Sirmac Mine: "The Highest grade hard rock lithium deposit in the world"

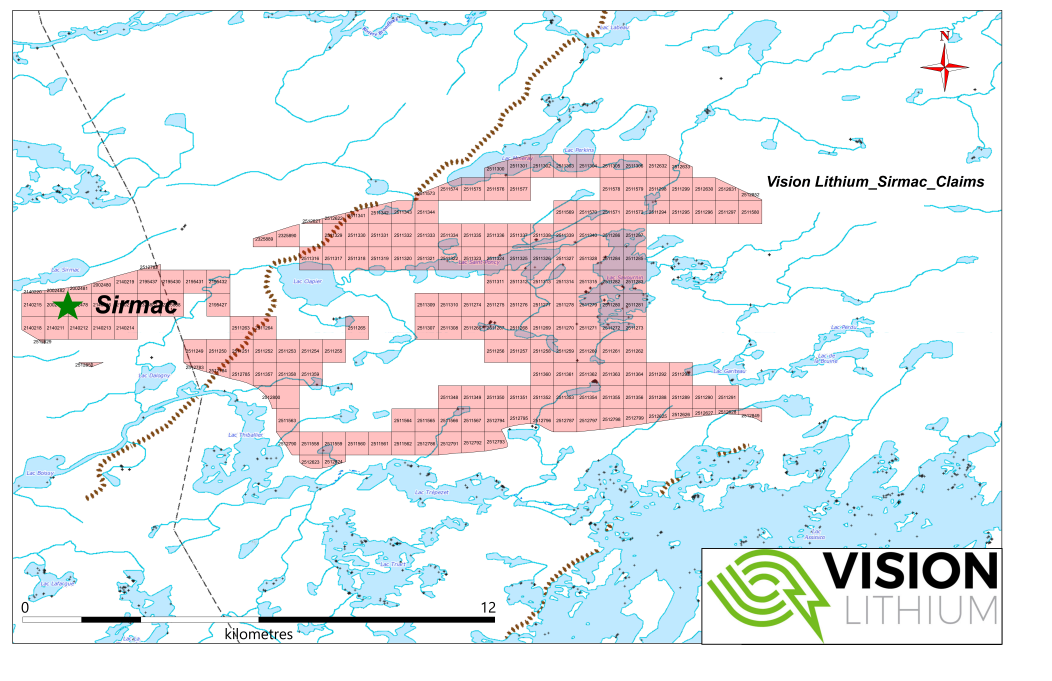

The Sirmac Property consists of 24 mining claims having a total area of approximately 1,100 hectares located approximately 180 kilometres North-West of Chibougamau, in the province of Qubec. A main forestry road passes next to the property and vehicles can reach the main mineral occurrences on the property using secondary logging roads. In addition, a 700 kV power line runs along its Eastern boundary.

NEMASKA LITHIUM RELATIONSHIP

On December 14, 2017, Vision Lithium announced the signing of a definitive asset purchase agreement for a 100% undivided interest in the Sirmac Lithium Property from Nemaska Lithium Inc. Vision Lithium issued $250,000 cash payment and 15,000,000 common shares of Vision Lithium to Nemaska Lithium bringing its ownership of Vision Lithium to approximately 19.9% of Vision Lithium shares. In addition, Vision Lithium assumed a pre-existing 1% NSR on certain claims comprising the Sirmac Property.

According to the agreement, Nemaska Lithium will have a pre-emptive right to participate in any future equity financing as long as it holds at least 10% of Vision Lithium’s issued and outstanding common shares. In addition, Nemaska Lithium was granted the following additional rights:

• a right of first refusal to purchase any concentrate originating from the Sirmac Property for further processing at its Shawinigan hydro-metallurgical facility;

• the right to act as exclusive marketing agent for all lithium salts from concentrate originating from the Sirmac Property;

• the right to receive a 2% marketing fee, in cash, on the gross proceeds from the sale of lithium products derived from concentrate originating from the Sirmac Property sold by Nemaska Lithium (and from any concentrate otherwise sold by Vision Lithium that is not purchased by Nemaska Lithium); and

• a right of first refusal to reacquire the Sirmac Property in the event that Vision Lithium wishes to sell or otherwise assign and transfer its right, title and interest in and to the Sirmac Property.

