NYSEAM:UEC - Post by User

Post by

mangoeon Apr 13, 2024 2:31pm

122 Views

Post# 35987590

Other Stocks info for investors 📃

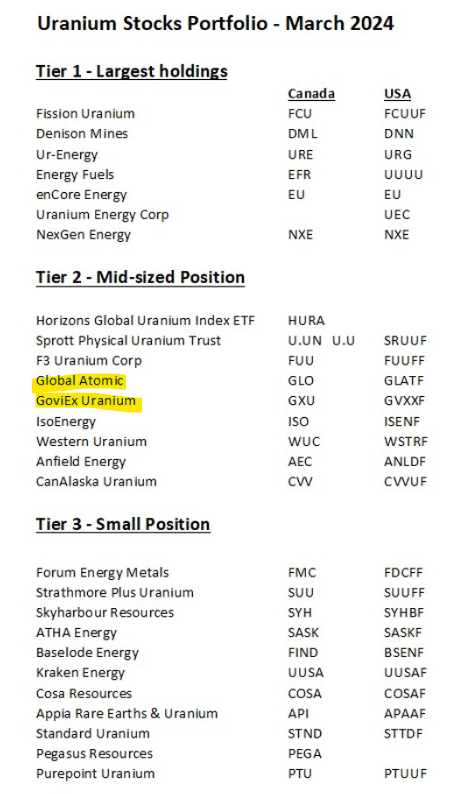

Other Stocks info for investors 📃  Thanks for your synopsis but, with all due respect, I would caution readers that $GLO & $GXU are Canadian #Uranium #mining companies, run by Canadians - not Americans - in Joint Ventures with the new government of #Niger under a strong & long-standing partnership with Niger's Ministry of Mines.

Thanks for your synopsis but, with all due respect, I would caution readers that $GLO & $GXU are Canadian #Uranium #mining companies, run by Canadians - not Americans - in Joint Ventures with the new government of #Niger under a strong & long-standing partnership with Niger's Ministry of Mines.

The views expressed by the targets of anti-American sentiment and protests have nothing to do with these mining projects whose owners & operators are headquartered in Canada, not the USA.

Canada does not operate any drone or other military bases in Niger. A small contingent of Canadian troops are still stationed in Niger and have NOT been asked to leave the country.

The swapping out of US military trainers of Nigerien troops to be replaced by Russian trainers changes nothing at the working level of uranium mining, imho. It is a symbolic change at the highest political level to drive home the point that American troops aren't welcome. The new Nigerien government is not surrendering control of the country to Russia or enabling Russia to take any kind of role in the industrial economy of the country.

