Welcome to Vanadium miners news. August saw Europe V2O5 prices steady and a slower month of news from the vanadium miners.

Vanadium uses

Vanadium is traditionally used to harden steel. New Chinese rebar standards are requiring more vanadium. Also, Vanadium Flow Batteries [VRFBs] are becoming increasingly popular especially for commercial energy storage, most notably in China. Vanadium Pentoxide [V2O5] is used in VRFBs and Ferrovanadium [FeV] is used in the steel industry.

Vanadium spot price history

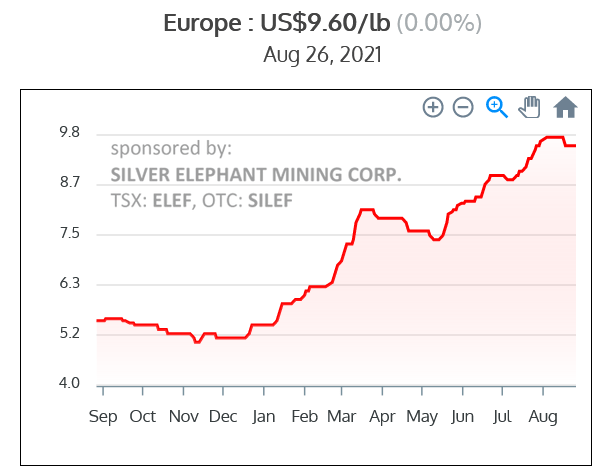

Europe Vanadium Pentoxide [V2O5] Flake 98% 1 year chart - Price = USD 9.60/lb (China price not given)

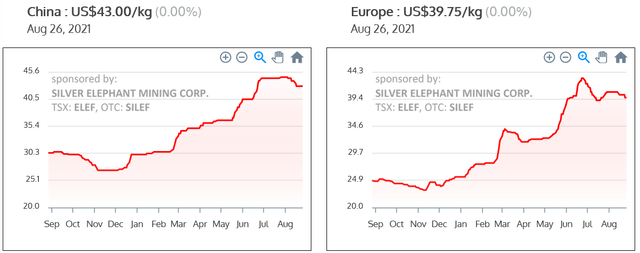

China and Europe Ferrovanadium [FeV] 80% prices - China = USD 43.00, Europe = USD 39.75

Source: Vanadiumprice.com

Vanadium demand versus supply

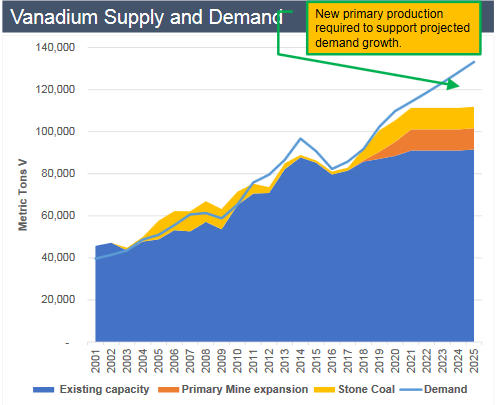

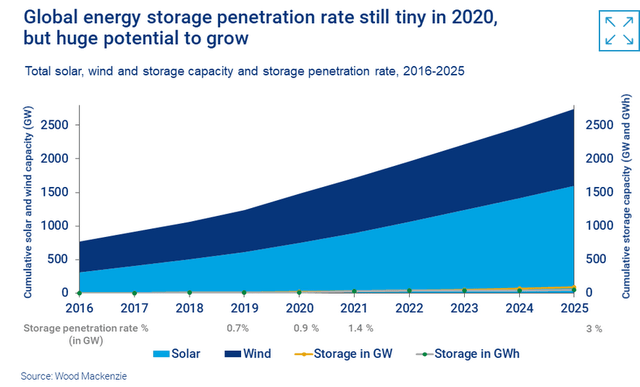

The charts below show energy storage to be a new source of vanadium demand, and overall demand looks likely to grow very strongly to 2025.

Vanadium total demand forecast to outstrip supply 2020-2025

Source: Technology Metals Australia investor presentation & TTP Squared

An April 2021 Wood Mackenzie report stated:

Global energy storage deployment surged a remarkable 62% in 2020, with 5 GW/9 GWh of new capacity added. This brought the total energy storage market to more than 27 GWh. Furthermore, we expect the global (energy storage) market to grow 27-fold by 2030.

Source: Woodmac.com

A Roskill post stated:

The vanadium market is set to tighten over the year and more so in 2022, driven by higher demand but also by tighter supply, as Chinese steel slag producers are running close to capacity. Outside of China, incremental supply will also be limited and come mainly from AMG’s new facility in Ohio, USA, and Bushveld’s Vametco gradually increasing its production in South Africa. Roskill believes that vanadium prices reached a low in Q4 2020 and should gradually rebound in 2021.....Vanadium redox batteries (VRBs) could become a major market for vanadium amid growing demand for energy storage, should the technology develop....On the supply side, Roskill does not expect significant tonnages from new projects to enter the market before 2024.

In 2017, Robert Friedland stated:

"We think there’s a revolution coming in vanadium redox flow batteries....”

Article goes into more detail...

https://seekingalpha.com/article/4452406-vanadium-miners-news-for-the-month-of-august-2021