Summary

In 3Q 2015 Timmins delivered much worse financial results than a year ago.

The company also recognized a huge impairment charge of $226.5 million, related mainly to the San Francisco Mine.

Timmins plans to cease its mining operations in early-2017, unless gold prices go higher.

Yesterday Timmins Gold Corp (NYSEMKT:TGD) announced its 3Q 2015 results. In the last section of this article I am discussing basic figures included in this report but first of all I have to comment on a few very important announcements made by the company.

In 3Q 2015 Timmins recognized a huge impairment charge in the amount of $226,510 thousand. This charge was mainly related to the following issues:

- The San Francisco Mine - an impairment of $177,071 thousand

- Inventory - an impairment of $39,392 thousand

- Exploration properties - an impairment of $6,785 thousand

The San Francisco Mine, located in the State of Sonora, Mexico, is a sole producing asset operated by Timmins. Since commencing its operations, San Francisco delivered 460,020 ounces of gold. According to the last technical report, issued in July 2013, San Francisco was holding reserves of 1,589,000 ounces of gold. These reserves were calculated using a long term price of gold of $1,250 per ounce, which is 10.3% higher than the price at which gold is trading today. Generally speaking, any gold mining company calculates its mineral reserves using the forecasted, long-term price of gold. If this price goes down, any mining company should consider an impairment charge. Timmins is no exception. Let me cite the company:

"The Company identified the following indicators of impairment during the three months ended September 30, 2015:

- Sustained decrease in the gold price resulting in a loss from mining operations at the San Francisco Mine, thereby requiring a significant change to the mine plan as the existing mine plan was uneconomic at current and forecast gold prices.

- Sustained decrease in the market capitalization of the Company."

Well, I am a little bit uncomfortable with the above statement. Timmins writes that most recently it has identified a sustained decrease in the gold price. It is quite a strange announcement - the downward trend in gold prices has been intact since the end of 2012 so the question is why Timmins discovered this fact just a few months ago?

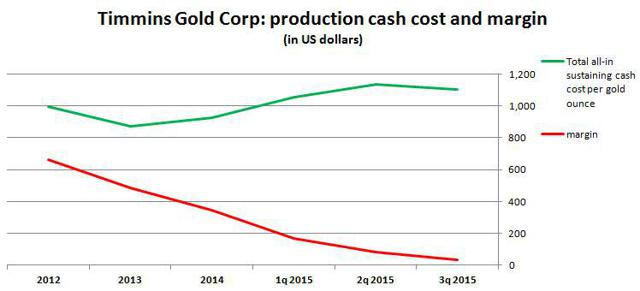

Next, in its financial statements the company is not disclosing the book value of the San Francisco Mine. Digging a little bit deeper in the company's statements I have found that the gross book value of this property (NASDAQ:COST) should stand at around $282.3 million (as of September 30, 2015). Decreasing this number by an impairment charge of $177.1 million, I find that today San Francisco is valued at $105.2 million. Is the company correct decreasing the San Francisco value by 63%? I think it is. Let me show a few figures. The chart below shows all-in sustaining cash costs and margins (defined as gold price realized less all-in sustaining cash cost) related to the San Francisco Mine:

(click to enlarge)

source: Simple Digressions and the company's reports

As the chart shows, due to lower gold prices, since 2012 the margins delivered by San Francisco have been dangerously approaching "zero". Let me ask: What is the value of a mine, which delivers practically no cash? Surely it is not high. However, let me stress that using a discounted cash flow model and assuming the long-term price of gold at around $1,100 per ounce the San Francisco value is certainly lower than before but if gold prices renew their upward trend, the valuations of gold properties will go up, San Francisco included.

Let me summarize. In 3Q 2015 Timmins found that it was the highest time to recognize an impairment charge of its main productive asset. As a result, value of the San Francisco Mine was reduced drastically. I think the company was right about this impairment. I only wonder why it made this remarkable decision in 3Q 2015. Probably the last change of the company's CEO could provide a clue but, well, I am not a fan of conspiracy theories.

