DarrelCamden-Smith/iStock via Getty Images

We're nearing the end of the Q4 and FY2021 Earnings Season for the Gold Juniors Index (GDXJ), and one of the first companies to report its results was Calibre Mining (OTCQX:CXBMF). Overall, the company had another solid year, being one of the few miners to beat production guidance and also grow production meaningfully on a year-over-year basis. Armed with a strong balance sheet, Calibre is well-positioned to continue spending to grow resources and optimize its operations, an attractive combination. Given the company's impressive organic growth profile with Gold Rock and Eastern Borosi, I would view pullbacks below US$0.96 as buying opportunities.

El Limon Drill Core (Company Website)

Calibre Mining released its Q4 and FY2021 results last month, reporting quarterly production of ~49,200 ounces, a 15% increase year-over-year. This strong finish helped the company beat guidance and report a new production record, with consolidated gold production coming in at ~182,800 ounces. While the 34% growth rate was helped by easy year-over-year comps, it was an outstanding year for the company, ending the year with a stronger balance sheet, and an improved jurisdictional profile despite limited share dilution and aggressive spending on exploration. Let's take a closer look below:

Calibre Mining - Quarterly Production (Company Filings, Author's Chart)

As shown in the chart above, it was another solid quarter for Calibre from a production standpoint, with production coming in just shy of 50,000 ounces, helped by continued growth at Libertad (Q4 2021: ~29,600 ounces). This steady growth at Libertad was helped by fast-tracking production at Pavon Norte, where the company fed ~305,000 tons to the hungry Libertad Mill last year at an average grade of 3.34 grams per ton gold. Combined with higher throughput and grades at its second operation, Limon, Calibre managed to increase production by more than 15% in Q4.

Not surprisingly, this led to significant growth on a full-year basis. Some of this growth was due to easy year-over-year comps due to a voluntary suspension of operations due to COVID-19 in Q2 2020. Having said that, whether up against easier comps or not, the company executed all of its plans with flying colors, a refreshing feat in a sector where investors have become used to disappointments. This included beating production guidance, making a new discovery (Volcan Zone) near the Libertad Mill, and increasing Pavon contributions to more than 1,000 tons per day ahead of schedule.

Pan Mine (Fiore Gold Presentation)

In addition to a solid performance from its legacy Nicaraguan assets (Limon and Libertad), Calibre also made the bold move to acquire Fiore Gold: a Nevada-focused gold producer that operates the Pan Mine. Calibre paid a very attractive price of ~0.70x P/NAV to acquire Fiore in the depths of a nasty cyclical bear market for gold producers, giving the company a third operation in a much more favorable jurisdiction (#1 ranked mining jurisdiction globally). Notably, this deal also came with a nearby development project in Gold Rock, which has the potential to produce ~55,000 ounces per year with a very modest upfront capex bill (~$80 million estimated after adjusting for inflationary pressures).

The only real negative worth reporting on during the year, though largely out of Calibre's control, was that we did see costs increase materially year-over-year. This was evidenced by all-in sustaining costs [AISC] increasing from $1,043/oz to $1,136/oz despite a significant increase in production. Calibre noted that the increased costs were driven by higher diesel prices and increased costs for grinding media/chemicals. The company also saw higher costs due to hauling an additional ~400,000 tons relative to FY2020 levels related to its Hub & Spoke Strategy of pulling material from Limon and Pavon to utilize excess capacity at the Libertad Mill.

With fuel costs rising, the fear may be that Calibre will see much higher costs in Nicaragua, and based on guidance, this is certainly the case. Given that Pan is a very low-grade asset that moves a significant amount of rock volume, it's also susceptible to cost increases. However, while costs are set to increase year-over-year based on guidance (AISC midpoint: $1,238/oz), I don't see this as a deal-breaker. This is because part of the reason for the higher costs is increased waste stripping and investment in exploration at Pan, and there is room to claw back some of the lost margins assuming the company can optimize the Pan Mine and increase production from the high-grade Eastern Borosi spoke.

FY2022 Guidance & Organic Growth

As noted above, FY2022 guidance calls for costs of ~$1,238/oz at the mid-point, even though production will increase materially. The increase in costs is mostly related to higher costs at the Pan Mine, where FY2022 AISC is estimated at $1,500/oz. In Nicaragua, costs are expected to remain relatively flat on a year-over-year at $1,150/oz (FY2021: $1,136/oz). Given the company's ability to under-promise and over-deliver, it's certainly possible we could see a beat on the guidance mid-point and therefore a slight beat on costs. However, with fuel prices remaining volatile, it's probably wiser to assume costs come in at or slightly above the guidance mid-point.

Annual Gold Production & Estimated/Potential Future Production (Company Filings, Author's Chart & Estimates)

The good news which I briefly discussed above, is that Calibre still has meaningful excess capacity at its Libertad Mill, with a total capacity of just over 2.2 million tons per annum. The company is currently utilizing roughly ~1.8 million tons per annum, leaving an excess capacity of 400,000 tons per annum. Assuming the company can bring material from Eastern Borosi 300 kilometers south to the Libertad Mill, this would represent an opportunity of more than 50,000 ounces per annum, which should improve AISC beginning in late 2023.

