https://seekingalpha.com/article/3461986-gld-a-strong-rebound?auth_param=151v:1atp78r:98e6ea53f9547bc35fd45e8c86cca744&uprof=11

Summary

- The HUI has reached my price target, GLD exceeded it.

- History favored that this month would be one of at least some sort of consolidation. And given how oversold the sector was, I decided to establish some positions.

- My intention has always been to buy the gold/silver stocks when playing this eventual rebound in the precious metals market, and I'm focused on quality.

- Increasing interest rates are going to reek havoc on various asset classes, precious metals will benefit from this.

The SPDR Gold Trust ETF (NYSEARCA:GLD) has staged an impressive rebound over the last few weeks. In my last update in late July, I said the following:

I would imagine that early next week we will see some bargain hunting in the gold shares and the precious metal. We are way oversold in both and need to consolidate a little here before we go down again....A 2-3 week period of consolidation would be perfectly normal (and expected).

As I also reiterated:

Given I was expecting the bottom to take 2-4 months, this seems too much too soon....I think there is a good chance the HUI rebounds back above 120 by the end of the week. I'm not forecasting any major bounces (could reach 130 but not much more). Rather I think we see some consolidation for a few weeks before the next drop.

So that's where we are right now, as the HUI went slightly above 130 and is hitting the 50 day MA resistance. I expected GLD to top around 108, but it went up further than I thought it would and is now just above 111. Either way, we are no longer oversold and if there is one more leg down, then I expect both the HUI and GLD to struggle to move up any further. I don't believe it's likely that we will see a big drop down to new lows in the next week, rather this consolidation will continue for a little while longer. A series of lower highs should be what occurs, with a few more retest of the 50 day MA for the HUI. If GLD keeps moving up then that would be very bullish for the short-intermediate term.

My Updated Plan Of Action

I have been in all cash since early June, as when the HUI started to break down I said:

I'm a little cautious here, raising a lot of cash, until I see things improve.

So over the last few months, I have protected my capital during that vicious decline in the gold stocks. I mentioned in my previous article that I was just going to remain in cash until GLD hit my price target of 90-100. However, on August 6-7, I decided to start scaling into the gold (and silver) stocks.

Given the HUI was at 107 at that time, it seemed like a good "jump back in" point, one with a lot lower risk. I didn't think the lows were in, but as I explained, I thought we could have a decent sized rally in the meantime. At worst it would be a good trade.

Besides, I simply don't have a crystal ball. I can't be 100% sure where the exact bottom is at. Rarely do things in the market go EXACTLY as you expect them to. There will probably be some curveballs along the way. I have my targets, but that's not to say I will be correct. So this could have also been considered a "what if I'm wrong" hedge as well.

I'm not all in, but I did established several positions and I have been buying weakness and selling strength over the last few weeks. Just some rotations as I don't want to get stuck in any positions since I'm not convinced yet that the bottom has been hit. If it has been reached, then at least I have a decent size build-up of precious metal shares, and would continue loading on the way up.

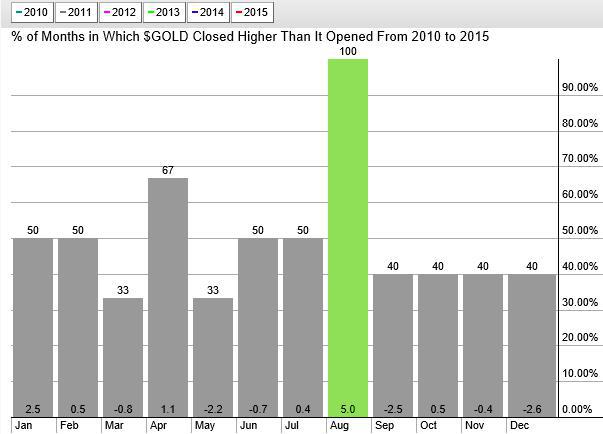

Another reason that I decided to buy into the gold and silver stocks instead of just wait is because August is usually very strong for the sector. In the last 5 years, gold has finished the month in the positive column 100% of the time (and 75% of the time since 2000). Considering we have been in a bear market since late 2011, that's a pretty significant statistic. So if there ever was a good chance for a rally during the year, the odds favor it happening in August.

