SVBL spinoff Arras Minerals Intercepts 431 Meters Grading 0. Arras Minerals Intercepts 431 Meters Grading 0.68% CuEq And Extends High Grade Mineralization To Over 900 Meters In Depth On The Beskauga Project In Northeastern Kazakhstan

Vancouver, British Columbia – Arras Minerals Corp. (“Arras”) is pleased to announce the assay results of Bg21002, the second drill hole in a planned 30,000 meter drill program on the Beskauga copper-gold deposit and surrounding area.

Highlights from hole Bg21002 Include:

- 995 meters of mineralization grading 0.40% CuEq (0.33g/t gold, 0.13% copper, and 0.88g/t Ag) from 43 meters and includes 431 meters grading 0.68% CuEq (0.53g/t gold, 0.23% copper, 1.32g/t silver) starting from 595 meters.

- The intercept described above also includes 251.8 meters zone grading 0.79% CuEq (0.61g/t gold, 0.27% copper, 1.52g/t Ag silver) starting from 774 meters.

- Hole Bg21002 was designed to test the extension at depth of a SE steeply dipping 300-meter-wide zone of high-grade mineralization which was drilled by hole Bg21001 and which intercepted 531 meters @ 1.14% CuEq starting at 44 meters from surface (for further details, see Arras’ press release dated January 31, 2022). Hole Bg21002 appears to have intercepted this zone starting at 595 meters and indicates that this zone may extend to 900 meters in depth. Mineralization remains open at depth.

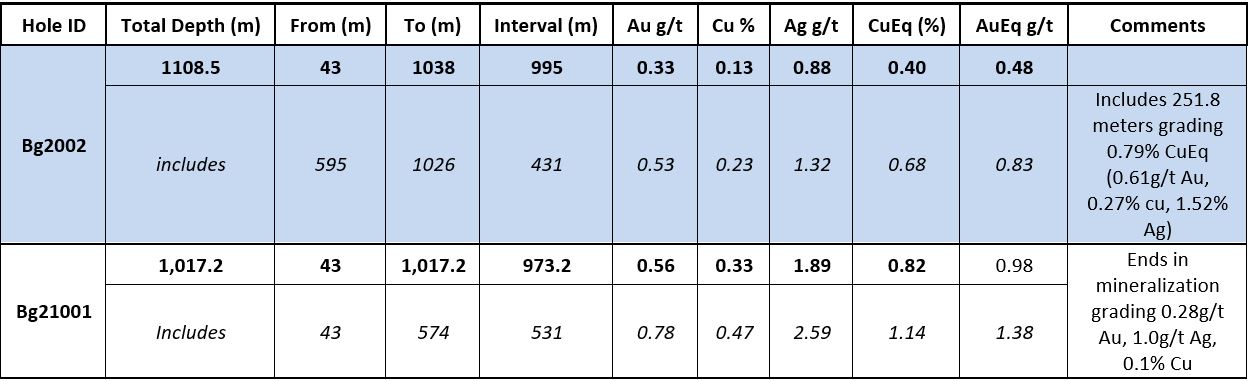

A summary of the results released announced to date in the table below.

Table 1. Summary table of Holes Bg21001 and Bg21002

Assumptions used for the copper equivalent calculation were metal prices of US$3.00/lb. Copper, US$1,700/oz Gold, US$22/oz Silver, and recovery is assumed to be 100%. The following equations were used to calculate copper and gold equivalence: CuEq = Copper (%) + (Gold (g/t) x 0.8264) + (Silver (g/t) x 0.012). AuEq = (Copper % x 1.21008) + Gold (g/t) + (Silver (g/t) x 0.012).

Tim Barry, CEO of Arras states, “Hole Bg21002 appears to extend the high-grade zone of mineralization we see at Beskauga an additional 300 meters at depth. What is especially encouraging is the observed width and continuity of the mineralization in this zone, which remains untested at depth. Our current drill program is also proving extremely useful in defining the controls on the mineralization and is giving us valuable insight into planning our drill program from 2022.”

