It's been a rough few months for the junior gold space (GDXJ), but there's one new issue that has not only defied gravity but also managed to massively outperform its benchmark during this correction. This company is New Found Gold (OTCPK:NFGFF), one of the most exciting discoveries thus far in 2020 with a high-grade resource sitting in a Tier-1 jurisdiction. To date, the company has delivered several massive gold intercepts on its 151,000-hectare property, with the highlight intercept being an incredible 19 meters of 92~ grams per tonne gold. However, the near-parabolic advance has left the stock valued at over US$450 million pre-resource, a hefty price to pay for a junior gold explorer. Therefore, I continue to see New Found Gold as a very risky proposition for new investors looking to start a position in the stock.

(Source: Company Presentation)

(Source: Company Presentation)

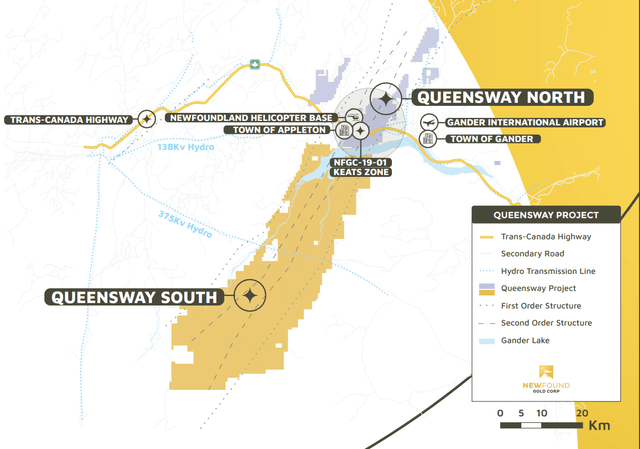

Up until recently, the province of Newfoundland in Canada barely got any recognition and was mostly known for two gold companies: Anaconda Mining (OTCQX:ANXGF) and Marathon Gold (OTCQX:MGDPF). However, since New Found Gold's much-awaited IPO debut earlier this year, we've seen a plethora of companies staking ground in the area or reminding investors that they too have land packages in Newfoundland. This has led to a surge in investor interest in Newfoundland, with the quiet province with a population of 500,000 now commanding similar excitement to the Pilbara Region of Western Australia when Novo Resources (OTCQX:NSRPF) grabbed the sector's attention in mid-2017. The ensuing staking rush and companies piggy-backing on Novo's nuggety gold find marked the top for Novo Resources, and most of the companies in the area have not created any real shareholder value since. Obviously, there's no guarantee that New Found Gold will face a similar outcome and top out in the coming months. Still, the current situation in Newfoundland feels eerily similar if the excitement continues.

(Source: Company Presentation)

(Source: Company Presentation)

Just over two months ago, I wrote that New Found Gold was beginning to get extended short term, and the stock corrected over 20% in the following two weeks. This pullback cooled off the valuation a little and returned some sanity to the market. However, in a sector where it's been hard to find any upside momentum with metals prices under pressure, it seems that investors are continuing to pile into New Found Gold (the momentum leader), with the stock up another 20% since my initial article. This has pushed the valuation from unattractive to borderline-insane for a pre-resource company, regardless of if this is a massive discovery. In fact, the current valuation of US$445~ million has left the stock valued higher than some gold producers and at a valuation that dwarfs even intermediate and million-ounce producers. Before digging into valuation, though, let's take a quick look at the recent developments below:

(Source: Company Presentation)

(Source: Company Presentation)

