This article first appeared on Trend Investing on September 30, 2020.

Since Tesla (TSLA) Battery Day, there has been a surge in interest in who can supply Tesla with the battery metals needed for them to ramp to a massive 3TWh battery capacity by 2030. To get an idea of the scale, for lithium this would mean about 2.7 million tonnes of LCE would be needed per annum, just by Tesla. This is about 9x total global lithium production in 2019.

In summary, this means for Tesla to grow to 3TWh (~20m EVs pa + energy storage), Tesla will need massive amounts of all the battery materials. According to Musk, they will also need to rely on several battery manufacturers as back up, such as existing suppliers Panasonic [TYO:6752] (OTCPK:PCRFY), Contemporary Amperex Technology Co. Ltd. (CATL) [SHE:300750], and LG Chem [KS:051910] (OTCPK:LGCLF).

In this article, I intend to focus on potential new Tesla EV metal suppliers from North America (USA & Canada) as Musk said at Battery Day he would prefer to source from North America, at least for his US operations. He also said he just needs the metal for their planned cathode facility, not the battery grade sulphate. For now this means a focus on lithium, cobalt, nickel, and manganese, and high purity alumina to make high energy density nickel cathodes. I will also cover anodes and graphite, as Tesla may also look to secure that, or at least an anode supply.

Tesla's existing supply chain

As I stated in my article from late last year: "Choosing EV Metal Miners And Battery Manufacturers By Connecting The Supply Chain - December 2019:

Tesla Inc. - Battery supply deals with Panasonic (and themselves (Tesla)). Last month Tesla signed a supply deal with CATL, and they also recently signed a deal with LG Chem to supply Model 3 in China. Tesla has signed lithium offtake agreements with Bacanora Lithium [LSE-AIM:BCN] [GR:2F9] (OTCPK:BCLMF), Pure Energy Minerals [TSXV:PE], Kidman Resources (bought by Wesfarmers [ASX:WES] ---> Mt Holland JV with SQM), and more recently Ganfeng Lithium [SHE:002460] [HK: 1772]. Cobalt supply comes via Panasonic/Sumitomo Metal Mining Co.(TYO:5713) (OTCPK:SMMYY) and hence from sources in the Philippines and previously Cuba (Sherritt)... Cathode supply from Tesla/Panasonic and Umicore (OTCPK:UMICF).

Note: Tesla also sources lithium from Albemarle (ALB), who source spodumene from their Greenbushes mine in Western Australia. They also source nickel from Norilsk Nickel (LSX: MNOD) (OTCPK:NILSY). Since the article above was published, Tesla has signed a cobalt deal with Glencore [HK:805] [LSE:GLEN] (OTCPK:GLCNF) and a lithium spodumene deal with Piedmont Lithium [ASX:PLL] (PLL). See the latest Tesla news immediately below.

Note: Tesla gets its anodes via Panasonic which source their anode supply from Shenzhen BTR New Energy Materials Co. Ltd. ('BTR') in China.

Latest Tesla news as related to the EV metal miners

- June 15, 2020 - Tesla to buy cobalt from Glencore for new car plants (for Shanghai and Berlin Gigafactories). Glencore can also potentially supply nickel.

- July 2020 - Elon Musk (July 2020) stated: “Please mine more nickel... Tesla will give you a giant contract for a long period of time if you mine nickel efficiently and in an environmentally sensitive way.”

- September 8, 2020 - Tesla joins cobalt group that supports artisanal Congo miners.

- September 17, 2020 - BMI Simon Moores says: “Raw material availability should raise the alarm bells for Tesla considering their rapid Gigafactory expansions in Berlin, Shanghai and Austin."

- September 22, 2020 - "Tesla expects significant shortages in 2022 and beyond, Musk cautioned, adding it intended to increase cell purchases from Panasonic [TYO:6752], South Korea's LG Chem [KS:051910], China's CATL [SHE:300750], and possibly other partners."