Drill Program: In October 2021, Arras announced the start of a planned 30,000-meter drill program targeting the extensions of the Beskauga deposit both laterally and at depth. In addition to testing the extents of the Beskauga deposit, the program is also targeting a series of previously undrilled targets in the wider area. These wider targets are supported by ground and recently flown airborne geophysics as well as in-situ geochemistry derived using “KGK” drilling (a drilling method developed in the former Soviet Union akin to 'wet' RC drilling, that recovers a 1-3 m core sample from the top of the underlying bedrock which is used to map lithology, alteration, and geochemistry).

For the drilling, Arras is using the local company “Tsentrgeolsemka LLP” and drilling restarted in early February of this year. Tsentrgeolsemka LLP is independent of Arras.

The drill program is being conducted under the Option to Purchase agreement (“Option Agreement”) executed on January 26, 2021, with Copperbelt AG (“Copperbelt”), a mineral exploration company registered in Zug, Switzerland.

Results: Hole Bg21002 was collared outside the area on which Arras’ current mineral resource estimate is based and was designed to test the continuity of the high-grade mineralization observed in hole Bg21001 announced by Arras on January 31, 2022 below 600 meters (for further details, see Arras’ press release dated January 31, 2022). Starting from 44 meters, hole Bg21001 intercepted 531 meters grading 1.14% CuEq (0.78g/t gold, 0.47% copper, 2.59g/t silver) before drifting out of this high zone at around 580 meters.

Drilling in a north-westerly direction, hole Bg21002 appears to have encountered the high-grade zone observed in hole Bg21001 at approximately 595 meters. This was marked by an observed increase in veining and alteration of the rock and marked the start of a 431-meter-wide zone grading 0.68% CuEq (0.53g/t Au, 0.23% Cu, 1.32g/t Ag). Within this interval a higher-grade zone of 251.8 meters grading 0.79% CuEq (0.61g/t Au, 0.27% Cu, 1.52g/t Ag) was also observed starting at 774 meters.

As seen in hole Bg21001, the mineralization observed in hole Bg21002 is hosted within a potassic altered diorite that has been later overprinted by strong to very strong argillic alteration comprising of illite and smectite; with subordinate kaolinite and dickite present at shallow levels (confirmed by Arras using TerraSpec SWIR/NIR spectroscopy). This mineralization at the top of the hole appears as a mixture of low grade disseminated, vein and fracture-controlled zones of pyrite, chalcopyrite, tennantite, bornite and covellite. Occasional intense zones of sheeted smokey quartz veins starting below 595 meters in depth were observed and correlate with high grade gold assays up to 4g/t. Like in Hole Bg21001, the observed argillic overprint gradually decreases with depth, eventually giving way to an apparent, largely unaffected, potassic alteration beyond c. 1000 m. At these depths, observed argillic alteration persists only as localized alteration around faults and fractures. Based on exploration undertaken to date, the Beskauga deposit is interpreted by Arras to represent a porphyry copper-gold deposit that has been overprinted by high-sulphidation epithermal mineralization, either through telescoping or due to clustering of multiple porphyry centres within the Beskauga license that have superimposed alteration and mineralization upon earlier phases.

The results from hole Bg21002 appear to extend the high-grade zone of mineralization at the Beskauga project to over 900 meters, starting from 44 meters below surface. Potential mineralization in this zone remains untested at depth.

