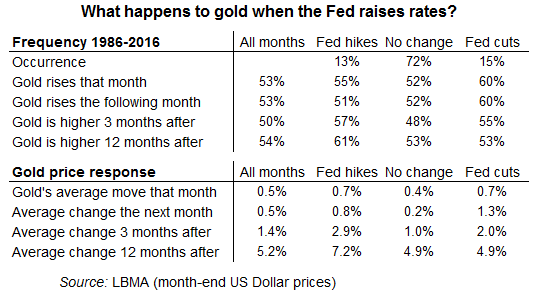

Although theory says that the price of gold should decline after an interest rate hike and it should increase after an interest rate cut, history shows that this expectation is often wrong. The financial markets always try to predict the future development and the interest rate change is often reflected by the asset prices before the rate change itself is officially announced. If there was a strong trend before the rate change, the trend may get disrupted for some time, although it tends to resume after the dust settles down.

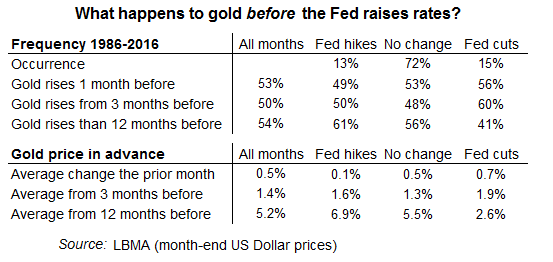

It's a fact that making money from financial trading means getting ahead of the move, buying before an asset goes up and selling it before it goes down. So if gold should fall when Fed rates go up - like everyone thinks, because it pays no income and so carries an opportunity cost in the form of lost interest on cash - then no one should want to wait. Sell early, provided you're sure you know which way the Fed will go.

The story is that selling in advance works to depress gold prices before the Fed makes its announcement (just like buying before a rate cut pushes it higher). Brought forward in time, this self-fulfillment cracks open a gap between what intuitions says gold should do when the Fed raises (or cuts) and what actually happens after the fact.