- September 28, 2020 - Piedmont Lithiumsigns sales agreement with Tesla... Five-year fixed-price binding agreement with optional five-year extension

- September 28, 2020 - Tesla to build lithium hydroxide refinery in Texas to feed Terafactory; first automaker to enter lithium

- September 28, 2020 - Tesla said to be eying investment in LG Chem

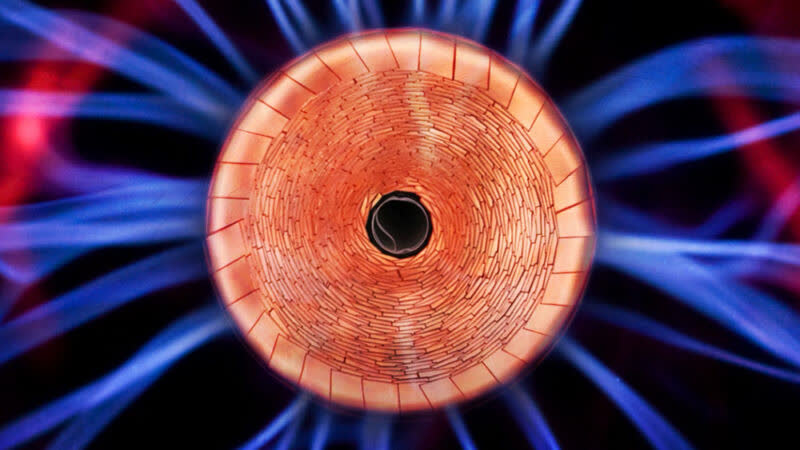

Tesla's new larger 4680 (46mmx 80mm) battery cell showing the coiled layers inside that contain the cathode, anode, & separator

Source

Tesla's potential North American battery metals supply chain contenders

Lithium (spodumene) - 'Most likely source'

The fact that Tesla plans to build a lithium converter in Texas next to their terafactory and planned cathode facility means they will need large supply of lithium spodumene. The closest main sources being from USA and Quebec, Canada. This week's Piedmont Lithium deal and lithium converter announcement show this is the way Tesla plans to proceed.

Galaxy Resources [ASX:GXY] (OTCPK:GALXF) (James Bay, Quebec, Canada)

Galaxy Resources would be a strong possibility due to having 3 lithium projects (Australia, Argentina, and Canada). Their James Bay spodumene project in Quebec Canada would be a nice fit for Tesla.

Critical Elements Lithium Corp.[TSXV:CRE] [GR:F12] (OTCQX:CRECF)

The Rose Lithium-Tantalum Project is located in Canada and has lithium as well as some rare earths.

Sayona Mining [ASX:SYA] (OTC:DMNXF)

Sayona owns the Authier Lithium Project in Quebec Canada, and is also bidding for North American Lithium [NAL] assets in Canada. A low market cap junior with an outside chance.

Frontier Lithium [TSXV:FL] (OTC:HLKMF)

Frontier Lithium owns the PAK Lithium (spodumene) Project comprising 6,976 hectares and located 175 kilometers north of Red Lake in northwestern Ontario, Canada.

Nemaska Lithium restructuring/creditors

Nemaska Lithium restructuring announced in C$600 million [AUD$624m] deal seen as ‘first piece of the puzzle’ in Qubec (Canada) lithium sector’s revival.

AMG Advanced Metallurgical Group NV [NA:AMG] [GR:ADG] (OTCPK:AMVMF) or Sigma Lithium Resources [TSXV:SGMA](OTCQB:SGMLF) (South America)

If Tesla was prepared to source spodumene from South America, that could mean possible supply deals from AMG or Sigma Lithium.

Lithium (from clay)

This is an unlikely source to make lithium hydroxide in the near term as lithium has never been mined at scale from clay before. Tesla has said they intend to mine their own lithium from clay from land they recently acquired in Nevada. At least this is near their Nevada gigafactory. We will see.

