Nerthuz/iStock via Getty Images

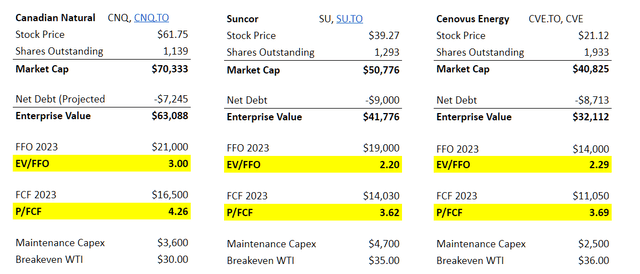

The future of energy income lies in Canada. Not in Enbridge or Pembina or TransCanada—those midstream operators’ income attributes are known quantities, and their equities are priced as such. Rather, the future likes with their customers, the major Canadian E&Ps, Canadian NaturalResources (NYSE:CNQ), Suncor Energy (NYSE:SU), and Cenovus Energy (NYSE:CVE).

HFI Research

Beginning in 2023, we expect that these three companies will pay out at least 50% of their free cash flow in the form of dividends and share repurchases. However, this highly probable outcome is lost on the stock market, which fails to appreciate their income prospects.

Of the three, CNQ is the gold standard among Canadian E&Ps. It has been the best run, generates the highest return on capital, and has the longest-lived reserves. However, these attributes are reflected in CNQ’s relatively high trading multiple versus SU and CVE.

If we factor in current stock prices, our favorites are first CVE, then CNQ, and third, SU. CVE, the smallest of the three, has the most appreciation potential and some of the best management in the Canadian oil patch. Despite its positives, the stock market doesn't recognize it as being in the same league as CNQ and prices its shares at a substantial discount.

SU is our least favorite because it has been poorly managed and has made bizarre capital allocation decisions that have led us to question management’s judgment. However, Elliott Management, an activist investment firm, has recently taken a large stake in SU to agitate for change. SU’s CEO, Mark Little, resigned on July 8, which is a positive turn in the company’s fortunes. But SU’s managerial problems run deep, and Elliott’s ability to set the company on a better footing remains to be seen.

Why Canadian Producers?

U.S. producers will also be paying out more to equity owners. But U.S. firms involve certain risks that apply far less to Canadian producers.

For one, U.S. producers face massive decline rates in their production. Over the first year of a well’s production, these producers typically see the daily output rate of their shale wells fall by more than 50%. They therefore must maintain a frenetic pace of drilling to keep production flat. This ensures that their operating costs are high and variable.

U.S. producers’ reserve estimates are more uncertain. These E&Ps are tasked with estimating reserves that lie several miles below the surface in geological formations that resemble a layer cake. Estimating reserves is subject to uncertainties and involves a great deal of management judgment. As a result, scandalous mistakes have not been uncommon over the industry’s history. Look no farther than APA Corp’s (APA) much touted Alpine High prospect, in which actual potential turned out to be a fraction of what management originally promised.

Lastly, U.S. producers face challenges that stem from the geology of their acreage. For instance, while oil prices were low relative to these firms’ operational breakeven levels from 2015 to 2021, they favored their most economic prospects, drilling the acreage that yielded the most oil and gas for the least cost. By 2022, much of their best acreage has been drilled. The acreage that remains is less prolific and higher cost. The rate at which acreage degrades in the future is largely a mystery to outside passive minority investors like ourselves.

The other geological challenge—which is a boon for their midstream operators—is the increasing gas-to-oil ratio of most U.S. shale basins. Over time, higher-value oil volumes will fall while lower-value gas volumes increase. As this happens, it will exert downward pressure on E&P margins.

Canadian Oil Sands E&P Advantages

By contrast, Canadian oil deposits are close to the surface. Their volumes are easier to estimate, so their reserve calculations are of higher integrity. The three major E&Ps have multiple decades of inventory. They produce most of their oil through surface mining or by injecting steam underground and pumping oil to the surface. And they don’t have decline rates anywhere near as high as U.S. producers. While their projects can have multi-billion-dollar upfront capital costs, once they’re operational, they transition to steady, low-cost operations. Shareholders can benefit from the stable free cash flow and lower taxes from high depreciation costs that are a legacy of their projects’ massive upfront development costs.

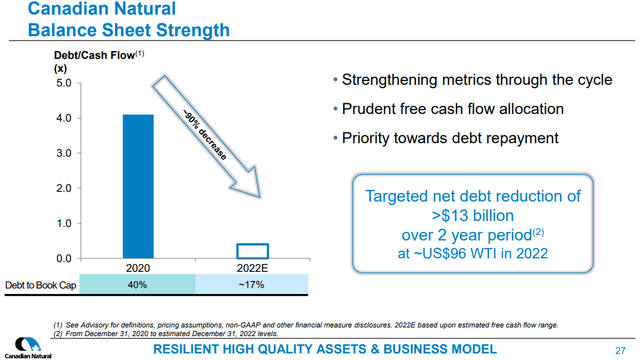

The Next Phase: Returning Capital to Shareholders

With low capital reinvestment requirements, the Canadian producers’ low-cost, steady operations through off huge amounts of cash. Since the industry just emerged from a brutal oil-market downturn with uncomfortably high debt levels, its first priority has been to use cash flow to pay down debt. Profitability has soared amid today’s oil prices, so they have been able to reduce debt at an unprecedented rate. Have a look at CNQ’s leverage over the past two years:

Canadian Natural Resources

Source: CNQ July 2022 Investor Presentation.

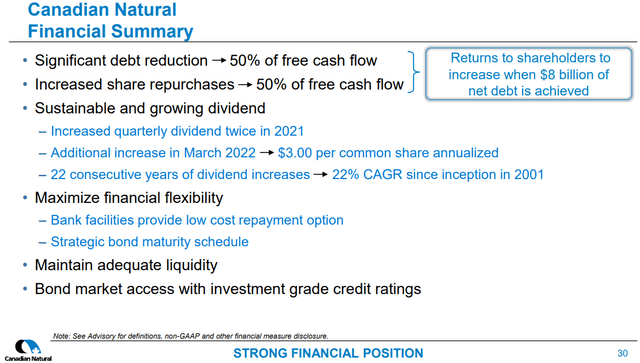

Once debt has been paid down, these companies have pledged to return capital to shareholders. Their current plans are detailed in the following slides.

Canadian Natural Resources

Canadian Natural Resources

Source: CNQ July 2022 Investor Presentation.

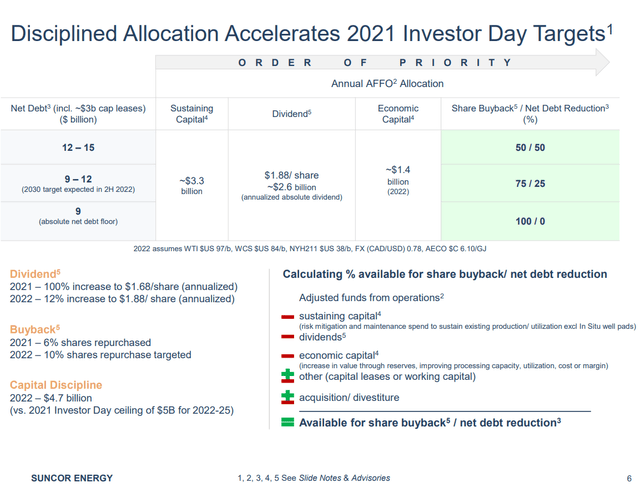

Suncor Energy