A video presentation that accompanies this release can be found at:

https://youtu.be/ITWxfkF5caw

October 20, 2021, Toronto, Ontario - Discovery Silver Corp. (TSX-V: DSV, OTCQX: DSVSF) ("Discovery" or the "Company") is pleased to announce an updated Mineral Resource Estimate ("Resource") on its flagship Cordero silver project ("Cordero" or "the Project") located in Chihuahua State, Mexico. The Resource is pit-constrained with an estimated waste-to-ore ratio of 1.1 and is supported by 224,000 m of drilling in 517 drill holes and reinterpreted structural and geological models of the deposit. 87% of the contained metal is in the Measured and Indicated category. The Resource will be used to support an updated PEA scheduled for completion later this quarter. The size of the Resource positions Cordero as one of the largest development-stage silver projects globally. Highlights include:

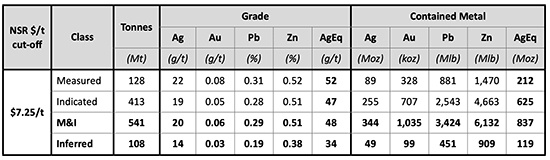

SULPHIDE RESOURCE (assumed to be processed via mill/flotation)

- Measured & Indicated Resource of 837 Moz AgEq1 at an average grade of 48 g/t AgEq1 (541 Mt grading 20 g/t Ag, 0.06 g/t Au, 0.29% Pb and 0.51% Zn)

- Inferred Resource of 119 Moz AgEq1 at an average grade of 34 g/t AgEq1 (108 Mt grading 14 g/t Ag, 0.03 g/t Au, 0.19% Pb and 0.38% Zn)

- High-grade subset – at a $25/t NSR cut-off a Measured & Indicated Resource of 509 Moz AgEq1 at an average grade of 101 g/t AgEq1 (42 g/t Ag, 0.11 g/t Au, 0.64% Pb and 1.04% Zn)

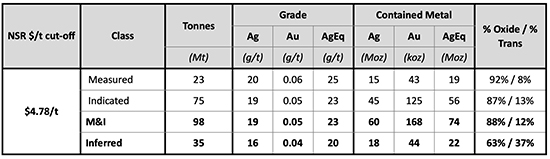

OXIDE/TRANSITION RESOURCE (assumed to be processed by heap leaching)

- Measured & Indicated resource of 74 Moz AgEq1 at an average grade of 23 g/t AgEq1 (98 Mt grading 19 g/t Ag and 0.05 g/t Au)

- Inferred Resource of 22 Moz AgEq1 at an average grade of 20 g/t AgEq1 (35Mt grading 16 g/t Ag and 0.04 g/t Au)

- High-grade subset – at a $15/t NSR cut-off, a Measured & Indicated Resource of 26 Moz AgEq1 at an average grade of 60 g/t AgEq1 (52 g/t Ag and 0.09 g/t Au)

Taj Singh, President and CEO, states: "This resource estimate represents a huge step forward in advancing Cordero for two key reasons. First, close to 90% of the contained metal is in the Measured and Indicated category. This achievement is reflective of the tight drill spacing supporting the resource along with the continuity of mineralization within each estimation domain. Second, the resource demonstrates the large volume of higher-grade mineralization within the deposit. This, along with the low strip ratio, excellent metallurgy and adjacent infrastructure, provide a strong platform as we pursue our target of outlining an average production rate of at least 15 Moz of AgEq per year for a minimum of 15 years with cash costs in the lowest half of the industry cost curve in our PEA later this quarter. Finally, we would also like to acknowledge the excellent work of our Mexican team in managing our sizeable drill program to deliver this very large and technically-robust resource."

SULPHIDE RESOURCE:

Sulphide mineralization is categorized as all mineralization that sits beneath the oxide/transition boundary and is assumed to be processed via standard flotation processing. Sulphide mineralization extends to depths of more than 800 m below surface. The estimates in the below table sit within a pit shell that extends to a maximum depth of approximately 600 m.

