H&R REIT (TSX:HR/UN) (OTCPK:HRUFF) units have fallen sharply this year due to fears about its Canadian malls and office exposure to energy tenants. Favorable news in both areas has not been reflected in the price. High rent collection and access to debt financing on attractive terms put the company in strong financial condition to survive the recession. The dividend reduction was a prudent move to conserve cash, but management recently expressed a desire to repurchase shares, and insiders have been buying. H&R's business has built value for shareholders over time and the unit price is likely to recover without any significant change in the company's strategic plan. Peer comparisons suggest that H&R units should currently trade around C$15.

Topics:

- Peer Returns

- 2Q20 Operating Results

- Investor Concerns

- Investment Considerations

Background: H&R is a diversified Canadian REIT with Office (41% of 2Q20 NAV), Industrial (8%), Residential (23%), and Retail (28%) assets in Canada (62%) and the United States (38%). All amounts in this article are in Canadian dollars unless otherwise indicated.

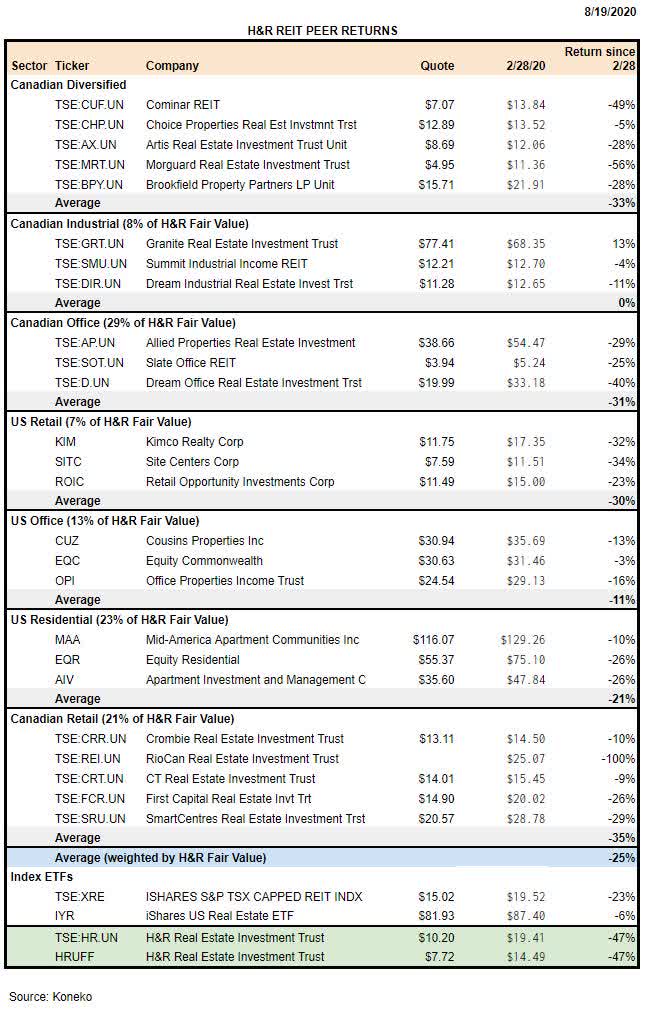

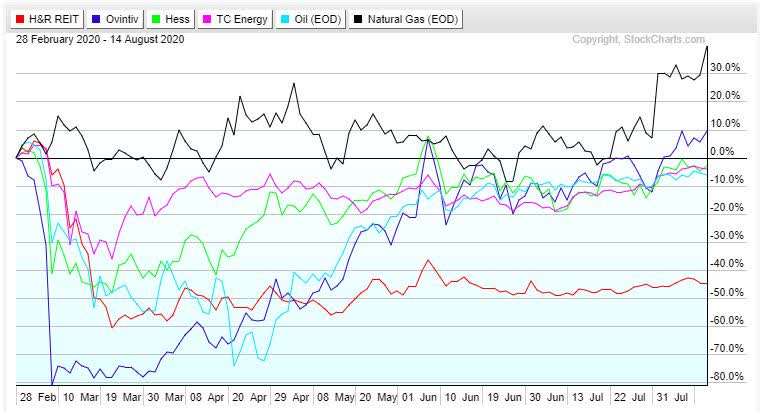

Peer Returns

H&R's diversified business model should protect it from weakness in particular sectors and markets, but since February, H&R units have underperformed broad US & Canadian indices and also sector returns weighted according to the sources of H&R Fair Value.