Approval from the TSX Venture was received in January 2018.

GEOLOGY

The Sirmac property is located in the North-East part of the Superior geological province, in the Frotet-Evans volcano-sedimentary belt. Four types of rocks outcrop on the Sirmac property: quartz-biotite-hornblende schists, amphibolitized flows or mafic sills, syenite pluton, and pegmatites, some of which are spodumene-bearing. The main foliation strikes E-W and has a steep dip. More than twelve granitic pegmatite dykes, whose thickness ranges from 1 to 100 m, have been identified. All of these cut the host schists and generally strike NNW-SSE (315°/350°), with an apparent sub-vertical dip and steep contacts with host rocks.

MINERALIZATION

The type of deposit associated with the lithium mineralization of the Sirmac property is a granitic, rare element-bearing pegmatite due to the presence of spodumene. In dyke #5—the known deposit—spodumene crystals are euhedral, with color and size varying from white to greenish- or grayish-white and from 1 to 30 cm in size, with an average size of 10 cm. The amount of spodumene found in the pegmatite ranges from 5 to 30% in volume. In general, the crystals are slightly altered and frequently contain rounded inclusions of quartz. A historical resource estimate was performed on the deposit by Wrightbar Mines Ltd. in 1994, with results indicating a total of 314,328 tonnes grading 2.04% Li2O.

HISTORICAL RESOURCE ESTIMATE

In 2012, Nemaska Lithium conducted a successful exploration campaign. In total, 9 sites were mechanically stripped for a surface area of approximately 13,000 m2. There were 29 channels completed over 739 metres for a total of 506 samples (selected results below, for full results see the Nemaska Lithium news release dated November 5, 2012).

Also as part of the same exploration program, Nemaska Lithium completed a diamond drill campaign of 72 shallow drill holes (3,414.5 m). A total of 1,953 samples, including quality control samples (13%), were sent to the lab for assay (selected results below, for full results see the Nemaska Lithium news release dated November 13, 2012).

Drill results from this program reported multiple intersections over 2% Li2O. More specifically, Nemaska Lithium intersected mineralization of up to 2.98% Li2O. This grade approaches the grade found at the Greenbushes deposit, which is the highest grade hard rock lithium deposit in the world.

From this work a mineral resources estimate was produced:

Historical Estimates

The existing Technical Report includes the following historical estimates for the Sirmac Property:

Table 1: Historical Estimates for the Sirmac Property with 0.50% Li2O Cut-Off Grade

Cut-Off Grade

Li2O%(1)

Category(1)(2)

Tonnage (t)(1)(3)

Average Grade Li2O%(1)

Average Grade Ta2O5 (ppm)(1)(4)

0.50

Measured

185,000

1.40

70

0.50

Indicated

79,000

1.40

80

0.50

Inferred

40,000

1.10

60

Notes:

(1) Effective date of December 2013.

(2) The historical estimates were calculated using the Canadian Institute of Mining, Metallurgy and Petroleum (CIM) Definitions Standards for mineral resources in accordance with NI 43-101. Mineral resources which are not mineral reserves do not have demonstrated economic viability. Inferred mineral resources are exclusive of the measured and indicated resources.

(3) Bulk density of 2.70 t/m3 is used. Rounded to the nearest thousand.

(4) Ta2O5 mineralization has yet to demonstrate recoverability and potential for economic extraction.

While the Company considers these historical estimates to be relevant to investors, as they may indicate the presence of mineralization, a qualified person has not done sufficient work for Vision Lithium to classify the historical estimates as current “mineral resources” or “mineral reserves” (as defined in NI 43-101) and the Company is not treating these historical estimates as current “mineral resources” or “mineral reserves”.

