Currie Rose

Northern Sphere

True Claims

Mc Donald Mines

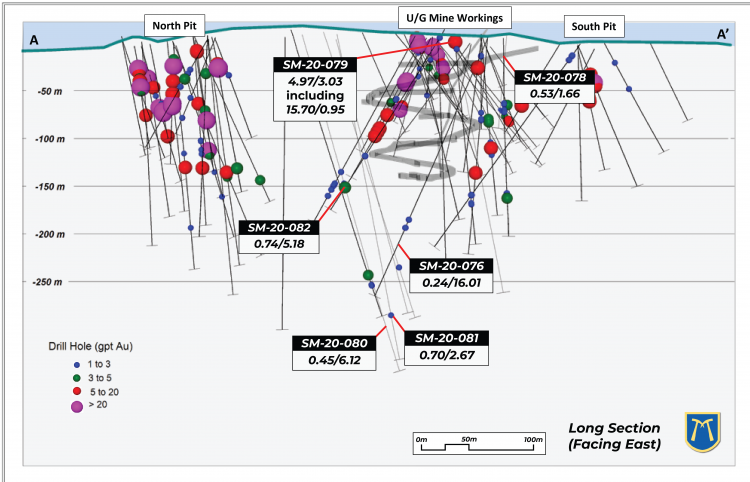

The Scadding mine along with ( north + sout pits ) have seen significant drilling,

I think of it as... they drilled the shhh out it.

What we don't have... is a 3-D modelling

to show birdseye and 360 view at depth what each of the 3 pits hold in gold.

What most have only seen is...

What BMK has drilled.

One has ot factor in... what the 3 former explorers drilled and what they mined.

Then... factoring in, what was left ( representative of the untouched former drill holes )

inconjunction with new drills from BMK.

This map is good...

but it could be alot better if former drills were included.

A 3D map would show longatude and latitude of the depoist - not just depth like image below.

Which is quite important.

WHERE AM I HEADED WITH THIS SUBJECT ?

Mining the gold VS rolling the stock.

Blast, dig scoop, ship off to Sudbury pay a toll fee for milling and recovery of gold.

INVENTUS MINING Just performed an open pit ( reef gold ) operation

Targeting $1,000,000 dollars in gold.

4 meter depth with apprx 5,000 ore tonnes

Which means the size of ore body would have to be -

20m x 25m x 4m x 2.5 ore weight = 5,000 tonnes

Did they achieve thier $1,000,000 million target

Yes.

Did it take a long time ?

Yes - too long.

Issues ?

Gold recovery - lots left in circuit.

Not the best clocked record for 5,000 tonnes. ( wink )

QUESTION IS PUT FORTH Does BMK have enough drill data - historical + current - to gain enough confidence of

how much gold is at the north pit and sacadding ?

SINGLE OUT NORTH PIT + PARTIAL PORTION OF SCADD

Analyze the image above in post

Could the north pit + partial portaion of Scadd offer up - 50m x 50m x 50m x 2.5 ore weight

x 3/grams average grade ?

312,500 ore tonnes @ 3 gram target

The junior would know for certain if they - inputted al lthe drill data into a -

interpolation and grade program.

They appear to have the 50m depth, but...

50m x 50m - longatude and latitude would need to be confirmed.

ISSUE ?

Not all ore tonnes are mineralized - between drill holes -

Past performance accounted for - 5+ grams per tonne.

This is undergeound mining - targeting the high grade.

Open pit - one has to grab all ore tonnes - thus - reducing the grade averages.

Therefore, one would have to still handle tonnage with no - pay dirt.

Cost to mine ore tonnage is not too expensive... it's when it's placed in circuit costs rise.

MODELLING

1) The mine model would have to veer from standard modellling.

Simply separate ore tonne costs to extract ( 312,500 tonnes )

vs - gold ounces assumed.

2 ) State targeted gold ounces expected or assumed.

Which would involve - all drill hole data - interpolation confidence -

Past performance 5 grams - knock it down to 2.5 grams - compensate for

non minerlaized ore.

3) Style of mining -

kept to 50 or so meters depth ( 150 ft ) use crane with grapple jaws.

Blast - Scoop and Transport to Mill.

ASSUMED ?

50m x 50m x 50m x 2.5 ore weight x 2.5 grams gold

= 25,120 ounces Au

x $1400 profit ( $750 cost per tonne from $2150 dpot gold cdn )

= $35,168,000 cdn

WHAT TO DO NEXT ? ( if successful )

Stock would repair. - 1st positive

Share dilution tamed - 2nd positive

3RD POSITIVE ?