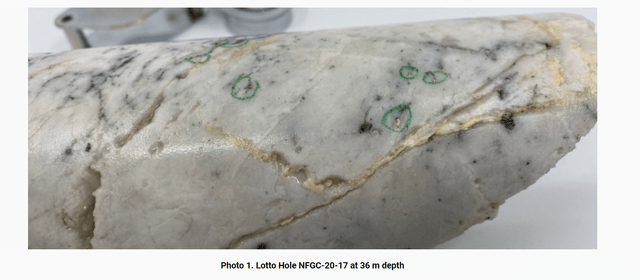

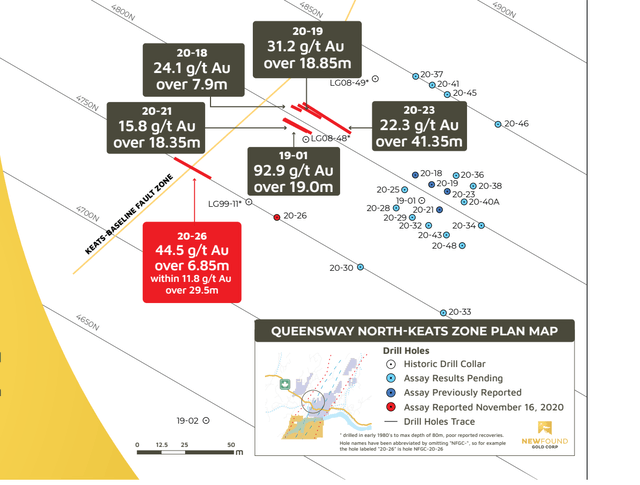

Over the past couple of months, New Found Gold has continued to release impressive intercepts out of its Keats and Lotto zones, with most intercepts coming in above 10 grams per tonne gold. The Lotto Zone lies 2 kilometers north of the high-grade discovery hole at Keats (19 meters of 92~ grams per tonne gold), and the company intersected 4.75 meters of 41.2 grams per tonne gold and 13.8 meters of 10.1 grams per tonne gold. These are very impressive intercepts for two reasons. The first is that they are near-surface, and grades like this near-surface are quite rare. The second reason they're exciting is that it confirms a second potential discovery on the company's Queensway Project, suggesting that the grades hit at Keats Zone are not likely merely an anomaly in a larger, low-grade bulk tonnage target.

(Source: Company News Release)

(Source: Company News Release)

Meanwhile, the company recently intersected 41.3 meters of 22.3 grams per tonne gold at Keats and 18.85 meters of 31.2 grams per tonne gold. While not as impressive as hole NFGC-19-01, these holes confirm the presence of high-grade gold in the vicinity of the discovery hole, though they were drilled very close to the intercept. Therefore, while these were small step-out holes, they don't tell us much about unexplored areas of the Keats Zone. This is not to discount the discovery at Keats by any means, but the true potential for Keats will be more clear once we get assay results back from other holes like 20-30, 20-33, 20-48, and 20-37 that are drilled between 50 and 100 meters away from NFGC-19-01. These holes are all currently pending and should be released before the end of January.

(Source: Company Presentation)

(Source: Company Presentation)

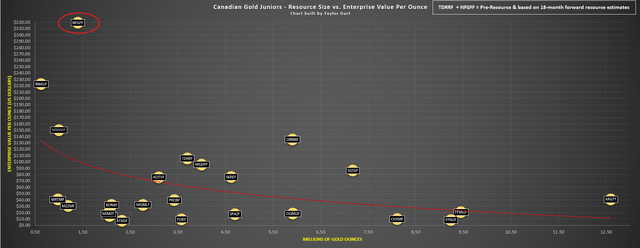

It's far too early to get a decent idea of what this project might hold long term, but it's fair to say that if we have a high-grade near-surface deposit in a Tier-1 jurisdiction, these ounces could certainly command a valuation of up to US$150.00/oz. However, based on my early estimates of what the company could prove up in the next 18 months, New Found Gold is trading at a valuation of over US$300.00/oz without any guarantee of these ounces eventually being proven up. My current estimate for what the company can prove up in 18 months is 1.40 million ounces at an average grade of 7.5 grams per tonne gold. This is merely a rough estimate and can be subject to change based on future drilling. Let's take a closer look at how this stacks up relative to other Canadian gold explorers. All calculations below are based on my estimate that New Found Gold can prove up 1.40 million ounces of gold at 7.5 grams per tonne gold by Q2 2022.

This above calculation is based on 143 million shares outstanding, a share price of US$3.30 (US$472 million), and subtracting an estimated cash of US$25 million by the end of Q2 2021. I have arrived at this cash calculation by subtracting an estimated cash burn of US$3 million per quarter from the US$36 million cash balance at the end of Q3 2020 [US$36 million (-) US$9 million for three quarters of G&A plus exploration expenditures = US$25 million in cash].

(Source: Author's Chart)

(Source: Author's Chart)

As noted in a recent article, the median enterprise value per ounce for Canadian gold explorers is US$28.56/oz, and we can see that New Found Gold is certainly an anomaly among the nearly 25 juniors listed. As shown above, New Found Gold trades at a 900% premium to other Canadian gold juniors, even though it is pre-resource and there's no guarantee of future ounces. Currently, New Found Gold's enterprise value per ounce sits at US$319.21/oz based on an estimate of 1.4 million ounces of gold proven up by Q2 2022 and an enterprise value of US$446.9 million.

(Source: Author's Chart)

(Source: Author's Chart)

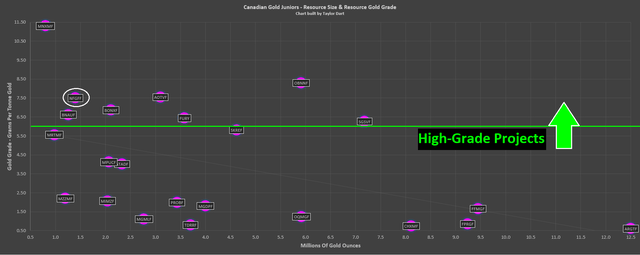

It's important to note that all ounces are not created equal, and New Found Gold certainly justifies a premium vs. the average Canadian junior gold company. This is because New Found Gold has the ability to define a very high-grade gold discovery at Queensway, and high-grade ounces tend to receive a significant premium. As shown above, there are only seven companies in Canada with a 1-million ounce resource above 6.00 grams per tonne gold, with these companies being Osisko Mining (OTCPK:OBNNF), Sabina Gold & Silver (OTCQX:SGSVF), Fury Gold Mines (NYSEMKT:FURY), Ascot Resources (OTCQX:AOTVF), Bonterra Resources (OTCQX:BONXF), Battle North Gold (OTCQX:BNAUF), and Auteco Minerals (OTC:MNXMF). The average valuation for these companies is over US$80.00/oz, suggesting that the market is willing to pay up for high-grade ounces. Therefore, while New Found Gold is trading at a 900% premium ($319.61/oz vs. $28.56/oz) vs. the median for all Canadian juniors, it's actually trading at closer to a 300% premium vs. other high-grade explorers. Let's see how the company stacks up in a more relevant chart that compares resource grade to enterprise value per ounce:

