Summary

Integra Gold has announced the discovery of new gold bearing zones at the Lamaque South project, as well as high-grade drill results from the No. 6 vein.

The new discovery is located just west of the Triangle Zone and south of the past-producing Lamaque mine.

The company now plans to follow up drilling to access the potential of these new gold zones, with 100,000 metres of diamond drilling planned for 2016.

Integra remains one of my highest-conviction picks among gold stocks.

Integra Gold

(click to enlarge)

(Integra Gold has returned 28.49% this year, compared to a 30% drop in the benchmark gold miners index (NYSEARCA:GDX). I expect this outperformance to continue. Credit: Yahoo Finance).

Recent Stock Price: $.23

Shares Outstanding: 349.24 million

Market Cap: $80.33 million

52-Week Range:

Integra Gold (OTCQX:ICGQF) recently reported the results from ongoing drilling at the No. 6 Vein, as well as the discovery of new gold bearing zones at the Lamaque South project. These results are great news for shareholders as it could lead to a larger gold resource than what was previously estimated, increasing the size, grades and value of the Lamaque South Gold Project in Canada (and increasing the chances of a takeover by a larger gold miner).

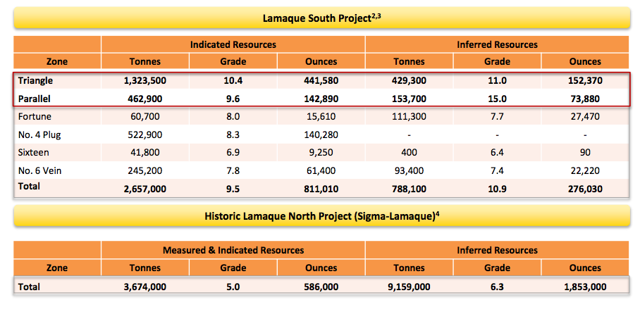

For investors unfamiliar with Integra, the company is advancing the high-grade Lamaque gold project to initial production, aimed for 2017. The project contains 1.057 million ounces of indicated gold resources at 7.1 g/t, plus 330,990 inferred gold resources at 8.4 g/t. The deposit has nearly doubled in size over the past 2-3 years due to drilling and exploration success.

(Note: this resource listed above doesn't even include historic resource at the Lamaque North Project, which contains 2.3+ million ounces of gold and measured, indicated and inferred resources).

(click to enlarge)

(Credit: Integra Corporate Presentation)

However, even at its current size, Lamaque South looks like it holds very strong economics. The mine will produce 100,000+ ounces of gold annually. At $1,175 gold, the project carries a pre-tax net present value of C$184.3 million, a 77% pre-tax rate of return, and projected cash costs of just C$551 per ounce and life of mine all-in sustaining costs of C$731 per ounce, according to the preliminary economic assessment.

What's more: the mine requires just C$61.9 million in pre-production capital, which is a very reasonable sum for a gold mine of this size. This is due to the company's wise acquisition of the Sigma/Lamaque Mill and Mine Complex, which gave the company a high-quality milling facility, leaching and carbon in pulp, crushing and grinding circuit, leach tanks, and a ball mill.

(Note: The PEA does not incorporate any of the additional resources announced in February, 2015 or resources from Lamaque North, which was acquired in the Sigma/Lamaque Mill and Mine acquisition).

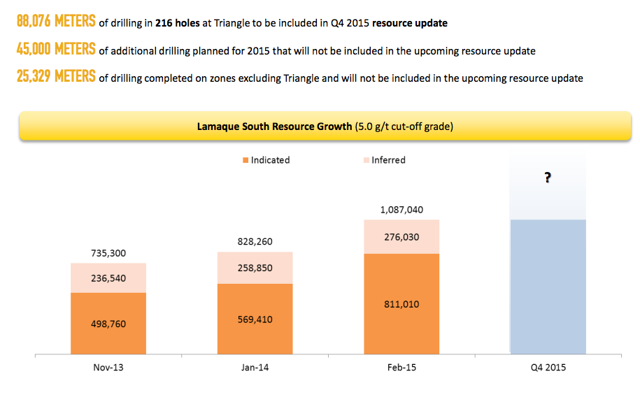

However, Integra clearly feels that Lamaque is much larger than the current 1 million ounce resource. Back in January, the company announced 50,000 metres of drilling would be completed in 2015, with most of the focus on the high-potential Triangle Zone and No.3 and No. 6 Vein. The company followed up with a solid updated resource estimate in February, as indicated resources increased by 40% and inferred resources by 13%.

I said it back then and I'll say it again: I feel there is a great chance Integra can double its current resource based on the company's consistent drilling success. In this new release, the company reported the following drill results at the No. 6 Vein:

- 13.18 grams per tonne gold ("g/t Au") over 1.80 meters ("m") in hole V6-15-01

- 32.15 g/t Au over 1.69 m in hole V6-15-05

- 22.64 g/t Au over 2.59 m in hole V6-15-11

- 11.95 g/t Au over 4.80 m in hole

In addition, new gold bearing zones were discovered approximately 2.7 kilometres west and 1.5 kilometres south of the past producing Lamaque Mine. A total of 5,686 metres were drilled from Oct. 2014 to April 2015, and the company intersected gold in five different drills. The results weren't exactly high-grade (.50 to 4.17 g/t), but management says "the presence of tourmaline, quartz veining and sulfides indicate their potential."

What's next: investors should keep an eye out for another updated resource estimate, scheduled for Q4 2015. More importantly, the company will continue to aggressively explore its properties. The drilling program at Lamaque was recently expanded to 90,000 metres this year, but next year the company plans on drilling 100,000 metres.

(click to enlarge)

Finally, El Dorado Gold recently bought a $14.6 million stake in Integra, as it clearly means the company is interesting in potentially buying out Integra in the future. Investors should keep an eye out to see if El Dorado increases its stake in Integra in the future.

In conclusion, Integra Gold continues to deliver outstanding drill results at its Lamaque South property, putting the company on a clearer path to initial production. I think the updated resource in Q4 will be a good one, and investors should look to buy shares ahead of the announcement.

Editor's Note: This article covers one or more stocks trading at less than $1 per share and/or with less than a $100 million market cap. Please be aware of the risks associated with these stocks.