RMP Energy Inc. (OTCPK:OEXFF) management was getting worried about the leverage and lack of value. So management hired some outside consultants. Those consultants advised selling a significant chunk of production. That sale wiped out the long-term debt and left the company with more than 3,000 BOED remaining.

(Chart figures in Canadian dollars unless otherwise stated)

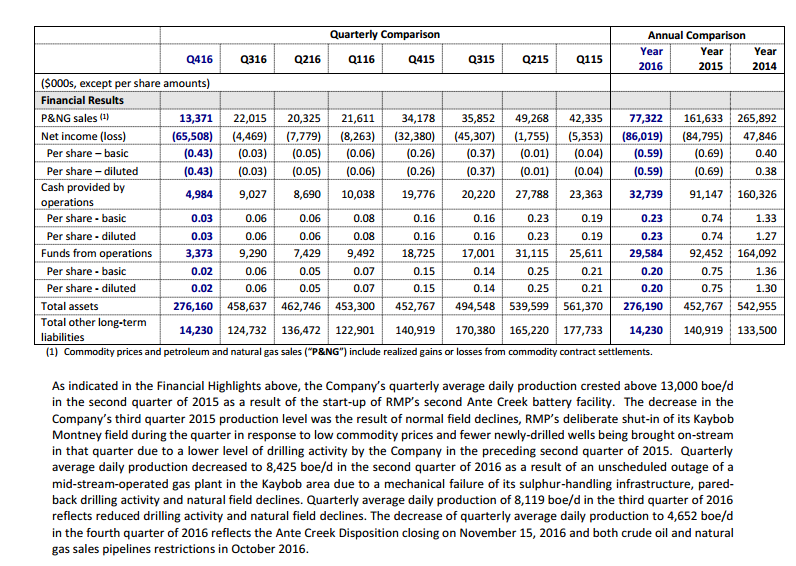

(Source: RMP Energy Inc., Fourth Quarter 2016, Management Discussion And Analysis)

Overwhelming the balance sheet cleanup were some sizable impairment charges. However, more than C$200 million assets were left on the books after the charges. So RMP Energy has some significant assets to use to grow production. The charges may have pointed to some optimistic accounting assumptions. So depreciation charges going forward need to be much more conservative. The impairment certainly were not pleasant and need to be avoided by taking larger operating charges earlier. However, the end result could not have been better for current investment reviews.

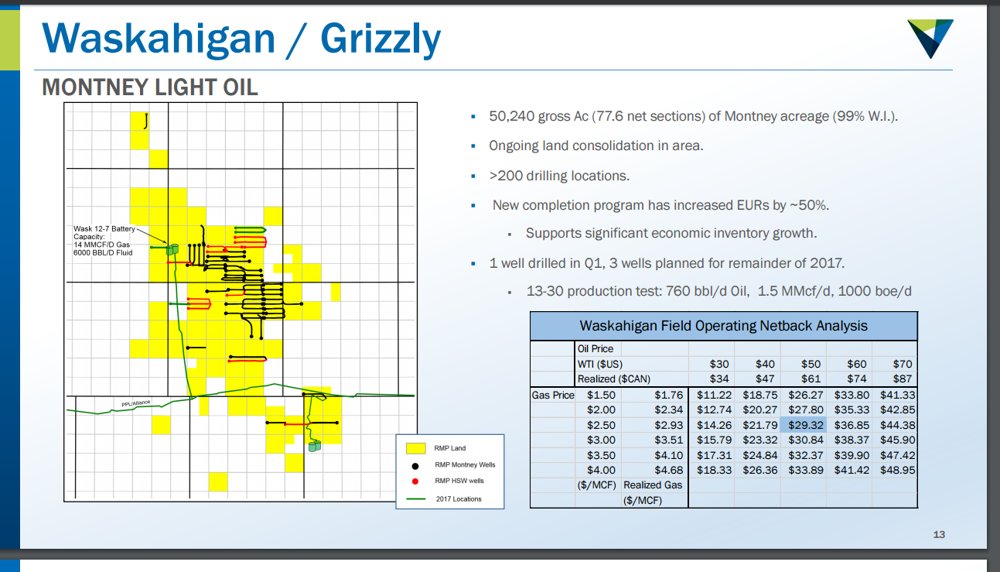

It may take Mr. Market a little while to catch on. But a company with no long-term debt and a small working capital deficit combined with some production could be a recipe for some decent capital gains in the future. The remaining leases are located in the Montney of Alberta, Canada. That is one of the areas that is very competitive with the Permian without the high lease costs.

