Juan Jose Napuri/iStock via Getty Images

It's been a rough 14-month stretch for investors in the Gold Miners Index (GDX), with the ETF plunging more than 40% from its Q3 2020 highs. Unfortunately, for investors in Eldorado Gold (EGO), the stock has been anything but a sanctuary, underperforming its benchmark this year with a -34% year-to-date return. The good news is that after this violent decline, the stock is now trading at ~0.75x P/NAV on solely its operating assets, making it one of the cheapest producers sector-wide. This is providing investors with upside to Skouries for free. Given the improving valuation, I would view any retracements below $8.20 as a low-risk buying opportunity.

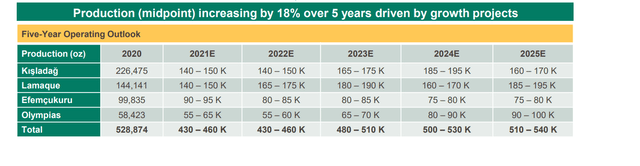

(Source: Company Presentation)

Eldorado Gold released its preliminary Q3 results this week, reporting quarterly production of ~125,500 ounces of gold, an 8% increase on a sequential basis. This has pushed year-to-date production to ~353,300 ounces, with Eldorado tracking at ~79.4% of its FY2021 guidance mid-point. The solid performance in Q2 was driven by another solid quarter at Lamaque and a step-up in production at Kisladag, with Kisladag's production coming in above estimates. Notably, the company also released solid exploration results from Quebec in the quarter, with more impressive grades out of Ormaque, which are well above the average reserve grade. Let's take a closer look below:

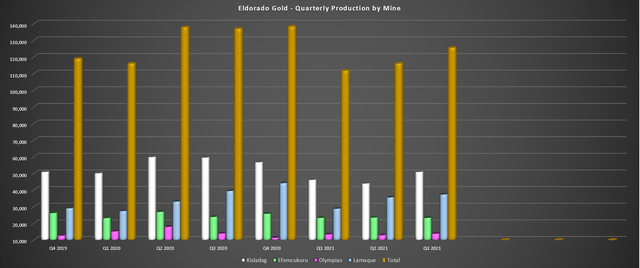

(Source: Company Filings, Author's Chart)

As shown in the chart above, gold production has declined sharply on a year-over-year basis due to much lower production from Eldorado's largest producer, Kisladag. This is related to much lower head grades relative to FY2020 levels, with an average head grade of ~0.79 grams per tonne gold H1 2021 vs. ~1.0 gram per tonne gold last year. Fortunately, the mine is outperforming guidance this year, with year-to-date production sitting at ~141,200 ounces, which is just ~3,800 ounces shy of the FY2021 guidance mid-point of ~145,000 ounces. Even if we assume that Q4 is the weakest quarter of the year, Kisladag should see a massive beat vs. the top end of guidance (150,000 ounces), with the potential for more than 175,000 ounces produced this year. At the same time, production at Eldorado's 2nd largest mine is helping to pick up the slack.

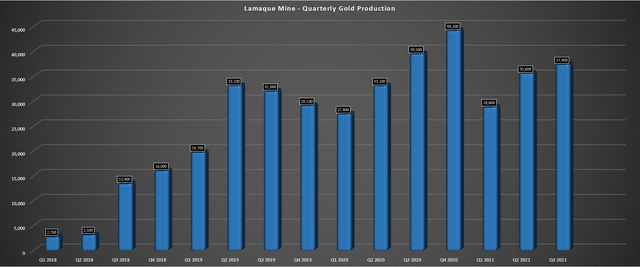

(Source: Company Filings, Author's Chart)

Looking at the chart above, we can see that Lamaque continues to post solid results, with production up again on a sequential basis in Q3 2021 (37,400 ounces vs. 35,600 ounces). Year-to-date, production is sitting at ~101,800 ounces, setting Eldorado up for another year of 140,000+ ounces of gold production. Assuming that Q4 is the strongest quarter of the year, as it was last year, we should see Lamaque meet its guidance mid-point (145,000 ounces), with ~43,200 ounces needed to meet this figure. While a beat would be preferable in a year when Kisladag production has dipped considerably due to grades, the operation is producing significantly more gold than estimated in the Pre-Feasibility Study (peak production: 135,000 ounces, average 117,000 ounces), and the 7-year mine life that was initially forecasted is looking far too conservative.

(Source: Company Presentation)

The much longer mine life than envisioned in the 2018 Pre-Feasibility Study is attributed to the fact that Lamaque is sitting on over ~1.08 million ounces of reserves as of last year, and Eldorado should report reserves of ~1.0+ million ounces of gold in its year-end update. This would translate to another six years of production at a ~170,000-ounce run rate, with already being in production for nearly three years (April 2019 - year-end 2021). Besides, Lamaque is home to another two million ounces of gold in the inferred category, has significantly measured and indicated resources backing up its reserve base, and Ormaque is looking like a very exciting new target, with an average grade of 9.53 grams per tonne gold on the current resource base. This is more than 30% higher than the reserve grade at Lamaque.

