Bet_Noire/iStock via Getty Images

Bet_Noire/iStock via Getty Images GoGold Resources Inc. (GGD.TSX)(OTCQX:GLGDF) is a silver producer, developer, and explorer with three operations in Mexico.

Below, let's have a deep dive into this emerging silver producer.

Investment thesis

GoGold operates the Parral tailings, and the past-producing, district-scale Los Ricos South and Los Ricos North projects (Fig. 1).

Fig. 1. The properties of GoGold, from this source.

Fig. 1. The properties of GoGold, from this source.

According to GoGold's business strategy, these projects represent three consecutive steps for the company to grow organically into an intermediate silver producer in the next few years:

- Parral produced 575 Koz AgEq in the latest quarter from tailings and generated US$7.5 million of free cash flow, which covers all the general and administrative expenses (G&A) of the corporate as well as a large part of the capital spending on exploration in the Los Ricos property. Thanks to the free cash flow from Parral, existing shareholders are, to a large extent, spared of equity dilution.

- The advanced-stage Los Ricos South is supposed to make GoGold a silver producer from two mines. Los Ricos South has a NI 43-101 compliant mineral resource estimate (or MRE) of 83.6 Moz AgEq. A preliminary economic assessment (or PEA), based on that MRE and announced in January 2021, suggests Los Ricos South is likely an economically viable project, with an IRR of 46% and AISC of US$11.35/oz AgEq. A pre-feasibility study (or PFS) is currently underway, to be followed by an investment decision by 2H2022. With Parral producing and Los Ricos North exploration drilling, GoGold may well avoid the so-called orphan phase of the Lassonde curve in Los Ricos South after all.

-

Los Ricos North, ~20km to the north of Los Ricos South, has a blue-sky exploration upside with >100 targets identified and is expected to drive the company to the next level in its aggressive growth. Based on a 100,000m drilling program focusing on 10 targets in 2021, an initial MRE will be produced by mid-October 2021, which will supposedly reveal Los Ricos North as having the potential to be multiple times the size of Los Ricos South.

GoGold is adequately funded to advance Los Ricos South and Los Ricos North simultaneously, thanks to the free cash flow from the producing Parral project and with US$73 million cash and no debt.

The GoGold team is both technically able and shareholder friendly. This is a group of experienced mine builders who constructed four mines in Mexico during the past 25 years. They steadily shepherded the Los Ricos property forward during the past 2-plus years. It's worth noting that the insiders have substantial skin in the game, with ~20% shareholding.

As a silver mining play and an organic growth story that's being methodically de-risked, GoGold checks a lot of boxes. The summer doldrums of late have resulted in a significant pullback of the stock, which I believe presents an entry opportunity to investors who have a time horizon longer than 3-4 years and who still believe in an ongoing long-term precious metal bull market.

Parral tailings

The 141-ha Parral property in Chihuahua, Mexico, hosts tailings from the historical Mina La Prieta silver and base metal mine. Silver mining in the Parral area dates back to 1620. Grupo Mexico recovered silver from the La Prieta deposit in 1920-1990 and placed the tailings to the north of the mine. The inefficiency of the flotation treatment at the time led to poor recoveries and the high abundance of precious metals in the tailings. As of July 29, 2020, the Parral tailings have 31.6 Moz AgEq of proven and probable reserves in 15.4 Mt of tailings (Table 1). In 2012, the Parral tailings were estimated to contain 37.1 Moz AgEq of measured and indicated mineral resources in 21.3 Mt of tailings.

Table 1. The proven and probable mineral reserves in the Parral tailings (upper) and the mineral resource estimate for the Esmerelda tailings, from this source. The Parral reserves were estimated based on operating costs of US$9.95/t, and Au and Ag process recoveries of 65% resulting in an AuEq cut-off grade of 0.34g/t, while the Esmerelda mineral resource estimate was estimated based on operating costs of US$10.14/t, and Au and Ag process recoveries of 50% resulting in an AgEq cut-off grade of 41 g/t, both using US$1,400/oz Au, US$16/oz Ag, and an Ag/Au ratio of 87.5:1.

Table 1. The proven and probable mineral reserves in the Parral tailings (upper) and the mineral resource estimate for the Esmerelda tailings, from this source. The Parral reserves were estimated based on operating costs of US$9.95/t, and Au and Ag process recoveries of 65% resulting in an AuEq cut-off grade of 0.34g/t, while the Esmerelda mineral resource estimate was estimated based on operating costs of US$10.14/t, and Au and Ag process recoveries of 50% resulting in an AgEq cut-off grade of 41 g/t, both using US$1,400/oz Au, US$16/oz Ag, and an Ag/Au ratio of 87.5:1.

