Unless indicated otherwise, all figures in CAD$ "Co" = Cobalt, "Ag" = Silver, "Cu" = Copper.

First Cobalt Corp. (FCC:TSX.V; FTSSF:OTCQX; FCC:ASX) provided a corporate update on Dec. 16th, and the market liked it—a lot! Combined trading volume of >32 million shares in Canada and the U.S. was ~25x the average daily volume of the past 90 days.

What was the big news? Management has secured $10 million in financing, composed of a $5 million interest-free loan from the federal government (with a 10-year maturity!), plus a $5 million non-repayable grant from the provincial government of Ontario. Ten million dollars is a nice chunk of the $77 million needed over the next 18 months to restart an upgraded, enhanced and greatly expanded cobalt refinery.

A very good week, strong government support + C$10M in non-equity funds

This latest development delivers a strong vote of confidence in; 1) First Cobalt Corp. and its management team, 2) the outlook for EVs, 3) the outlook for cobalt's continued use in Li-ion batteries, 4) the end user's desire to diversify away from China's refined cobalt (China controls 80% of the market), and 5) Ontario's robust plans to build a high-tech, economy-boosting EV ecosystem.

Non-dilutive capital is great for shareholders, but that it comes from federal/provincial government sources meaningfully de-risks First Cobalt's refinery rehabilitation project. This announcement signals to prospective debt providers and offtake partners that the company's 100%-owned refinery has been vetted and thought to be financially and environmentally sound.

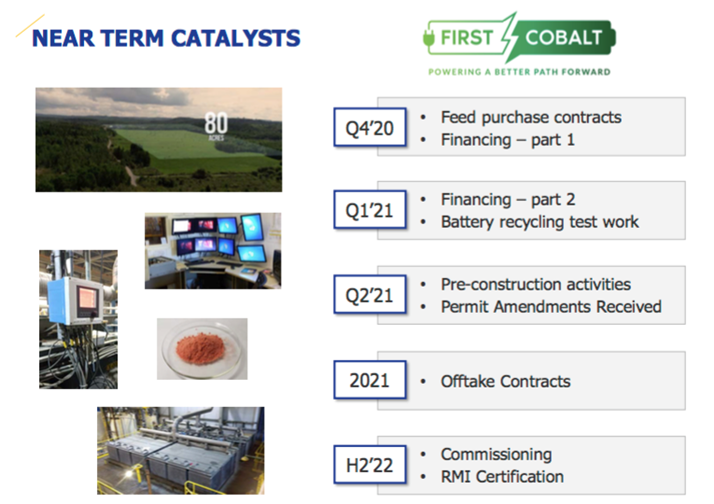

Getting this critical funding done now nicely reinforces management's timeline to commercial production in mid-to-late 2022, and highlights management's ability to deliver on promises and prudently de-risk the company.

This important financial package sends a clear message to automakers like Ford and Fiat Chrysler (both recently announced $1B+ EV plans in Ontario) that Canada/Ontario is serious about clean, green energy and about actively participating in the paradigm shift of vehicle electrification. OEMs would be wise to sign cobalt offtake agreements with First Cobalt now, before rivals lock it all down!

Finally, the announcement advances the campaign to attract Li-ion battery and battery component (cathode) manufacturers to Canada. Ontario is centrally placed in Canada and well within trucking distance of the major North American auto hub of Michigan (USA), where 21 global OEMs have a headquarters or technology center.

De-risking of the refinery restart to spark substantial value creation

Readers of my work know that I'm bullish on a rebound in the cobalt price from its current level of just over US$18/lb (China price). Even in the midst of a global pandemic, longer-term EV penetration estimates across the board are as high, or higher, than ever.

Readers are reminded that the EV landscape is being hungrily pursued by a few dozen multi-billion dollar companies, companies that know how to develop, build, market and sell cars, companies unafraid of (initially) losing billions of dollars to gain market share.

Another reason I'm bullish on cobalt is that there appears to be a nascent rebound in lithium prices. Fastmarkets shows lithium prices in China up ~20% in the past few months, including +10% in December. If demand for lithium is increasing, it can only be good for cobalt.