After factoring in all these additional resources, I would not be surprised if Lamaque ultimately had a 15+ year mine life (2019-2034), and at higher production rates than initially projected (~165,000 ounces per annum vs. 117,0000 ounces per annum). These estimates are based on a resource base of ~3.5 million ounces of gold (Lamaque + Ormaque) separate from reserves and a 70% conversion rate. So, while I initially thought that Eldorado Gold overpaid for Integra Gold in its 2017 acquisition at a value of more than $500 million, this acquisition should pay off handsomely if this mine continues to produce gold well into the 2030s. Notably, Eldorado continues to make new discoveries at Ormaque, with step-out holes like 2.15 meters of 21.3 grams per tonne gold (30-meter step-out), 1.0 meter of 40.4 grams per tonne gold (80-meter step-out), and 1.05 meters of 38.8 grams per tonne gold.

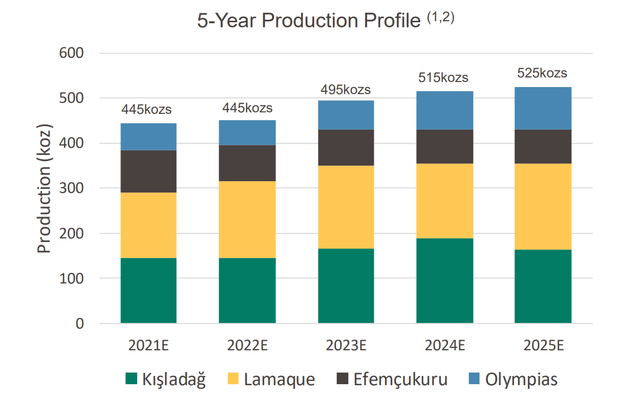

(Source: Company Presentation)

Eldorado's current plan is to steadily ramp up production at Lamaque, with production set to increase to ~190,000 ounces per annum in FY2025 (144,100 ounces in FY2020). This would represent a respectable ~5.7% compound annual production growth rate, and if grades continue to come in where they have at Ormaque, I wouldn't rule out 195,000-ounce potential per annum long-term for a couple of years. This is based on a throughput rate of 800,000 tonnes per annum (in line with capacity) and slightly higher grades of 8.0 grams per tonne gold, benefiting from higher-grade feed at Ormaque. So, while the decline in Kisladag from FY2020 to FY2025 is disappointing, Lamaque and Olympias should easily pick up the slack, as shown above.

(Source: Company Presentation)

Unfortunately, despite the improving production rates expected at Lamaque and Olympias, there is no growth on a consolidated basis relative to FY2020 levels (~529,000 ounces produced). The good news is that Eldorado has arguably a top-10 undeveloped gold project in its wings, with Skouries projected to produce ~280,000 gold-equivalent ounces [GEOs] per annum at all-in sustaining costs below $250/oz. This would translate to a dramatic improvement in Eldorado's consolidated cost profile and a meaningful lift in production. The next step at Skouries is an updated Feasibility Study, and a potential financing decision, with the possibility for Skouries to be in commercial production by 2025 (~2.5-year construction schedule). So, while there's no growth from FY2020 to FY2025 based on existing mines, Skouries would be a game-changer. Let's take a look at the valuation:

Based on ~182 million shares outstanding and a share price of $9.40, Eldorado Gold trades at a market cap of ~$1.71 billion yet has a combined NPV (5%) of ~$2.5 billion on its operating assets. If we subtract out projected corporate G&A, this leaves Eldorado Gold trading at a P/NAV of 0.77 ($1,710 vs. ~$2,200), but this figure is solely on operating assets. In summary, investors are getting Skouries, which is one of the sector's best development projects (ignoring the less favorable jurisdiction) for free. This makes Eldorado Gold an attractive bet if the stock dips to oversold levels in the coming weeks and retraces some of its recent rallies. Let's take a look at the technical picture below:

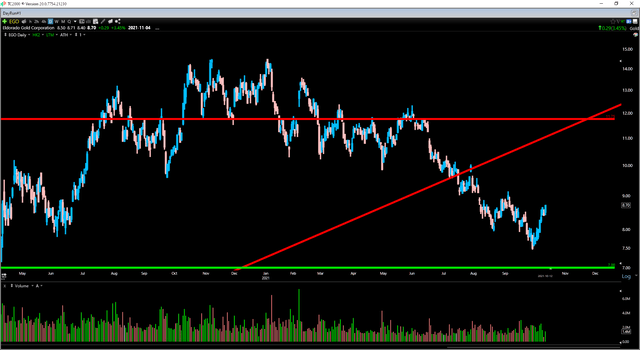

(Source: TC2000.com)

As shown above, Eldorado Gold has seen a violent decline from its 2020 highs and has strong resistance at $11.75, with support below at $7.00. With the stock currently trading in the bottom-third of this trading range, it is certainly possible that this rally could continue. However, I prefer to buy as close to support as possible, and with Eldorado now 25% above its recent support level, the stock is now outside its low-risk buy zone. Having said that, if the stock were to pull back a little to shake out some weak hands and dip below the $8.20 level, I would view this as a low-risk buying opportunity.

(Source: Company Presentation)

Eldorado Gold is not my favorite producer by any means, with barely 30% of its production coming from Tier-1 jurisdictions. Still, with the stock trading at a 0.77x P/NAV, with this not factoring in significant potential upside from Skouries, the valuation has become quite compelling. This doesn't mean that the stock has to go up in a straight line just because it's undervalued, with this evidenced by many producers dropping sharply over the past years despite strong fundamental stories. However, if Eldorado were to pull back closer to its support level at $7.00, the technicals would align with the fundamentals for a low-risk trade. In summary, while I like the stock fundamentally, I plan to wait for a dip to $8.20 before starting a position. Obviously, the stock may not retrace, but I already have several positions in other miners elsewhere in the sector.