As this interest increases, the market is beginning to see quite a few new mining companies spring up. For instance earlier this month we saw a Canadian IPO for an iron ore company in the Ukraine called Black Iron. Additionally, some iron ore firms are starting to attempt to develop deposits in relatively remote areas like Zone Resources (ZRESF.PK) in Northern Canada. This article will look at some of the more technical aspects that an investor should consider when conducting their diligence on a firm in the iron ore sector. The goal is to give investors a few tools that they can use to make intelligent decisions about the positions they decide to take.

Hematite vs. Taconite

Hematite

(Source: Geology.com)

Taconite, a form of Magnetite

(Source: websters-online-dictionary.com)

Iron ore is the second largest commodity market in the world behind crude oil, and is the main ingredient in steel. Generally, iron ore falls into two categories, hematite and magnetite. Hematite is a rich iron ore product with an Fe grade around 40-70%, depending on the deposit. Hematite is generally referred to as Direct Shipping Ore or "DSO" for short because it can easily be mined and beneficiated using a simple crushing and screening process before it's shipped off to a steel producer.

Hematite is characterized by a red rusty color, and is predominantly mined from the Pilbara region of Western Australia, and the Carajas mine in Brazil by the world's major iron ore producers: BHP Billiton (BHP), Rio Tinto (RIO), and Vale (VALE). Kumba Resources (KIROY.PK) in South Africa is also a large exporter of hematite ore as well. Of note is that hematite is not often rigorously processed, and as such can often have impurities which can be costly for steel makers to remove. Final end products for hematite are generally sold as either lumps or fines. Lumps are larger than fines, and are preferred because they can be directly fed into a blast furnace. Fines, by contrast, cannot be fed directly into a blast furnace because they effectively smother the furnace. To reduce this smothering effect, fines must be sintered. Below is an example of how hematite ore is processed.

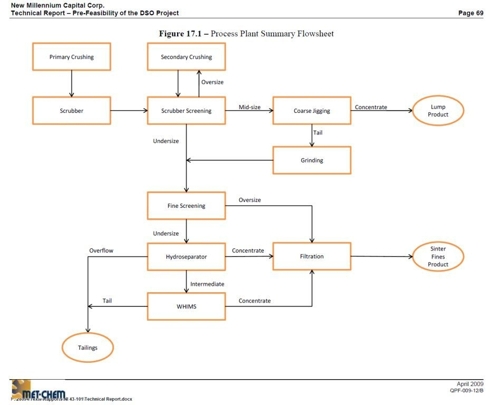

Hematite Processing: One Step:

(Source: nmlresources.com)

Taconite by contrast, which contains a finely dispersed magnetite, has a low Fe grade of around 25-30%. Large taconite deposits are found in North America, in either the Mesabi Region in the United States or the Labrador Trough in Canada. The largest North American miner of taconite is Cliffs Natural Resources (CLF), and the Iron Ore Company of Canada. Some smaller, but up-and-coming firms that have an interest in the taconite sector include Labrador Iron Mines (LBRMF.PK), New Millennium Capital (NWLNF.PK), Alderon Resources (ALDFF.PK), and Adriana Resources (ANARF.PK). Other smaller firms with an interest in taconite include The Mesabi Trust (MSB), Champion Minerals (CPMNF.PK), Cap-Ex Ventures (CPXVF.PK), Palladon Ventures (PLLVF.PK), Zone Resources (ZRSEF.PK), and Advanced Explorations Inc. (ADEXF.PK), among others.

Because of their low iron grade, taconite and magnetite require greater processing than hematite in order to form an iron concentrate product of 60-70%. The beneficiation process for taconite requires crushing, screening, grinding, magnetic separation, filtering and finally drying. This concentrate product can be processed further to produce pellets which can be fed into a Direct Reduced Iron "DRI" plant, and then later used for steel making. While taconite may require more processing than hematite, it often produces a superior end product with fewer impurities and a higher Fe grade. This higher grade product, in turn, can fetch a significant premium over hematite lump and fine products. Final end products for taconite are generally either concentrate, pellets, sinter, or DRI. Concentrate is generally the first product you get from Taconite beneficiation. The concentrate product is then binded together with bentonite or metallurgical coal to produce a pellet or a sintered pellet, and those pellets can be fed into a processor to create DRI. Below is an example of how taconite is processed. As you can see, it's much more complicated than hematite processing.

