Battle north gold articleRead....

THE LION: BATTLE NORTH GOLD - GRADE CONTINUITY, SMALL RESOURCE

The reason for changing the name of a former ill-fated project and/or company is to protect it from any lingering negative bias. The Phoenix Gold Project, now called the Bateman Gold Project, which was previously owned by Rubicon Minerals, now Battle North Gold, fits the bill.

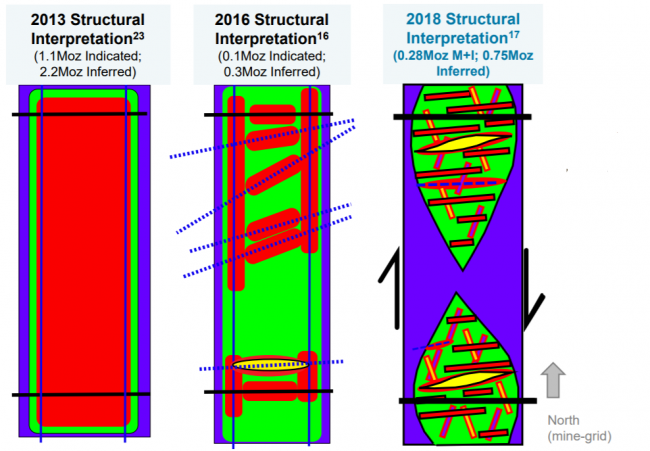

The critical problems with the deposit’s gold mineralization include a lack of continuity and high variability, (Fig. 11). A changing structural interpretation of the gold mineralization has underpinned a significant drop in the global resource from 3.3 million ounces in 2013 to about 1 million ounces in 2018. Currently, it stands at 733,000 ounces grading 7.0 grams per tonne gold between the F2 and Finlay zones.

(Figure 11: Evolution of the Bateman gold deposit’s structural interpretation from 2013 to 2018. Source: Battle North Gold)

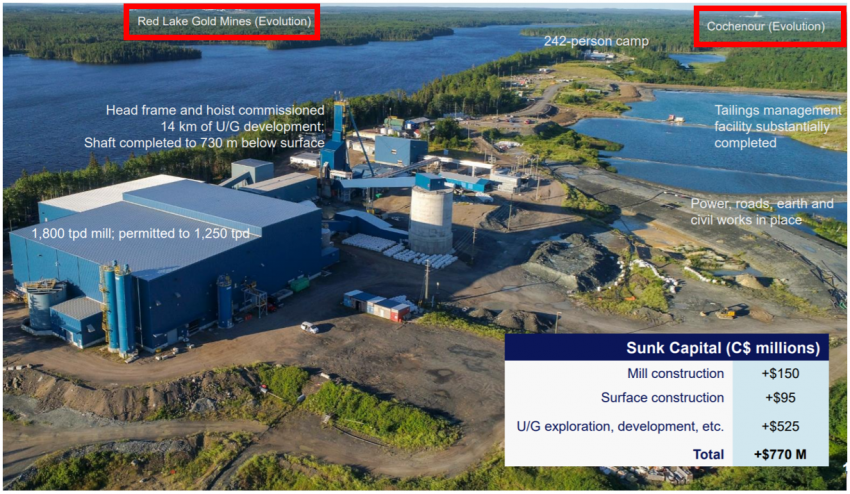

Regardless, previous operators had sunk about C$770 million into the 1,800 tonne per day plant facility and underground mine development, including a shaft, (Fig. 12); therefore, Battle North did not think it needed a lot more funds to get the project into commercial production (C$109 M).

(Figure 12: Phoenix processing plant in the Red Lake gold district of northern Ontario. Source: Battle North Gold)

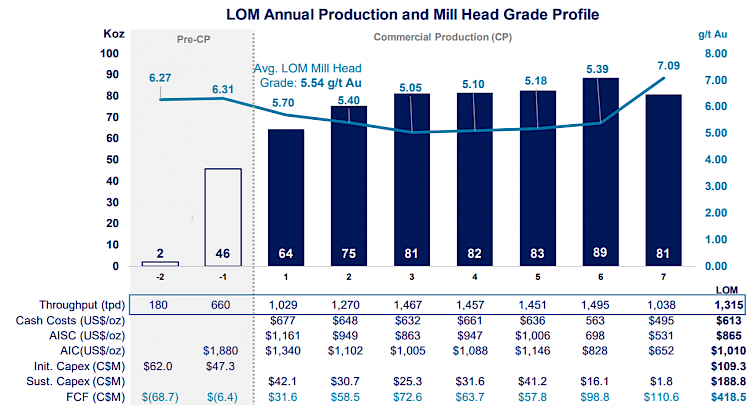

Given a 20% dilution rate, the Bateman project’s life-of-mine head grade is 5.5 grams per tonne gold, (Fig. 13), hardly high-grade compared to peer deposits in the Red Lake mining district of northern Ontario. The forecast annual production in the 2020 feasibility study was about 80,000 ounces at an all-in-sustaining cost (AISC) of US$865 per ounce over an 8-year mine life.

(Figure 13: Life of mine annual production and head grade for the F2 Zone. Source: Battle North Gold)

Evolution Mining (EVN.ASX)’s cash acquisition of Battle North Gold was driven by the Australian-based mid-tier gold producer’s desire to add adjoining ground (+288 sq km) to its Red Lake land package, including the Bateman gold project, (Fig. 14), and get hold of another plant (permitted to 1.25 kt/d) to expand the annual production from its Red Lake operation to over 300,000 ounces.

The timing of the transaction may have been dictated by the Bateman project’s development timeline, as Evolution Mining would rather acquire Battle North Gold before it started using the plant to treat its own ore from the F2 Zone.

(Figure 14: Claim map of the Red Lake district showing Battle North Gold properties abutting Evolution Mining’s ground to the north, east, and west. Source: Battle North Gold)

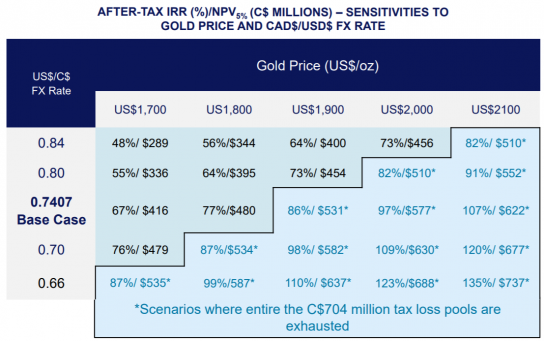

In addition to the infrastructure and land package provided by the acquisition, the previous expenditures at the Bateman gold project have generated a significant tax loss pool (C$704 M) that could be used to reduce the tax impacts of any operating income from the mid-tier producer’s operations at Red Lake, (Fig. 15).

(Figure 15: Positive economic impacts of applying accumulated tax losses of C$704 million on operating income at different scenarios. Source: Battle North Gold)

Despite the issues with the project’s development (grade continuity, small resource), the transaction makes more sense than the other two because of the permitted plant and the size of the land package.

Based on its peer group of junior developers, the acquisition cost (EV/oz) was a significant premium (US$173 vs. US$50-55) due, most likely to the permitted plant facility and sizable land package in Ontario.