- The township of Hidalgo Del Parral purchased the land and the rights to the tailings in 2008 from Grupo Mexico, S.A.B. de C. V. (OTCPK:GMBXF), which gave the city full entitlement to the tailings including any retreatment for metal recovery.

- In October 2011, Absolute Gold Holdings Incorporated optioned the property with the intent to mine and process the tailings for precious metals, with the township of Hidalgo Del Parral retaining a 12% net profits interest (or NPI) after the deduction of costs and capital depreciation without royalties due or payable on the project, and retaining all historical disturbances and environmental liabilities.

In March 2012, GoGold acquired Absolute Gold and obtained the Parral tailings project. Funded by US$35 million, the company started the Parral tailings project construction in August 2013, and achieved its first silver and gold production in June 2014.

In February 2015, GoGold acquired another tailings project - Esmerelda, fka, Promotora - that is located to the southwest of the township of Hidalgo Del Parral (Fig. 2). As of July 2020, the Esmerelda tailings were estimated to contain 13.3 Moz AgEq of measured and indicated mineral resources in 5.7 Mt of tailings (Table 1).

Fig. 2. The Parral and Esmerelda tailings, and the heap leach facility, from the same source as Fig. 1.

Fig. 2. The Parral and Esmerelda tailings, and the heap leach facility, from the same source as Fig. 1.

Parral production

GoGold declared commercial production at Parral on March 1, 2015, producing 315,804 oz AgEq, with 405,596 tons of tailings stacked, in the 1Q2015. Since then, the company has experimented with the heap leach routine with variable results. In the previous 8 quarters, production averages 577,100 oz AgEq (Fig. 3).

Fig. 3. The Parral tailings stacked on the leach pad and rehandled (upper) and silver equivalent ounces produced and sold, shown with the realized price and AISC (lower), compiled by Laurentian Research for The Natural Resources Hub based on the company-released information.

Fig. 3. The Parral tailings stacked on the leach pad and rehandled (upper) and silver equivalent ounces produced and sold, shown with the realized price and AISC (lower), compiled by Laurentian Research for The Natural Resources Hub based on the company-released information.

Financial results

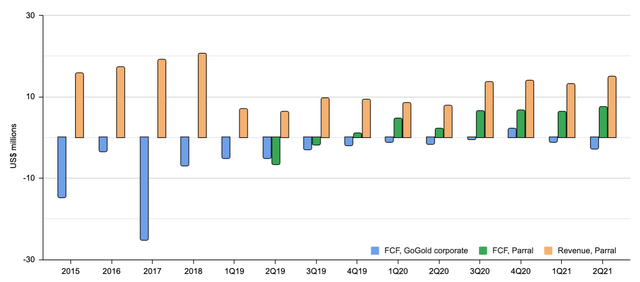

The Parral tailings project achieved positive free cash flow beginning in the 4Q2019 as GoGold finally succeeded in fine-tuning the heap leach operations. As the silver price rose sharply in late 2020 relative to a more or less stable AISC, the free cash flow generated by the project further expanded (Fig. 3; Fig. 4).

Fig. 4. The revenue and free cash flow generated from the Parral tailings project, and the free cash flow of GoGold, compiled by Laurentian Research for The Natural Resources Hub based on the company-released information.

Fig. 4. The revenue and free cash flow generated from the Parral tailings project, and the free cash flow of GoGold, compiled by Laurentian Research for The Natural Resources Hub based on the company-released information.

From 4Q2019 to 2Q2021, the quarterly general and administrative costs at GoGold nearly doubled to approximately US$2.0 million. However, the Parral tailings operation generated enough free cash flow to cover the entire G&A costs, with the remaining free cash flow contributing significantly to the exploration programs carried out by the company elsewhere. As a result, the company only incurred US$6.6 million of net capital expenditures during this time, thus sparing shareholders of considerable equity dilution.

Los Ricos

GoGold acquired the 29 Los Ricos concessions in Jalisco state from private Mexican owners on March 26, 2019, after a long period of due diligence and negotiations. After acquiring the concessions, CEO Brad Langille could not contain his excitement,

“Our team has been following this asset for over eight years and began serious negotiations almost a year ago after the sale of Santa Gertrudis to Agnico Eagle Mines Limited for total proceeds of US$95 million. With this new agreement in place, we can continue exploring this project and test our belief that a large-scale high grade system exists... As part of our due diligence process we have reviewed historical drilling and historical mining documents which will help us focus our exploration program on the halo that exists around the historical high grade ore shoots.”

