Another EV Post: How much Oil will EVs displace?As this has been quite a topic of discussion here, I thought I would pass on a good 200 page report I read on EVs from the EIA in May 2022 from my nephew. He is a mechanical engineer in Alberta, working on a team that is involved in developing EV charging stations across Canada.

https://iea.blob.core.windows.net/assets/ad8fb04c-4f75-42fc-973a-6e54c8a4449a/GlobalElectricVehicleOutlook2022.pdf I was interested to see their projections on the amount of oil EVs will displace globally in the future.

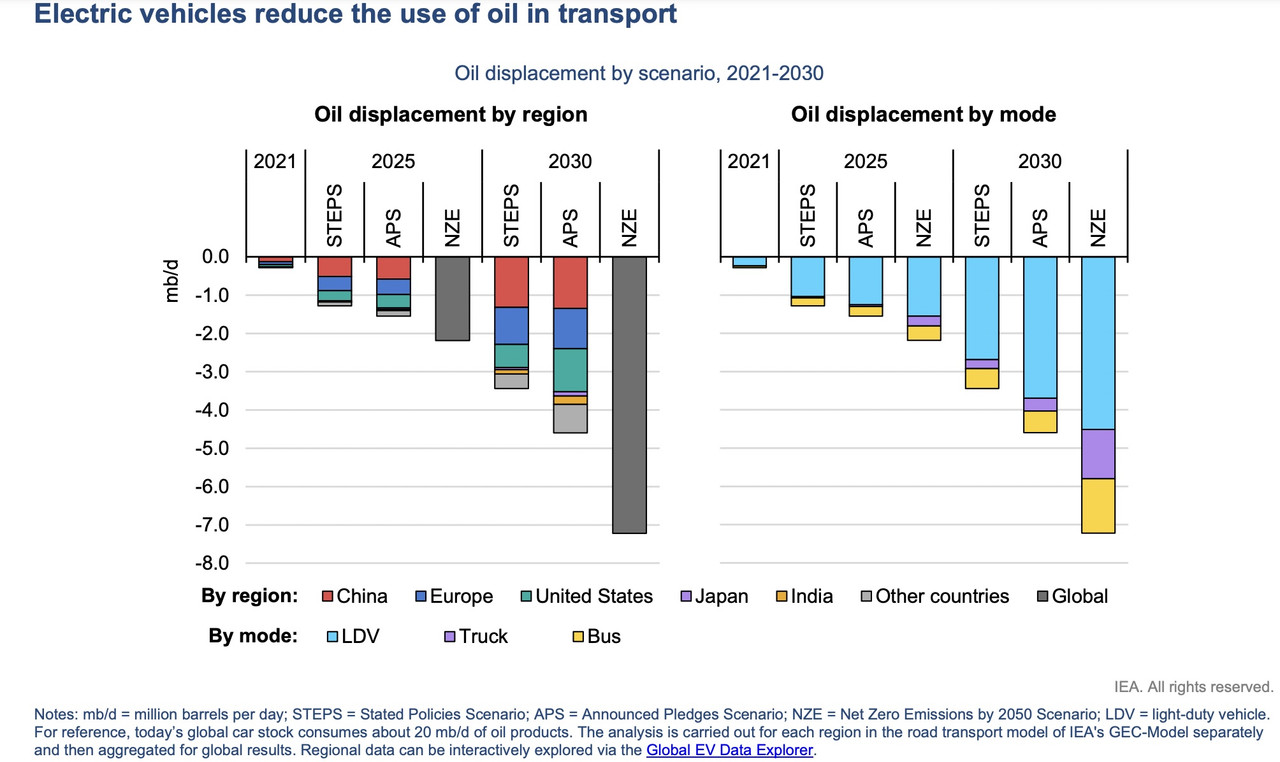

I found it on page 129:

Now, they give 3 optimistic scenarios for 2030, of which only one is anywhere near realistic; the STEPS scenario. It is the only one that takes into account actual committed policy and the reality of EV manufacturing limitations like batteries. Note that in 7 years, by 2030, the EIA expects EVs to generate a global oil displacement savings of a mere 3.5M bpd under the STEPS scenario.

When I see that, it is reassuring. I think that the reduction in oil consumption by switching to EVs is comparatively minimal when you take into account the annual growth in global oil demand. In fact, oil demand is projected by the EIA to rise from 99.65M bpd now in 23Q1 to 102.85M bpd by the end of 24Q4. So even accounting for the rapid move to EVs as we are doing now, oil demand is forecast to increase. Now, oil demand and consumption would be even a lot higher than that if there were no global EV transition. In perspective, that 3.2M bpd increase in oil demand in only 2 years, is about the same as the savings due to EV adoption in 7 years. Hard to say what global oil demand will be like in 2030 with any certainty with that growing annual demand rate, and the many other factors.

To be clear, I'm not against EVs. I feel we will need to employ every kind of vehicle possible to meet future transportation demand in an ever growing energy consuming world. As Experienced has pointed out, they make good economic sense in some places in Canada (perhaps a harder sell in Alberta where power is almost triple the cost elsewhere).

So, my thoughts are, and continue to be, with capital spending on global oil production reduced by 30% to 40% of normal, just where in the world is all this extra 3M bpd of oil going to come from by the end of 2024? OPEC is nearly out of spare capacity, and US shale is not in a position to come to the rescue.

The answer is 'nowhere'. As demand exceeds supply, oil prices will rise higher to the point where it kills off demand to meet supply.

This is why I maintain a core position in several Canadian oil producers. They are producing so much cash now, they could buy back all their debt and shares in a few short years. They have infrastructure in place, and have decades of reserves to draw from producing cash for years in case the speed of the transition is slower than our dreamers and politicians think. I'm betting this is the case, and we have a long run yet with oil.

However, perhaps I am wrong, and this energy transition becomes a miracle and oil is no longer needed for transportation as everyone on the planet is all driving flying cars that run on renewable bunny farts. At these stock prices, it still makes sense to buy and reap the rewards of cash these companies are making for a few more years until their plants are converted to bunny farms with tiny vacuum hose arrays.