Summary

Timmins Gold's brand-new CEO has already made a first important decision; if the gold price doesn't recover, the flagship mine will be placed on care and maintenance.

That's surprising as San Francisco wasn't really losing a lot of cash.

Timmins Gold will have difficulties to defend itself against (hostile) takeover offers as the development-stage projects definitely have a lot of merit.

Introduction

Timmins Gold (NYSEMKT:TGD) has reported its financial results of the third quarter of this year and whilst the huge net loss doesn't (or at least shouldn't) really surprise anyone, Timmins is also taking drastic measures and announced it's planning to shut down its only producing mine until the gold price recovers.

TGD data by YCharts

The hidden warning in the Management Discussion

I had circled Nov 3 on my calendar as Timmins Gold was supposed to release its financial results today. The company has done so and filed the financial statements and management discussion and analysis on SEDAR yesterday evening. However, as of this moment (10:30 AM ET), Timmins still has NOT published the accompanying press release on its website, and that's extremely surprising considering the huge (negative) news I stumbled upon whilst reading the Management discussion.

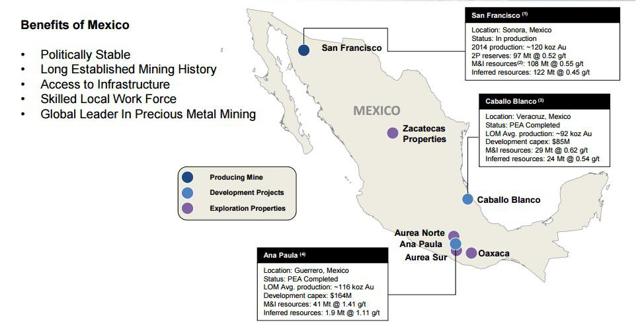

(click to enlarge)

Source: company presentation

If you scroll to page 3, there's a stunning paragraph in the filing:

Assuming the gold price remains in its current range over the next year, open pit operations at the San Francisco Mine will continue to mid-2016, at which point the Mine would be placed on care and maintenance. Heap leach operations would continue until early-2017. Production guidance for fiscal 2016 is between 65,000 and 70,000 gold ounces with a cash cost of approximately $700 to $750 per gold ounce

So, if the gold price doesn't increase substantially, Timmins Gold will shut down its only producing mine, and that's quite a surprising fact.

Was this really necessary? What's next?

Why was this surprising? Despite the low gold price, Timmins still reported a positive operating cash flow of $1M. Okay, that was not sufficient to cover the ongoing capital expenditures but you should keep in mind a large part (and probably the majority) of the capex should be qualified as growth capex.

(click to enlarge)

Source: company presentation

The main culprit for winding down the operations might be the fact that Timmins Gold is expecting a lower recovery rate, which already forced the company to reduce the book value of its inventory by $36M. On top of that, this impairment charge converted Timmins Gold's positive working capital position into a WC deficit, and that's probably the main reason why the (new) management team wants to reduce the cash outflow.

And indeed, it's really remarkable to see how a CEO who has been in charge for just three weeks dares to take such a life-changing decision considering Timmins Gold was mulling over the potential to chase a relatively sizable higher grade ore zone on the property. It's also remarkable to see Goldcorp (NYSE:GG) investing $4.5M in Timmins Gold at a price which is now approximately 25-30% above the current market price. This cash inflow from Goldcorp should help Timmins Gold to reduce the working capital deficit and reduce the 'immediate' needs.

Timmins Gold's aggressive expansion plan earlier this year will now be halted as the company simply won't generate a sufficient amount of operating cash flow to fund the development of both Ana Paula and Caballo Blanco. And that's a pity, as these are two low-capex and advanced stage projects that would be profitable at the current gold price.

Investment thesis

A lot has happened in the past month, Timmins fired its CEO, completed theacquisition of a mill, announced a $4.5M investment by Goldcorp and is now planning to put the San Francisco mine on care and maintenance in anticipation of a higher gold price in the future.

Timmins' share price has now fallen by 90% in just 16 months time and could now be an attractive buyout target for a more senior gold and Mexico focused company and that's probably what keeps the share price relatively stable. Putting the San Francisco mine on care and maintenance is a huge surprise but I trust the management knows what it's doing.