All block modelling, 3D solid generation and geological interpretation was conducted by SGS Geostat. Modelling and block interpolation was done using Genesis © software. As of December 2013, no other deposit in the Sirmac Property has mineral resources stated or estimated. In order to limit the mineral resources representing “a reasonable prospect of economic extraction”, a Whittle © Pit optimization was completed using the Lerchs-Grossman 3D algorithm. Considering the blocks limited to the optimized pit shell and a cut-off grade of 0.50% Li2O, the Sirmac Property comprises 185kt of measured resources at 1.40% Li2O, 79kt of indicated resources at 1.40% Li2O, and 40kt of inferred resources at 1.10% Li2O (see Table 1 above). These historical estimates of mineral resources do not represent mining reserves since they have not shown economic viability.

The existing Technical Report confirms that all sample assay results were independently monitored through a QA/QC program including the insertion of blind standards, blanks and the reanalysis of duplicate samples at a second umpire laboratory. The results of the QA/QC program and the resampling program indicate that the sample database is of sufficient accuracy and precision to be used for the generation of the historical estimates.

WORK PLANNED

Vision Lithium intends to start a 2018 exploration program that includes:

• Conduct close-spaced high resolution Mag survey to better define the geometry and extent of the numerous pegmatite dykes on the property

• Create drill program to confirm known mineralization and test other dyke potential

• Metallurgy to confirm ore is amenable to 6% Li2O concentrate

• Metallurgy to confirm concentrate can produce battery grade lithium carbonate and lithium hydroxide

• Update resource calculation

https://visionlithium.com/sirmac/

-------------------------------------------

Vision Lithium has 9 Minning Properties: Lithium, Cobalt, Gold, Copper, Nickel

The technical information in the following section was reviewed by Yves Rougerie, geologist and President & CEO of Vision Lithium Inc. Mr. Rougerie is a Qualified Person within the meaning of the term as defined in of National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

The Company has an interest or option to acquire an interest in the following properties:

Name Red Brook, NB

Epithermal, NB

Benjamin, NB

Dme Lemieux, QC Sirmac, QC Broadback North QC

Status Notes

Royalties 2%

2% 2% Nil

1% on 24 claims Nil

Wholly owned

Wholly owned

Wholly owned

Recently acquired Zn-Cu-Pb-Ag-Au project

Recently acquired Zn-Cu-Pb-Ag-Au project

Recently acquired Zn-Cu-Pb-Ag-Au project

Wholly owned Cu-Zn porphyry/skarn project Wholly owned Lithium project

Wholly owned Lithium project

-3-

Vision Lithium Inc.

MD&A for the year ended August 31, 2020

Wabouchi, QC St. Stephen, NB Epsilon, QC

New Brunswick Properties

Wholly owned 50% Interest Wholly owned

Lithium project Nil Ni-Cu-Co project Nil Inactive Au-U project 2%

rd

On June 3 , 2020, Vision Lithium announced the signing of a definitive purchase agreement for the arm’s length

acquisition of a 100% undivided interest in the Red Brook, (Red Brook)-Epithermal and Benjamin mineral exploration properties from 9248-7792 Quebec Inc. and Prospect Or Corp. The three contiguous Properties comprise 17 mineral claims covering 4,760 hectares (47.6 km2) located approximately 60 km West of the mining centre of Bathurst in Northern New Brunswick. The Properties are easily accessible by year-round, well-maintained forestry road infrastructure. An additional 30 claim-units were added to the Epithermal group in the summer.

Under the agreement, Vision Lithium issued 6,000,000 common shares of the Company to 9248-7792 Quebec Inc. and 4,000,000 common shares to Prospect Or Corp and granted the vendors a 2% net smelter return royalty on the Properties, one-half of which may be repurchased by Vision Lithium for $1,000,000.

