Summary

Integra Gold recently announced an updated resource estimate for the Triangle Zone at its Lamaque South property.

The deposit continues to grow at a rapid pace: indicated resources grew by 21% while inferred resources increased 400%.

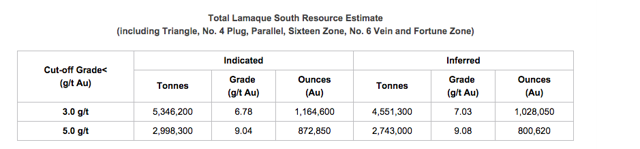

The total resource at Lamaque South now eclipses 2 million ounces at grades near 7 g/t gold.

I discuss what this means for shareholders.

Integra Gold

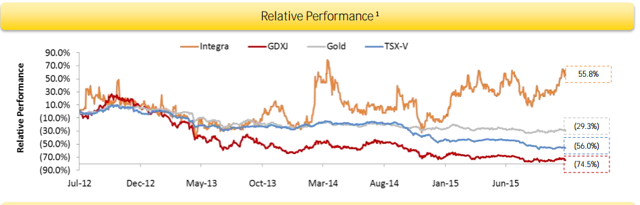

KALRF data by YCharts

Recent Stock Price: $.25

Shares Outstanding: 350.52 million

Market Cap: $85.88 million

52-Week Range: $.15 - $.29

Integra Gold (OTCQX:ICGQF) is advancing the high-grade Lamaque South gold project to initial production by late-2017. The project previously contained around 1.3 million ounces of gold in all resource categories, doubling in size over the past 2-3 years due to exploration success. But Integra just announced a new resource update at the Triangle Zone deposit (2.5 km southeast or Val-d'Or, Quebec) that is a game-changer for shareholders.

The results included 27,815 metres of drilling in the form of drill-hole step-outs. Integra says that Triangle Zone indicated resources increased by 21% to 627,810 ounces of gold, at average grades of 7.37 g/t. However, inferred resources at the Triangle Zone increased a whopping 400%, from 174,470 gold ounces to 871,530 gold ounces, at average grades of 6.89 g/t.

(click to enlarge)

(Credit: Integra News Release)

So what does this mean for the entire Lamaque South gold project? Well, it means that Lamaque South now contains 1.16 million ounces of gold in indicated resources (10% increase) and 1.028 million ounces of gold in inferred resources (211% increase), pushing Lamaque South over the 2 million ounce mark.

This is quite amazing, because the deposit contained just 1.087 million ounces as of February of this year. So the deposit basically doubled in size in less than a year's time due to the aggressive drilling by Integra and its exploration success.

What's more: the company feels the potential for further resource extension is "excellent." Seven drill rigs are currently active at the Triangle zone, drilling 8,000 to 10,000 metres per month. The company is focusing most of its efforts on this deposit because of its potential. Integra plans a massive 100,000 metre drill campaign for 2016.

In addition, the company says that an additional 43,435 metres of drilling has been completed on targets other than the Triangle Zone, and has not yet been integrated into a new resource update. That includes 8,197 metres of drilling on the No. 6 Vein and 13,108 metres of drilling on the No. 3 mine. It also includes drill results released on Nov. 3, which included 482.26 g/t gold over 1 metre and 58.89 g/t gold over 1.8 metres, at the Parallel Zone.

What's next is more drilling (100,000 metres in 2016), but also an updated preliminary economic assessment.

Readers may remember that Integra's PEA says the deposit is expected to produce 109,900 ounces of gold annually for just 4.5 years, with AISC of just C$731 per ounce. At US$1,175 gold, it carries a net present value (pre-tax, 5% discount) of $184.3 million and an internal rate of return of 77%.

However, this is based on the previous resource estimate. It's highly likely that the updated PEA will show stronger economics, now that Integra has nearly doubled its total resource base. With a 2 million ounce deposit, it's possible the mine life could be extended to at least 10 years, or the annual production estimate could be increased.

Readers should also remember that Integra recently closed on a C$14.6 strategic private placement investment by large-cap gold miner El Dorado (NYSE:EGO). As I pointed out in a previous article, El Dorado also gets the right to participate in future equity offerings, and potentially add one director to the board (should El Dorado's ownership exceed 19%). It's pretty clear what El Dorado's intentions are: I think the company could be interested in buying out Integra in the future, to diversify its production out of riskier mining jurisdictions.

(click to enlarge)

Here's the bottom line for investors: Integra's outstanding performance and resource expansion should continue, even as gold prices have fallen under $1,100 per ounce. The company owns a world-class gold deposit that still has a ton of exploration upside., despite a 100% increase in resources over the past year or so. The stock is a buy here in my opinion.

Editor's Note: This article covers one or more stocks trading at less than $1 per share and/or with less than a $100 million market cap. Please be aware of the risks associated with these stocks.