Maybe someone can explain what is going on to me. Nat gas prices are extremely low in North America right now and likely to stay low for awhile. Oil is ok, but there is fear that we are over supplied. At the same time, most Canadian firms who have released their capex for the year have higher figures than last year.

First of all, why is capex increasing when companies are not making money with nat gas?

Are people surprised with the increased capex? What am I missing?

I would very much appreciate someone's opinion on this.

https://boereport.com/2024/01/18/2024-budget-release-review-boe-intel/

We’re just over two weeks into 2024 and roughly half of Canada’s public E&Ps have announced their budgets for the year. The order of the day with respect to capital spending? Change. Of the 29 companies we’ve assessed, only 13 have 2024 budgets that changed by less than 10% (upward or downward) compared to 2023. And in good news for the industry, only 3 companies forecast reduced spending in 2024 with the average company announcing a capital budget increase of 4.4% in 2024. Interestingly, some of Canada’s largest E&Ps maintained impressive consistency: ARC Resources Ltd., CNRL and Imperial Oil all posted 2024 budgets that were within 5% of 2023’s figures. In fact, Imperial’s budgets for 2023 and 2024 are identical at $1,700 million.

| Capital expenditures guidance* for Canadian E&Ps with available 2023 and 2024 figures |

| Company | 2023 (Average of upper and lower bound where recent data is unavailable) | 2024 – Lower Bound | 2024 – Upper Bound |

| | $MM | $MM | $MM |

| Advantage Energy | 265 | 260 | 290 |

| ARC Resources | 1,850 | 1,750 | 1,850 |

| Athabasca | 145 | 175 | 175 |

| Baytex (Combining post-acquisition H2 2023 guidance with Q1 and Q2 actuals) | 1,035 | 1,200 | 1,300 |

| Birchcliff | 300 | 250 | 250 |

| Bonterra Energy | 120 | 90 | 100 |

| Canadian Natural Resources | 5,400 | 5,420 | 5,420 |

| Cardinal Energy | 97 | 185 | 185 |

| Cenovus | 4,250 | 4,500 | 5,000 |

| Crescent Point | 1,200 | 1,400 | 1,500 |

| Gear Energy | 53 | 57 | 57 |

| Headwater | 235 | 180 | 180 |

| Imperial | 1,700 | 1,700 | 1,700 |

| InPlay Oil | 83 | 76 | 81 |

| Kelt Exploration | 285 | 350 | 350 |

| Kiwetinohk | 285 | 275 | 295 |

| MEG Energy | 450 | 550 | 550 |

| NuVista | 520 | 500 | 500 |

| Obsidian Energy | 300 | 380 | 380 |

| Ovintiv (US$) | 2,750 | 2,745 | 2,785 |

| Paramount | 738 | 830 | 890 |

| Peyto | 425 | 450 | 500 |

| Spartan Delta | 280 | 130 | 130 |

| Suncor | 5,600 | 6,300 | 6,500 |

| Surge Energy | 175 | 190 | 190 |

| Tamarack Valley | 450 | 450 | 500 |

| Tourmaline | 1,860 | 2,345 | 2,345 |

| Vermilion | 570 | 600 | 625 |

| Whitecap | 925 | 900 | 1,100 |

* We have reported Capital Expenditures guidance at the broadest specification possible (ie. where E&D capex guidance and total capex guidance are both available, we have reported total capex guidance). Some companies do not break down their capex guidance into components or only provide E&D capex guidance, however, so we have reported the broadest available in each case.

BIG JUMPS FROM 2023

We wanted to start by examining the companies with the most significant changes to their budgets compared to last year. One the largest capital expenditure increases we observed was from Baytex, with a 2024 capital expenditure outlay that exceeds last year’s by over 20%. This increase was unsurprising, however, on account of the company’s acquisition of Ranger Oil in mid-2023. The company’s 2024 priorities include strong drilling and completion performance in the Eagle Ford, development progress at Pembina, and further delineation of the company’s Clearwater and Mannville heavy oil acreage. The company also announced its intention to drill 14 stratigraphic test wells across its heavy oil portfolio.

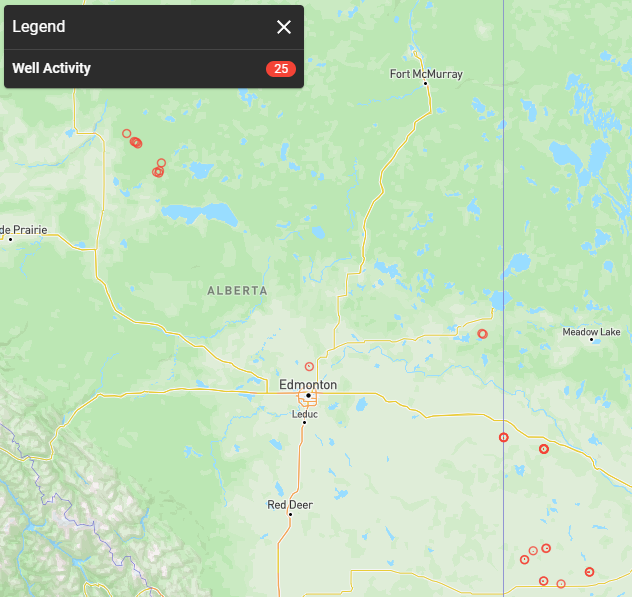

Baytex Licences Over Last 30 Days (11 of which were obtained after January 1 2024), December 16 2023 – January 15 2024

