RE:SU short position reduced by $4.35 billionOK Obscure1, here's my technical take and update.

I'm bullish at this level, and have added more to my call options, now holding 1000 contracts, $30 Call Dec 16, 2022.

One must look at SU on the US side, as it is the tail that wags the dog.

Technically we are at very heavy support. Not just a double bottom, but at around $30USD they were never able to breach this area level for the past year, after multiple attempts. We are now also trading at the bottom of the bollinger band ranges. A break lower is statistically less likely, but always possible.

For those on the fence deciding whether to hold or sell, if you are going to set your stop loss for SU, sell it below this level if breached. Not right above it as some here have done. You will likely be taken out, then the stock kisses support, then rebounds with a bounce as we have seen so many times. The strong USD means this support level will be higher on the Canadian side than you expect. We are approaching or at this major support level once again now.

As short positions have had some major covering, perhaps they see this support level as well, and do not expect much further downside.

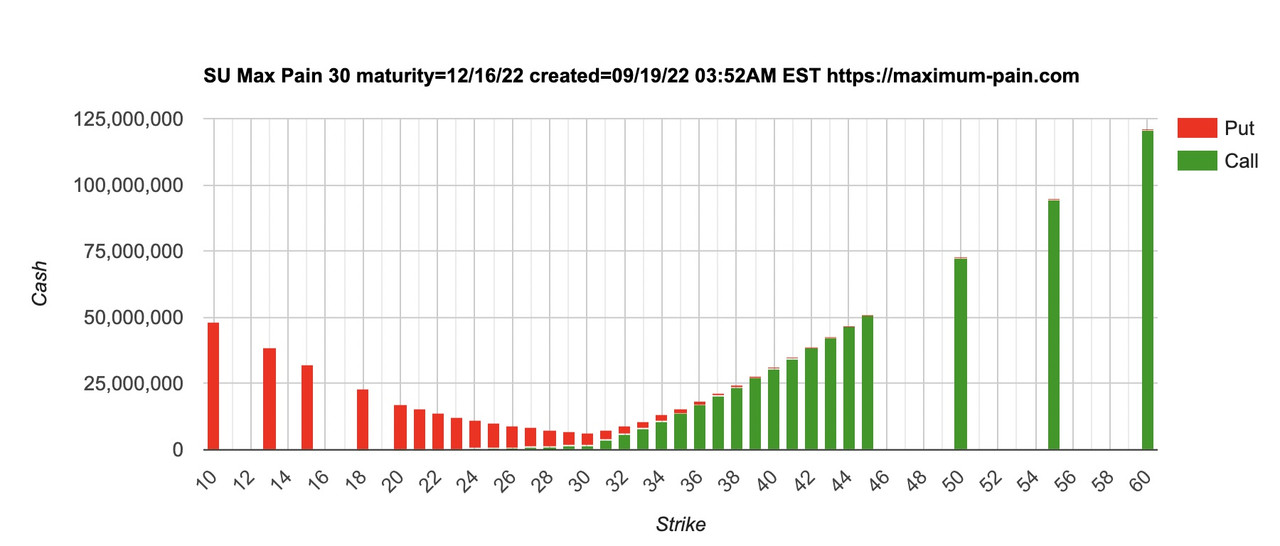

On the option side, December 2022 expiry seems to carry the biggest weight of open interest at present compared to most other months in the near term future. Remember, this is a changing chart as positions are entered and exited, but with Max Pain at $30USD, there is no incentive for counterparties to drive the price down further to profit from Max Pain. They will stay out of the way.

For those new to it, bookmark this site, and enter in the parameters to use.

https://maximum-pain.com/options Here is the max pain chart as it sits today, for SU December 16, 2022 expiry:

That all said, SU and all others are still influenced by the oil price, and general market malaise as we know and discussed. We enter this week with a soaring USD, lower oil prices, and lower futures as sentiment weighs. We have 16 central bank rate decisions this week. China data has shown that they exported more finished products than expected, threatening the high price of diesel, although inventories are still low.