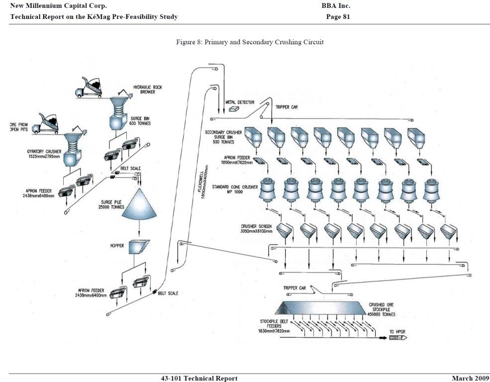

Taconite Processing Part 1: Crushing Circuit

(Source: nmlresources.com)

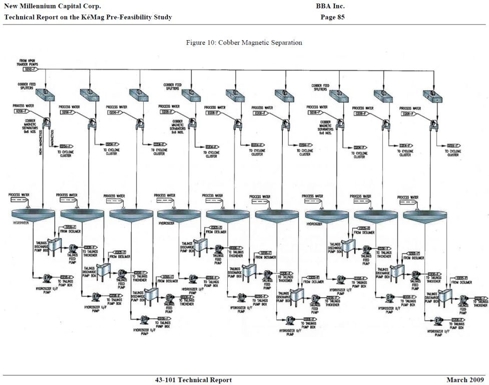

Taconite Processing Part 2: Screening and Magnetic Separation

(Source: nmlresources.com)

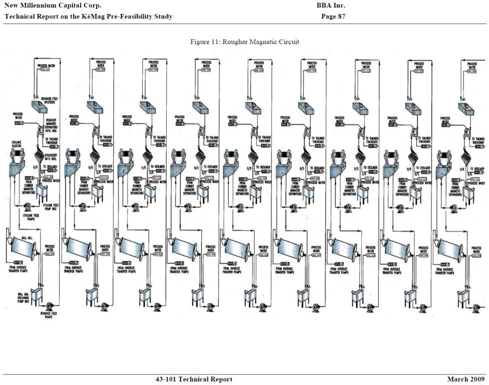

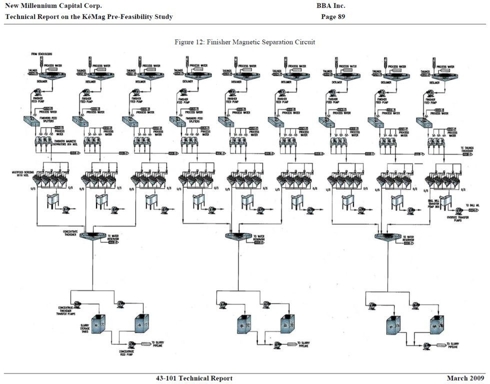

Taconite Processing Part 3: Further Magnetic Separation

(Source: nmlresources.com)

Taconite Processing Part 4: Finishing Circuit

(Source: nmlresources.com)

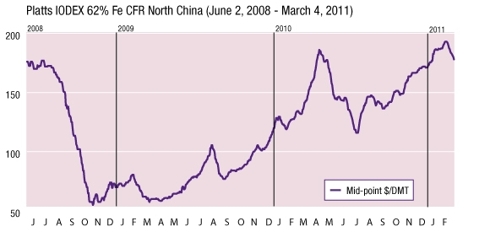

Platts Iron Ore Benchmark

About a year ago, the world's iron ore markets shifted from annual contracts towards quarterly contracts. The shift has been monumental for the iron ore industry and has created a great interest in the pricing of iron ore. Today, Singapore and India are in the process of setting up a derivative market for iron ore, but the de facto spot price index is published by Platts called "IODEX", and by a Metal Bulletin referred to as "MBOI". These indices are updated daily. The Platts website has spot prices for both 62% Fe, and 63.5% Fe iron products. Below is a chart looking at the daily spot price for 62% Fe.

Click to enlarge:

(Source: platts.com)

The important takeaway from the chart above is that the grade of the Platts Iron Ore Index is 62%, which means that ore below 62% will sell at a discount to the index, and ore above 62% will sell at a premium.

Location, Location, Location

Almost all iron ore companies sell their iron ore as FOB, meaning Freight On Board, or sometimes known as Free On Board. In general, this means that the seller (in this case the iron ore firm) has to pay to transport the product to port, house the product at a storage facility, and pay for the loading of the product onto the ship.The buyer of the iron ore is then responsible for the dry bulk shipping costs, the unloading costs, and the transportation of the product to their own facility.So, as with real estate, mining locations are very important.The further a mine is from a port or a railroad, the more expensive it is to bring the iron product to market.Mining firms that are close to water or rail road tracks thus enjoy a lower cost per ton than firms that aren’t.

Some companies have come up with low cost alternatives to shipping the product via Rail Road, like New Millennium Capital’s (NWLNF.PK) slurry pipeline, which allows them to be one of the lowest cost producers of iron ore in Canada.Other companies, like Advanced Explorations Incorporated (ADEXF.PK), have strategically selected to produce iron from mines located near water so as to mitigate the need to pay railroad costs.