(Source: StockCharts.com)

This time of year is usually a standout for the gold market due to robust international demand. The wedding season in India begins in late September and last through January. Jewelers start stocking up in the months before in order to be prepared for the increased demand.

Let me be clear though. This doesn't mean that international demand is going to vault the gold price. Notice I'm not discussing gold's average return during the month of August (which is usually very strong). We are in the final stages of this bear market, so I wouldn't be looking at past monthly returns in gold and try to extrapolate anything from it. Rather, the graph I posted above shows more of a sign of stability than anything else. I'm simply saying that there was a good chance that gold would find its footing during this month.

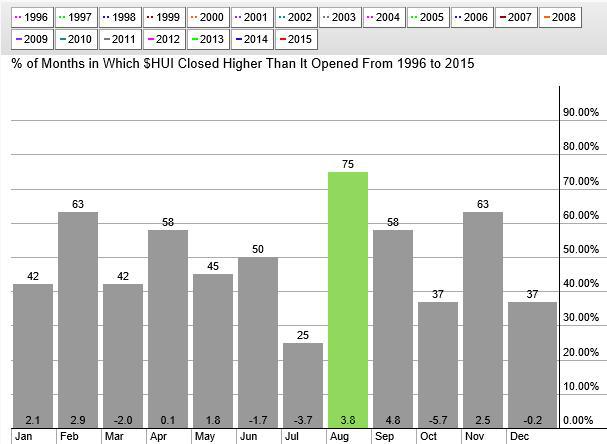

This stability also shows up in the gold stocks as well. Over the last 19 years (since 1996) the HUI has closed higher in the month of August 75% of the time. Again, this month has the best chance of showing a gain, even if it's a modest one. This also makes sense given that July has the lowest percentage of higher closes.

(Source: StockCharts.com)

In both GLD and the HUI, history favored that this month would be one of at least some sort of consolidation. And given how oversold the sector was in late July/early August, it seemed like a low risk entry.

Focus On Quality

My intention has always been to buy the gold/silver stocks when playing this eventual rebound in the precious metals market. GLD doesn't interest me, neither does physical gold. I want to own the stocks. I did own a lot of physical gold and silver on my first go around during 2003-2004 (in addition to the precious metal stocks), as I was loading up when silver was at $4-$6 and gold was at $375-$400. I sold all of my physical in 2010, which was a little early, but I was happy with the return given gold was about $1,200-$1,300 and silver was at $15-$25. This time around though, I don't plan to buy gold and silver themselves, rather I'm just going to play the mining stocks.

The gold (and silver) stocks are extremely compelling investments at the moment. They have had my attention for a while now. Most are trading well below book value, and the ones that interest me still have great businesses that easily support their valuations. This is where I want to be invested over the next few years as values are simply incredible. While physical gold and silver are a very cheap asset class, they are nowhere near the extreme undervaluation levels that the precious metal companies are trading at right now.

Most stocks in this sector have declined to levels that were unimaginable a few years ago. The riskier companies have been hurt the most, and typically the smaller juniors are the ones with the most risk. The temptation for some investors is to load up on these in anticipation of the rebound. The idea is that the upside is much greater than the larger producers or other stocks which haven't declined to the same extent. But why take that risk when everything else is cheap too?

I fully expect this sector to unleash massive profits over the next 2-5 years, I don't think anybody is going to be disappointed with the returns from the higher quality companies. That doesn't mean that I advocate only buying the large caps. I want a balanced portfolio that gives me exposure to small cap explorers as well as large producers, and everything in-between. The point is, just because some $30 million junior explorer with an average gold project might have a ton of leverage, it's not going to be on my buy list over higher quality names.