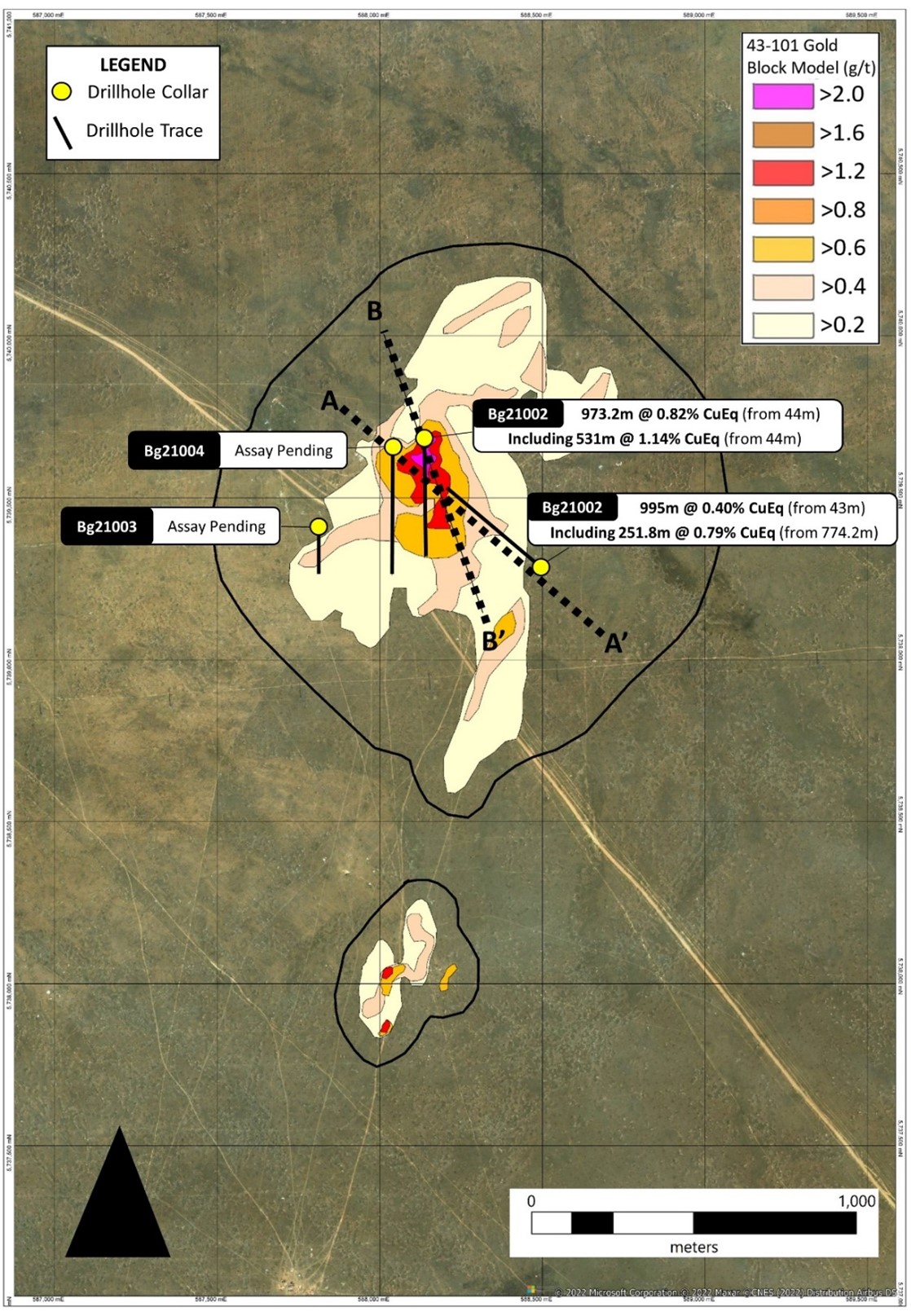

Figure 1. Location of the first four holes of the planned 30,000 meter drill program on the Beskauga deposit and wider area (for further details, see Arras’ press releases dated October 7th, 2021 and January 31, 2022). Line A-A’ shows the section line for hole Bg21002 and line B-B’ shows the section line for hole Bg21001. Assays are still pending for holes Bg21003 & Bg21004. Also shown are the grade contours from the block model for gold (only) developed for the purposes of the current mineral resource estimate at the Beskauga project.

