Summary

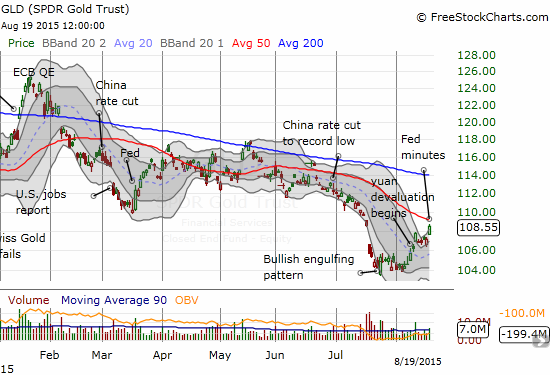

- The SPDR Gold Shares benefits from Federal Reserve minutes that further confirm the churn on hiking rates.

- The rally in SPDR Gold Shares appears to confirm an earlier case for a bottom but now the ETF sits right under important resistance.

- I examine the Fed's latest churn by dividing the key parts of the minutes into the two different camps.

- Overall, the agreement on the need for more data makes a September hike seem even less likely than before and incrementally improves the (near-term) prospects for gold.

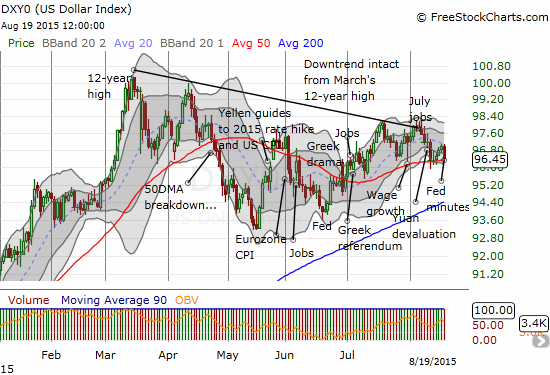

The U.S. Federal Reserve released its minutes from its July 28 to 29, 2015 meeting. It was pretty much the same back and forth on monetary policy and the U.S. and global economies, but the words took on more significance than usual because of all the anticipation about the timing of the Fed's first rate hike on the way to normalization. One net effect of the hemming and hawing was to send the U.S. dollar index down.

The dollar's downtrend from the March 12-year high remains well intact.

Presumably, the continued lack of a definitive schedule for the first rate hike made market participants incrementally less interested in the U.S. dollar as a play on policy divergence against other major currencies.

More importantly for me on this day, the SPDR Gold Trust ETF (NYSEARCA:GLD) responded to the dollar weakness with a gain of 1.3%. This gain further confirms GLD's bounce off recent lows and resumes the upward push from those levels. GLD has now filled the gap down from July 20th which at the time seemed to doom GLD to a quick trip to $100 and below.

SPDR Gold Shares continues its bounce off the recent bottom but is now trading up against resistance from the downtrend defined by the 50-day moving average (DMA)

The rally in GLD is notable and marks yet another validation of the use of Google trends to assess market sentiment in the face of extreme movements in gold's price. In "The Commodity Crash Accelerates: A New Juncture for Buying Gold," I made the case for a bottom in gold. GLD is up a modest 3.5% since then, but the accompanying rally has featured much stronger buying volume than selling volume. As more uncertainty looms over the timing of a Fed rate hike - including the possibility that the Fed is forced to punt on normalization - GLD looks more and more attractive, albeit tentatively. I now expect an "ah ha" moment to send gold soaring. Fed wavering on normalization would place the U.S. back in-line with the herd of central banks that are in retreat on monetary policy and make gold incrementally more attractive as an alternative currency. That potential upside confirms the attractive risk/reward of betting on July's low on GLD as some kind of bottom.

Once again, Fed-speak gave no definitive clues on the timing for a first rate hike. Those who expected more are experiencing the triumph of hope over experience. I divided the relevant components of the minutes into two camps: "yes, let's hike" and "yes, well, but…"

YES, LET'S HIKE

For the most part, the committee members looking forward to a rate hike in the near future are assuming the economy will continue to improve. If forced to decide NOW whether to hike or not, current economic conditions would not facilitate a rate hike. Thus, time is ticking down to the wire for the accumulation of evidence that will push these members over the edge to a rate hike.