Most lithium juniors have responded to this improvement in battery metal sentiment. Share prices have been running for a few months now. The top-12 performing lithium companies (of about 70 I'm tracking) are up an average of 760%! from 52-week lows.

Even before this week's news, First Cobalt Corp. was, (in my opinion), less risky than most pre-revenue metals/mining companies. How many juniors are within 24 months of commercial production and long-term, high-margin cash flow?

First Cobalt's primary cobalt refinery: worth its weight in gold?

How many juniors own 100% of a tangible hard asset that's arguably worth a multiple of its entire market cap? How many have the backing of government entities, a global metals giant like Glencore and signed NDAs with half a dozen OEMs?

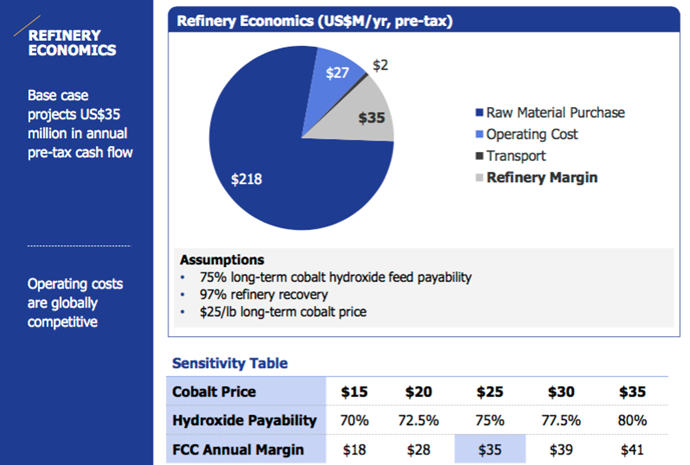

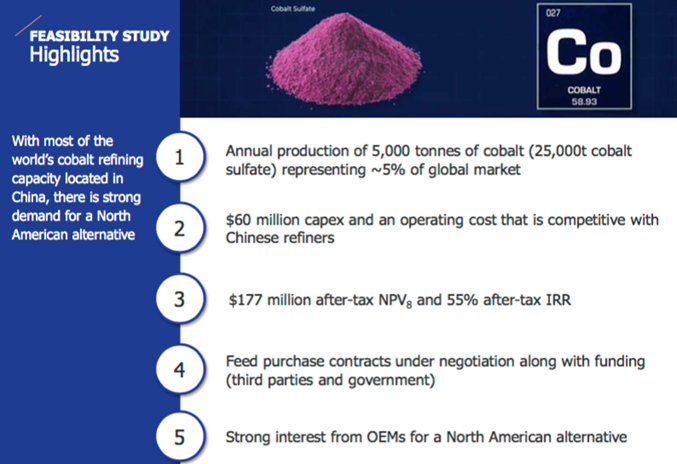

In thinking about some of the hottest gold stories of recent years, many are still 5+ years from production, have upfront capital requirements well into the hundreds of millions and proposed mine lives of 8–12 years. Most of these projects are valued, even the ones at PEA-stage, with a 5% discount factor. First Cobalt's $230 million after-tax NPV is calculated with an 8% discount rate, yet it's backed by a recent Definitive Feasibility Study ("DFS").

First Cobalt's refinery needs another $67 million to reach commercial production within 24 months. And, its refurbished lifespan is 25–30 years, limited more by tailings considerations then by plant operability.

Investment sentiment in longtime laggard #uranium has soared this month. I've been watching U.S. uranium player Energy Fuels for years. Despite $2 million in trailing 12-month revenue, it now sports a half billion dollar market cap! Most of that valuation is tied directly to White Mesa, a hard to replicate, one of a kind in its region, uranium/vanadium refinery.

Why am I talking about uranium? The point is, when commodity prices are strong, well run, highly utilized refineries print money, tremendous amounts. The tide appears to turning for cobalt; 2021 could be the start of a multiyear bull market in cobalt (and lithium, nickel).