An impairment of San Francisco initiated subsequent and remarkable decision:

"As a result of the recently completed review of operations based on the prevailing gold price, management has revised its operating plan for the San Francisco Mine. Assuming the gold price remains in its current range over the next year, open pit operations at the San Francisco Mine

will continue to mid-2016, at which point the Mine would be placed on care and maintenance. Heap leach operations would continue until early-2017. Production guidance for fiscal 2016 is between 65,000 and 70,000 gold ounces with a cash cost of approximately $700 to $750 per gold ounce"

I think it is the most important statement announced in the company's 3Q 2015 Management Discussion. If gold prices stay at today's levels or go even lower, the company will stop producing gold in early-2017. When it happens, Timmins will become a junior miner focused on exploration and development of two newly acquired properties: Caballo Blanco and Ana Paula, both located in Mexico. In my opinion, Ana Paula is the property, which should be explored and developed in the first place. This project holds an IRR of 23.1%, using the price of gold of $1,105 per ounce (which is close to the price at which gold is trading today). Ana Paula contains 1,859 thousand ounces of gold classified as resources and the initial CAPEX is estimated at $164 million. The project's NPV is $137.8 million (using a discount rate of 5%).

In September 2015 Timmins acquired the processing plant and auxiliary equipment to be used at Ana Paula. According to the company, through this acquisition the initial capex of the project should decrease to around $104 - $124 million. It means that the project's economics is going to be much better than before, which supports my opinion that Ana Paula should be developed in the first place.

Summary

In my opinion, 3Q 2015 report is one of the most important documents the company published in its history. If gold prices stay at today's levels or go even lower, the company will cease its operations in early-2017. The company has not provided any new mine plan for San Francisco, if such scenario is intact. Apart from that, the company has not provided a detailed plan of the future development and exploration works at Ana Paula or Caballo Blanco. Therefore in the nearest future the Timmins investors will have serious problems with determining the value of the company's shares, which should increase the share prices volatility. The last change at the CEO position, in my opinion very enigmatic, makes the whole situation even more complicated.

Last but not least. Timmins is a rare example of a mining company announcing that it is going to stop mining due to low gold prices. In my opinion, it is quite a reasonable behavior - is it sensible to dig a very rare metal out of hard rock when you are not able to do it profitably? Why not to follow the uranium sector example, which has chosen to wait for better times instead of conducting unprofitable mining operations?

3Q Financial results

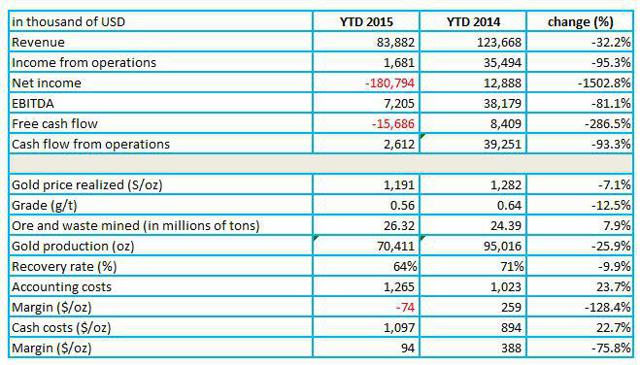

The table below summarizes basic financial and operating measures:

(click to enlarge)

source: Simple Digressions and the company's reports

As the table shows, the company's financial results deteriorated in the first nine months of 2015, compared to 2014. The major reasons standing behind these negative developments are lower gold prices and lower gold production. Timmins does not control the prices of gold therefore let me discuss the issues controlled by the company.

YTD 2015 Timmins, to produce gold, had to mine more rock than in 2014 (an increase of 7.9%). More blasting, grinding and crushing means higher costs. Next, the grades reported by the company were also lower than in 2014 (a decrease of 12.5%). Recovery rates also went down (a decrease of 9.9%). As a result, the company produced less gold at higher costs. Hence negative margin defined as gold price realized less accounting cost of production. Simply put, this year Timmins became unprofitable. Fortunately, the company was able to deliver some cash from its operations - each ounce of gold sold delivered $94 in cash ($388 in 2014).

T