The Sulphide Resource as outlined in the table below assumed a $7.25/t Net Smelter Return ("NSR") cut-off (see Resource Estimate Summary section below).

1. Please refer to the Supporting Technical Disclosure section for cautionary statements and underlying assumptions for the Resource.

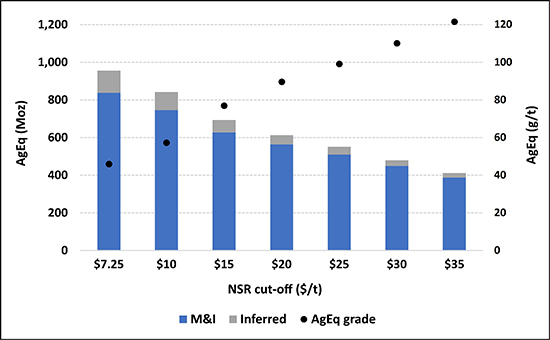

Sulphide Resource Estimate – NSR Cut-off Sensitivity

A significant portion of the Sulphide Resource persists at higher NSR cut-offs as highlighted in the graph below. At an NSR cut-off $25/oz, the Measured & Indicated Resource is 509 Moz AgEq1 at an average grade of 101 g/t AgEq1 representing over 60% of the total Measured and Indicated Sulphide Resource.

Note – NSR cut-off of $7.25/t is the reporting cut-off for Sulphide mineralization

OXIDE/TRANSITION RESOURCE:

Oxide/transition mineralization is categorised as all mineralization that is at or close to surface that is weathered (oxide) or partially weathered (transition). Oxide/transition mineralization is assumed to be processed via heap leaching. Lead and zinc are not incorporated in the Oxide/Transition Resource given these metals are not recoverable through heap leaching. The depth of the oxide/transition zone varies across the deposit from approximately 20 m in the Pozo de Plata zone to depths of up to 100 m in certain areas in the South Corridor and in the far north-east of the deposit.

The Oxide/Transition Resource as outlined in the table below assumed a $4.78/t NSR cut-off (see Resource Estimate Summary section below).

1. Please refer to the Supporting Technical Disclosure section for cautionary statements and underlying assumptions for the Resource

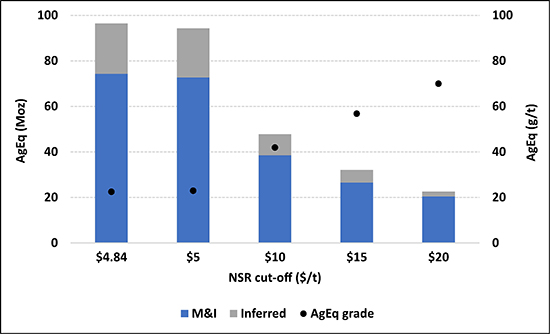

Oxide/Transition Resource Estimate – NSR Cut-off Sensitivity

A graph showing sensitivities to the NSR cut-off is also provided below. At a $15 NSR cut-off the Oxide/Transition Measured & Indicated Resource is 26 Moz AgEq1 averaging 60 g/t AgEq1 highlighting the excellent potential to generate meaningful cash flow via heap leaching in the early years of the mine life.

Note – NSR cut-off of $4.84/t is the reporting cut-off for Oxide/Transition mineralization

RESOURCE SUMMARY:

Resource estimation:

- The Resource was compiled by Rock Ridge Consulting Resource Geologists. Mo Srivastava of Red Dot 3D was retained to complete an independent third-party review of the Resource estimation methodology.

- Supporting drill dataset consists of 224,000 m of drilling (517 drill holes); of this drilling 92,000 m of drilling (225 drill holes) was completed by the Company.

- The Resource incorporates geological and structural constraints and is an in-pit resource containing a total of 782 Mt of Mineral Resource and 893 Mt of waste.

Net Smelter Return (NSR) cut-off:

- NSR is defined as the net revenue from metal sales (taking in to account metallurgical recoveries and payabilities) less treatment costs and refining charges.