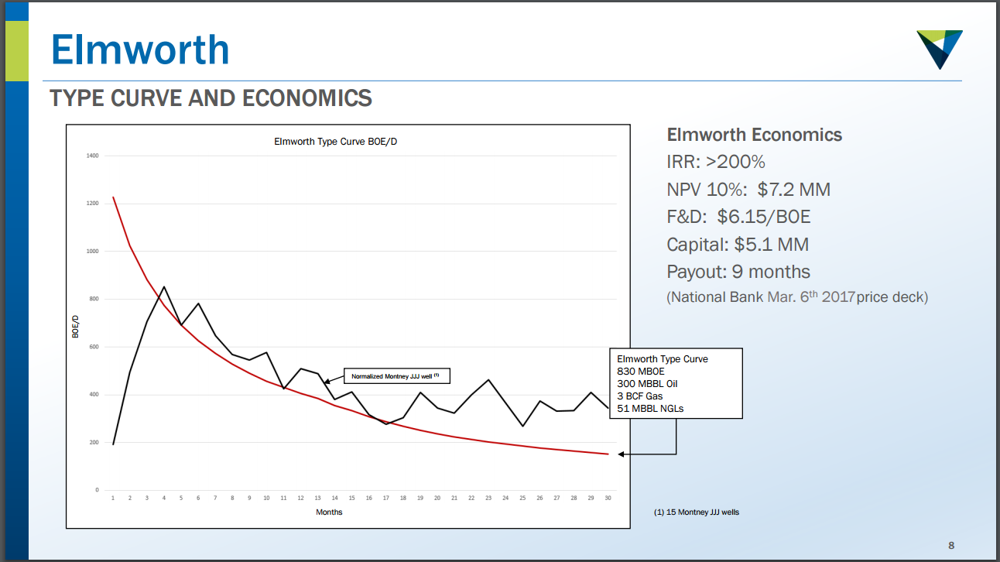

(Source: RMP Energy Inc. website, April 18, 2017)

Basically, this company gets to start over with some attractive assets, no long-term debt and a credit line. The working capital deficit was roughly C$3.1 million. Some would consider that debt, but it is not that significant when compared to the C$40 million credit line shown above. If necessary, management can defer drilling and allow the cash flow to decrease the working capital deficit.

The granting of the C$40 million credit line means the banks expect a roughly C$13 million cash flow for the year. Banks do not like to go more than about three times cash flow from operations. That assumption could prove very conservative, as the company has begun posting some incredibly successful results from its remaining acreage. If those results continue, then the credit line could be expanding significantly during the next twelve months.

Management is going to emphasize liquids production going forward. So it will not take much of an increase in the percentage of oil produced to double that cash flow. Oil is only about one-third of current production. Some of the natural gas liquids have had no value at times, so remained part of the gas production. The emphasis to find and produce oil will change the characteristics of this company going forward. The market may no longer look at RMP Energy as primarily a natural gas producer with some oil production.

The stock may look a little expensive right now based upon that beginning cash flow. But the drilling program has just begun. Continuing drilling success could cause Mr. Market to re-evaluate the cash flow potential of this company significantly. That should cause a stock price double. Normally, growing companies are priced at more than 8 times cash flow. Right now, the stock price reflects what may have been a distressed sale. But...