Meanwhile, the company is drilling aggressively with a budget of ~$40 million in FY2022, and higher-grade discoveries could also benefit costs. Given the very prospective ground that the company is drilling and its enormous budget relative to peers of its size, I would not rule out further discoveries which should benefit both assets from a cost standpoint long-term. This is because if the company can increase its reserve grade at its mines meaningfully with mining and milling costs remaining relatively constant, costs at both assets should decline. The last opportunity, of course, is Gold Rock, which should see lower costs with a slightly higher grade than Pan.

Assuming the company can deliver on its medium and long-term goals, we could see production grow to ~285,000 ounces initially in FY2024 (Eastern Borosi contribution) before increasing further to ~335,000 ounces per annum if Gold Rock is developed. This would represent roughly 40% growth from the FY2022 guidance mid-point, giving Calibre one of the better growth profiles among its peer group. The key, however, will be costs, which is one area the company is lagging behind its peers after scooping up the higher-cost Pan Mine.

Financial Results

Moving over to Calibre's financial results, we can see that the company reported record quarterly revenue of $88.1 million in Q4, representing 10% growth year-over-year. Notably, this was despite being up against difficult year-over-year comps as the company had to lap a much higher gold price in Q4 2020. On a full-year basis, revenue and operating cash flow increased 35% and 30%, respectively, driven by higher gold sales and offset by a slightly lower gold price and slightly higher operating costs.

Calibre Mining - Quarterly Revenue (Company Filings, Author's Chart)

Calibre Mining - Operating Cash Flow (Company Filings, Author's Chart)

Given the strong growth in operating cash flow, Calibre actually managed to increase its cash balance on a year-over-year basis despite significant investments in exploration and development. As of year-end, Calibre was sitting on a cash balance of ~$80 million, giving the company an enterprise value of approximately ~$491 million at a share price of US$1.16 (fully-diluted basis). This strong cash balance and continued free cash flow generation will allow the company to continue executing its plan of growing resources and adding new 'spokes', and affords it the ability to have an aggressive exploration budget.

Valuation

Based on ~492 million fully diluted shares and a share price of US$1.16, Calibre Mining has a market cap of ~$571 million and an enterprise value of ~$491 million. This is a very reasonable valuation for a mid-tier producer, especially when we consider that many companies in the development stage without permits are trading at higher capitalizations. In fact, on an enterprise value to reserve ounce basis, Calibre trades at just ~$377/oz, and just ~$186/oz on a Measured & Indicated [M&I] resource basis (excluding Golden Eagle Project).

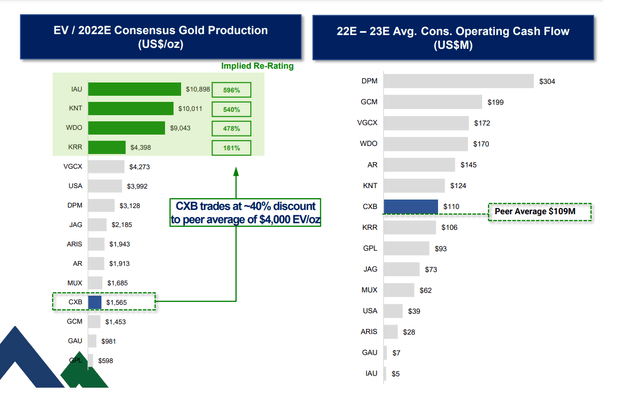

These are very attractive valuations, especially given that substantial inferred mineral inventory at Eastern Borosi is likely to eventually make it into the M&I and reserve categories. Calibre also trades at an attractive valuation from an operating cash flow standpoint, valued at less than 4.5x FY2022 operating cash flow estimates. Finally, as the company points out in its most recent presentation, it also trades at a deep discount to peers from an enterprise value to consensus gold production standpoint, near the bottom of the pack.

Calibre Mining - EV/Gold Production, Operating Cash Flow Relative to Peers (Company Filings, Author's Chart)

I would argue that the implied re-rating target is not realistic by any means, given that there's no reason that Calibre should trade in line with Tier-1 producers with higher margins like Karora (OTCQX:KRRGF) or Wesdome (OTCQX:WDOFF) given its current jurisdictional profile. In fact, even with ~35% of annual production from Pan and Gold Rock in 2025 and an improved jurisdictional profile, I don't see any reason it would trade at anywhere near these levels. Having said that, the stock could easily justify trading in line with Jaguar Mining (OTCQX:JAGGF) or Aris Gold at ~30% higher valuations, so there is upside from this valuation metric as well.

To summarize, from a valuation standpoint, I see Calibre Mining as very reasonably valued, and a valuation of 6x cash flow would not be unreasonable for the stock. This would translate to a fair value of ~US$1.50 for the stock (fully-diluted basis). Having said that, when it comes to small-cap producers, I generally prefer to bake in at least a 35% margin of safety, meaning that the stock would need to decline below US$0.97 to enter a low-risk buy zone. Let's take a look at the technical picture:

Fiore Gold (Fiore Gold Presentation)

Calibre Mining had an outstanding year, and FY2022 will be an even better year with the company adding a third operation to its arsenal. Meanwhile, the company has further growth in the tank given its excess Libertad capacity and two development projects, which could push production above 330,000 ounces by FY2025. Assuming the company can deliver on this goal, there is the potential for an upside re-rating in the stock long-term. In summary, I see Calibre as a solid buy-the-dip candidate for those comfy with producers in less favorable jurisdictions (Nicaragua), and I would view pullbacks below US$0.96 as buying opportunities.