- Sulphide mineral resources are reported at a $7.25/t NSR cut-off based on the estimated processing and G&A cost for sulphide mineralization.

- Oxide/transition mineral resources are reported at a $4.78/t NSR cut-off based on the estimated processing and G&A cost for oxide/transition mineralization.

Pit constraint & NSR calculation assumptions:

- Key assumptions are outlined directly below (the full list of assumptions can be found in the Appendix):

- Commodity prices: Ag - $24.00/oz, Au - $1,800/oz, Pb - $1.10/lb, Zn - $1.20/lb.

- Metallurgical recoveries: sourced from the Company's 2021 test program - sulphides were based on locked cycle test work and oxides/transition was based on coarse bottle roll test work.

- Operating costs:

- Base mining costs of $1.54/t for ore and $1.64/t for waste (with incremental costs of $0.024/t per 10 m bench below the 1550 elevation) were developed by AGP Mining Consultants Inc.

- Processing costs of $6.39/t for mill/flotation and $3.92/t for heap leaching and G&A costs of $0.86/t were developed by Ausenco Engineering Canada Inc.

- Pit slopes: pit slope assumptions were based on a pit slope assessment completed by Knight Pisold and Co. (USA).

- Commodity price assumptions were guided by the NI 43-101 requirement for the Resource to have 'reasonable prospects' of economic extraction. The Company plans to use a more conservative price deck for the PEA.

Growth Opportunities:

- Bulk-tonnage targets: follow up drilling of historic holes that returned encouraging intercepts in the far north-east of the deposit within Domain 6 (see Estimation Domains below).

- High-grade vein targets: future drilling to test extensions along strike and at depth at Todos Santos and along strike to the north-east of the Josefina vein trend.

SUPPORTING TECHNICAL DISCLOSURE:

- Mineral resources that are not mineral reserves do not have demonstrated economic viability.

- AgEq for the Sulphide Resource is calculated as Ag + (Au x 16.07) + (Pb x 32.55) + (Zn x 35.10); these factors are based on commodity prices of Ag - $24.00/oz, Au - $1,800/oz, Pb - $1.10/lb, Zn - $1.20/lb and assumed recoveries of Ag – 84%, Au – 18%, Pb – 87% and Zn – 88%.

- AgEq for the Oxide/Transition Resource is calculated as Ag + (Au x 87.5); this factor is based on commodity prices of Ag - $24.00/oz and Au - $1,800/oz and assumed recoveries of Ag – 60% and Au – 70%.

- The Resource is constrained by a pit optimisation; supporting parameters for this pit constraint are provided in the Pit Constraint Parameters section in the Appendix below.

- Individual metals are reported at 100% of in-situ grade.

- Sensitivity cut-offs reported are a subset of the in-pit Resource.

- The effective date of the Resource is October 20, 2021, and is based on drilling through July 2021.

- All figures are in US dollars unless otherwise noted.

- There are no known legal, political, environmental or other risks that could materially affect the potential development of the Resource.

- A full technical report will be prepared in accordance with NI 43-101 and will be filed on SEDAR within 45 days of this press release.

APPENDIX:

An appendix with the following supporting information can be found at the end of the release or the following link: Appendix

- Resource Estimation Methodology

- Pit Constraint Parameters

- Long Sections / Cross Sections

- Resource NSR Cut-off Tables

About Discovery

Discovery's flagship project is its 100%-owned Cordero project, one of the few silver projects globally that offers margin, size and scaleability. Cordero is located close to infrastructure in a prolific mining belt in Chihuahua State, Mexico, and is supported by an industry leading balance sheet with over C$75 million available for aggressive exploration, resource expansion and future development. Discovery was a recipient of the 2020 TSX Venture 50 award and the 2021 OTCQX Best 50 award.

On Behalf of the Board of Directors,

Taj Singh, M.Eng, P.Eng, CPA,

President, Chief Executive Officer and Director

..........Bluetick