EIA Builds: Crude +4m, Gasoline +5.6m, Dist +3.9mBig builds reported in crude, and products.

Market shrugs it off.

Why?

Exports down, Imports up, a huge net change of over 2.5mm bpd difference from last week.

EIA adjustment fudge factor large again, of 1.2mm bpd.

Domestic production up 100k to 12.9mm bpd.

From Twitter:

Distillates up 3.9 mm barrels (vs +0.6 exp) – implied demand – down nearly 0.3 mm bpd week to week – poor demand continues. Nutshell: Bearish as weekly reports go. Look for draws to resume soon. EIA: US CRUDE IMPORTS REACH HIGHEST SINCE AUGUST 2019. US crude production: This week’s domestic crude oil production estimate incorporates a re-benchmarking that affected estimated volumes by less than 50,000 barrels per day, which is about 0.4% of this week’s estimated production total. EIA sitting here thinking the same thing, utilizations in PADD 2 have been excellent- 100, 100, 98... and yet gasoline inventories keep falling US crude exports were down 1.842mbpd w/w to 3.090mbpd last week - EIA EIA: gasoline demand plummets to 8.31mbpd, likely an underprint, GasBuddy modeled demand at 8.59mbpd. US implied oil demand (product supplied) rose by 788kbpd w/w to 20.991mbpd last week w/w changes in kbpd gasoline -1,014 jet fuel +175 distillate -288 residual fuel oil -50 propane/propylene -487 othter oils +2,452 EIA  EIA data, week ending 9/8 Crude oil: +4.0M Domestic prod: 12.9MMbpd SPR: +0.3M Cushing: -2.4M Gasoline: +5.6M Impld mogas demand: 8.31Mbpd Distillates: +3.9M Refiner utilz: 93.7% Total exports: 9.05MMbpd EIA (wk ending 8 Sept) Crude: 3.954M Cushing: -2.450M Gasoline: 5.560M Distillates: 3.931M US petroleum inventories (crude, SPR, refined products) rose by 10.699mb w/w to 1,616.190mb last week

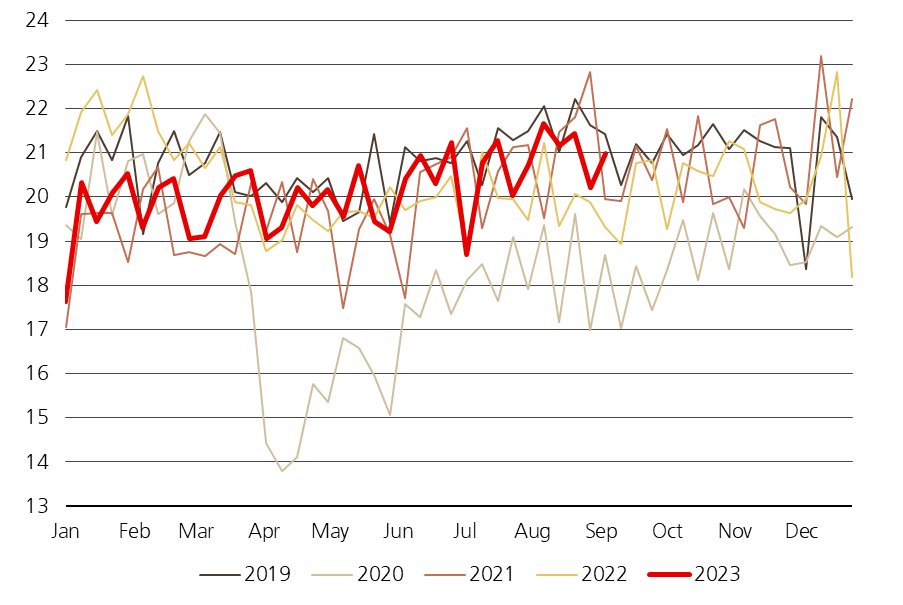

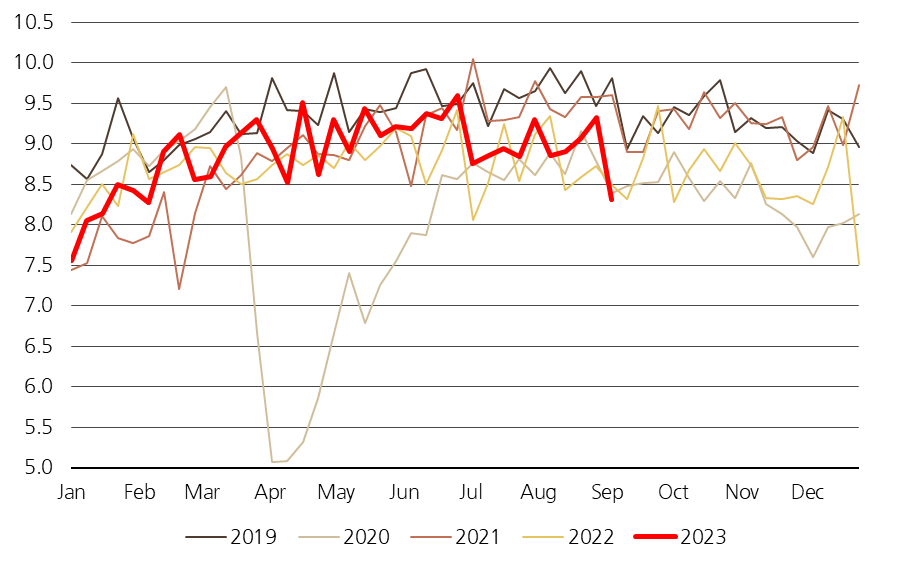

EIA data, week ending 9/8 Crude oil: +4.0M Domestic prod: 12.9MMbpd SPR: +0.3M Cushing: -2.4M Gasoline: +5.6M Impld mogas demand: 8.31Mbpd Distillates: +3.9M Refiner utilz: 93.7% Total exports: 9.05MMbpd EIA (wk ending 8 Sept) Crude: 3.954M Cushing: -2.450M Gasoline: 5.560M Distillates: 3.931M US petroleum inventories (crude, SPR, refined products) rose by 10.699mb w/w to 1,616.190mb last week  US Implied oil Demand:

US Implied oil Demand:  US Implied gasoline demand:

US Implied gasoline demand:  Evergreen caveat: weekly data is volatile so don't spend too much time thinking about a single report. And in terms of crude trend, we're still ~36 million barrels lower over the past 7 weeks.

Evergreen caveat: weekly data is volatile so don't spend too much time thinking about a single report. And in terms of crude trend, we're still ~36 million barrels lower over the past 7 weeks.