Another company that is seriously elevating its spending is Cardinal Energy. The company’s new thermal oil project, which we recently covered, appears to be behind this jump; the company is allocating $69 million to its thermal oil operations compared to $116 million that is allocated to conventional projects. That $116 million is split between development ($60 million), optimization ($16 million) and maintenance/other ($40 million).

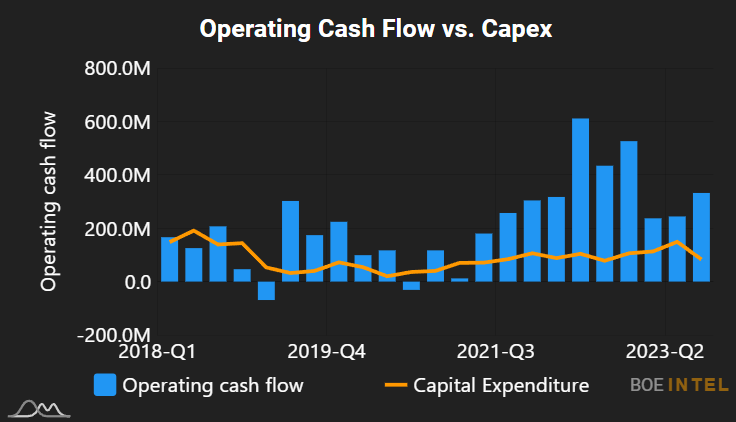

MEG Energy is another E&P with big spending ambitions for the year ahead. The company’s announced $550 million budget eclipses the prior year’s by $100 million and is broken up into $450 million in sustaining capital and $100 million that has been allocated to production capacity growth. The capacity growth spending will include the development of a 3rd processing train, a skim tank, and steam optionality tie-ins. This spending boost is supported by strong free cash flow that reached $1,600 million in 2022 and $700 million through Q1-Q3 in 2023.

MEG Energy Quarterly Operating Cash Flow & Capital Expenditures, Q1 2018 – Q3 2023

NOTEWORTHY DROPS FROM 2023

Headwater Exploration announced its budget guidance in its November 2023 corporate presentation and confirmed it in a press release a month later (Headwater’s November 2023 presentation is unavailable on its corporate site, but is available to BOE Intel users here). The company has still allocated significant resources to both production growth and maintenance in 2024, with $20 million penciled in specifically for exploration drilling. In addition, the company acknowledged an intention to grow its dividend; as of January 2024, Headwater’s 2024 dividend guidance is $95 million.29dk2902l

Another noteworthy drop was announced by Bonterra Energy in a December press release. The company’s 2024 capex budget, which will be fully funded by internally generated funds flow, is 20.8% lower than 2023’s. Rather than a drop in spending, this year’s budget is likely better conceptualized as a return to normal after an exceptionally productive year. Bonterra drilled 42 wells in 2023, compared to 32 in 2022 and 34 in 2021. This means the company’s budgeted 33 wells are comfortably in line with the average for the past 3 years.

EARLY CHANGES TO 2024 BUDGETS?

We might only be 18 days into 2024, but one company has already tweaked its capital plan for the coming year. In its December budget announcement, Crescent Point reduced its capital expenditure guidance to $1.4-1.5 billion from a preliminary figure of $1.45-$1.50 billion that was announced concurrently with its Hammerhead Energy acquisition. The company did not provide a direct explanation for the decrease, but the company’s updated budget is still over 20% higher than its most recently-published 2023 capex guidance.

In addition, we wanted to highlight a capital expenditure guidance figure for 2023 that changed in the very last month of the year. NuVista bumped its 2023 capital expenditure guidance up from $475 million (seen in the company’s November presentation, no longer on the company’s site but available on BOE Intel) to $520 million (seen in a January press release).

NuVista Energy Quarterly Capital Expenditures & Net Debt, Q1 2018 – Q3 2023

With oil price volatility taking center stage amid supply chain and geopolitical troubles in the Red Sea, it is entirely possible that we see more changes in Capex budgets. For the latest corporate announcements from the Canadian oil patch, continue to keep an eye on the BOE Report. And for enhanced analytical capabilities, check out BOE Intel.