All in US$

1) FY Revenue 12% better than expectation

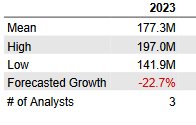

Actual FY-23 annual revenue = $199M or 12% better than the analyst consensus of $177.3M

Revenue consensus

2) FY Earnings Per Share (EPS) way lower than expectation

Actual Q1-23 EPS = ($0.02)

Actual Q2-23 EPS = ($0.09)

Actual Q3-23 EPS = ($0.19)

Actual Q4-23 EPS = ($0.21) The worst Q of 2023

Actual FY-23 EPS = ($0.51)

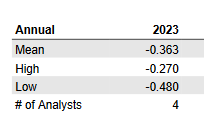

Actual FY-23 EPS = ($0.51) or 40% worst than the analyst consensus of ($0.363)

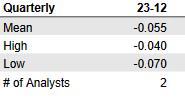

Actual Q4-23 EPS = ($0.21) or 382% worst than the analyst consensus of ($0.05)

EPS Consensus

3) Operating costs

Actual FY-23 Operating Costs = $174.8M or 88% of Revenue.

FY-23 Gross margin = 12%.

Actual Q4-23 Operating Costs = $43.2M or 98% of Revenue

Q4-23 Gross margin = 2% .

Note: We are not talking about Net Margin (i.e after deduction of ALL costs incurred by the company but only Gross Margin. A 12% Gross Margin is ridiculous (to say the least), never mind a 2%.

The operating costs are prohibitively high. And we are not even taking into consideration SG&A and other corporate / development / LCE support / misc costs.

No company can stay afloat in such a red sea forever.

4) Conclusion

Largo’s CEO: “While vanadium appears to have very promising long-term fundamentals, the Company remains solely focused on reducing costs and meeting its production and sales targets to withstand the current period of low vanadium prices.”

Sales are dependent on the prices of V which fluctuate based on factors beyond management control.

Costs are mostly within the control of management.

With Q4-23 Gross Margin at a ridiculous rate of 2% of Revenue, it was obvious that management cost reduction effort was a total failure then. But that was the past. With regard to 2024, we already know that the V prices are even lower in Q1-24 than in the challenging year of 2023. On a forward looking view, here is what I’m worried about:

Will management be able to deliver on its promise of reducing costs in a way that is good enough to keep Largo afloat if the “current period of low vanadium prices” persists?

DYODD