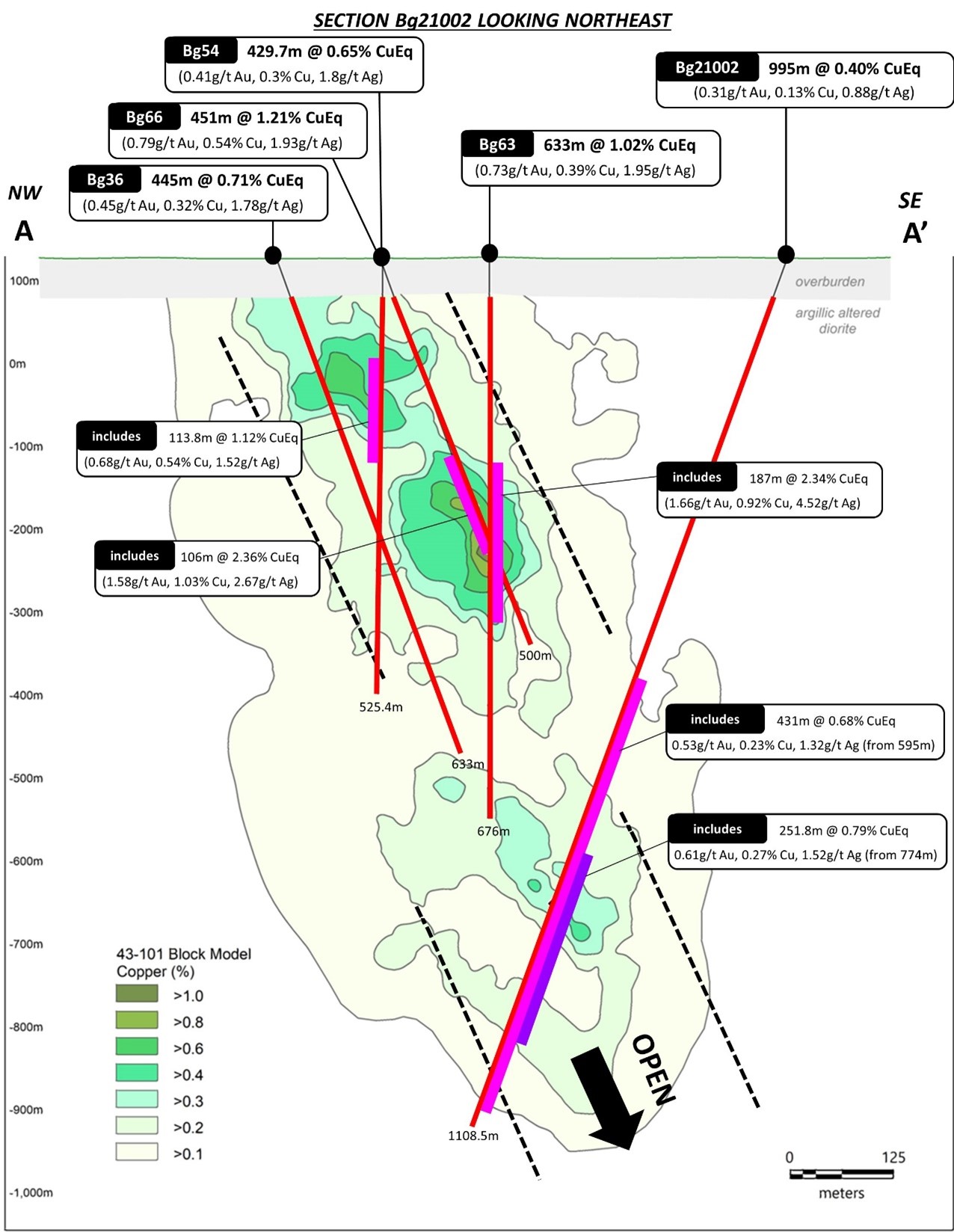

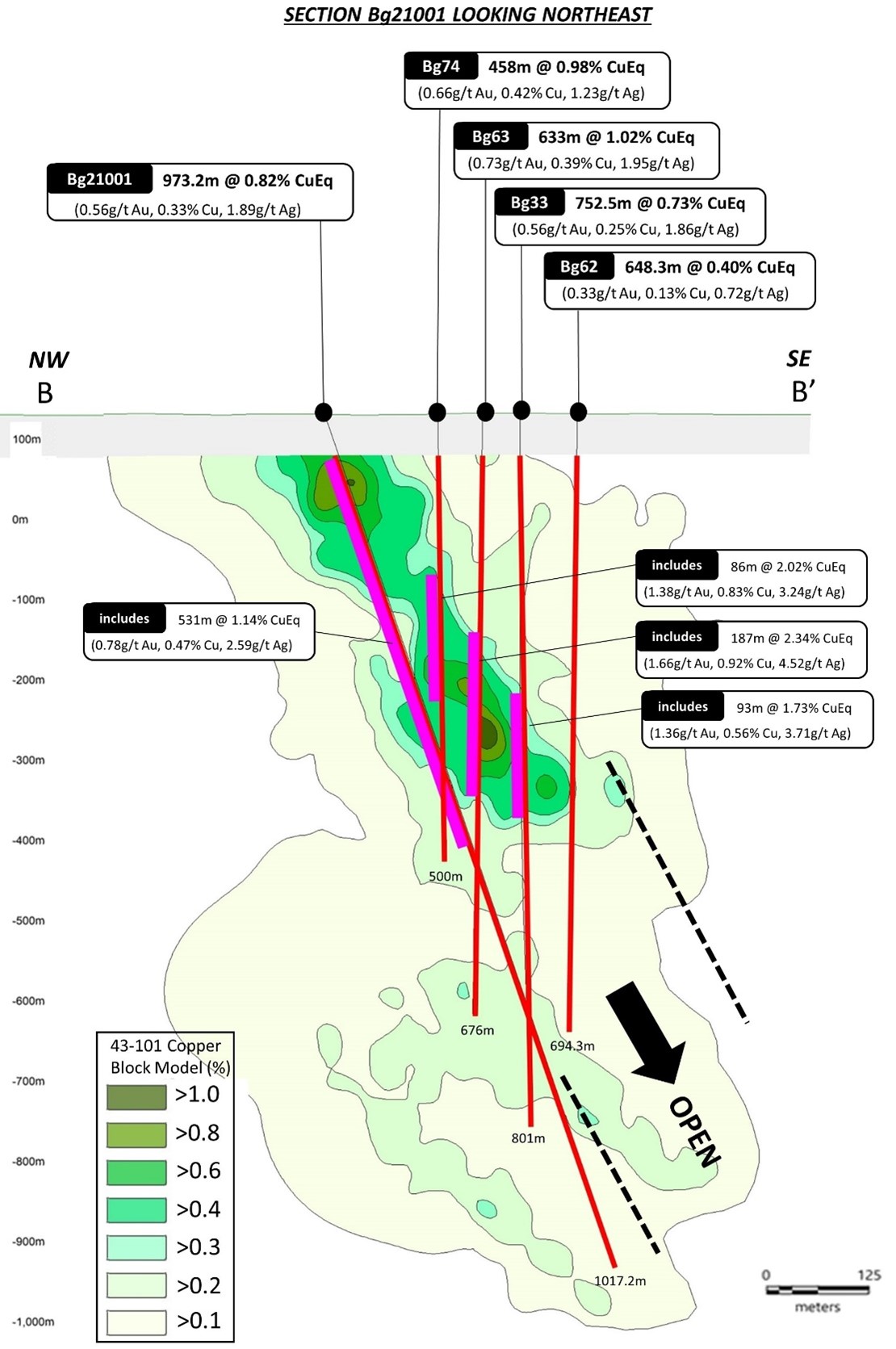

Figure 2. Cross section showing hole Bg21002 intersecting the high-grade zone observed in hole Bg21001(Figure 4) at depth, and in relation to several re-assayed holes previously announced by Arras on October 5th & 7th, 2021 (for further details, please see Arras’ press releases on October 5 and October 7, 2021 and January 31, 2022). Also shown are the grade contours from the block model for copper (only) developed for the purposes of the current mineral resource estimate at the Beskauga project. The cross section demonstrates the steep, southeast dipping high grade copper-gold-silver trend observed through exploration to date. This trend is observed beginning at the paleo-bedrock surface (44m in depth), to average between 200-300m wide and to be consistently mineralized down to at least 900 meters (observed in hole Bg21002). Mineralization remains untested at depth.

