RE:RE:RE:The recent $1.9 billion SU short sale mysteryI think that is just fine. You and both sons did well on their trades. The hardest thing for me is to have the discipline to sell or trim positions once it takes a run up, knowing that it will likely be a lot higher in the future. I played that trade wrong many times, and had to pay a higher price a little while later to get back on the train. So, they made a great profit. Good for them!

As I have a long term upward bias, I am never comfortable shorting oil or oil stocks, and feel have a better chance going long. I believe even if you get the initial timing wrong, it will eventually rebound and you will be in the green again, and all this time, has always been the case.

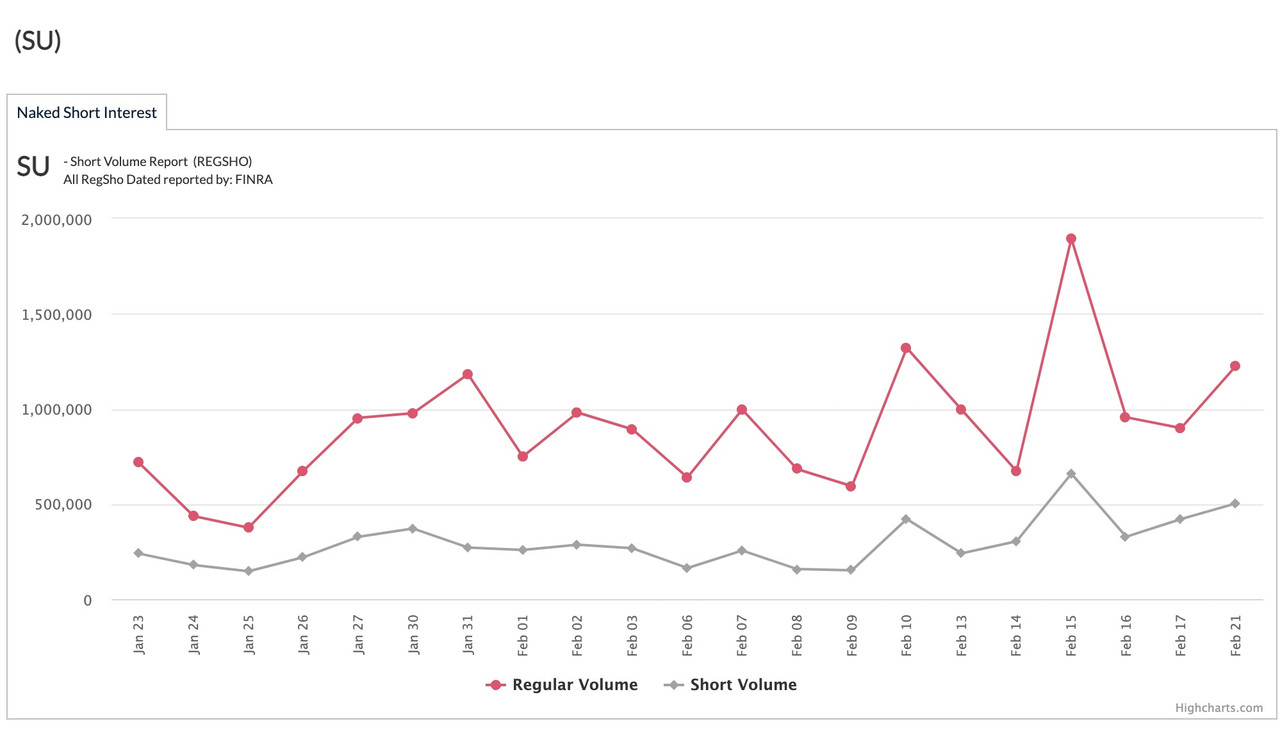

Further to the SU shorts we are discussing, here is some more daily data on the volumes. Notice the increased short sales that printed when the stock spiked after earnings, as well as yesterday, when it spiked on the news of the new CEO. SU has outperformed most others lately in comparison.

I thnk this is normal buy the rumour, sell the news trade action, in the face of short term overall weakness in the energy sector targeting those outperformers during a downward trend.

As we know and agree, the general markets are in far more serious trouble, which will likely hold down energy, as everything is game for liquidation in a selloff. Oil may have more downside yet for a bit, but only to a point.

In the meantime, we now have hit record global oil consumption in December, had a big spike in long open interest in crude contracts reversing months of declines, increasing China oil demand with more refining and imports as well as increased mobility data, We have dropping productivity, rig counts, frac spreads, and DUCS in the US. NG will continue to be a train wreck, and producers are cutting back on new wells, but HO and RBOB still holding up relatively good.

Oil inventory report increases of late are seasonal, data adjusted, and still reflect the consequences and fallout of the massive front running of the Russian product embargos in the global market. Sure, decreased amount of trucking and more folks working from home have muted the return on diesel and gasoline demand in NA. Cheaper transportation costs as a result will act to trim inflation.

Just as the effect that the front running Russian heavy crude and SPR releases had on our differentials which are now tightening up to $18 ish, products should undergo a similar price recovery after the glut of Russian product shipments arriving has stopped, along with refinery maintenance season supply reductions, combined with the start of global driving season. West to east arbitrage will soon become more favourable to increased NA exports of product and crude.

https://nakedshortreport.com/company/SU/

Obscure1 wrote: According to my TD account, my average sale across 30,000 shares was $44.28 per share.

Before that, I was often trading SU shares back and forth while maintaining a core position as I find trading around a core position is often very effective. My best guess without checking is that I probably averaged a $2 to $3 win per share for each of several round trips on the flips. Obviously, some trades were better than others for sure.

One of my sons did start selling SU early at just under $39. He ended up selling at an average of just under $22 per share on his 17,000 shares. He bought those share at about $22. He moaned a bit as the share price went higher and his pending tax bill on his non-TFSA shares, but he was pretty happy with his $340k win.

My other son got in a bit later ($24ish per share) but he got out closer to $49 than $48 so he won the bragging rights for the Suncor trade.

I guess trying to knock others down is your thing, but you should get your facts straight first or you end up looking pretty stupid.