There have also been reports that Tesla had discussions to acquire Cypress Development Corp. (TSXV:CYP) (OTCQB:CYDVF) which has a Nevada lithium clay project. The other talked about target is Lithium Americas' [TSX:LAC] (OTC:LAC) Thacker Pass project in Nevada. Another Nevada lithium-boron junior is ioneer Ltd [ASX:INR] [GR:4G1] (OTCPK:GSCCF). Finally, it should be noted that US company Albemarle (NYSE:ALB) is the only Nevada lithium producer, albeit their plant is currently temporarily shutdown.

I view any Tesla lithium from clay deals as a Tesla post 2025 lithium strategy.

Lithium (from brine)

Generally, lithium from brine is used to make either lithium chloride or lithium carbonate. There are many lithium brine miners such as Albemarle, SQM (SQM), Livent Corp. (LTHM)[GR:8LV], and Orocobre [ASX:ORE] [TSX:ORL] (OTCPK:OROCF) sourcing from either Chile or Argentina. The next lithium mine to commence (in 2021) is the Cauchar-Olaroz Project in Argentina owned by Lithium Americas (49%) and Ganfeng Lithium (51%).

Lithium (direct extraction, lithium chloride)

Standard Lithium [TSXV:SLL] (OTC:STLHF)

Standard Lithium recently commenced operations at first-of-its-kind direct lithium extraction plant in Arkansas, USA. The plant recently produced and shipped 20,000 litersof lithium chloride product. Could be promising.

Lithium from tailings in boron mine California USA

Rio Tinto [ASX:RIO] (RIO) has discovered lithium in their tailings at their California boron mine. If their pilot program is successful, Rio could produce 5,000 tons per year of lithium carbonate, for a modest $50m CapEx spend. Rio's main lithium project is known as Jadar. It is a unique, world-class, lithium-borate deposit near the town of Loznica in Serbia.

Cobalt

Jervois Mining [ASX:JRV] [TSX-V: JRV] (OTC: JRVMF) [FRA: IHS] (merged with eCobalt Solutions [TSX:ECS] (OTCQX:ECSIF))

Jervois Mining would be a front running cobalt junior for a Tesla contract as they have a high grade cobalt project on US soil. Their Idaho Cobalt Operations ('ICO') is at an advanced stage and can produce valuable copper and gold by-products.

In a September 29, 2020 announcement:

"Jervois Mining to acquire the So Miguel Paulista nickel and cobalt refinery in Brazil... SMP Refinery has annual refined production capacity of 25,000 metric tonnes of nickel and 2,000 metric tonnes of cobalt and is currently on care and maintenance... Cash purchase price of R$125 million (US$22.5 million), payable in tranches, with a R$15 million (US$2.7 million1) cash deposit paid by end December 2020... Jervois to refine concentrate from its Idaho Cobalt Operations (“ICO”) and return cobalt metal to the United States. Additional supply contracts to be pursued."

Jervois Mining's advanced stage Idaho Cobalt Operations ('ICO') in the USA

Source

First Cobalt [TSXV:FCC] (OTCQB:FTSSF)

First Cobalt offers 3 projects in 1 - Their Idaho USA copper/cobalt sulphide project, their Canadian cobalt/nickel refinery, and their potential bulk tonnage cobalt operation in the Canadian Cobalt Camp. First Cobalt hopes to have their North American cobalt/nickel refinery operational with ore feed from Glencore by 2022. A great valued junior miner with a decent chance at a future Tesla supply contract.

Fortune Minerals [TSX:FT] (OTCQB:FTMDF)

Fortune Minerals is developing their vertically integrated NICO gold-cobalt-bismuth-copper project in the Northwest Territories of Canada. Their 1.1m ounces of gold and good progress on Tlicho All-Season Road construction help improve their chances.