"At Waskahigan in the first quarter of 2017, RMP successfully drilled and completed a 100% working interest Montney 'step-out' horizontal oil well (13- 30 -63-23W5), located on the western flank of the Company's acreage position. The flow test result from the recently completed hybrid slick-water operation was strong. Production flow testing was for a 200-hour period (approximately 8 days). Over the last 72 hours of the production test, the 13-30 well tested at an average rate of approximately 760 bbls/d of 40-degree API crude oil and 1.5 MMcf/d of associated sweet solution gas for an oil-equivalent rate of approximately 1,000 boe/d. RMP expects to have the 13-30 well tied into company-owned infrastructure and placed on-production later this week."

"The 8-25 well production test results were successful, with flow-back results indicating the discovery of a new oil pool and demonstrating the Middle Montney reservoir to be oil bearing and gas charged. The 8-25 well was drilled to a total measured depth of 4,523 metres, with 2,208 metres of horizontal section. The production flow test was for a 173-hour period (approximately seven days). Over the last 72 hours of the production test, the 8-25 well tested at an average rate of approximately 220 bbls/d of 45-degree API crude oil and approximately 1.0 MMcf/d of natural gas, resulting in an oil-equivalent rate of approximately 390 boe/d"

"The Company also successfully drilled and completed its third, 100% working interest well in the Middle Montney oil window at Elmworth (4-18-68-2W6). Drilled from the same surface lease pad as the 3-22 well, the 4-18 well is a 'step-out' to the southeast. The 4-18 delineation well, drilled to a total measured depth of 4,935 metres with 2,518 metres of horizontal length, was fracture stimulated with hybrid slick-water. The production flow test was for a 165-hour period (approximately seven days). Over the last 72 hours of the production test, the 4-18 well tested at an average rate of approximately 200 bbls/d of 45-degree API crude oil and 2.3 MMcf/d of natural gas, resulting in an oil-equivalent rate of approximately 600 boe/d. Please refer to Reader Advisories at the end of this news release."

More important were the test results shown above. The company is on the verge of increasing its production rate by 50%. The first well guarantees a decent jump in the oil percentage of production. The remaining production prior to that first announcement was about 35% oil. So, adding a relatively larger producer that is mostly oil will lead to a sizable cash flow jump. Cash flow in the second quarter will likely double. Plus, these are fairly shallow wells that are cheap to drill. So they are going to be extremely profitable unless decline rates are obscenely high.

The production given up by the disposition was seen as coming from an increasingly mature field about to enter the declining years or the secondary recovery years. In any event, management felt the most profitable years of that production sold were gone. But that puts pressure on management to produce with the remaining leases.

RMP Energy remains with about C$223 million of oil and gas-related fixed assets. If the results do not justify this remaining book value, more write-offs would result. So, it is incumbent upon management to prove the value of the remaining assets. Even a debt-free company must establish some verification of book value. The above announcements appear to show that management is off to a good start. Mr. Market does not really appear to have reacted to the news yet, but that is the kind of news that will draw positive market attention sooner or later.

(Chart figures in Canadian dollars unless otherwise stated)