Most judged that the conditions for policy firming had not yet been achieved, but they noted that conditions were approaching that point. Participants observed that the labor market had improved notably since early this year, but many saw scope for some further improvement. Many participants indicated that their outlook for sustained economic growth and further improvement in labor markets was key in supporting their expectation that inflation would move up to the Committee's 2 percent objective, and that they would be looking for evidence that the economic outlook was evolving as they anticipated…

Some participants…emphasized that the economy had made significant progress over the past few years and viewed the economic conditions for beginning to increase the target range for the federal funds rate as having been met or were confident that they would be met shortly.

Those ready to hike rates step back and see a process of improvement inexorably moving the Fed toward a rate hike. Getting going on normalization will not only deliver the standard benefits for inflation and financial stability but also provide a good communication tool to assure market sentiment toward the economy. On the flip side of this sentiment-soother is the potential interpretation of a LACK of action: "the Fed knows something horrible that we do not yet understand or see…"

A couple of others thought that an appreciable delay in beginning the process of normalization might result in an undesirable increase in inflation or have adverse consequences for financial stability. Some participants advised that progress toward the Committee's objectives should be viewed in light of the cumulative gains made to date without overemphasizing month-to-month changes in incoming data. It was also noted that a prompt start to normalization would likely convey the Committee's confidence in prospects for the economy.

Labor markets are essentially healed and will continue to approach maximum employment with on-going improvement in the economy.

In assessing whether economic conditions had improved sufficiently to initiate a firming in the stance of monetary policy, the Committee noted that, on balance, a range of labor market indicators suggested that underutilization of labor resources had diminished further. Most members saw room for some additional progress in reducing labor market slack, although several viewed current labor market conditions as at or very close to those consistent with maximum employment. Many members thought that labor market underutilization would be largely eliminated in the near term if economic activity evolved as they expected.

The members who are ready to hike are reassured by the transitory impact of the deflationary pressures from falling energy prices and a strengthening U.S. dollar.

In considering the Committee's criteria with respect to inflation for beginning policy normalization, most members viewed the incoming data as reinforcing their earlier assessment that, although inflation continued to run below the Committee's objective, the downward pressure on inflation from the previous decreases in energy prices and the effects of past dollar appreciation would abate.

Someone at the Fed is already very itchy at the trigger…

One member, however, indicated a readiness to take that step at this meeting but was willing to wait for additional data to confirm a judgment to raise the target range.

YES, WELL, BUT….

The cautious members of the Fed look out nervously upon the horizon. For example, they take no assurance in a transitory impact on inflation. Add to the list of "international developments" the devaluation of the Chinese yuan. This (still on-going) event seems to underline economic troubles in China which in turn potentially translate to troubles in other economies. If so, the Fed has yet one more reason to proceed with extreme caution on normalization.

…some participants expressed the view that the incoming information had not yet provided grounds for reasonable confidence that inflation would move back to 2 percent over the medium term and that the inflation outlook thus might not soon meet one of the conditions established by the Committee for initiating a firming of policy. Several of these participants cited evidence that the response of inflation to the elimination of resource slack might be attenuated and expressed concern about risks of further downward pressure on inflation from international developments.

The cautious members are not yet convinced the labor market is healthy enough to begin normalization.

…several were concerned that labor market conditions consistent with maximum employment could take longer to achieve, noting, for example, the lack of convincing signs of accelerating wages, which might be signaling that the natural rate of unemployment could currently be lower than they previously thought.

The cautious members are much more nervous about the deflation-like pressures from the continuing collapse in commodity prices. The prospect of igniting the U.S. dollar again is also of concern. The two dynamics are correlated and even reinforcing. Policy normalization carries the prospect of tightening the linkage even further.

…core inflation on a year-over-year basis also was still below 2 percent. Moreover, some members continued to see downside risks to inflation from the possibility of further dollar appreciation and declines in commodity prices. In addition, several members noted that higher rates of resource utilization appeared to have had only very limited effects to date on wages and prices, and underscored the uncertainty surrounding the inflation process as well as the role and dynamics of inflation expectations.

EVERYBODY TOGETHER NOW

Interestingly, the entire Committee appears to be in agreement that it needs yet MORE data to get comfortable with policy normalization.

The Committee agreed to continue to monitor inflation developments closely, with almost all members indicating that they would need to see more evidence that economic growth was sufficiently strong and labor markets conditions had firmed enough for them to feel reasonably confident that inflation would return to the Committee's longer-run objective over the medium term.

This agreement notably dampens the prospect for a September hike. I suspect that given so many pundits and the like are sticking with September forecasts that the lack of one will cause some notable market disruptions that should incrementally pressure the dollar downward and thus help push gold higher.

Be careful out there!

Additional disclosure: Long GLD shares and call options