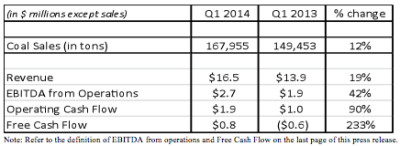

CanAm Reports Q1 2014 Coal Sales Revenue of 168,000 tons and $16.5 million respectively, an Increase of 12% and 19% over the Prior Year

(via Thenewswire.ca)

Calgary, AB /TNW-ACCESSWIRE / May 30, 2014 - CanAm Coal Corp. (TSXV: COE) ("CanAm" or the "Company") has filed its condensed interim consolidated financial statements and related management discussion and analysis for the period ended March 31, 2014. Definitions of commonly used non-IFRS financial measures (EBITDA from operations and Free Cash Flow) are included at the end of this press release.

The Company announced today its first quarter 2014 financial results for the period ending March 31, 2014. Revenue and EBITDA from operations for the quarter were $16.5 million and $2.7 million respectively as compared to $13.9 million, $1.9 million in the prior year. Loss for the quarter was $1.5 million as compared to $1.8 million in the prior year. Sales for the quarter were 168,000 tons as compared to 149,000 tons in Q1 2013 or an increase of 12%.

Click Image To View Full Size

Operational Highlights

The first quarter of 2014 was characterized by an extremely challenging operating environment resulting from the harsh winter conditions experienced in most of the Eastern US including Alabama, especially in January and February. These conditions resulted in temporary closures of many of our customers' facilities, road closures which prevented coal shipments to our customers and production challenges associated with equipment operating conditions and employee mobility. Despite these challenges, the Company achieved sales growth of 12% and EBITDA from Operations growth of 42%. Overall, production was lower than expected and production costs were higher resulting from inefficiencies created by the challenging operating environment described above.

Sales and Customer Highlights

Towards the end of 2013 and into the first quarter of 2014, the Company entered into discussions with a number of customers to either renew or extend its current off-take agreements. As a result, the Company has now off-take contracts in place ranging from one to as much as five year commitments. For the period 2014 to 2016, production has been sold into such contracts in excess of 95% for 2014 and in excess of 70% for 2015/2016. For the period 2017 to 2020, close to 50% of the Company's production has been contracted for.

In addition, the harsh winter experienced at the start of the year throughout most of the Eastern US has resulted both in low coal and gas inventories and higher gas prices which will bode well for overall coal demand in 2014 and the potential for an improved pricing environment.

Liquidity and Financial Position Highlights

As at March 31, 2014, the Company had a working capital deficit of $25 million. A significant portion of the deficit relates to repayment of approximately $12 million in debentures due in May 2014.

During the quarter the Company initiated a number of initiatives to improve this working capital situation and its overall financial position. Such initiatives were completed in April and May and consisted of:

Additional US $3 million financing by major US Financial Institution

Effective April 18, 2014, the Company amended its equipment financing agreement with its main banking and equipment lender. The main changes were to increase the principal amount of the loan by US $3 million (54 month term) and to reset the amortization period for the outstanding amount of the original loan (US $13.2 million outstanding at April 2014) to 48 months. The blended interest rate on the facility is 4.04%.

Conversion of 2016 debentures into equity

Effective May 16, 2014, the Company entered into binding agreements with certain holders of its 9.5% unsecured non-convertible debentures, due August 7, 2016, to repurchase, at par, an aggregate amount of approximately $7.3 million of the 2016 debentures. The Company has entered into these agreements in relation to certain obligations of the Company to satisfy debt under its existing equipment financing agreement with its US banking partner. The binding commitments represent 50%+ of the total outstanding $13.1 million debenture debt that matures in August 2016. The anticipated closing date of the transactions contemplated by the binding agreements is July 25, 2014.

Private placement financing of $14 million

Effective May 23, 2014, the Company closed a brokered private placement of 14 million units for gross proceeds of $14 million. Each unit is comprised of $1,000 principal amount of non-convertible secured debentures and 670 common share purchase warrants. The debentures mature 48 months from the date of issuance and will bear interest at a rate of 12% per annum, payable semi-annually. As part of the financing, approximately 9.4 million warrants were issued that entitle the holders to purchase one common share of CanAm at a price of $0.065 per share for a period of 4 years from the closing date. The proceeds from the offering were primarily used for the repayment of the Company's 10% and 9.5% debentures and related interest which matured on May 8, 2014 and on May 9, 2014.

