RE:RE:RE:RE:Will we get back to $50.37 - Year High?Matt, great point. This is a very important issue.

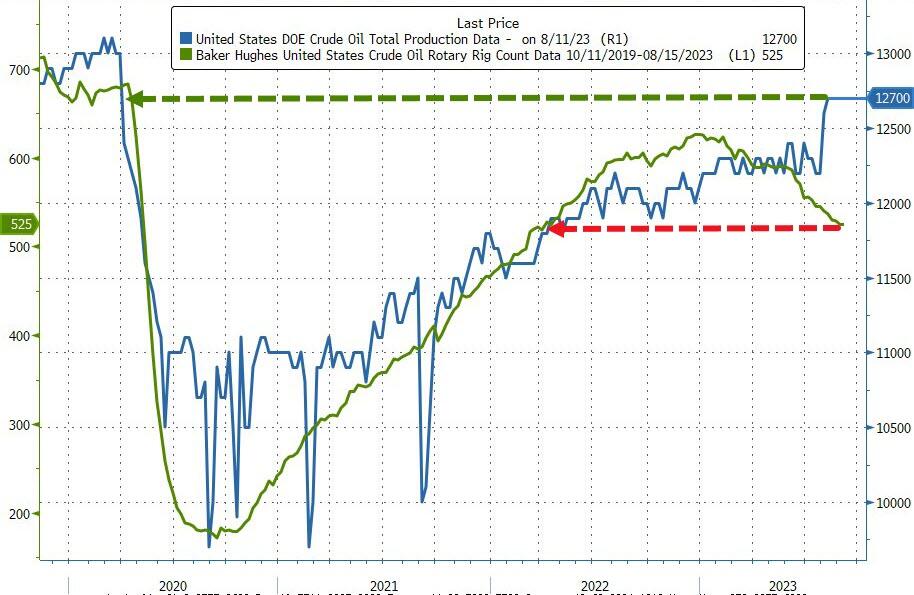

Why is US Oil production reportedly increasing while rig counts and other data shows it should be dropping?

On the surface, it doesn't add up.

I posted many weeks ago and over time, various tables and charts showing why we should soon be seeing decreasing US shale production. I think it is still coming, but will be a little later than I expected.

The charts have shown before show that rig counts are still dropping, DUC counts have fallen, in addition there has been less Frac spread activity. Shale oil is getting gassier, and first tier acerage inventory is being exhausted. Well productivity per meter drilled has been decreasing, meanwhile well lengths have become longer.

There are lags in production numbers to all these factors, so it would be expected that there would eventually be a change to the downside in the reported production.

I can think of a few reasons, but I may be wrong in their impact to production figures.

We generally think of crude oil like the stuff you see when you pull out your engine drain plug. Black, viscous, and a certain feel between the fingers. However, US oil production reported includes all grades. The overall average API of US oil has been getting lighter, as there have been more condensates and lighter oils added in the mix than in previous reports.

With booming US nat gas production, it also comes with a lot more lighter oil condensates produced.

These hydrocarbon gas liquids (HGL) are produced at the wellhead as gas, but once separated from methane at the gas plant, they include ethane, propane, butanes, and hydrocarbons with five or more carbon atoms, referred to as pentanes plus, naphtha or plant condensate. Plant condensate can also be blended with crude oil, which would change both the distribution and total volume of oil received by refineries.

I believe the US oil production reporting parameters have also recently changed to include mixed grades which have received blending of these lighter oils that may have inflated the overall figures. This hidden information is hard to find, for me at least.

Keep the following in mind when looking at the chart of US production by API below:

Refinery crude oil slates—the mix of crude oil grades that a refinery can process into petroleum products such as gasoline and diesel—have become lighter over time. In 2005, the average API of crude oil inputs into U.S. refineries was 30.2 degrees. The average increased to 33.0 degrees in the first half of 2022. So, here is the data on US oil data on various API grades over the last years, and for a few months till May 23 that show that US oil production is getting lighter:

https://www.eia.gov/todayinenergy/detail.php?id=54199

https://www.eia.gov/todayinenergy/detail.php?id=54199 Regarding the increased US oil production lately, EIA offers this reason:

New wells in the United States have generally been increasingly productive over the last several years. Looking at the Permian region, the highest productivity came in 2021, but productivity in 2023 is nearly as high (Figure 3). The high productivity in 2021 was likely the result of oil production companies responding to changes in the markets driven by responses to the COVID-19 pandemic. As a result of the rapid shift in consumption patterns, many oil wells were shut in to reduce production as refinery runs and demand for fuel fell. Oil production companies kept only the most economical fields producing, increasing the production per well in 2021 beyond what may have occurred otherwise. https://www.eia.gov/petroleum/weekly/archive/2023/230809/includes/analysis_print.php An additional factor, is that in order to survive during that time, companies tended to drill their best acerage when prices were low. These wells would naturally have produced higher flow rates, which still may be influencing figures. We had the highest well productivity when prices were at rock bottom.

Since the US refiners can't process half of the oil the US produces even with blending, it is exported, and it relies on imports of mediums and heavier oils for feedstock like WCS to blend it's light oils. With production becoming lighter and with no more refineries being built to take lighter and lighter oils, US fuel production is bound to face future challenges.

In the end, it may not really matter how much reported production there is in the US if they can't even process it. It may be more relevant for us to know the amount of oil production they can actually use and process into usable fuels or product. The rest is a trade balance figure.

With so many qualified experts we have on this SU board now, engineers, financial investment advisors, geologists, and all the experienced oil men, it would be welcome if someone with some refining expertise could step in and add to the discussion.

Above all, I hope we can continue to keep discussions cordial, and respect those taking their time to share their insights, expertise, and opinions with others here.

When not in agreement, let's try to avoid personal attacks like we see so often on other boards which have lowered the board quality to drive contributors away and have eventually become useless as an information sharing community.

matt2018 wrote: I hear you guys on the challenges of shale oil business and while it does makes sense, it's not adding up?

According to EIA Field Production of Crude Oil, it peaked at 13M b/d in Nov/2019.

It tanked in May/20 down to 9.7M and then eventually built back up to the 11M b/d range and stayed there for much of 2021 & 2022, going back above 12M again in Sept 2022.

For 2023 it's been increasing at steady pace and now back up to 12.7M b/d.

At same time, many of the large cap oil producers (USA & Cda) have taken advantage of extra FCF from recent high oil prices to aggressively pay dow debt, return more % FCF to shareholders while slashing Capex spending. That's what they have been reporting.

This is also evident with the weekly rig count declines.

So when is this expected declne in shale oil expected to happen?