marchmeena29/iStock via Getty Images

Investment Thesis

I believe that buyers of Dorel (OTCPK:DIIBF) today will be handsomely rewarded. Very friendly distributions are likely next year following the closing of the recent sale agreement. I also believe that these distributions will ignite a significant revaluation in Dorel’s shares meaningfully higher than where they are today. The earnings normalization following the end of the pandemic should also play a part in catalyzing Dorel’s stock.

Dorel’s Recent Sale is the Needed Catalyst

Dorel seemed like it was at a deep discount for a while but I was never intrigued by the stock due to a lack of catalyst. I believe that the recent sale of the Sports segment brings several catalysts. Perhaps most importantly is the change in the management’s attitude. The sale of a core holding means that the management is open to unlocking value for shareholders by letting key assets go. This should be very bullish for the stock and may result in the myopic street rerating Dorel to where it should be.

The management did specifically say that they weren’t exploring sales in either of the other two assets but given the right price, why not? I see this commentary as a way of taking pressure off rather than outright being against further asset sales.

I see the sale as a valuation catalyst as well as a sign of further shareholder-friendly actions.

Sale Premiums Pave the Way for Distributions

Perhaps the most tangible benefit of the sale will be shareholder returns. Dorel has a large Net Debt position of $509 mn which it will have to reduce first. Fortunately, the sale premium is rich enough that it easily covers the debt position and then some. Dorel is to receive $810 mn cash for the sale, or ~$300 mn more than the entire debt position. I expect a sizeable special dividend followed by the reinstatement of a regular dividend which likely was thus far blocked by the debt position. The return potential is very sizeable given the company’s current market capitalization of ~$530 mn and should bode very well for the stock price.

Dorel is Undervalued

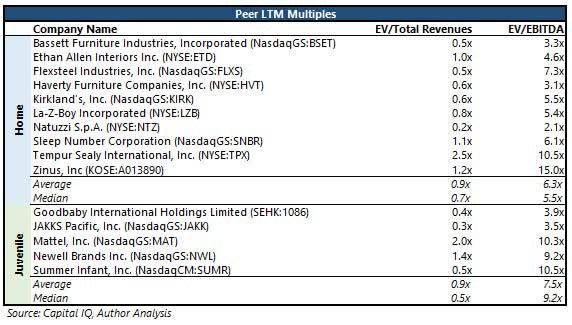

The gains from a potential rerating would be huge. Dorel is dirt cheap. I’ve built a simple peer multiple valuation model for what the company could be trading at with normalized market sentiment. I went and built a basket of peers for the Home and Juvenile segments using their trailing EV/revenue and EV/EBITDA multiples. The median multiples for the Home segment came out to 0.7x revenue and 5.5x EBITDA and 0.5x revenue and 9.2x EBITDA for the Juvenile segment.

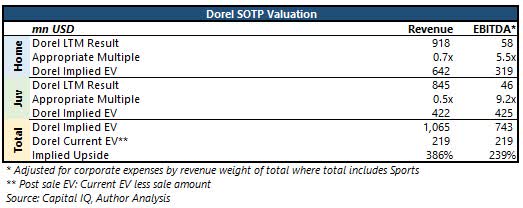

Then I used these multiples on post-sale segment results. I’ve used revenues as is and I adjusted EBITDA for the segment share of corporate expenses by their share in revenue in the total company including the Sports segment. I assume the majority of Sports segment corporate expenses would be eliminated with the sale. Not all of it will go, of course, but then there is likely a lot of expenses associated with the sale that won’t recur. My calculation yielded a multi-bagger upside of 386% for the revenue method and 239% for the EBITDA method. EBITDA is more appropriate here as the different cost structures make revenue multiples unreliable, but still, peer EBITDA valuation implies 2.4x returns.

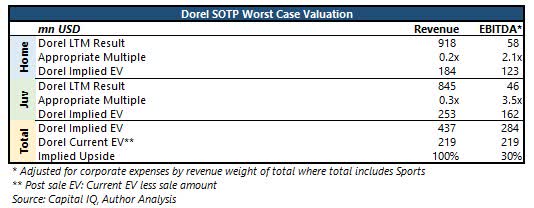

Then, to stress test the valuation, I tried a worst-case scenario using the lowest peer multiple of each group. Even if Dorel trades at tied peer-low multiples, it has a 30% upside. And let’s not forget that this is with zero debt and rich shareholder returns. Dorel is a buy.

Positive Macro Factors Could be a Further Catalyst

Despite initially benefiting from the spending surge during the pandemic, Dorel is now facing a difficult operating environment. The company is lapping COVID fueled quarters which makes it difficult for it to show impressive YoY growth. As the world normalizes and we pass through tough-comp quarters, the results should begin to look better.

Perhaps more importantly, Dorel is significantly harmed by the pandemic due to supply chain issues. The company’s most recent quarterly results incurred a $34-39 mn revenue impact and an additional $4 mn EBITDA profitability impact from supply chain woes. These are on quarterly results and are very material.

Supply chain issues aren’t forever. The stresses already seem to be thawing with the Baltic Dry Index well off of its October highs and down to levels seen in the first quarter of 2021. Omicron may complicate the situation but it won’t be permanent. Normalizing supply chains normalizing Dorel's results should boost Dorel’s rerating.

Dorel is a Buy Today

I viewed Dorel as a value trap before the sale agreement but things are very different now. Before, the company was heavily indebted, couldn’t return capital, and lacked catalysts to get its multiple higher. The sale changed that. The sale premium is enough to pay off the entire debt position and leave enough cash for significant distributions. The sale premium is so much higher than the overall company multiple, it leaves the rest of the company dramatically undervalued in my opinion.