The newly acquired Properties are located west of the Bathurst VMS District. A sequence of Ordovician and Silurian supracrustal rocks is intruded by Middle Devonian Granodiorite as well as other Siluro-Devonian felsic intrusions with which porphyry, skarn and other mineralization is genetically and spatially related. Similar Cu porphyry-base metal skarn related mineralization occurs at Gasp-Needle Mountain porphyry copper deposit and at the Company’s Dme Lemieux property associated with Devonian intrusives in the Gaspsie region of Quebec. Work on these properties was delayed due to COVID related access restrictions and significant work is now planned for the next fiscal year.

Red Brook Property

Following the discovery by prospectors of rocks with a high zinc content of up to 13%, a large stripping program was completed by previous operators on two highly altered zones (A and B). Zone “A” returned values of up to 15% Zn as well as gold and copper values up to 2.62 g/t Au and 0.5% Cu.

Best Selected Samples from Zone “A” on the Red Brook Property:

-4-

Vision Lithium Inc.

MD&A for the year ended August 31, 2020

Zinc Zone

Zn % 15.05 12.10 8.79 8.20 8.13 7.70 7.02 6.98

Cu % 0.21 0.19 0.25 0.20 0.18 0.17 0.17 0.18

Au g/t 0.04 0.04 0.03 <0.01 <0.01 0,02 <0.01 0.01

Zn % 0.02 0.02 0.02 0.06 0.01 0.01 0.02 0.01 0.01 0.07 0.03 0.01 0.01 0.01 0.02 0.00

Gold-Copper Zone

Cu % 0.55 0.47 0.45 0.45 0.44 0.43 0.43 0.36 0.34 0.33 0.32 0.31 0.29 0.26 0.22 0.18

Au g/t 0.79 0.28 0.95 0.27 2.62 0.21 0.53 1.61 0.33 0.22 0.19 0.24 0.44 0.32 0.13 0.91

The stripping and sampling of zone “B” also returned anomalous values of up to 0.33 g/t Au and 0.48% Cu. Subsequent to this work, Rio Tinto optioned the Red Brook property and adjacent claims in order to evaluate the near surface Copper Porphyry and related Cu-Zn skarn type potential. They completed a large IP survey on the property itself and adjacent claims. The results of the IP survey indicated the presence of high chargeability IP anomalies. The high chargeability anomalies appear to be related to pyrrhotite mineralization, which is ubiquitous in the high-grade lens from zone “A”. The altered areas from zone “A” with values up to 2.62 g/t Au, 0.55% Cu, 15% Zn, all contain massive pyrrhotite.

The high-grade Zone “A” lens on the Red Brook property has never been tested by drilling. The strong chargeability anomalies which extend over more than 4 km have also not been drill tested. Both represent high priority drill targets. Further field exploration, stripping and sampling are also warranted on this property.

-5-

Vision Lithium Inc.

MD&A for the year ended August 31, 2020

Epithermal Property

The Epithermal property is located in between and contiguous to both the Red Brook and Benjamin properties. It was only recently staked following construction of new forestry access roads. The vendors discovered a large outcrop of sericite-altered rhyolite with apparent breccia textures and quartz veins. A single sample assayed 40 ppb Au, indicating a fertile environment for gold mineralization. The occurrence has no reported prospecting or drilling history. Field work is required to advance this new and exciting prospect.

Benjamin Property

The Benjamin property is located east of the Epithermal property. The property covers approximately 15 sq. km. and is host to a copper-molybdenum porphyry type deposit in intensely altered and fractured granodiorite porphyry, part of a Devonian intrusive complex. Best historical intersections include 218m @ 0.22% Cu, 312m @ 0.12% Cu, 52m @ 0.20% Cu, 10m @ 0.39% Cu and 10m @ 0.30% Cu.

Stratmat first explored the area in 1954, followed by Soquem-Temex in the 1970’s. In the summer of 2019, the Vendors located two old trenches using a Lidar map, and resampled the old trench of hole 7014, as well as the old trench in the South C zone. The trenches exhibit altered and mineralized rocks. The trench along hole 7014 returned values of up to 1.14 g/t Au. The description of the drill hole in the Soquem report describes a 200m hole with mineralized rhyolite, which appears to coincide with the surface rocks found in the trench. Drill holes were not assayed for gold at the time of drilling. The core for several of the historic drill holes is preserved and may be available for resampling and assaying for gold.