Economic headwinds may prove too strong for technicals to bear. Will see.

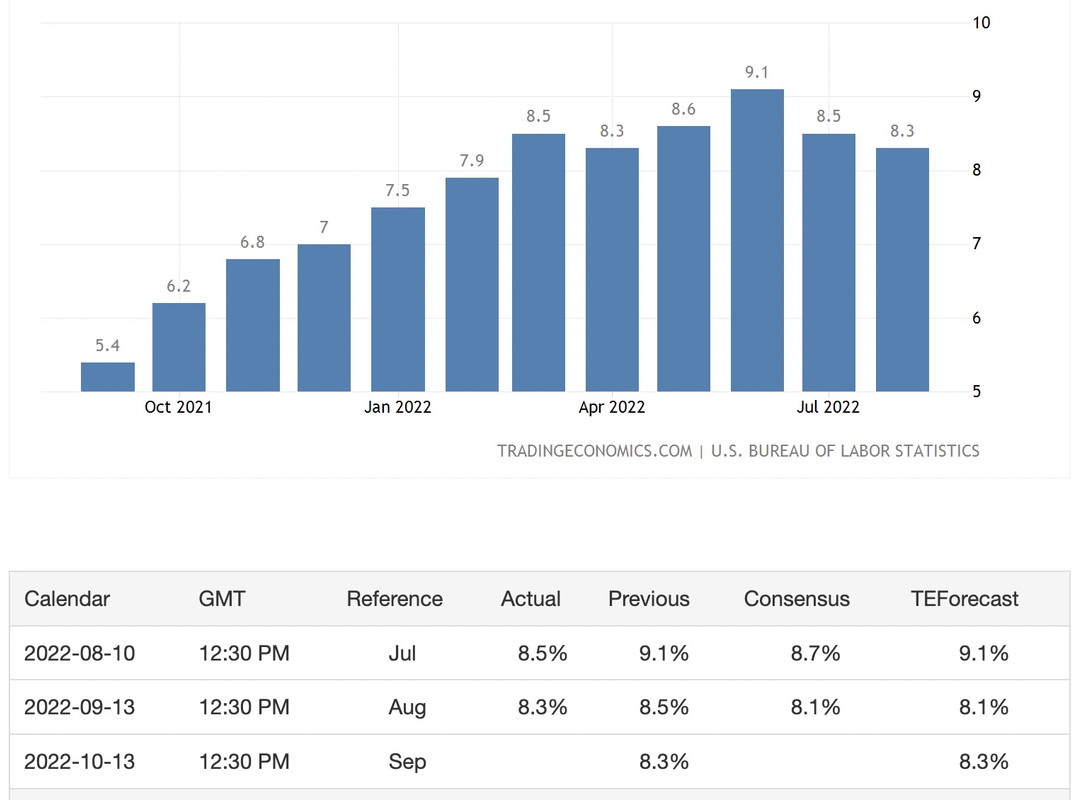

One more chart I would like to share is that of US inflation rate. The annual inflation rate is decreasing, a good thing. Like floodwaters receding, it is still high but it seems to show perhaps the worst is behind us, although the Fed is still behind the curve. Last week, it was not dropping as fast as expected, hence last weeks big drop in the markets.

Obscure1 wrote: The Sept 15th short positions have been posted:

https://shortdata.ca/largest-short-positions

From August 31st to Sept 15th, the dollar value of short positions for SU dropped from $5.204 billion to $0.849 billion.

That is a lot of short covering over the past two weeks and leaves minimal shorts still in the game.

What does it mean?

One can never be sure, but SHORTS are sophisticated and they are typically incredibly well organized.

If I had to make a guess, it would be that the shorts know (or strongly expect) what is about to happen next and are getting out of the way before getting positioned for the next run up.

I don't follow the options market, but my hope is that Migraine will keep us informed of when the pros begin to turn bullish. There are only six weeks left before the draining of the SPR ends. I don't expect that the pros will wait until the last minute before they begin putting on heavy call options but I'm not sophisticated in that world at all.