Bullish on Rogue Resources, v.RRS

Share Structure

47.4 million shares outstanding

68.7 million fully diluted

29.7 million shares in float

Some Large Shareholders

Fiduci Ananke 17.9%

Marquest Asset Management 8.6%

BMO Asset Management 0.5%

John de Jong (CEO) 0.4%

Summary Info on Rogue in Mining Market Watch Article

Rogue Resources Inc. (TSX-V: RRS) (US Listing: GCRIF)is a uniquely diversified/de-risked junior miner with core assets on three commodity fronts (silica, nickel, and iron). Rogue offers near-term catalyst potential as it advances its 100% owned flagship high-purity silica project toward resource and a potential production scenario. RRS.V has potential for considerable upside share price revaluation for the fact that it has grades superior to its neighbor which has been profitably in production for 50 years, and the closer Rogue approaches comparatively, the more its share price is apt to rise. Rogue's nickel and iron projects have large inherent value, yet present no drain on capital as they await the next commodity cycle or attracts a joint venture.

Current Project Focus – High Purity Silica project

Rogue believes that its high purity silica project holds the opportunity for the greatest market potential for return, given its capacity for near-term production and cost outlay required to bring the deposit into production.

Silicon is a chemical element with symbol Si and atomic number 14. Silicon is the eighth most common element in the universe and the second most common element in the earths crust.

Silicon very rarely occurs as the pure free element in nature.Silicon is most widely distributed in various forms of silicon dioxide (silica) or silicates – molecular expression Si02.

Silica is used as a component for the production of:

-

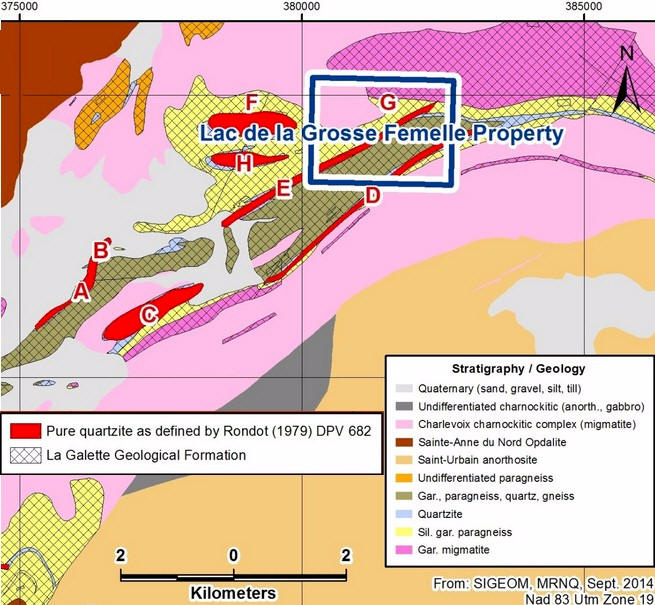

The Femelle Property displays similar geology to the Sitec Mine which is located within 4 km of the Femelle Property and has been in production for more than 50 years. In 2012, Sitec produced approximately 250,000 tonnes of silica and estimated future mine life at over 20 years. Estimated annual revenue for Sitec is in the $20 million range.

-

There are 10 quartz mineral horizons on the Sitec property, four (4) of which strike SW-NE towards the Femelle Property of Rogue Resources, which is adjacent and contiguous to the NE of the Sitec Deposit. Moreover, the Femelle Property hosts 2 quartz mineral lithostratigraphic horizons, which are oriented SW-NE as well.

-

The Femelle Property is underlain by quartzite sequences with multiple quartzite outcroppings.Quartzite commonly contains a high silica content with minimal impurities, typically less than 1%. Commonly referred to as high purity quartz, the silica produced from this type of quartz is highly sought after.

-

With prices for economic high purity silicon ranging from $130 to >$5,000 per tonne (depending on % purity), it puts Rogue in play. Rogue's quartzite silica deposit is top-notch/superior-grade and purity compared to more prevalent quartz sandstones deposits, the superior nature lends the deposit to specialized high-tech industrial interests, and the proximity of Rogue's high-grade SiO2 project to the ports of the St. Lawrence make it a coveted asset.

-

The recent completion of an NI 43-101 technical report included the collection of samples for analysis. Of twenty two samples taken, fifteen surface samples of white quartzites were collected within one of the two quartzite units located on the property. Six of the fifteen samples returned oxide assays ranging between99.09 to a high of 99.54% SiO2, 0.17 to 0.59% Al2O3, 0.07 to 0.12% Fe2O3, and 0.02 to 0.12% TiO2, with the other nine samples returning oxide assays of 97.61 to a high of 98.94% SiO2.

-

An airborne Heli-MAG survey was flown over the quartzites of the Femelle Project on December 7, 2014, with preliminary maps and reports to follow. The survey consisted of 321 km of north-northwest oriented flight lines spaced at 100 meters, in an effort to better define under-exposed quartzite on the project.