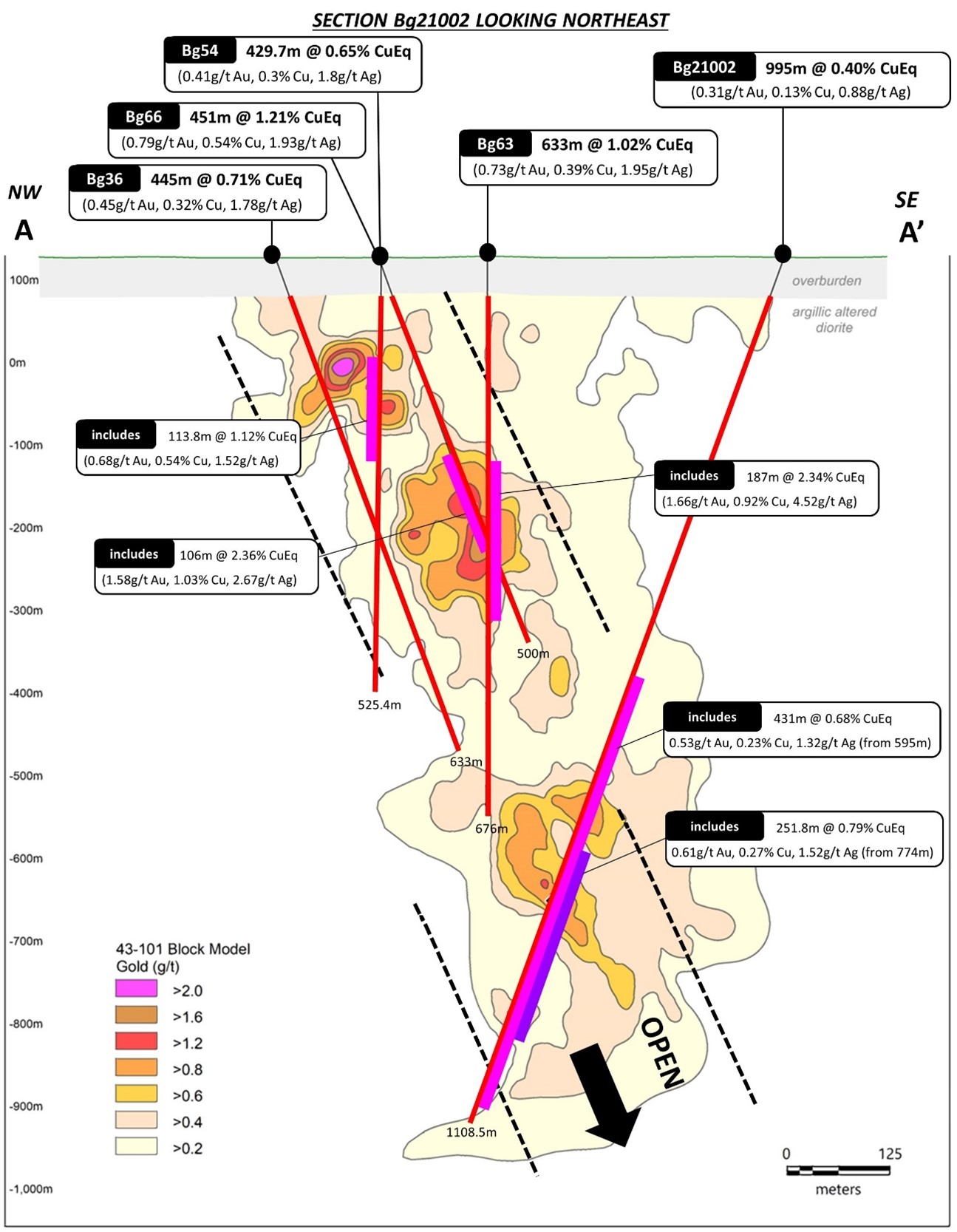

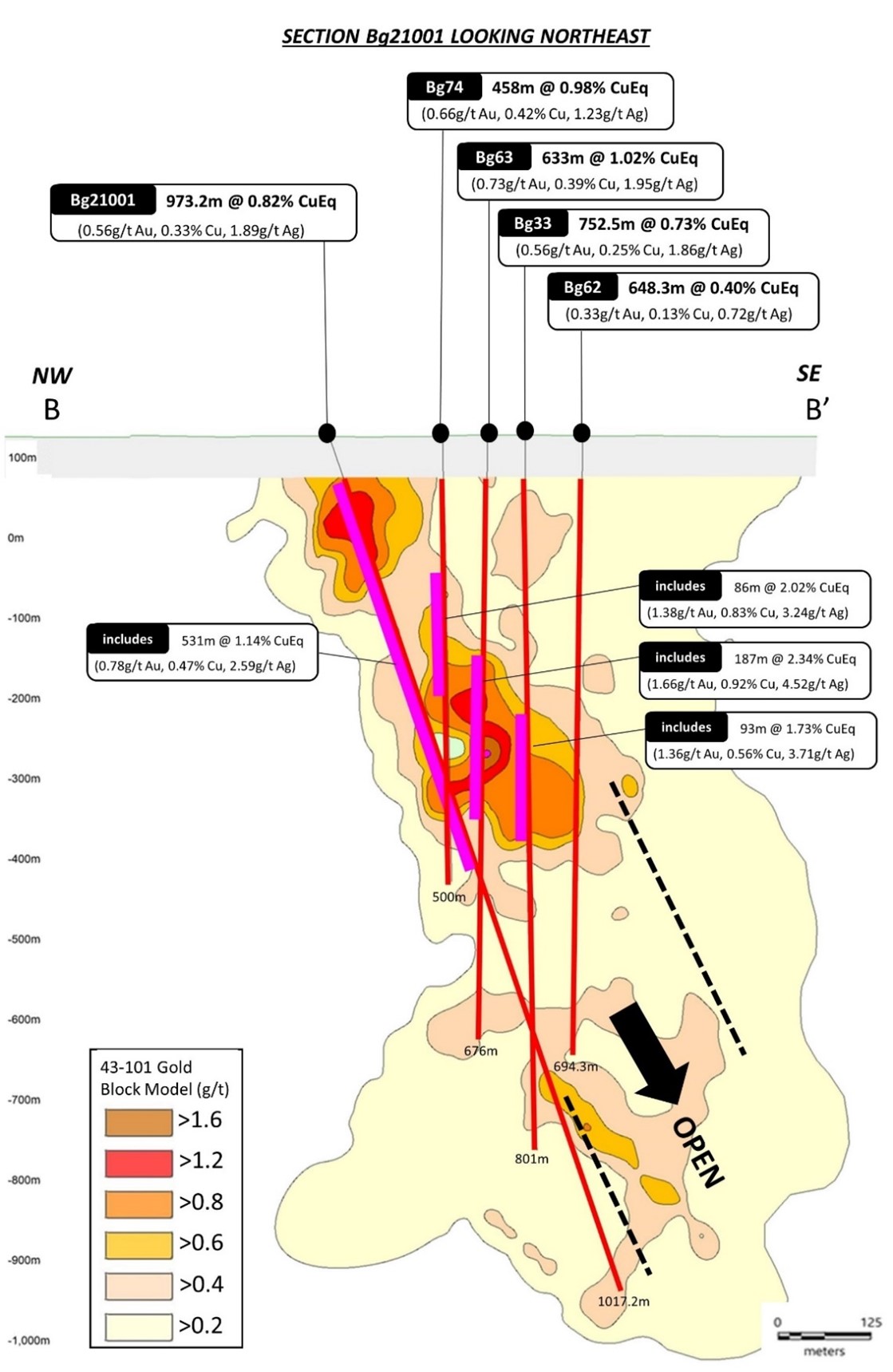

Figure 3. Cross section showing hole Bg21002 intersecting the high-grade zone observed in hole Bg21001(Figure 4) at depth and in relation to several re-assayed holes previously announced by Arras on October 5th & 7th, 2021 (for further details, please see Arras’ press releases on October 5 and October 7, 2021 and January 31, 2022). Also shown are the grade contours from the block model for gold (only) developed for the purposes of the current mineral resource estimate at the Beskauga project. The cross section demonstrates the steep, southeast dipping high grade copper-gold-silver trend observed through exploration to date. This trend is observed beginning at the paleo-bedrock surface (44m in depth), to average between 200-300m wide and to be consistently mineralize down to at least 900 meters (observed in hole Bg21002). Mineralization remains untested at depth.

Figure 4. Cross section showing hole Bg21001 announced by Arras on January 31, 2022 (for further details, see Arras’ press release dated that date). Also shown are the grade contours from the block model for copper (only) developed for the purposes of the current mineral resource estimate at the Beskauga project. The cross section demonstrates the steep, southeast dipping high grade copper-gold-silver trend observed through exploration to date. This trend is observed beginning at the paleo-bedrock surface (44m in depth), to average between 200-300m wide and to be consistently mineralized down to at least 900 meters (observed in hole Bg21002). Mineralization remains untested at depth.

