Semis' Perfect Storm

The semiconductor industry has benefitted from a "perfect storm" which requires several negative macro events to line up at the same time. The COVID-induced "Work From Home" and "Learn from Home" (WFM, LFH) lifestyle created a surprising surge in demand for semiconductor-related products, while the lockdown interrupted the supply chain of chip production which has already been experiencing a long-term chip shortage. A surge in demand along with a supply shortage allowed semiconductor firms (semis) to raise prices to increase revenue and profit from a perfect combination of negative economic scenarios.

One year after the COVID lockdown, the WFM demand has started to fade after the virus is under control and the stimulus package kicks in. The semi chip shortage has worsened to the point that it has affected real production. Semi shareholders have become increasingly more appreciative of the chip shortage which has turned into a critical supply constraint. In this post, I seek to identify the extent of the supply (chip) shortage risk for the 12 largest US semi companies. Before any shareholders' appreciation of the risk can be measured, I will first examine how semi firms got to this point of chip shortage.

GM's "Just-in-Time" vs. Huawei's "Ahead-of-Time"

Amid the COVID lockdown and subsequent drop in auto sales (Q1 2020), General Motors' (NYSE:GM) "Just-In-Time" inventory system cancelled or delayed their chip orders from the major chip suppliers, Taiwan Semiconductor Manufacturing Company (TSM) and Samsung (OTC:SSNLF). The chip capacity free-up was moved to meet part of the semis' WFH demand as both TSMC and Samsung have always been at full capacity. When the auto demand rebounded sharply in 2H 2020, GM could not meet the car orders due to the loss in the chip production queue. GM estimated that it will lose $2 billion in 2021 as a result. Although TSMC has promised to manufacture auto chips as its first priority, the return to normal production will still take some time, especially because the automobile industry has one of the longest supply chains.

On the other side, semis' supply shortage may worsen as it is just a matter of time that semis have to return the borrowed auto chip capacity. In contrast to GM, adding to current shortage was Huawei's "ahead-of-time" stockpiling of PCs and chips. In anticipation of the US scheduled sanction, Huawei has speeded up its $24 billion purchase of PC and chips before the US ban deadline in September 2020. When the tech giant began stockpiling semiconductors, other companies followed their lead, adding to the global shortage.

Chip Shortage in "Danger Zone"

It is estimated that, on average, companies are shipping 10% to 30% below current demand levels and it will take at least 3-4 quarters for supply to catch up with demand and then another 1-2 quarters for inventories at customer/distribution channels to be replenished back to normal levels. While chip shortages will only get worse heading into the spring, the lead times (the amount of time from when an order is placed to when an order is delivered) for semiconductors are entering a "danger zone" of above 14 weeks, the longest lead time they've had since the last chip boom in 2018, as warned by Susquehanna's Christopher Roland. Stifel analyst Matthew Sheerin also alarmed the "elevated book-to-bill levels, growing backlog, a 'double-ordering' red flag, continued supply disruptions, increased materials costs, and an imminent multi-quarter inventory correction."

Chip Shortage Causes Real Damages

Up to late 2020, the net impact of chip shortage has been favorable. As chip demand easily outstripped the supply, companies can raise prices enough to offset the opportunity losses from the unfilled new units demanded. The shortage is hardly noticeable when companies were making record revenue and earnings during such a difficult time. However, there is growing evidence that the real damage surfaces when the "second leg" of the supply shortage starts limiting the quantity of the products being manufactured. Obviously, the real pain has been felt first by the auto industry. Just a few weeks ago, Ford (F) announced to cut shifts at its truck plants producing the highly profitable F-150, citing the global automotive chip shortage. On the same ground, GM will pause production for the following week at plants in Kansas, Ontario, and Mexico. GM further warned that the semiconductor shortage would impact materially the 2021 production. IHS Markit estimated that the overall hit to the auto industry will be around $61 billion for 2021. And automotive isn't the only industry being hit by the chip shortage. Sales of certain iPhone models have reportedly been limited because particular components were not available. Also, some have pointed to chip shortages for problems in getting ahold of Sony's new PlayStation 5 and Microsoft's latest Xbox.

A growing number of major chipmakers have voiced concerns about the brewing crisis. In a recent interview, the CEO of Xilinx warned of a prolonged shortage due to those supply chain constraints and said he hoped the shortage wouldn't last all year. For the largest mobile chipmaker, after missing Q1 2021 revenue by $20 million and guiding down Q2 nearly 10%, Qualcomm (NASDAQ:QCOM) also warned that the "shortage in the semiconductor industry is across the board." In Q4 2020, citing its "supply constraints," AMD lost PC market share for the first time since 2017, which the company warned could continue through H1. AMD mentioned that it will face 'tightness' ofsupply in the first half of 2021 with Big Navi graphics cards and some models of Ryzen 5000 CPUs. Similarly, Nvidia's (NASDAQ:NVDA) RTX 3000 stock may not improve until May. Intel (NASDAQ:INTC) got more aggressive visiting the notion of outsourcing some of its bread-and-butter CPU products.