-

The Quebec government recently announced a $382 million investment in FerroAtlantica, one of the world's largest silicon metal producers, which is preparing to build a silicon metal plant at Port Cartier, Quebec, located on the St Lawrence River approximately 400 kilometers southeast of the project. This plant is projected to come on stream in June, 2016.

From the February 18, 2015 news release:

Work continues on preparing for an extensive exploration program that has been planned for Rogue's Lac de la Grosse Femelle silica project early in Q2. Preliminary work has begun on siteand the permitting process is well underway.

From Interview of CEO by Secutor Capital:

We are working with someone closely connected with FerroAtlantica and are planning to set up meetings with them in the near future.

Two Phase Exploration Plan Outlined

-

Phase 1 (Q1 and Q2)

-

Airborne Mag, EM and Radiometric Surveys

-

Ground Geophysical Surveys

-

Prospecting, mapping and sampling

-

Outcrop stripping and trenching

-

Bulk sample of 50 tonnes

-

Phase 2 (Q3)

-

Diamond drilling (NQ size)

-

5000m drill program

**** Other Positives ****

-

Recent Money Raised

Over $3 million Raised From Sept. to Nov. 2014

Private Placement Offering

A private placement announced on July 30, 2014, wasover-subscribedand closed on September 23, 2014, for$2.51M. The proceeds of the placement will primarily be directed towards advancing the Femelle Silica Project.

Sale of Timmins, Ontario Real Estate Asset

The Company closed the sale of the Timmins office complex on November 28, 2014 withnet sale proceeds of $565,000. The proceeds of the sale will be used to advance the silica property through exploration and for general working capital.

Total$3,075,000

2. John de Jong, President and CEO of Rogue Resources

Mr de Jong is the former president and CEO of Integra Gold Corp.. He was instrumental in developing Integra's Lamaque Gold project in V'al d'Or, Quebec's Valley of Gold. In fact, Rogue shares office space with Integra Gold and is supported by the same highly experienced office staff. Integra Gold now has a market cap of $64.2 million .

https://www.integragold.com/i/pdf/2011-june-china-business-magazine.pdf

In Mr de Jong's interview with Secutor Capital Management he said this about Rogue Resources:

“My interest in the Company was that I saw it needing to get re-focused, re-financed and that it needed to bring a project into the Company that the market could support. I did that with Integra Gold and brought it to a point where it was on the cusp of stepping out in a bigger way. I hope to do the same with Rogue.”

3. Top Technical Advisor, Mackenzie Watson

As stated in the February 18, 2015 news release, Rogue has scored a top notch technical advisor in recent Canadian Mining Hall of Fame inductee, Mackenzie Watson. One of his many accomplishments included the buyout of his Freewest Resources in 2010 by Cliffs Natural Resources for$240 million.

Rogue is pleased to announce that Mr. Mackenzie Iles Watson, B.Sc., P.Eng has joined Rogue as a technical advisor.

"We look forward to drawing on Mac's formidable expertise as we begin to define our quartzite formations both in size and purity. His record in the Canadian mining industry speaks for itself and we feel honoured that he has agreed to provide technical assistance and guidance to us," commented John de Jong.

4. Rogue's Radio Hill Iron Ore Property

-

Extensive drilling has been carried out on the project, including 140 drill holes

-

In 2011/2012 Rogue conducted over 10,000m of drilling

-

Infrastructure in immediate area includes CN Rail main line, natural gas, and Timmins Ontario mining expertise

-

metallurgy testing needed for resource calculation

-

The second phase of metallurgical work is underway. Once complete, the company will likely produce a NI 43-101 compliant resource estimate (inferred).

-

Significant intercepts include 308m of 40% total iron, 318m of 40% total iron, and 354m of 40% total iron.

-

Significant potential exists for further discovery with the 12km Nat River Iron Formation

5. Langmuir High-Grade Nickel Project

-

An advanced stage nickel project that has received in excess of $7 million in development.

-

Ownership 100% Rogue Resources

-

Over 80 holes drilled on deposit

-

Over 18 million pounds of nickel defined (Inferred and Indicated, NI 43-101)

-

Top intercept was 1.14% nickel over 72.45m, including two separate heavily mineralized intervals of 2.23% Ni, 0.22% Cu, 0.20g/t Pt, and 0.50g/t Pd over 17.5m of core, and 1.74% Ni, 0.22% Cu, 0.20 g/t Pt, and 0.47 g/t Pd over 13.1m of drill core

-

Fully operational nickel mill within 3km of property

-

Upside potential exists in deep geophysical targets not fully tested with diamond drilling

-

Airborne geophysics has been flown over the entire property by Geotech using VTEM B-field system. More than 20 separate clusters of airborne EM anomalies have been identified