at a good pace to mid-year, with July world oil consumption forecast at 98.2 mbpd (but still about 4 mbpd below 'normal'). This incremental demand is being materially supplied by two sources, Brazil and OPEC. We might accept Brazil's crude oil production growth as given, allowing that the timing might be off by a month or two. The pivotal question is instead OPEC's intentions.

The EIA uses a volume (or demand) driven model, implying that OPEC will passively increase production to meet demand, and thereby keep oil prices low. But why would OPEC do this? If OPEC simply maintained current production levels, the world would be 3.5 mbpd short of supply by mid-year. A shortfall of 3.5 mbpd -- 3.6% of global consumption -- is a lot. It would rapidly drain remaining excess inventories, leaving only oil prices to mediate between supply and demand just as the world economy is showing both strength and momentum as the pandemic ends. In other words, in the coming months consumers will be prepared to compete for the available barrels of oil, and that should push oil prices up sharply. Related: $70 Oil May Cause Slowdown In Demand Recovery

That's the '$100 / barrel' thesis.

A few important notes and caveats. In many cases, operators must commit to producing barrels before they know what the price will be. In this case, OPEC can let prices rise and add barrels at its discretion. This provides OPEC a great deal of control and flexibility over oil prices. Certainly, higher oil prices are better, but more barrels can be added on fairly short notice if OPEC believes the market is overheating. This should encourage OPEC to test ever higher price levels.

And of course, Middle East politics are convoluted. The complex interplay of Iran, Saudi Arabia and the United States can produce unexpected results. Were Iran more collected, it could probably bring the US back toward some sort of deal in short order, thereby freeing Tehran to increase oil exports and push down oil prices. On the other hand, the Houthi attack on Saudi oil facilities at the loading port of Ras Tanura may push the Saudis back into the US embrace and motivate the Kingdom to keep oil prices lower to curry favor with the Biden administration.

It is hard to know where the balance comes out. Nevertheless, now is OPEC's best opportunity to make real money in the short to medium term. They would be fools to let the opportunity slip by.

By Steven Kopits of Princeton Energy Advisors via Zerohedge.com