Life sciences investors looking for a penny stock with potential should be considering Kalytera Therapeutics (Kalytera Therapeutics Stock Quote, Chart TSXV:KALY), says Echelon Wealth Partners analyst Doug Loe.

Life sciences investors looking for a penny stock with potential should be considering Kalytera Therapeutics (Kalytera Therapeutics Stock Quote, Chart TSXV:KALY), says Echelon Wealth Partners analyst Doug Loe.

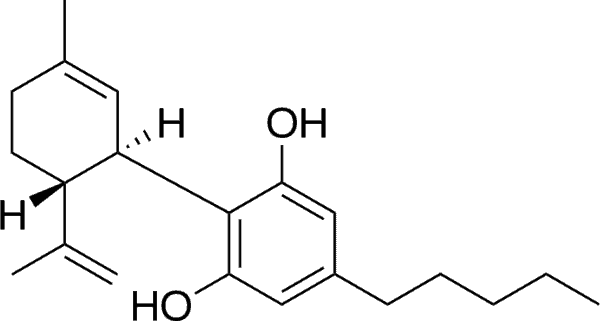

On Tuesday, KALY released what it described as additional positive interim data from its continuing phase 2 clinical study evaluating cannabidiol for the prevention of acute graft versus host disease following bone marrow transplant.

“These interim results are encouraging,” CEO Robert Farrell said. “Our goal is to diminish the risk of developing GVHD that cancer patients face when choosing to undergo a bone marrow transplant procedure, and we believe that CBD has the potential to become the first pharmaceutical to be approved for prevention of GVHD.”

In a research update to clients Tuesday, Loe maintained his “Speculative Buy” rating and one-year price target of $0.30 on Kalytera Therapeutics, implying a return of 275 per cent at the time of publication. The analyst says the final data is on the horizon here, but that interim data are quite positive in comparison to Phase II CBD/GvHD data already published by clinical collaborators.

“Second interim GvHD Phase IIa analysis again reveals that CBD-treated patients endured minimal, if any, GvHD symptoms: Today’s update, about six weeks beyond the first interim analysis described above, was also positive, with no new episodes of GvHD emerging during that time in the same 12-patient cohort. GvHD incidence data in combination with safety data generated so far were sufficiently positive to the trial’s data safety monitoring board (DSMB) to allow for Kalytera to start enrolling for a second 12-patient cohort, this time to be treated with 150-mg twice-daily CBD dosing.”

Loe does not see meaningful revenue from KALY until 2024, when he is projecting the company will generate EBITDA of (All figures USD) $17.4-million on revenue of $26.4-million. The following year, he is modeling EBITDA of $56.6-million on a topline of $65.1-million.

“On the milestone watch, we expect Kalytera to formally begin enrollment for the two remaining CBD dosing regimen cohorts (150-mg twice-daily, 300-mg twice-daily) in the above trial, and to generate final 105-day follow-up data on GvHD frequency/severity within the next 2-3 quarters,” the analyst adds. “Starting pivotal Phase II/III GvHD testing by end-of-year is probably an aggressive timeline, but could be achieved if Phase IIa GvHD testing completes enrollment by, say, mid-FQ219 and thus report final data by mid-FQ319.”