Global Energy Metals [TSXV:GEMC] (OTC:GBLEF)

GEMC is a super low market cap company with 4 early stage projects (1 in USA, 2 in Australia, 1 in Canada), with potential for cobalt, copper, nickel, and gold. Interestingly, their 85% owned USA project is in Nevada (Lovelock Mine & Treasure Box Projects). Also most appealing is their higher grade cobalt (Indicated: 57.9kt @ 0.51% Co & 0.25% Cu, Inferred: 6.3t @ 0.48% Co & 0.14% Cu) at their 70% owned Werner Lake Cobalt Project in Ontario, Canada.

An outside chance, but huge upside for investors if a Tesla supply contract arrives. Market cap is a staggeringly low C$2.37m.

Canada Silver Cobalt Works Inc. [TSXV:CCW] (OTCQB:CCWOF)

The company is currently focused on silver at their Ontario projects; however, there is potential for cobalt, nickel, gold and copper by-products. You can read more here.

Nickel

Nickel supply is clearly Elon Musk's biggest concern as reported:

- July 2020 - Elon Musk - “Please mine more nickel... Tesla will give you a giant contract for a long period of time if you mine nickel efficiently and in an environmentally sensitive way.”

I responded to this news with my article that focus on the "giant contract" and hence the majors. Tesla will need to deal with one of these to secure enough nickel. Nickel miners with larger scale nickel production are Norilsk Nickel, Vale SA [BZ: VALE3](NYSE:VALE), BHP Group Ltd. [ASX:BHP] (BHP), Glencore (OTCPK:GLCNF) [LSX:GLEN]. IGO Limited [ASX:IGO] (OTC:IIDDY) has a world class resource but would need to ramp up significantly and grow with Tesla. Of these 5, only Vale and Glencore have North American nickel mines, making them the favorites. They also have cobalt.

Below are some possible nickel juniors with North American projects who may win a Tesla nickel supply contract.

Talon Metals [TSX:TLO] (OTCPK:TLOFF)

Talon Metals has a JV with Rio Tinto in the good grade nickel-copper-cobalt Tamarack Project in USA. One of the better juniors with a chance to win a Tesla contract due to location and having nickel and cobalt and a strong partner.

Nickel Creek Platinum [TSX:NCP] (OTCQB:NCPCF) - Low grade large scale Nickel Shw suplhide project in the Yukon, Alaska, USA.

Giga Metals [TSXV:GIGA] (OTCQB:HNCKF)

Large scale low grade nickel project in Canada. Reported to be in talks with Tesla, but on September 11, Giga Metals stated"there is no material announcement forthcoming."

Giga is currently developing the Turnagain nickel-cobalt sulphide deposit in central British Columbia (Canada) with a goal of one day producing 40ktpa of nickel. The NI 43-101 compliant resource contains 5.2 billion pounds of nickel and 312 million pounds of cobalt in the measured and indicated categories, plus a further 5.5 billion pounds of nickel and 327 million pounds of cobalt in the inferred resource category.

Waterton (Private equity firm)

Large scale lower grade nickel-copper sulphide Dumont Project in Canada. Karora Resources Inc. (TSX:KRR) (OTCQX:KRRGF) (formerly RNC Minerals [TSX:RNX]) retained some small exposure in a recent deal.

Garibaldi Resources [TSXV:GGI] [GR:RQM] [LN:OUX6] (OTCPK:GGIFF)

Excellent nickel grades at their polymetallic Nickel Mountain Project in BC, Canada. An okay chance especially if they can prove up and grow the resource.

Canada Nickel Company [TSXV:CNC]

Low grade early stage large scale Crawford Nickel-Cobalt-Palladium Project in Canada. Has a chance.

Manganese

I have not spent a lot of time yet on the manganese miners as the manganese market is more driven by the steel market than EVs.

Below is an article I since published on Trend Investing.

Manganese X Energy Corp. [TSXV:MN] (OTCPK:MNXXF)

Manganese X say that "there is no manganese mine production in the United States or Canada."

Manganese X owns the Battery Hill Project in Woodstock New Brunswick, Canada. Their current market cap is C$41m. Here is the latest company presentation. Sounds promising.