If H&R had dropped 23% in line with the Canadian index, then it would trade at C$14.95. If it dropped 25% in line with a weighted measure of peers, then it would trade at C$14.56.

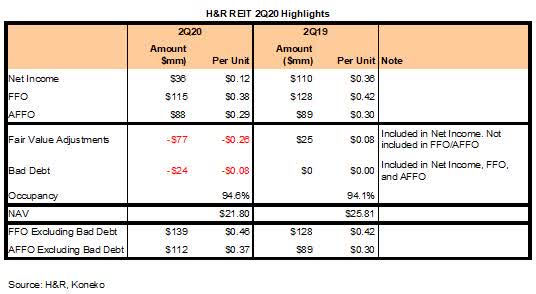

2Q20 Operating Results

H&R operating results were below expectations due to a $24mm bad debt provision comprised of $18mm expected tenant concessions, $3mm attributable to tenant bankruptcies, and $3mm concessions to tenants under the CECRA program. The provision was almost entirely in the retail division where stores were closed for extended periods. Excluding bad debt, the run rate for FFO/AFFO is ahead of last year.

Risks in the retail segment are described in greater detail below under "Investor Concerns". The $24mm bad debt provision was unavoidable during the period of store closures, but only the $3mm attributable to bankruptcies represents rents that will be lost going forward. The CECRA program has only been extended to August. A limited number of other tenants may be granted concessions at the discretion of the company.

H&R secured substantial liquidity during the quarter by issuing $400mm of 5-year debentures at a 4.07% rate and 3 mortgages totaling $113mm at a weighted average rate of 3.8%. At 6/30, the company had $131mm of cash on hand and $996mm of borrowing capacity on lines of credit. Access to credit on favorable terms highlights the low valuation of H&R equity.

Investor Concerns

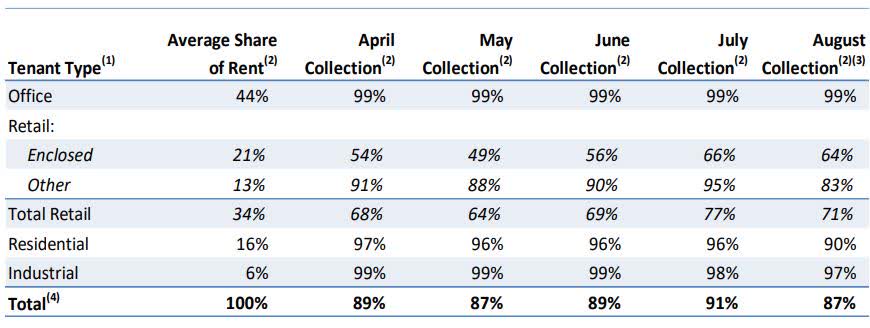

H&R has exposure to several areas of heightened concern to investors, but where news has been better than feared. Overall rent collections have remained high (91% in July) and the trend over the past 4 months has been positive.

During the 2Q20 conference call, management said that final August payments from retail tenants were expected to be ahead of July's 77% and that other segments would be in line.

H&R moved quickly in 1Q20 to reduce the "fair value" of its investment properties by $1.3Bn, about 10% of their 12/31/19 value. This appears to fairly reflect the risks in those parts of the portfolio currently under pressure.

Energy Tenants:

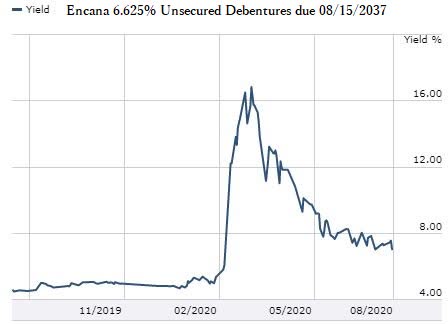

- Ovintiv (f/k/a Encana pays 12% of H&R rents) has 18 years remaining on its lease at The Bow tower in Calgary. It's an excellent building, but the contracted rent is far above current market rates in a city suffering from over 27% office vacancy. If Ovintiv went bankrupt, then it would presumably break the lease and H&R would suffer declines in rental income and asset value. Encana 2037 bonds which have about the same maturity as The Bow lease spiked to a yield over 15% in March. One could argue that a similar cap rate should be applied to The Bow rent payments. The bonds have subsequently recovered to a 7% yield, but I believe H&R equity investors and analysts still believe the risk requires a cap rate of 8-10% or even higher.