You have the best of the best trading at deep discounts, I'm not going to be buying the garbage companies just because I might make more. That's not sound investing. It could work out okay this time, but if you apply that strategy consistently to your investing, then you are going to be taking unnecessary risks. Eventually that catches up to you. The simple fact is the high quality companies are selling at big discounts as well, so why buy the lesser quality ones?

Gold And Silver Stocks: A Long-term Bet On The Coming Inflation

The U.S. Government is overspending, over-indebted, and over-leveraged. There is no easy way out as we are backed into a corner. I know gold investors have all heard this before but the scary part about all of this is it's 100% true. This isn't some exaggeration of reality or fabrication of the truth. Our situation in the U.S. is very dire if you look at it from a long-term perspective. Things are stable now because of low interest rates and lower payments on health and social programs. But when rates increase and spending on these unfunded liabilities increases, everything goes sideways.

From the Congressional Budget Office:

If debt continued to rise relative to GDP, at some point investors would begin to doubt the government's willingness or ability to repay its obligations. Such doubts would make it more expensive for the government to borrow money, thus necessitating cuts in spending, increases in taxes, or some combination of those two approaches. For that reason, the amount of federal debt held by the public relative to the nation's annual economic output is an important barometer of the government's financial position.

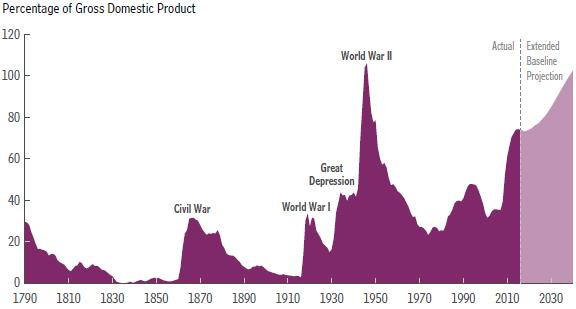

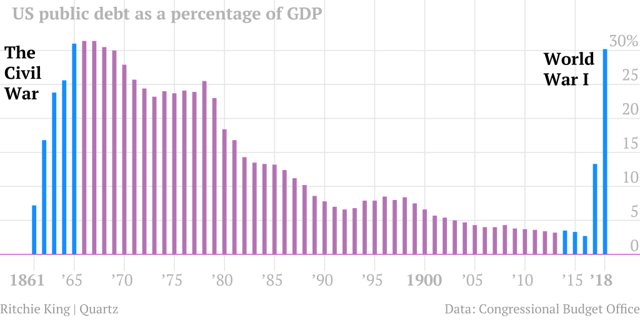

Below is a graph that shows the Federal debt held by the public as a percentage of GDP. 2040 might seem like a long way off, but by that time our debt-to-GDP will be will over 100%. Some might say "well that's lower than it was at the end of WWII, so no big deal." But there is a big difference between then and now. In the 1940's, the very high percentage of debt-to-GDP was a temporary aberration, basically a quick spike higher and then a quick return to the norm. That's not our current situation, there will be no reversion to the mean unless drastic, economic-crushing measures are taken. But I don't see us going down that road. Rather, we will have decades of high debt-to-GDP levels, and only elevated levels of inflation will bring this back down.

(Source: CBO)

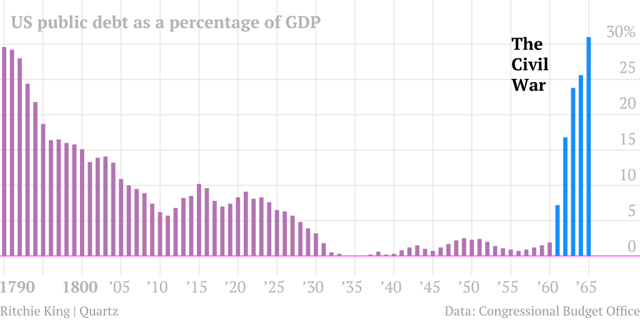

All of those past spikes in debt-to-GDP occurred during major wars. Once the wars were over and the spending stopped, the debt-to-GDP came down. The graph above shows the peak in 1946 for WWII, and then declined dramatically. Below shows the spikes caused from the other major wars in the U.S., followed by the eventual decline in percent of debt-to-GDP.