Figure 5. Cross section showing hole Bg21001 announced by Arras on January 31, 2022 (for further details, see Arras’ press release dated that date). Also shown are the grade contours from the block model for gold (only) developed for the purposes of the current mineral resource estimate at the Beskauga project. The cross section demonstrates the steep, southeast dipping high grade copper-gold-silver trend observed through exploration to date. This trend is observed beginning at the paleo-bedrock surface (44m in depth), to average between 200-300m wide and to be consistently mineralized down to at least 900 meters (observed in hole Bg21002). Mineralization remains untested at depth.

About the Beskauga Deposit: The Beskauga deposit is a gold-copper-silver deposit with a NI 43-101 compliant “Indicated” Mineral Resource of 207 million tonnes grading 0.35 g/t gold, 0.23% copper and 1.09 g/t silver for 2.33 million ounces of contained gold, 476.1 thousand tonnes of contained copper, and 7.25 million ounces of contained silver and an “Inferred” Mineral Resource of 147 million tonnes grading 0.33 g/t gold, 0.15% copper and 1.02 g/t silver for 1.56 million ounces of contained gold, 220.5 thousand tonnes of contained copper, and 4.82 million ounces of contained silver. For further details regarding the Mineral Resource estimate at the Beskauga project, please see the technical report entitled “Beskauga Copper-Gold Project, Pavlodar Province, Republic of Kazakhstan, dated February 8, 2021.

The constraining pit was optimised and calculated using a NSR cut-off based on a price of: $1,500/oz for gold, $2.80/lb for copper, $17.25/oz for silver, and with an average recovery of 81.7% for copper and 51.8% for both gold and silver.

Assay and QAQC Procedures: All sample preparation and geochemical analysis of the diamond drill core was undertaken by ALS Global at its laboratories in Karaganda (Kazakhstan) and Loughrea (Republic of Ireland), respectively.

After drying and fine crushing, a 250 g split was pulverised to 85 % passing a -75-micron screen. A 30 g split of the pulp was analysed for gold using fire assay and Atomic Absorption Spectroscopy (AAS) finish (ALS method Au-AA25™) at ALS Karaganda. A second pulp split was then air freighted to ALS Loughrea and analysed for 48 elements by Inductively Coupled Plasma Mass Spectrometry (ICP-MS) after 4-acid digestion on a 0.25 g aliquot (ALS method ME-MS61™). Where samples exceeded 1% copper, they were re-analysed using a 4-acid digest ICP-MS ore grade method (ALS method Cu-OG62™). ALS Global and its laboratories are entirely independent of Arras Minerals Corp.

Arras Minerals operates according to its rigorous Quality Assurance and Quality Control (QA/QC) protocol, which is consistent with industry best practices. This includes insertion of certified standards, blanks, and field duplicates comprising of quarter drill core at an insertion rate of 2.5%, 2.5% and 5% respectively, which is deemed appropriate for this stage of exploration. The blanks and standards are Certified Reference Materials (CRM’s) supplied by Ore Research and Exploration, Australia, who are entirely independent of Arras Minerals Corp. Internal QA/QC samples were also inserted by the analytical laboratories and reviewed by the Company prior to release. No material QA/QC issues have been identified with respect to sample collection, security and assaying.

Qualified Person

The technical disclosure presented in this news release has been reviewed and approved by Tim Barry, CEO and Director of Arras Minerals Corp., a Chartered Professional Geologist (MAusIMM CP Geo) with the Australasian Institute of Mining and Metallurgy and a “Qualified Person” for the purposes of National Instrument 43-101.

On behalf of the Board of Directors

"Tim Barry"

Tim Barry, CPAusIMM

Chief Executive Officer and Director

INVESTOR RELATIONS:

+1 604 687 5800

info@arrasminerals.com

About Arras Minerals Corp.

Arras is British Columbia incorporated private company advancing a portfolio of copper and gold assets in northeastern Kazakhstan, including the Option Agreement on the Beskauga copper and gold project.