US Semis' Chip Shortage Exposures

Obviously, the quickest relief is sought from the major chip suppliers. Taiwan's government recently announced that TSMC and United Microelectronics (UMC) are committed to prioritizing auto chips if additional capacity becomes available. Early this year, TSMC forecast $25-28B in 2021 capex, which was 50% above expectations. But capacity adds don't happen quickly and there are shortages elsewhere in the semi manufacturing supply chain. On average, it costs $10 billion to build a new foundry and it takes three years to deliver new chips. It may be time for US semis to recognize the exact supply risk they are facing.

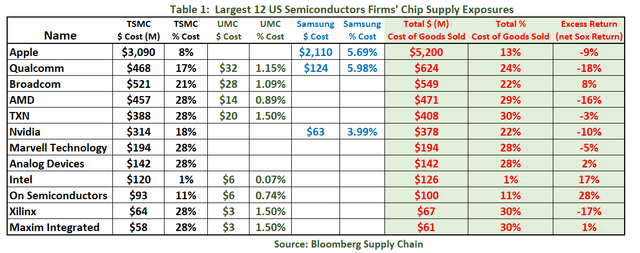

To quantify US semis' exposure to chip supply shortage, I identified the current "relationship value" (sales) from the top 3 major chip suppliers, TSMC, United Microelectronics, and Samsung to the largest 12 US semis customers (market cap > $1 billion) from Bloomberg Supply Chain Database (Table 1). Intel has its own chip production, so the lowest total chip supply exposure around 1%. Other than ON Semiconductor (ON) and Apple's (AAPL) low teen exposures, most large US semis have over 20% chip cost exposures from the three major chip suppliers.

Any Semi Stocks Upside Left?

In December, the Semiconductor Industry Association estimated global chip sales would grow 8.4% in 2021 from 2020's total of $433B (up from 5.1% growth between 2019 and 2020). So, semi demand remains high into 2021 or maybe 2022. If the semi stocks have already factored in supply shortage risk, there could be more gains ahead from the generally bullish macro forecasts.

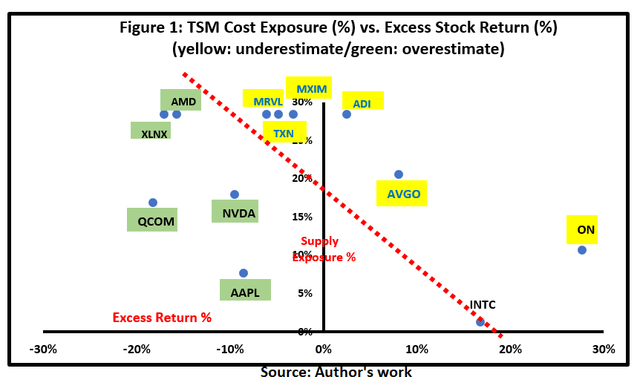

To check this possibility, I compared semis' quarterly excess stock returns (net SOX index return) based on the level of their supply exposures. The argument is that if the market has priced in supply shortage risk, semis with large supply exposures should have experienced lower stock returns in the recent period. From Figure 1, it appears that semis, as a group, recognize the higher risk associated with the large supply risk. This is shown by the negative relationship (the red line) between recent stock return and the supply ratio.

In particular, semi-related stocks like Apple, Nvidia, Advanced Micro Devices (AMD), and Xilinx (XLNX) with larger TSMC exposures have underperformed the SOX index for the last 3 months. On the other (yellow) side, stocks like Marvell Technology (MRVL), Maxim Integrated (MXIM), Analog Devices, Inc. (ADI), and Texas Instruments (TXN) with similarly large TSMC exposures still outperformed the market. Since the "correct" stock price adjustment amid a specific supply shortage is not yet known, all I can say is that green semis further away from the red line (e.g., QCOM, NVDA, AAPL) may have overestimated the impact of supply shortage, while the yellow semis (e.g., ADI, AVGO, ON) likely underestimated the shortage impact. As a result, the former (latter) will have more upside (downside) ahead.

Compared to how Intel fared with a mere 1.3% TSMC exposure, there are some "outliers." Qualcomm with a 17% exposure has underperformed by -18%. This is in sharp contrast to Broadcom (AVGO) with a 21% exposure but outperformed by +8%. It may suggest that not all the semis have factored in the potential impact of supply shortage properly. This would leave room for individual correction.

Takeaways

The second leg of the current chip shortage has finally started causing some real damages on the semi-related companies. Unlike in 2020, simply raising prices cannot make up the loss in revenue for the unfilled orders anymore. On one hand, both the fading WFH and the slowing recovery may wipe out the previously unfilled demand. On the other hand, the prolonged supply shortage already forces many companies to reduce the production. The imperfect combination of such scenarios may shorten the life span of the perfect storm.

One silver lining is that, at least in the short run, the favorable industry forecast provides support for the semi stocks' upside moves. Even for the supply risk, there is indication that semis as a group may have factored in the impact of the chip shortage. Largely, semis with larger (smaller) chip supply exposures have underperformed (outperformed) the SOX Index. Semi stocks like QCOM, NVDA, and AAPL may have relatively overstated the chip shortage impact, while ADI, AVGO and Broadcom likely understated the chip impact. For these stocks, there is room for further price adjustments ahead.