- Hess (6% of rents) occupies the Hess Tower in Houston. H&R says: "due to the confidentiality under the tenant's lease, the term is not disclosed", but media coverage of the 2011 purchase said it ran through 2026. Hess is unlikely to go bankrupt during the lease term, but occupancy and rents could suffer at the end of the lease due to the high office vacancy rate in Houston.

- TC Energy (2% of rents) and Altalink (1% of rents) are energy midstream companies that should not be of any concern.

The energy sector has substantially recovered from the supply crisis caused by the temporary Saudi production surge and the demand crisis caused by COVID-19. Energy-related fears implied by the weak H&R unit price seem excessive.

H&R reduced the IFRS fair value of its office investment properties year-to-date by $689mm, about 12% of the 12/31/19 carrying value. It probably combines reductions of 0-20% for individual locations based on tenant mix and market factors such as prevailing cap rates, vacancies, and releasing costs.

Malls: H&R receives 21% of rents from enclosed retail (i.e. malls) in Canada. Management commented about the pace of recovery:

- Each mall reopened at a different time with the last being the Dufferin Mallin Toronto at the end of June.

- Malls and tenants are not open for as many hours as pre-COVID-19.

- Tenants have had some difficulty re-staffing while employees are receiving Emergency Response Benefit from the government.

- Tenant sales are about 20-30% below a year ago. H&R mentioned that malls with limited competition in smaller communities are performing well while super-regional malls are slower to recover.

- Food and personal care tenants are reporting sales down 30-50%

- Electronics, fashion, and footwear "are performing well, with some posting comparable sales greater than last year"

- Fitness facilities "are surprised at how well they are doing"

- Movie theatres are suffering from a lack of new releases from Hollywood studios due to closure of all US theatres. Producers of The Spongebob Movie: Sponge on The Run cancelled its theatrical release when they realized it might have limited appeal, but because there is no competition it opened in 300 theatres across Canada last week. The film was shown 8 times on Sunday at H&R's Park Place Mall in Lethbridge. The Montreal Globe&Mail reviewer wrote that his children enjoyed the fart jokes. Sorry America, no Spongebob farts for you.

Support for further recovery of the retail sector in Canada will come from the country's competent response to the COVID-19 epidemic. As of 8/15, Canada had 4,672 active cases (0.012% of population) compared to 2,521,992 active cases in the United States (0.761% of population). Canada is getting back to work. Stores are open. Employees are returning to offices.

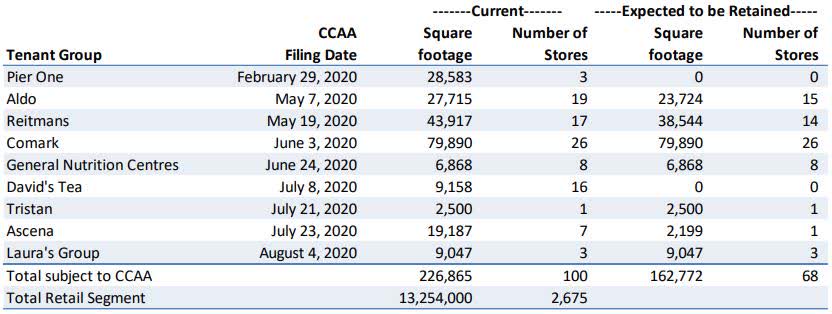

H&R projects that retailer bankruptcies announced in 2020 will boost its vacancies by only 0.5%:

H&R reduced the IFRS fair value of its retail investment properties year-to-date by $665mm, about 16% of the 12/31/19 carrying value. It probably combines reductions of 20-30% for malls and 0-10% for other properties such as the grocery-anchored ECHO division in the US.

