Emission-free technologies such as electric vehicles (EVs), solar panels, wind turbines, and nuclear reactors are critical to reducing energy-related emissions and fulfilling net zero goals by 2050.

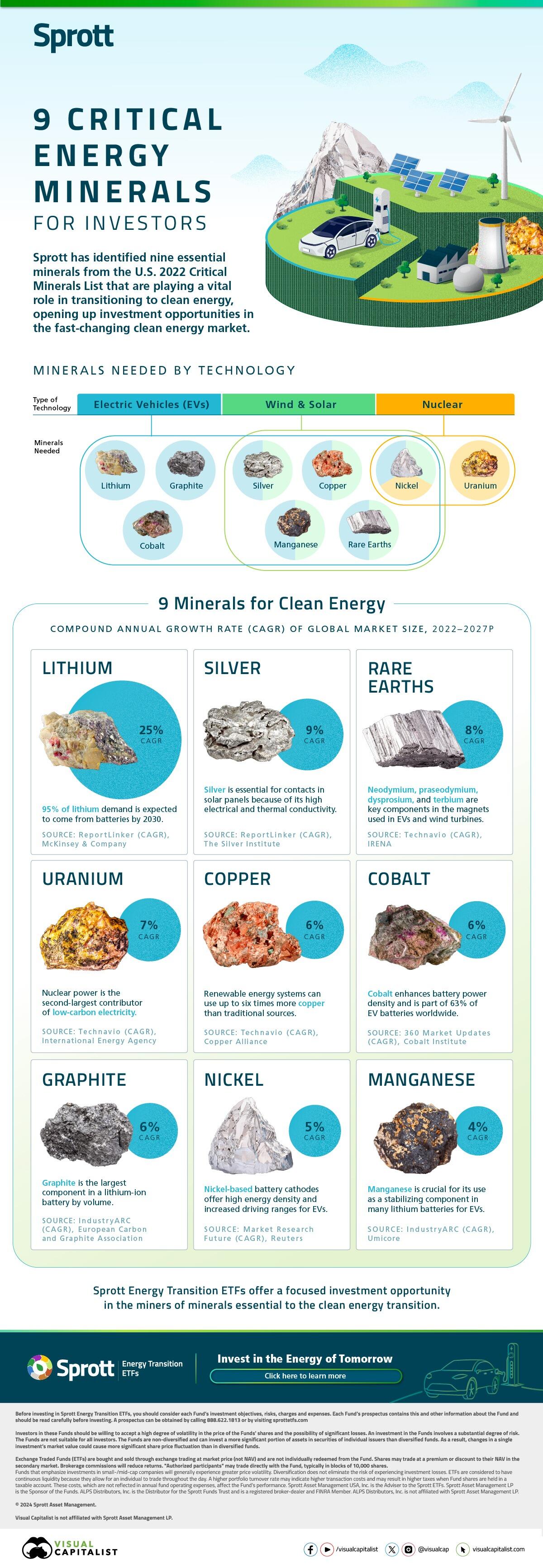

In this graphic, Visual Capitalist partnered with Sprott to explore nine minerals crucial for these technologies and their projected compound annual growth rates (CAGR) in global market size from 2022 to 2027.

Identifying the Nine Key Clean Energy Minerals

Sprott has identified the following minerals from the U.S. 2022 Critical Minerals List as fundamental to the energy transition, offering significant financial opportunities for investors as the transition accelerates.

Let’s delve into each one.

-

Cobalt: Maximizes the stability and longevity of batteries. Cobalt is part of the chemistry of 63% of EV batteries worldwide.

-

Copper: Essential for conductivity in electrical infrastructure, including wind, solar, and EV charging stations. In general, renewable energy systems can use up to six times more copper than traditional ones.

-

Graphite: The largest component of lithium-ion batteries used for EVs and energy storage.

-

Lithium: An essential component of electrolytes in EV batteries and lithium-based energy storage systems. By 2030, 95% of lithium demand is expected to come from batteries.

-

Manganese: Used as an electrode in many lithium-ion batteries for EVs.

-

Nickel: A key element in battery cathodes, offering higher energy density and longer driving ranges for EVs.

-

Rare earths: A vital component in the magnets used in wind turbines and EVs.

-

Silver: Essential for conductivity in solar panels and other electrical infrastructure, possessing the highest electrical and thermal conductivity among all metals.

-

Uranium: The fuel for nuclear power plants that can provide dispatchable and low-carbon power to the electricity grid. Nuclear power ranks as the second-largest contributor to low-carbon electricity production.

Projected Growth for Clean Energy Minerals

With demand escalating for clean energy technologies, demand for their essential components is also expected to grow, offering avenues for investors to capitalize on the dynamic clean energy market.

Below we list the projected compound annual growth rates (CAGR) for each of these minerals, which is their average annual growth in market size over a specified period, taking into account the effects of compounding.

With an average projected CAGR of over 8% through to 2027, driven especially by demand for lithium, silver, and rare earth metals, investors are taking note.