High purity alumina ('HPA')

I plan to spend some time soon researching the best miners in this sector and who supplies Tesla/Panasonic. Stay tuned.

Anodes and Graphite

Tesla has started making anodes in their new battery production line, but would still need to buy the anode material. This suggests they ideally need a North American anode material supplier.

The new battery cell anode will increase the silicon slightly from about 10% in the older cells. I have not looked at silicon companies as there is minimal silicon or opportunity there. Silicon holds more electrons and increases energy density, but it has limits in use for now due to the large expansion and contraction that can cause cracking. A new trend maybe wrapping the anode in graphene to prevent cracking as Samsung Electronics [XLON:SMSN] (OTC:SSNLF) has done with their graphene battery. One small graphene company with potential is ZEN Graphene Solutions [TSXV:ZEN] (OTCPK:ZENYF). Of interest, they also make a 99% effective graphene viricidal mask for COVID-19.

For a background on the global anode suppliers, here is my article "A Look At The Top Li-Ion Battery Anode Manufacturers". It states that 67% of global anodes are made by just 4 Chinese companies - Shenzhen BTR New Energy Materials Co. Ltd. (supplies Panasonic/Tesla), Hitachi Chemical, Shanshan Technology Co., Ltd., and Mitsubishi Chemical.

Syrah Resources Limited [ASX:SYR][GR:3S7](OTCPK:SYAAF)(OTC:SRHYY)

Syrah is the largest flake graphite producer in the world and is progressing their Battery Anode Material [BAM] plant in Louisiana, USA. Syrah supply BTR with graphite, which supplies Panasonic/Tesla with anodes. Syrah's production has been massively cut back due to graphite oversupply, so supply deals would now be in question. They look a good chance to supply Tesla with anode material from their developing USA BAM plant.

NextSource Materials Inc. [TSX:NEXT] [GR:1JW] (OTCQB:NSRCF)

NextSource Materials Inc. is a mine development company based in Toronto, Canada, that's developing its 100%-owned, Feasibility-Stage Molo Graphite Project in Madagascar. The company also has the Green Giant Vanadium Project on the same property. One big plus is their modular approach, which can allow for a super-low start-up CapEx of just US$25m.

Westwater Resources (WWR) (formerly Alabama Graphite)

Westwater’s Coosa Project in Alabama, USA, is expected to be the first US domestic producer and processor of battery graphite materials.

Mason Graphite [TSXV:LLG] [GR:M01] (OTCQX:MGPHF)

Mason Graphite is a Canadian graphite mining and processing company focused on the development of the Lac Guret project located in northeastern Quebec, where the graphite grade is believed by management to be among the highest in the world.

The company is currently progressing their Lac Guret project towards production, as well as advancing work program on value added graphite products such as spherical graphite production.

Nouveau Monde Graphite [TSXV:NOU] (OTCQX:NMGRF)

Nouveau Monde Graphite owns the Matawinie graphite project near Montreal, Canada. Nouveau Monde’s research & development consortium is advancing their carbon-neutral battery anode program. Successful anode materials tests have been completed and Nouveau Monde is currently progressing the detailed engineering and procurement for its integrated battery anode material process, with commissioning of the demonstration facility scheduled for mid-2021.

Talga Resources [ASX:TLG] [GR:TGX] (OTCPK:TLGRF)

Talga is building an integrated graphite anode facility in Sweden fed by graphite from Talga’s Vittangi Project. They plan to produce 19,000tpa of anode production for 22 years from 2023.

Magnis Energy Technologies Ltd. [ASX:MNS] (OTC:URNXF)

Magnis sources their graphite from their 100% owned Nachu Graphite Project in Tanzania. They are also partnering to develop Li-ion gigafactories in the USA and Australia. Magnis owns 53.39% of the planned New York gigafactory, with C4V owning 45.18%.

A plus for Magnis is they have the inventor of lithium-ion batteries, Professor Stanley Whittingham (2019 Nobel Prize winner), as a Magnis Non-Executive Director, helping with R&D.