Apartments: It was initially feared that residential properties might be significantly impacted by the sharp rise in unemployment plus tenant friendly emergency regulations like eviction moratoriums, but actual performance has been excellent. A NAREIT survey showed that members averaged collection of 96% of rents in June and July. Tenants view rent as "essential" spending and tenant incomes have been supported by emergency government assistance.

H&R also reported 96% collection from multifamily properties and explained that half of the shortfall was "folks who are being strategic with the policies" (taking advantage of the eviction ban). The other half was people who still have income/assets, but may have a temporary shortage of funds and H&R is willing to work with them on a payment plan. H&R said the number of tenants who have no job, no income, no assets, and simply cannot pay any more is "immaterial".

The longer-term impact of COVID-19 is uncertain. REITs are offering more concessions to attract tenants in higher-priced coastal markets (H&R owns 50% of one property in New York City) while many expect better performance from affordable Sunbelt markets (H&R owns 21 properties in Texas, Florida, and North Carolina). The company mentioned that about 40% of the tenants at its NYC property had been foreign students and there would be a near-term hit to occupancy. On the conference call management stated that schools would not be open, but this is not entirely correct. For example, NYU will be open.

H&R reduced the IFRS fair value of its multifamily investment properties year-to-date by $8mm, about 0% of the 12/31/19 carrying value.

Investment Considerations

Dividends: H&R reduced its dividend by 50% (as I suggested in my prior article) to $0.0575/month. Any change in the dividend does not affect the underlying value of the company and its assets so this article does not offer any detailed commentary about past present or future dividends. The distribution (currently C$0.69/year) gradually returns a portion of the full NAV which we can now acquire in the market at a discount. The distribution is amply covered by AFFO and strong rent collection so it is very unlikely to be cut. The company can apply its retained cash flow to development, redevelopment, and share repurchase.

Diversified Business Model: Diversified REITs (including H&R as well as Brookfield, Artis, and Morguard) have been trading at lower valuations than companies operating in a single segment. Prior to the COVID-19 crash H&R traded at a discount of 15-20% to Net Asset Value and that is unlikely to change without significant management actions to demonstrate greater internal growth and to deliver more value to shareholders. Fair Value for H&R is therefore about 80% of NAV (0.8 X $21.80 = $17.44).

Strategic Initiatives: The persistent gap between H&R's unit price and asset value might lead to pressure for corporate actions to reduce or eliminate the discount. The company might sell mature assets more aggressively and repurchase its units as was done by Dream Office and Artis. However, any such plan is unlikely during the disruption from the virus.

Long-Term Value Generation: H&R delivered a 13.6% IRR (NAV appreciation + dividends) from 2003-2019. The unit price implies a degree of distress which is not evident in the financial statements or real estate operations. Malls may continue to disappoint, but the company has an attractive growth pipeline through new developments, and redevelopments. If NAV returns to growth and the unit price discount shrinks then investors at the current price will earn high returns without any dramatic corporate catalysts.

Unit Repurchase: Management spoke very favorably about unit buyback during the 2Q conference call:

We believe the current -- roughly 50% discounts to our IFRS fair value that our units are trading and is excessively discounting the risk in our business. We hope our Q2 results provide some comfort to investors that our cash flow and portfolio value is more resilient than our unit prices suggest. As noted in the past, we are always looking at ways to improve our business and the variety of options we look at is broad. With the unit price trading where it is currently and with the REIT's adequate liquidity, the option of buying back our units has become very attractive, particularly relative to other investments we might pursue. Over the rest of 2020, as visibility improves and economic conditions return to a more normal state, we expect to have excess liquidity, and we'll consider buying back units if current price levels persist."

Since 1Q20 earnings were announced in May insiders have purchased $3.0mm of units, including a 50,000 unit buy on 8/14 by Alex Avery who used to manage REIT equity research for CIBC.

Disclosures

The author is a unitholder of H&R REIT. Investors are encouraged to check all of the key facts cited here from SEDAR filings and other sources prior to making any investment decisions.

Diversity Our Strength is the official motto of the City of Toronto.

Disclosure: I am/we are long HRUFF. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.