Summary impact

The impact of the additional equipment financing, the extension of the equipment financing loan term, a successful refinancing of the May debentures and other measures taken by the Company will reduce the working capital deficit by approximately $18 million. In addition, long-term debt will be reduced by a minimum of $7.3 million resulting from the debt to equity conversion.

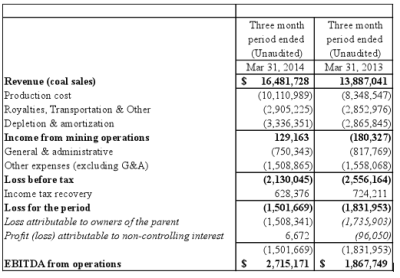

First Quarter 2014 Financial Results

Click Image To View Full Size

-

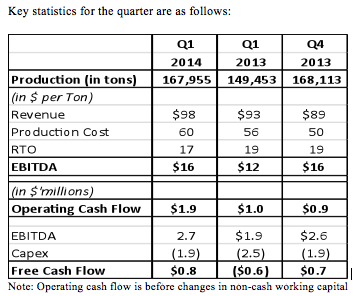

-.Sales for the quarter were 168,000 tons, an increase of 12% over Q1 2013 sales and on par with Q4 2013. Improved sales are mainly attributed to the fact that the Company's three new mines were fully operational in Q1 2014 and that the Company has a higher contracted customer sales base.

-

-.Long term off-take contracts continue to enable the Company to achieve better than market pricing for our high quality coals. Average sales price per ton for Q1 was largely consistent with the prior year, after exclusion of the impact of the higher US$ vs the Cdn$.

-

-.Average production cost per ton was $60 per ton (US$54 per ton) compared to $56 per ton (US$56 per ton) in Q1 of 2013. Although this represents an improvement from last year, the harsh winter conditions described above and the impact thereof on operational efficiencies have prevented us from achieving our target production cost of US$50/ton.

-

-.Operating cash flow of $1.9 million was double the cash flow achieved in the comparable quarter of 2013.

-

-.Investment in equipment and mine development was $1.9 million as compared to $2.5 million in the comparable period last year. In Q1 2013, the Company invested $1.2 million in mine development in conjunction with the opening of its 3 new mines which was accomplished by the end of the first half of 2013. Mine development in Q1 2014 was approximately $0.3 million.

-

-.Free cash flow at $0.8 million is significantly up from ($0.6) million in Q1 2013 and continues to improve quarter over quarter.

-

-.Repayment of equipment financing obligations continues at a healthy pace and during the first quarter the Company repaid $2.0 million of these obligations.

Company President and CEO, Jos De Smedt commented: "We are extremely pleased with our accomplishments to date as we tackled a number of important issues for the Company. First, we managed to deliver a good first quarter despite extremely difficult operating and shipping conditions experienced especially in January and February of this year. Second, we secured additional off-take contracts with some of our key customers and now have off-take in place for 95% of our production in 2014 and 70%+ for 2015/2016. Last but not least, we significantly improved our working capital situation and improved the overall financial position of the Company as a result of our new arrangements with our US banking partner, our successful private placement of $14 million of secured debentures maturing in May 2018 and our binding agreements to convert up to $7.3 million of our 2016 debentures into equity."

Outlook for 2014

The Company is optimistic about 2014 as the overall coal market has improved following the colder-than-normal winter in most of North America, especially the south-east United States. As a result thereof, gas prices have increased, coal demand has strengthened and coal inventories are at record lows which will bode well for coal demand in 2014.

Notwithstanding the challenges experienced in Q1 2104, the Company still expects coal sales growth of approximately 10%. With 95% of 2014 production under contract, the Company is well positioned to sell this increased production. With an increase in sales and the Company's continued focus on operating efficiency, it is expected that EBITDA from Operations will grow in 2014. The Company believes that its existing equipment fleet is sufficient for the foreseeable future to support the existing mine plan and has therefore positioned the Company well on a capital expenditures perspective. On this basis, no significant new equipment purchases are planned for 2014.

On the basis of the forgoing and the fact that the majority of 2014 production has been sold into off-take contracts, the Company expects to consistently generate free cash flow for the balance of 2014.

For Further Information:

CanAm Corporate Office:

Jos De Smedt, President & CEO

Tel: 403.262.3797

Toll Free: 1.877.262.5888

Email: jdesmedt@canamcoal.com

EBITDA from operations and Free Cash Flow