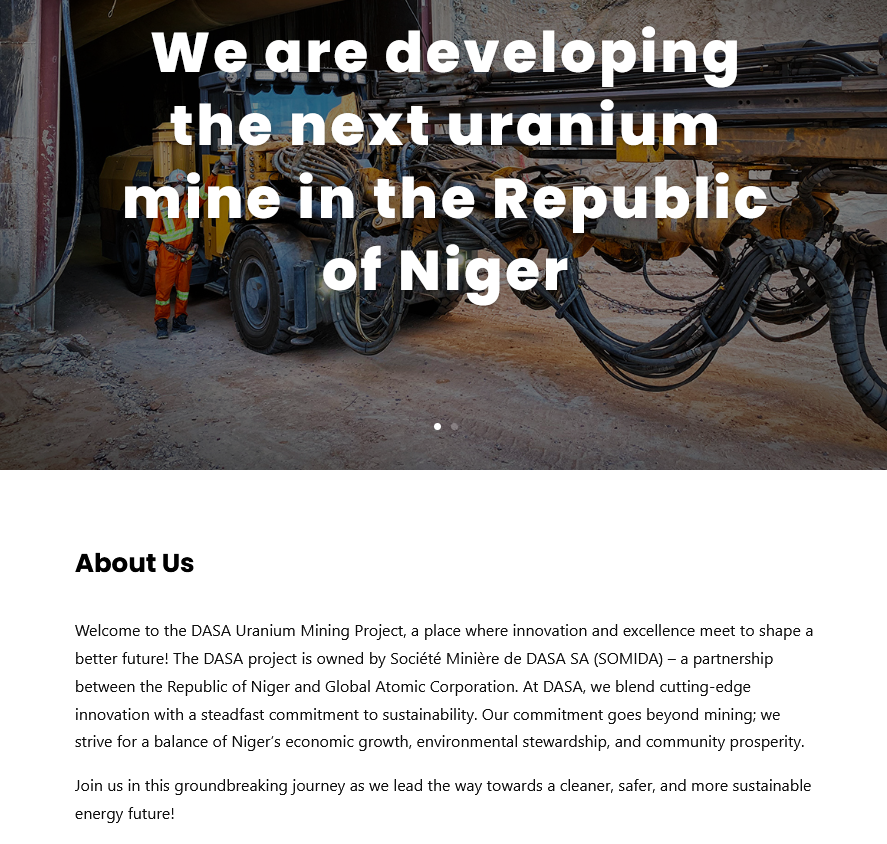

The new government of Niger holds a 20% stake in the uranium mining projects of Global Atomic and GoviEx. The success of those projects relies heavily on these Canadian companies who provide the technical expertise to manage mine construction and operations. Dasa's SOMIDA mining partnership employs Nigerien troops to provide mine security, and offers good-paying jobs to Nigerien mine workers that support much-needed economic growth for the impoverished nation. The coup government won't realize any profits and royalties from the SOMIDA uranium mining partnership unless Global Atomic is provided the full support needed to bring Dasa into production.

Mining is hard, and uranium mining is among the hardest given the additional requirements for radiation safety in conducting mining operations. The technical details of the ore bodies and mine operations are in the hands of Canadian companies who are managing operations. There is zero incentive on the part of the Nigerien Ministry of Mines to try to hand off these projects to Russians or Chinese who have no knowledge, experience or access to the know-how needed to build and run these mines. To do so would lead to many years of delays or totally derail these mine projects. The government is relying on these projects to bring profits and economic prosperity. To attempt to change their ownership or management teams now would be a major setback for the new government's plans for rebuilding the economy.

Further, Global Atomic and GoviEx are establishing offtake deals with western nuclear fuel buyers who will pay high-end world prices in their supply contracts, ensuring that Niger will get maximum economic benefit from uranium sales. A change to Russian or Chinese offtakes at likely substandard pricing & wages would lead to lost opportunity and a lower standard of living for Nigerien workers. Where is the sense in that?

Yes, there are still uncertainties with regards to financing of these projects, but those discussions and negotiations are taking place in company boardrooms in Canada. The syndicates of banking institutions from around the globe are not investing in Dasa or Madaouela for political reasons... they are seeking to make a lot of money on the realized sales of uranium when the mines get into operation. They will undertake the necessary risk analyses to determine whether or not they wish to participate and under what terms being negotiated in Canada. If any potential lender decides against making an investment then there are others willing to take their place.

Having said all that, the share prices of the companies already reflect these risks involved with respect to project viability, management, operations and financing. Downside risk is low compared to the upside profit potential they offer to investors at current share prices, in my humble opinion.

We, as investors, must always recognize that we have no control over these situations. Our control is limited to whether or not we choose to own shares of the companies and how we structure our portfolios to capture the potential rewards and hedge against further project and downside risk.

I have not sold any of my $GLO or $GXU shares as I have a well diversified portfolio that stands to benefit no matter which way the winds of Nigerien politics blow. $GXU has other projects outside Niger so is not a pure play on the Nigerien situation, so they will see upside growth from their other non-Niger projects.

Both companies are held by the large Uranium sector ETF's $URA and $URNM so will see large volumes of mandated buying of their shares as more funds flow into those sector ETF's, supporting their share prices regardless of the evolving politics of Niger.

If either company's projects in Niger were to suffer a fatal blow as trader and short-seller FUD would have you believe then that would lead to strong upward pressure on Uranium prices as essential new mined production falls by the wayside. The gains realized by the other holdings in my portfolio will swamp out whatever losses may be incurred by $GLO and $GXU.

then that would lead to strong upward pressure on Uranium prices as essential new mined production falls by the wayside. The gains realized by the other holdings in my portfolio will swamp out whatever losses may be incurred by $GLO and $GXU.

That's why it is so important to structure your portfolio so that individual company risk is minimized. Whether or not U put all your eggs in one company or a basket of companies is something U can control. One company's failure can lead to the rest of your portfolio soaring.

Sorry about the rant!

It's your money so invest it in companies and jurisdictions suited to your own level of risk tolerance and due diligence. Take responsibility for your own investment decisions and the possible consequences that follow... good or bad. It's all up to U!

Good luck with your research and investments!