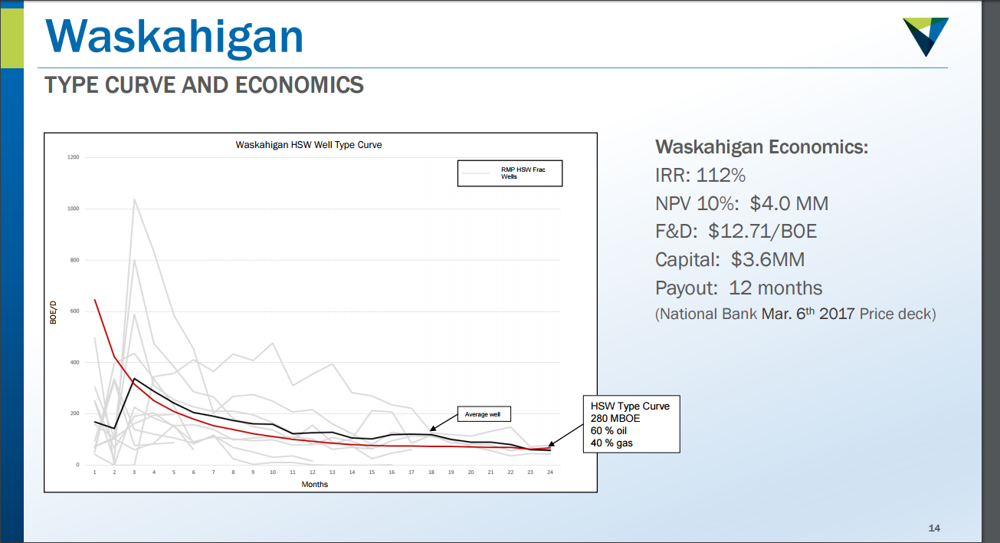

(Source: RMP Energy Inc., March 2017 Corporate Presentation)

The most important figure shown above is the payback figure. Anytime the company can get its money back within one year, there is a good possibility of an increase in the capital budget and bank credit line. RMP Energy can basically drill two wells with the same capital in the fiscal year. So not only does it benefit from the cash flow of the first well, but also the cash flow of the second well, while the first well still has a healthy flow rate that adds to cash flow.

Suppose that new Waskahigan well is flowing about 100 BOED with a C$20 netback after payback. Then the company cash flow benefits about C$60 thousand per month, plus another Waskahigan well can be drilled with the same money. There is every chance that the well announced above will pay back long before 12 months. The beginning production shown in the announcement is probably worth between C$400 thousand and C$500 thousand a month cash flow, assuming a $20 netback. Right now, that netback is running about 50% higher.

So, if management hedges to assure a "guaranteed" netback, then the capital spent has a faster payback. The second well can be drilled when the first well is still flowing approximately 300 BOED. So the cash flow compounding or growth happens (what could be) exponentially faster rather than linearly faster. These are very rough approximations to give a broad example of what could happen. So by the start of the next fiscal year, management not only has a capital budget for the year (possibly some of it borrowed), but it also has the capital expenditures as cash from every well that paid back in the previous fiscal year.

The company is beginning from a very low production base at the start of the fiscal year. So, even though management is predicting an average production of less than 5,000 BOED for the year, the exit rate will probably be much higher. The three wells announced above already put management within sight of 5,000 BOED, and there is more drilling announced. Management has already announced an increase in reserves of 50% for some of the wells drilled. This announcement means flow rates, decline rates, and possibly production mix as the well ages will all be affected.

(Chart figures in Canadian dollars unless otherwise specified)

(Source: RMP Energy Inc., March 2017 Corporate Presentation)

The first slide highlights the results of the large producer drilled on the acreage. This has obviously raised expectations for the remaining three wells. But the market cap of RMP Energy as of April 18, 2017, is only $94 million. There were approximately 145 million shares outstanding at fiscal year-end 2016, so every well drilled could have a very positive effect on the stock valuation.