(Source: TheAtlantic.com)

(Source: TheAtlantic.com)

We are in a much different situation today than we were in those previous spikes. The War on Terrorism increased our debt over the last decade, but while the fight might continue in theory, the level of spending on this war has dramatically declined. Yet this time our debt-to-GDP isn't moving lower. The reason is because while spending on this war against opposing countries/groups contributed to some of the build-up of debt in the mid-late 2000's, it wasn't the main factor for our level of insolvency increasing. And the projected increase in our debt-to-GDP over the next 1-2 decades isn't because of spending on wars. Although you could say we are at war, just not in the traditional sense.

We are at economic war, against ourselves, as the increases in spending on various programs - Social Security, Medicare, Medicaid, the Children's Health Insurance Program, and subsidies offered through health insurance exchanges - are contributing to the increase in the percent of debt-to-GDP.

Throw into the mix the rising interest payments on all of this debt when the Fed Funds rate normalizes, and you have a perfect inflation cocktail recipe.

The reason why debt-to-GDP isn't going to come down like before is simply because we don't have a temporary event that is causing the debt to rise, rather we have a permanent one. And we are simply past the point of no return. As the CBO says:

For debt as a share of GDP to return to its average percentage over the past 50 years-38 percent-by 2040, the government would need to pursue a combination of increases in revenues and cuts in noninterest spending (relative to current-law projections) that totaled 2.6 percent of GDP each year.

In 2016, 2.6 percent of GDP would be about $480 billion. The problem is if you try and cut spending by hundreds of billions, especially when your economy is just limping along, you are most likely going decrease revenue. In the end they cancel each other out or you end up going too far with the spending cuts and GDP collapses, which could cause the Debt-to-GDP to expand.

Republicans have put their ideas forth on what they want to do. But some of these budget proposals are pure fantasy. No side is really going to enact the changes that need to be made that would put a dent into this pile of IOU's.

And according to the CBO, the longer it takes to implement the necessary changes, the greater the size of the policy changes that would be needed:

If lawmakers waited for some time before reducing federal spending or increasing taxes, the result would be a greater accumulation of debt, which would represent a greater drag on output and income in the long term and would increase the size of the policy changes needed to reach any chosen target for debt.

Another interesting note from the CBO:

In addition, faster or slower implementation of policies to reduce budget deficits would tend to impose different burdens on different generations: Reducing deficits sooner would probably require more sacrifices by today's older workers and retirees for the benefit of today's younger workers and future generations. Reducing deficits later would require smaller sacrifices by older people and greater sacrifices by younger workers and future generations.

So what's it going to be? Who is going to make the sacrifice? The older generation or the younger/future generation? Both, or neither, depending how you look at it. The debt is on an upward trajectory that is ultimately unsustainable. We aren't going to implement policy changes that would severely cripple economic growth like you see in other countries. Most of these nations don't have a currency printing press at their disposal like we do. Rather this will all be taken care of through increased inflation via greater expansion of the money supply.

This isn't going to take until 2040 to play out either. The CBO is projecting that the Fed Funds rate normalizes to around 4% over the next decade. It's also projecting that the deficit will balloon to $1 trillion annually as a result of the increase in interest payments on the debt. However, I believe the CBO is ultimately too conservative on its time-table. I believe that rates could be well above 4% in a few years, which will cause our ascent to 100% debt-to-GDP to accelerate. That's when the ball really gets rolling.

Ultimately, I don't expect smooth sailing over the next 3-5 years. Increasing interest rates are going to wreak havoc on various asset classes, GLD will benefit from this. Gold and silver stocks even more so.