Typical mining costs to drill are approx $200. meter ( give or take )

$200.meter x 200meter holes = $4,000/per hole

$30,000,000 million

~ $4,000 per hole

= 7,500 drill holes

No more shares would be needed ot drill out the claims.

Since the shares would not see dilution - every successful drill finding minerals would

movel the valuation needle northward - creating value.

4TH POSITVE -

Junior would have - $5,000,000 in the bank,

from the original ( hypothetical ) $35 mil from gold credits.

5th POSITIVE ?

Involves ( bonus minerals ) if they... had any.

Such as nickel in chlorite hydroxide form or... uranium.

Why throw in a wild card ?

Nickel and uranium presence is noted in core assaying.

ppm values are not high.. but, the what if, it converted to a chloride / serpentine nickel ?

Sudbury ( west side ) has the sulphide nickel - east side seen a sodic intrusion - which is

only logical to think, the nickel if present in high grades may have transitioned.

HERE'S A HOMEMADE MAP OF SCADDING + NORTH PIT

1 - When i look at google mpas i see the northern part of Bristol erroded ( near norty pit )

suggesting = gold came in from North watershed

2 - Why watershed gold ?

Simply put, the gold is foind in breccia chlotires - broken ores and most gold is VG

which could point to - source is not far - didn't have time to convert to fine gold.

3 - They didn't drill on the other side of the erroded Bristol, gold could have parked itself

in this area - bristol - being a resistence point - capturing the gold.

4 - i have a white circle as most probable.. .but, if my theory is correct - watershed gold -

white circle could harbor less being a thoroughway... and resistent points are needed.

therefore - white circle may be wrong and gold could be on other side of erroded knoll.

and... with water force - breccia gold rode over the small knoll of bristol

- parked itself at south pit - choke point before escarpment small channel way

- parked itself at scadd mine perhaps a larger depression to accumilate

- and at north pit, the knoll slowing down the gold in water flow and dropping out aside of knoll.

- continued through to - south pit down into drop zone and into Glade.

- Ashigami + Arcade influence and north watershed, contributing to Glade.

Notice the few gold showings ( colored dots ) over Bristol.

This is a quartz carbonate. Historicla drills did hit this zone, but the assay results are beyond hard to find.

Hole 20 046

would be in the white box lower right corner - inline with north pit and east pit.

also most likely influnced by ,Ashigami - long ago watershed.

https://apis.mail.yahoo.com/ws/v3/mailboxes/@.id==VjN-5QiH52KGhJJafvgCjwmzVF72v8JvbmsrnIdTvAMeA9MSO1o-idfBnsll3s9AMp2LsVOAykft_OCWIB6Ledswcw/messages/@.id==ANzZDAp1Iw2UY0-1xgWpODbUwjs/content/parts/@.id==2/thumbnail?appid=YMailNorrin So... these are my open thoughts...

And.. .all dependent upon - CONFIDENCE - of tabulating / factoring in all drill holes

from all 4 juniors - over lay them with an interpolation - know for certain how many gold ounces they may have...

When one thinks about it....

They have a mine permit - hard ot come by nowadays.

Why not use it ?

And... if the area has seen significant drilling with approx 4 juniors.

Or work thereof... why not take it to the next level and bring value to shareholders vs roll stock ?

IF.... there were 25,000 ounces - it's quite impressive whst it could do, if put to good use.

Shore up the junior with cash holdings and.... use rest to drill out a few other potential deposits without touching the share structure - no dilution, or, far less dilution and begin racking up the gold ounces and other mineral pounds.

Other juniors mined the area with small operations

And who knows... maybe they'd put inventus to shame.. wink.

Instead a severa lhundred ounces - maybe - BMK would outshine inventus with

mining multiple tohusand ounces of gold. Pull it now is most logical - while gold is still with a

high spot value. Secure the needed funding now.... and never have ot worry raisng capital for future drilling - this would certainly attract attention for the junior...

So.. does the junior have the meterage of, 50m x 50m surface area ?

Appears they have the depths for 60m - mineralized gold.

Could combining a poortion of Scadd with North pit - selectively carving out enough tonnage

to amass a tonnage eq to - 50m x 50m x 50m with a modest 2.5 grams average ?

Only the junior knows this intel -

They have all the data...

never assembled it into one visable 3D map or diagram to show shareholders

what they really have.

Or.. .roll the stock, rince and repeat...

Pocket drill zones - show and tell to majors - let them fill in the blanks - have their inhouse pros

crunch the numbers using interpolation programs - junior never tallies a resource for thier own shareholders... hmm.

Cheers....