The Benjamin property has been recognized as a porphyry copper-moly type. It is near a large granite intrusive. Only a relatively small area near the intrusive has been tested. A thorough prospecting program is recommended along with trenching and sampling and ground IP surveys. In addition, a review of the porphyry deposit is warranted to model the deposit, evaluate its potential at depth and its gold potential. The property warrants a further evaluation for porphyry deposits and contact related skarn deposits and their gold potential.

The Company is planning exploration programs for these Properties in 2021.

Dme Lemieux Property

The Dme Lemieux Property is made up of 238 map-designated claims totaling 11,599.84 hectares or roughly

2

115.99 km . The Property is located in the Gaspsie region of eastern Qubec, approximately 32 km south-southeast of

the town of Sainte-Anne-des-Monts, Qubec. Access is accessed by way of the main road that cuts across the Gasp peninsula and the National Park of the same name.

No field work was completed on the property during the period. However, the Company had planned a field and drilling program for 2020 and had received drilling permits for the program. Funding is in place for this program which is now planned for 2021. The Dome Lemieux property is located less than 200km north by road from the newly acquired New Brunswick, creating synergies for the exploration of both sites.

-6-

Vision Lithium Inc.

MD&A for the year ended August 31, 2020

Sirmac Property

The Sirmac Lithium Property, acquired from Nemaska Lithium in 2018, consists of 25 mining claims (cells) having a total area of approximately 1,108 hectares located approximately 180 kilometers by road northwest of Chibougamau, in the province of Qubec. 169 claims added in 2018 have expired in early 2020. The Company added a new claim to the group during the period to protect the East zone occurrence.

Metallurgical testing completed by SGS-Lakefield (‘SGS”) in the previous period from samples from the Sirmac property were successful in recovering 88.3% of the Lithium at a grade of 6.23% Li2O. Following receipt of these excellent results, SGS produced an amount 91.9 grams of very high purity Lithium Carbonate grading above 99.5%.

Broadback North Property

The Broadback property consists of 27 cell claims covering 1,414 hectares and is located approximately 10 km west of the Sirmac property and 180 km northwest of Chibougamau, Qubec. The property was staked to cover a prominent pegmatite body which may be prospective for lithium exploration. No field work was done on the property in 2020.

Wabouchi (formely Nemiscau) Property

The Wabouchi property consists of 10 contiguous claims covering 534 hectares located Southeast of the village of Nemaska in northern Qubec. A government mapping program in 2018 recognized a spodumene-bearing pegmatite dike on the property. The recently staked claims are located in the general area of the Nemaska dike swarm, approximately 5 km south of the Wabouchi lithium deposit of Nemaska Lithium which is in the development-construction phase.

St-Stephen Property

The St-Stephen Property comprises 189 claims located near the town of St. Stephen in the southwest corner of New Brunswick. VLI staked the property in 2004 and 2005 and there are no underlying royalties. Indiana Resources (“IMX”) has acquired an initial 50% interest in the property following a 4-year, million-dollar expenditure on the claims. Indiana is the operator of the works.

The Property hosts numerous historic zones of magmatic Ni-Cu-Co mineralization, including several significant occurrences. The most significant zones are found at the Roger’s Farm deposit which was the object of underground development and exploration in 1959-1960. IMX drilled several historic and newly discovered zones and has expanded and enhanced their potential.

Epsilon Property

The Epsilon Property consists of 21 claims covering 1,107 hectares and is located approximately 300 km northeast of Chibougamau, Qubec. The Company completed the acquisition of an undivided interest in the Property in April 2009. The Company has exploration credits exceeding $1.3M on the property.

https://backend.otcmarkets.com/otcapi/company/financial-report/267133/content