Subsequently, on Aug. 22, 2019, GoGold acquired 100% ownership of the 29 concessions and a 2% NSR from private owners through the concession agreement.

The 22,000-ha Los Ricos property is made up of 29 claims and had several historical mining operations. GoGold subdivides the Los Ricos property into two projects, including 11 concessions covering 9,643-ha in Los Ricos South and 18 concessions in Los Ricos North (Fig. 5).

- The past-producing Santo Domingo silver-gold deposit of Stroud Resources Ltd. (OTCPK:SDURF) is located 10km to the north of Los Ricos South. Since 1989, Stroud has drilled a total of 45 holes, resulting in a measured and indicated mineral resource of 6.0 Mt averaging 0.47 g/t Au and 101 g/t Ag containing 25.7 Moz of AgEq and an inferred mineral resource of 3.48 Mt containing 13.4 Moz of AgEq (see here).

Fig. 5. The Los Ricos property, from the same source as Fig. 1.

Fig. 5. The Los Ricos property, from the same source as Fig. 1.

The Los Ricos property is part of the Hostotipaquillo mining district where silver and gold mining dates back to the Spanish colonial times. From 1908 to 1930, the Cinco Minas Mining Company produced 33.3 Moz Ag and 233,495 oz Au from 2.45 Mt of ore (Fig. 6).

Fig. 6. The Hostotipaquillo mining district, from this source.

Fig. 6. The Hostotipaquillo mining district, from this source.

TUMI Resources and Bandera Gold carried out exploration activities in Los Ricos South in 2002-2007, confirming epithermal precious metal mineralization from near the surface. No exploration work was done on the property from 2007 to late-2018 due to a protracted legal dispute.

In 2016, the Mexican courts awarded the title of the property to the private Mexican owners from which GoGold optioned the property. Appeals that challenged the 2016 Mexican court decision have been dismissed.

Los Ricos South

GoGold commenced its exploration program in January 2019. Around 35,000m of diamond core drilling primarily focused on the Los Ricos vein in the historical Cinco Minas underground mine defined measured and indicated mineral resource 63.7 Moz AgEq grading 199 g/t AgEq contained in 10.0 Mt, and inferred resource of 19.9 Moz AgEq grading 190 g/t AgEq contained in 3.3 Mt, 2/3 amenable to open-pit mining and 1/3 amenable to underground mining (Fig. 7; Table 2).

Fig. 7. A longitudinal section (upper) and an aerial view (lower) of the Los Ricos vein in the Los Ricos South project, from the same source as Fig. 1.

Fig. 7. A longitudinal section (upper) and an aerial view (lower) of the Los Ricos vein in the Los Ricos South project, from the same source as Fig. 1.

Table 2. The mineral resource estimate at Los Ricos South, pit constrained and out of pit, under the metal price assumption of US$1,400/oz Au and US$16/oz Ag, 93% process recovery and US$18/t process for pit constrained AuEq cut-off grade of 0.43 g/t Au, 93% process recovery, $57/t mining cost and US$18/t process for out-of-pit AuEq cut-off grade of 1.80 g/t Au, from this source.

Table 2. The mineral resource estimate at Los Ricos South, pit constrained and out of pit, under the metal price assumption of US$1,400/oz Au and US$16/oz Ag, 93% process recovery and US$18/t process for pit constrained AuEq cut-off grade of 0.43 g/t Au, 93% process recovery, $57/t mining cost and US$18/t process for out-of-pit AuEq cut-off grade of 1.80 g/t Au, from this source.

The initial PEA at Los Ricos South was announced on Jan. 20, 2021. At US$21.00/oz Ag and US$1,550/oz Au, Los Ricos South is estimated to produce a total of 69.6 Moz AgEq (42.9 Moz Ag, 352,000 oz Au, and 4.5 Mlb Cu) in 11-year mine life, generating an after-tax NPV-5 of US$295 million with an after-tax IRR of 46%, for initial capital costs of $125 million. The average LOM AISC is US$11.35/oz AgEq.

GoGold is conducting a pre-feasibility study (or PFS), which will lead to an investment decision by 2H2022.

Los Ricos North

While working toward the initial PEA at Los Ricos South, GoGold started an exploration program at Los Ricos North in March 2020, where it had acquired five new concessions. The company identified >100 targets, seeing great exploration potential there.