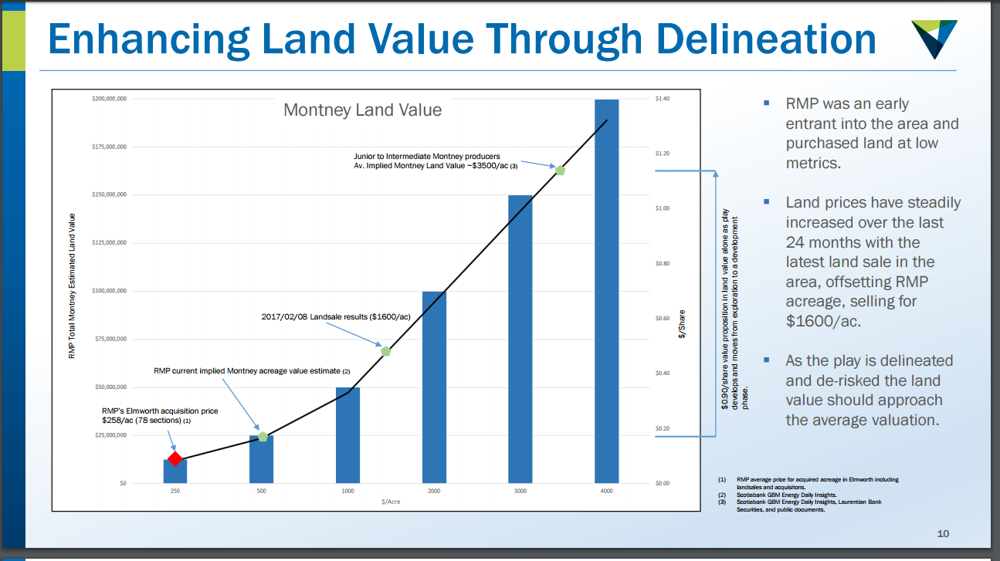

Management has emphasized the increase in value that is taking place with regard to its Elmworth acreage. However, the Waskahigan acreage has every bit as impressive results. That acreage should also be appreciating along with the Elmworth acreage. As shown above, the Elmworth acreage is worth about C$60 million. The Waskahigan acreage should at least double that figure. A few more large well results along the lines of the announcement above could make that assumption very conservative.

But another C$60 million for Waskahigan equals C$120 million. This exceeds the current Canadian market value of the stock. RMP Energy has still more unexplored acreage. Plus this acreage, like the Permian, has several intervals that have not been delineated at all. The company could be very profitably busy on this acreage for a long time. This discussion does not include still more unexplored acreage or some more mature producing plays plus the infrastructure on the books. This is one very undervalued and growing company.

The latest completion techniques used on the Waskahigan well announced above have likely revolutionized the play. Management had already drilled dozens of wells with inferior results. This type of outcome is actually similar to the Stack and Scoop, as well as the Permian and Austin Chalk. Management ends up tossing out historical results and acting as though the play is completely new territory. The new completion techniques have done this time and again over the last few years.

The current new techniques may also lead to some reworks and sidetracks to more efficiently drain oil and gas from existing wells. Those kinds of reworks and sidetracks often have fantastic (and realistic) IRRs. Paybacks are usually within a few months. So this company could very well be on the verge of cashing in on some very profitable production.

The latest capital budget guidance is C$49 million, which includes considerable infrastructure investment to lower future production costs. But there are still two Waskahigan wells to be drilled and two Elmworth wells. Average second-half production of slightly less than 5,000 BOED implies an exit rate north of 6,000 BOED. Continuing well design and other operational improvements sweeping the industry could make the outcome conservative.

More importantly, successful drilling results will result in revaluation of the company acreage. So the second slide becomes very believable, if not conservative. The Montney has some very low costs that can withstand substantial commodity price declines. This area is very competitive with more expensive areas like the Permian. Because leasing costs are far cheaper, the Montney has some decided cost advantages in certain areas.

This relatively debt-free company could find itself becoming a takeover candidate. For the kind of IRRs shown above, a 50% takeover premium would really be nothing. The percentage of oil production is already increasing. The modest capital budget has already been increased once. Expect more favorable results to culminate in another capital budget increase. The liquids emphasis ensures that this will be a company with very different production metrics this time around. Daily production has probably already passed 4,000 BOED. So the market value divided by the estimated production is less than $24,000 per flowing BOED. By year end, that figure could be C$16,000 per flowing BOED or less, with a greater oil percentage than in the past.

The cash flow by year end should exceed a C$30 million annual rate in the fourth quarter. So this debt-free company is cheap, and likely to become cheaper in short order. The stock price will likely at least double this year, with a lot more growth over the next five years. Right now, Mr. Market is looking at the past sale with some trepidation, but the new company will soon announce itself through a series of successful wells. That should allow the market to factor in a future success rate.

Disclaimer: I am not an investment advisor, and this article is not meant to be a recommendation of the purchase or sale of stock. Investors are advised to review all company documents and press releases to see if the company fits their own investment qualifications.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor's Note: This article covers one or more stocks trading at less than $1 per share and/or with less than a $100 million market cap. Please be aware of the risks associated with these stocks.