Honey-POO's Buying NVA Nva is a mess with management, bond holders, lack of facilities, huge capital investment required, fighting declines, Pipestone rampup issues, the list goes on.

Paramount - it is not complicated with share holders issues, no bond maturity dates, no banks breathing down your neck, no rolette wheel with pipestone, paying a dividend. Why get involved in that NVA mess.

Clear Sailing That is the name of the Paramounts new Clear Water/Martin Hills company. Paramount has been in the Clear water for years now, buying land, mapping geology, attending landsales, and seeding the landscape with small companies that are farming in on their land base, increasing the land value of the hood. POU is the Riocan of the oil sands leases marketplace, and clearwater if its not Boardwalk, call it Park Place.

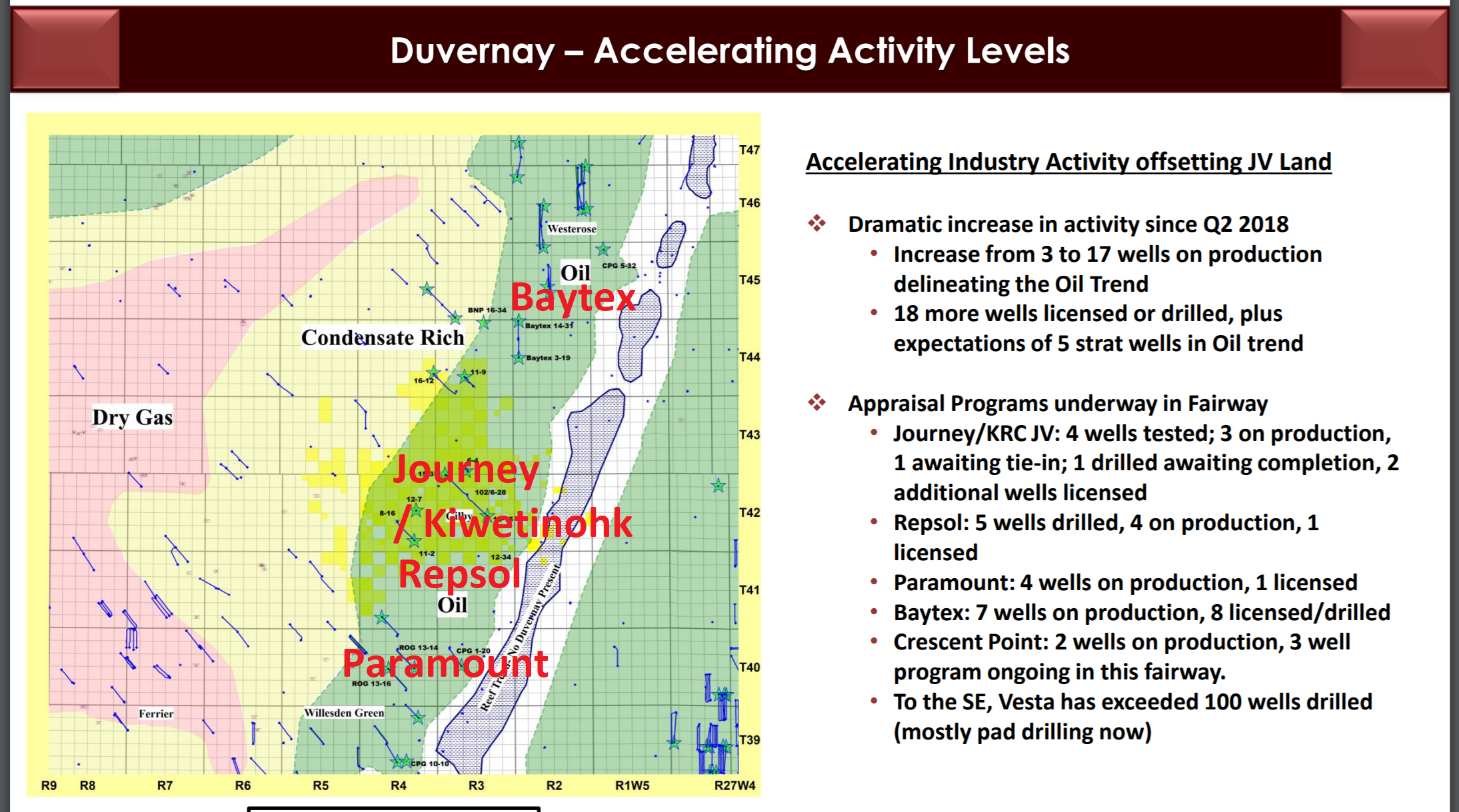

Smoke Signals With the recent flurry of activity with CPG around smokey, the skys are clearing, and all that is left at Smoky Duvernay and on the horizion what looks like mountains, but after closer examination it is piles of green backs towering into the statosphere. Years of over engineering by shell, and over optimization, has left a well understoond, under exploited over analyed resouce that CPG has purchase. With a more pragmatic approach that involves optimising returns, production, and investment, CPG are going to make out like bandits and smokey is the sweet spot of the play, and either the money will be bubbling to the surface, or CPG will have it helicoptered in.

Aurora Borealis - North Duvernay

Pou has be sitting on this play for years, and becasue they own all the mineral rights, surface to basement, they have pursuing the shallow ecomical zones while their entire time recognizing the prize that exists in the duverany zone. Paramount has half cycle economics happening here and a lot of surface infastructure. Muphy oil on one side, CPG on another, Chevron pouding at the back door, and shell managemnt hoping we have some positions for them in the future.

East Duvernay (Vesta 74%oil, 85%Liquids, 15%gas)

The well results are in and now we simply have to build the plant, or find a midstream partner that wants to build a plant, (Lots of them around) East Duvernay represents a significant landbase, and a significant resource in the best part of the East Duvernay. Vesta has great economics, and JR know all about them.

NVA is simply to messy, to much debt, and to much EGO, pou has lots of opportunity rather than pick up all the hair that comes with NVA, in my humble opinion.

HoneyPot - Idea.

Go NVA shopping, buy an asset, juice the NVA stock and dump all the shares, get the asset at a discount.

IMHO