Coming into 2021, GoGold has an aggressive 100,000m drilling program at Los Ricos North aiming to deliver an initial mineral resource by mid-October 2021. The drilling program focuses on targets including El Favor, La Trini, Casados, and El Orito (Fig. 8).

Fig. 8. Maps showing select targets at Los Ricos North, from the same source as Fig. 1.

Fig. 8. Maps showing select targets at Los Ricos North, from the same source as Fig. 1.

Some of the exciting intersections from the 2020 and 2021 drilling programs at Los Ricos North are highlighted below:

- Past-producing El Favor: 1,676 g/t AgEq over 3.4m within 69.3m at 145 g/t AgEq from the surface; 1,243 g/t AgEq over 1.3m within 56.1m at 105 g/t AgEq; 5,071 g/t AgEq over 1.0m within 61.3m at 285 g/t AgEq; 1,576 g/t AgEq over 0.9m within 51.3m at 136 g/t AgEq; 3.3m of 3,675 g/t AgEq within 52.1m of 306 g/t AgEq; 11m of 529 g/t AgEq and 5m of 737 g/t AgEq; 15.3m at 174 g/t AgEq; 2.3m at 2,245 g/t AgEq and 70.5m at 115 g/t AgEq;

- El Orito: New discovery including 43m averaging 323 g/t AgEq; 84.6m at 125 g/t AgEq; 1,126 g/t AgEq over 1.8m within 11.4m at 275 g/t AgEq and 48.6m at 164 g/t AgEq; 1,729 g/t AgEq over 1.8m and 53.4m at 145 g/t AgEq; 1,007 g/t AgEq over 4.2m within 58.0m at 168 g/t AgEq; 1,181 g/t AgEq over 1.7m within 38.1m of 186 g/t AgEq; 1,197 g/t AgEq over 1.2m within 73.7m of 101 g/t AgEq;

- La Trini: 1,233 g/t AgEq over 0.8m within 511 g/t AgEq over 3.2m; 3.4m of 2,765 g/t AgEq within 61.4m of 204 g/t AgEq; 1,048.4 g/t AgEq over 1.3m within 15.2m of 123.8 g/t AgEq; 17.2m of 186 g/t AgEq including 11.0m of 267 g/t AgEq; 5.6m of 1,070 g/t AgEq within 21.8m at 335.2 g/t AgEq; 8.8m of 670 g/t AgEq within 29.4m of 254.1 g/t AgEq; 29.8m of 713 g/t AgEq, including 4.5m of 4,251 g/t AgEq;

- Casados: New discovery at past-producing Casados including 56.5m of 171 g/t AgEq; 7,616 g/t AgEq over 0.8m within 49.1m of 291 g/t AgEq also at Casados; 1,320 g/t AgEq over 1.5m within 16.8m at 306 g/t AgEq, extending mineralized zone 200m to the east; 2,835 g/t AgEq over 0.8m on a new vein; 1,213 g/t AgEq over 1.9m within 33.6m at 164 g/t AgEq; 4,367 g/t AgEq over 1.0m within 45.9m at 259 g/t AgEq; 3,435 g/t AgEq over 1.0m within 41.6m of 312 g/t AgEq.

The pattern of monstrous grades (up to 7,616 g/t AgEq) within broad zones of respectable grades seems to suggest Los Ricos North is a huge silver-gold system with remarkable mineralization continuity (Fig. 9). I believe it's highly likely that investors will be pleasantly surprised by the forthcoming maiden mineral resource estimate.

Fig. 9. Longitudinal sections of the El Orito area (left) and Casados deposit (right) showing grade thickness, from this and this source.

Fig. 9. Longitudinal sections of the El Orito area (left) and Casados deposit (right) showing grade thickness, from this and this source.

The upside

GoGold has 277.6 million basic shares plus 14.8 million options and DSUs outstanding, giving 292.4 million fully-diluted shares. At US$2.18 per basic share as of Sept. 20, 2021, the company has a market cap of US$605 million. With US$73 million cash and zero debt, and ignoring the US$13 million receivables from the Mexican government, GoGold has an enterprise value of US$532 million.

- Silver mineral resources tend to be valued at roughly US$4.5/oz Ag or US$1.8/oz AgEq in terms of the EV/MRE metric. Once silver mineral resources are converted to reserves, a silver producer on average can grab a lofty EV/MRE multiple of ~US$16/oz Ag, in part reflective of the rarity of pure-play silver producers. In other words, a lot of value creation - to be precise, an eight-bagger - can be had by advancing a silver exploration project to production.

