Aug 4th 2021 | Business, Oil & Gas

Courtesy of Rystad Energy via Oil & Gas Journal

Courtesy of Rystad Energy via Oil & Gas Journal Production of shale oil and gas can be like running a video game studio. If a video game company was sure that its highly-anticipated release (say, E.T. The Extra Terrestrial) was going to be the hottest-selling video game of all time, it’s a common practice to produce large quantities so shelves are well stocked for Christmas. If demand fails to meet expectations, sometimes it can result in a landfill full of Atari cartridges.

Likewise, an oil and gas company expecting 2020 to turn out just like any normal year, may drill lots of wells to meet anticipated demand.

- As you may be aware, 2020 did not turn out just like any normal year which led to a huge inventory of drilled but uncompleted wells (DUCs).

What’s a DUC? DUCs are wells that have been drilled but not yet hydraulically fractured to start production, as commodity prices are too low. In the past, this approach ensured steady production growth with highs balancing out lows.

- Unlike video games which never regain their anticipated demand and are thrown away, DUCs simply wait until prices recover to be completed. Like now.

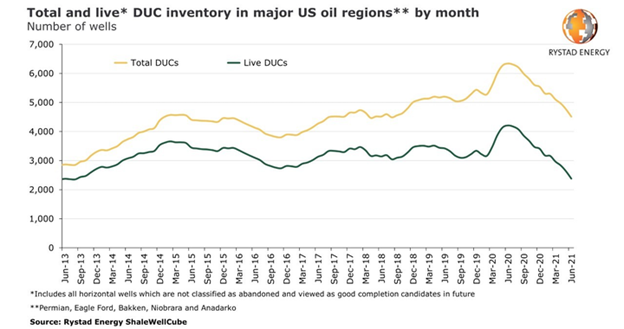

What’s new: In 2020, many wells were drilled but not completed due to challenging oil prices. Since then, US producers have been burning through their inventory of DUCs to offset production declines and take advantage of stronger commodity prices and lower completion costs.

- This inventory reduction is even more apparent when you exclude dead DUCs that were drilled more than 2 years ago and have a low likelihood of ever being completed.

Zoom out: Low DUC inventories will likely lead to more drilling activity, but it also means that producers can’t respond as quickly to changes in market prices. One hopes that producers today were Atari gamers back in the day and have learnt the lesson.