(Source: Author's Chart)

(Source: Author's Chart)

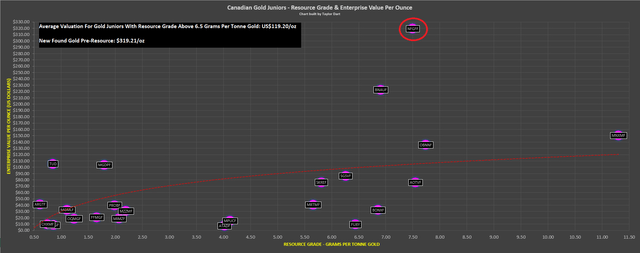

The chart above compares resource grades to enterprise value per ounce and is a much better way to assess undervaluation or overvaluation for a company. This is because high-grade ounces receive a premium, as noted earlier. However, if we look at the line of best fit (red line) between these companies, we can see that New Found Gold is trading well above the trend line, with fair value coming in near US$100.00/oz for 7.5~ gram per tonne gold deposits. In fact, the closest comparisons from a grade are Ascot Resources and Osisko Mining, and these two companies trade at valuations of US$77.00/oz~ and US$131.50/oz, respectively.

If we use a larger sample size and look at the average of all companies with a resource above 6.50 grams per tonne gold, we come up with a valuation of US$119.20/oz. Therefore, even after factoring in that New Found Gold should get a premium for grades, we have a stock trading at 150% above the average. The closest peer on a valuation basis is Battle North Gold, but this company is likely less than two years away from production and has modest upfront capex to fund Bateman. Therefore, it deserves to be valued at above US$150.00/oz. Meanwhile, Osisko Mining has the largest and highest-grade undeveloped gold deposit in Canada outside of Sabina Gold, with over 5 million ounces in its global gold inventory. However, with zero ounces proven up, New Found Gold trades at a large premium and is priced for near perfection.

(Source: Author's Chart)

(Source: Author's Chart)

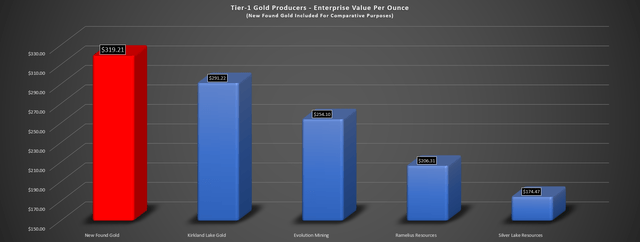

What about if we compare New Found Gold to gold producers in Tier-1 jurisdictions?

If we look at the chart above, we can see that some Tier-1 jurisdiction gold producers like Ramelius (OTCPK:RMLRF) and Silver Lake (OTCPK:SVLKF) are now trading below US$225.00/oz even though they're generating significant free cash flow. Meanwhile, Evolution Mining (OTCPK:CAHPF) is trading at a valuation of barely US$250.00/oz as a 650,000-ounce per annum gold producer, despite the fact that the company generated over A$710 million in net mine cash flow the past 12 months. Therefore, for an investor looking to park money in the sector, I would argue that there is much better value elsewhere from a reward to risk standpoint. This is because intermediate gold producers can be bought for 20% less than New Found Gold: a pre-resource explorer.

Some investors will argue that New Found Gold is a new paradigm, the biggest discovery of the past decade, and it belongs at a US$1 billion valuation. While anything is possible, we've heard this before several times in the past few years, and I would argue it's far too early to call this the discovery of the past decade. Assuming this is just a decent discovery with 2.0 million ounces of gold at 7.0+ grams per tonne gold, I believe that New Found Gold is getting close to fully priced. This is because the ceiling for fair value for high-grade ounces for an explorer is generally US$200.00/oz, and current high-grade explorers are valued at below US$120.00/oz on average in Canada.

(Source: Company Presentation)

(Source: Company Presentation)

A frothy valuation does not preclude a further rally in New Found Gold, and valuations often get stretched far past where they should, as we saw with De Grey Mining (OTCPK:DGMLF) earlier this year. However, given that New Found Gold's valuation is already pricing in a lot, this is a very high-risk proposition, and drill results must deliver to sustain a US$3.30 share price. Therefore, I believe investors would be wise not to chase the stock above US$3.30, and I would view any rallies to above US$3.60 as an area to book more profits.

Disclosure: I am/we are long GLD, MGDPF. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.