A sum-of-the-parts (aka, SOTP) analysis of the Parral reserves (16.570 Moz Ag or 31.585 Moz AgEq), Esmerelda tailings silver equivalent ounces (13.305 Moz AgEq) and Los Ricos South silver equivalent ounces (83.561 Moz AgEq) points to an intrinsic value of US$439 million. Factoring in the US$73 million cash, the non-Los Ricos North assets of GoGold are valued at US$1.85 per basic share. The implications are:

- The market assigned to Los Ricos North a value of US$0.33 per share by the market, which further indicates GoGold will need to find ~50 Moz AgEq in Los Ricos North to justify the current share price. The ensuing question is whether GoGold will be able to report 50 Moz AgEq of maiden mineral resource there. Judging from the kinds of grades and thicknesses so far encountered, I believe it's highly likely Los Ricos North contains more than 50 Moz AgEq.

- Additional upside does exist beyond Los Ricos North. By the time Los Ricos South produces in, say, 2024, and assuming global mineral resources are converted to reserves at 75%, some US$1.22 per share of value will be added. When Esmerelda is advanced to production, some US$0.39 per share will be created.

In summary, for an investor with a time horizon of >5 years, GoGold has an upside of US$3.46 per share. When a 50 Moz AgEq Los Ricos North is advanced to production, the upside can be north of $4.42 per share (Fig. 10).

Fig. 10. Stock chart of GoGold, modified from this source.

Fig. 10. Stock chart of GoGold, modified from this source.

The risk

A slew of risk factors come with the above upside. It may take years for GoGold to optimize the leaching of the Esmerelda tailings. In a very unlikely case, additional appealings of the rights concerning the Los Ricos property may arise. There are above-the-ground risks associated with advancing the Los Ricos South project toward production, including permitting and financing.

However, the primary risk perhaps lies in the subsurface uncertainties associated with the exploration of the Los Ricos North project, the chief value driver for the sock. That's why the maiden mineral resource estimate expected in mid-October 2021 is so critical.

Fortunately, the management team at GoGold appears to be one that shareholders can count on overcoming various operational challenges to deliver value-adding results.

- CEO Brad Langille is a successful mine builder, having had four mines under his belt, including Ocampo, El Cubo, Orion (Animas-Del Norte), and Parral, all in Mexico and built over 25 years. He co-founded and led Gammon Gold Inc. and Mexgold Resources Inc. from grass-root exploration to production. He has been involved in raising over C$1 billion in capital over his career. COO Anis Nehme has worked with Langille for many years since Gammon Gold.

Langille said, "We have a track record of finding off-the-radar assets, bringing the capital to them, doing what we do well, and turning them into dollars for our shareholders."

- Having watched the GoGold team closely over the last two years, paying particular attention to how they fixed the Parral tailings operation and shepherded the Los Ricos projects forward, I am impressed by their strategic approach and technical capability.

- The personal interest of the insiders seems to be well aligned with retail investors; they own ~20% of the shares, giving them substantial skin in the game.

The shareholders do not have to be unduly worried about GoGold issuing equity shares to fund its aggressive exploration program at Los Ricos North and the advancing of Los Ricos South toward production thanks to the free cash flow thrown off by the Parral tailings project. With US$73 million in the bank, the company is well funded to simultaneously advance both Los Ricos South and Los Ricos North projects.

GoGold trades on the TSX and the premier-quality OTCQX board with adequate liquidity. The stock is a member of OTCQX Best50, having been a member of that board since October 2019.

Investor takeaways

GoGold is a self-funded junior silver explorer/producer in Mexico, where the management has a track record of advancing projects from exploration to production.

I particularly like the sequence of projects GoGold has lines up:

- The Parral tailings - with a reserve life of 14 years - generate free cash flow that is being deployed to the Los Ricos property.

- With a PFS underway, Los Ricos South is being advanced toward an investment decision by 2H2022. Once Los Ricos South is on-stream, GoGold will be producing ~7 Moz AgEq per year from two mines.

- By accelerating the blue-sky exploration at the richly-endowed Los Ricos North, GoGold is swinging for the fences.

There are a number of near-term catalysts that may drive the share price considerably higher, including news flow from drilling at the Los Ricos property, the initial mineral resource estimate for Los Ricos North by mid-October 2021, and the PFS, FID, and attainment of commercial production of Los Ricos South by late 2022.

Judging from the above considerations, I believe GoGold offers an investor with a five-year time horizon an advantageous risk-reward profile characterized by a multi-bagger potential of capital appreciation at moderate risk.