Magnis has three key areas of focus - Batteries, Gigafactories, Graphite

Source: Magnis.com.au

ZEN Graphene Solutions Ltd.

ZEN Graphene Solutions Ltd. is a mineral development company based in Thunder Bay, Ontario. ZEN Graphene is currently developing the Albany Graphite Deposit (“Albany”), as well as developing graphene and graphene applications. The company is very progressive and is focused on ways to upgrade and market their graphite based products.

Risks

- Risks related to the EV boom. Also risks related to any battery chemistry or battery technology changes.

- Elon Musk is somewhat unpredictable. Some of his past lithium off-take deals with very early stage lithium miners went nowhere.

- Tesla has said they may make their own lithium supply from Nevada clay; this would be a very long-term play at best.

- Falling EV battery metal prices. Most look to be near a bottom now, but will need demand to surge before we see higher prices.

- Mining risks - Exploration risks, funding risks, permitting risks, production risks, project delays.

- Company risks - Debt, management and currency risks.

- Sovereign risk - Low for the USA and Canada, but permitting can be slow.

- Stock market risks - Dilution, lack of liquidity (best to buy on local exchange), market sentiment.

Further reading

Tesla battery day statements

- 100% EVs requires 100x growth of battery capacity/production.

- 100% renewable energy battery storage requires 1,600x growth in battery capacity/production.

- Tesla plans to be able to produce a US$25,000 EV in 3 years or so from now.

- Musk says: "Long term we want to make about 20m EVs pa".

- Tesla plans to reach 3TWh battery production capacity by 2030.

Conclusion

For now it looks like Piedmont Lithium is the big winner with a Tesla supply deal. Who will be next?

My view is we will probably hear soon of a Tesla nickel or cobalt (or both) supply deal next, as these are key metals where there are huge future supply concerns. Remember Elon Musk's recent words: "Please mine more nickel".

Front runners for a Tesla nickel-cobalt supply deal would be Vale (Canada source of large scale nickel and cobalt), Glencore (Canada nickel, cobalt contract already), BHP (Australia nickel), or Norilsk Nickel (Russian nickel & cobalt). For the cobalt juniors perhaps Jervois Mining (US cobalt plus nickel processed in Brazil) or First Cobalt (US cobalt processed in Canada) look to be leading cobalt contenders as they are the most advanced and offer both nickel and cobalt from North America. For nickel juniors, Talon Metals is probably the front runner due to their USA location. For anode material, Syrah Resources look to have a good chance at winning a contract, noting they are not US based. The other would be Westwater Resources.

The usual risks apply and investors should read the risks section carefully.

It should be noted if Tesla succeeds in accelerating the transition to electric mobility and energy storage, then this will speed up the other competitors, boosting overall demand for EV and battery metals/materials. The Li-ion battery megafactory count at 167 only confirms this.

As usual, all comments are welcome.

Disclosure: I am/we are long ALB, AMG ADVANCED METALLURGICAL GROUP NV [AMS:AMG], BHP GROUP [ASX:BHP], VALE, FORTUNE MINERALS [TSX:FT], GALAXY RESOURCES [ASX:GXY], SQM (SQM), OROCOBRE [ASX:ORE], LITHIUM AMERICAS [TSX:LAC], JERVOIS MINING [TSXV:JRV], FIRST COBALT [TSXV:FCC], GLOBAL ENERGY METALS CORP. [TSXV:GEMC], SYRAH RESOURCES [ASX:SYR], MAGNIS ENERGY TECHNOLOGIES [ASX:MNS], ZEN GRAPHENE SOLUTIONS [TSXV:ZEN], MMC NORILSK NICKEL [LSX:MNOD], GLENCORE [LSX:GLEN], KARORA RESOURCES INC. (TSX: KRR)(KRRGF), JIANGXI GANFENG LITHIUM [SHE: 2460], TSLA. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The information in this article is general in nature and should not be relied upon as personal financial advice.