Lithium producers are instructive in considering the potential value of high demand metal refineries. Albemarle and SQM trade at an average of 6x revenue and 21x EBITDA. By contrast, based on the May, 2020 DFS completed on the cobalt refinery, First Cobalt is trading at about 3 times its enterprise value to 2023 projected EBITDA (after adding anticipated debt to the enterprise value). Yet, that debt could potentially be paid off in as little as two years!

Expert consultant group Hatch valued the 12-tonne per day facility at US$78 million in 2012. Today, adjusted for inflation, that figure is more like US$90 million. However, how much might the refinery be worth once it's upgraded and enhanced to operate at 55-tpd (+358% vs 12-tpd), making it capable of generating ~$45 million in pre-tax cash flow/year for 20+ years?

I believe the refinery should be worth at least double that of the 12-tpd configuration, or US$180 million = C$234 million. Compare that to First Cobalt's enterprise value of approx. C$80 million at the December 16th close.

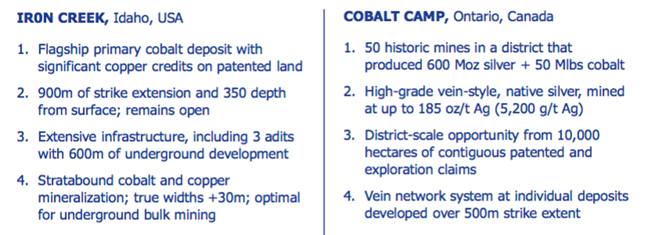

First Cobalt's non-refinery Co-Ag-Cu assets will be increasingly valuable

Clearly, the lion's share of First Cobalt Corp.'s value lies in its refinery, but it also has high-grade Ag/Co properties in Ontario and Co/Cu resources in Idaho (USA). In a stronger battery metals environment, these non-refinery assets could be worth a considerable amount.

Readers may recall that the company's market cap was north of $200 million for a time in 1H 2018 when the Co price rose above $40/lb. Could First Cobalt's Co-Ag-Cu properties/resources in Ontario and Idaho (USA) be worth in the tens of millions of dollars next year?

Yes, as battery metal sentiment continues to improve, I believe those assets could be valued at C$0.05–C$0.10 / share, or even more by 2022–23. Having said that, all eyes are on the refinery restart for the foreseeable future.

Over the next 12 months there are substantial catalysts to watch for, including the following critically-important events. First, securing long-term Co hydroxide (feedstock) contracts to supply the refinery. Second, finalizing financing commitments to fully fund the refinery through commercial restart—perhaps a quarter or a third of 2023's cobalt sulfate production could be sold to an OEM for an upfront payment in 2021? That alone could eliminate the need for any further equity raises.

Third, the potential disposition of some assets, most notably parts of the company's considerable Ag-Co properties in Ontario, but only at attractive valuations. Fourth, locking in multiyear offtake agreements for the refinery's battery-quality Co sulfate.

Tremendous blue-sky potential packed into this EV story

First Cobalt Corp. (TSX-V: FCC) / (OTCQX: FTSSF) shares touched C$0.27 before closing at C$0.22 on December 16th. A price above $0.30 seems reasonable upon further good company news, possibly in the next several weeks. And, if the Co price bounces, boutique investment firm Red Cloud's price target of C$0.45, based largely on a 4x multiple of 2023e EBITDA, appears within reach next year. I imagine that target could be raised in coming weeks or months.

Readers may have noticed the extreme valuations of EV-themed companies like Tesla, Nio, Workhorse, Plug Power, Blink Charging and others—these are not mining companies, and in a way neither is First Cobalt. The company's valuable, one-of-a-kind refinery places it squarely in the EV space because its future is tied to EVs more than anything else.

Throwing First Cobalt Corp. into the EV arena would be huge. I'm not saying this will happen, only that it might. The company will be (meaningfully) cash flow positive years ahead of most of those high-flying EV upstarts. Rest assured, with or without that investment affiliation, I agree with CEO Mell that the best is yet to come.

Peter Epstein is the founder of Epstein Research. His background is in company and financial analysis. He holds an MBA degree in financial analysis from New York University's Stern School of Business.