Investors should also pay attention to the country that the iron mine is located in, and the location of the mine relative to the firm’s major buyers.The country is an important consideration because a stable country like Canada or Australia will generally fetch a premium over firms in less stable countries. Sundance Resources (SUDCF.PK), for example, has an iron mine in Cameroon.

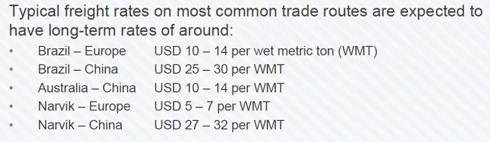

Additionally, the location of the firm relative to its buyer is an important consideration.For instance, the Finnish firm Northland (NRSRF.PK) enjoys a considerable advantage over Canadian and Brazilian iron ore producers who ship to Europe.Below is an excerpt from a recent investor presentation from Northland Resources, which discusses the cost of different long term freight rates from common iron ore trade routes.

(Source: northland.eu)

Grade is King

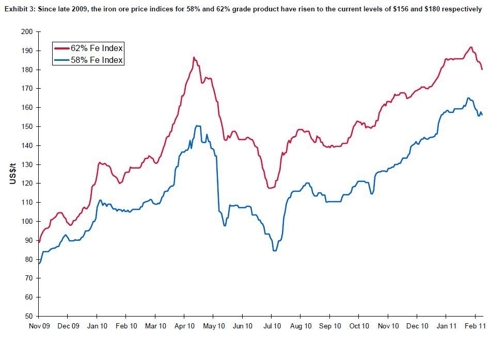

A popular phrase in gold mining is that "Grade is King", and the same holds true for iron ore. A recent report written by Ocean Equities for Northland presented some rather interesting findings. Ocean Equities posited that a difference of approximately $5 per Fe Unit exists. This means that the difference between a 62% Fe product, and a 67% Fe grade product would be about $25 a ton. Below is a chart they created to look at the difference between 58% Fe and 62% Fe. Here's a link to the report for further reading.

(Source: northland.eu)

As I mentioned before, a higher grade iron product is preferable for steel firms, because the steel firm is shipping less waste product and thus saves money on freight. Additionally, a higher grade iron ore allows steel companies to save on production costs because the higher grade product will typically have fewer impurities.

Iron Ore is a Margins Business

Like most businesses, the margin between production costs and sales price is what determines profitability. With iron ore firms, the major metric that an investor needs to look at is cost per ton. Cost per ton will typically include the costs of mining, processing, and any SG&A that is associated with running the business. Sometimes rail costs and port costs are not included in this figure, and need to be tacked on in order to figure out the true cost of selling a ton of iron ore. Rail costs and port costs are of particular importance when the mine is a long distance away from a port, or a customer. As the Northland freight chart indicated, Canadian and Brazilian firms selling iron ore to China will have to sell their ore at a slight discount relative to Australian firms because of the extra shipping distance. Conversely, Canadian and Brazilian firms selling iron ore to Europe or the Middle East have a distinct advantage over Australian firms.

Because steel-making is a cyclical business, it's important to select firms that will be able to produce their product at a profit in almost any economic environment. While the price for 62% Fe is about $180, firms that produce iron concentrate products above 62% will enjoy a premium to the MBOI and IODEX benchmark.

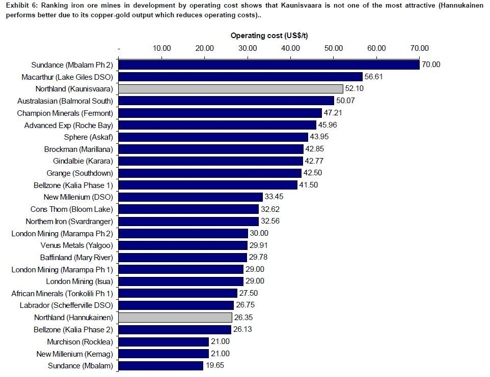

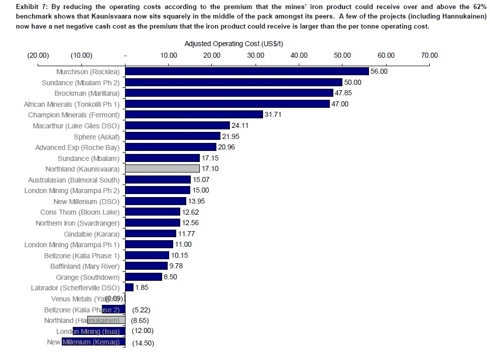

Below are two charts from Ocean Equities that look at a basket of junior iron ore miners. The first chart looks at the cost per ton of these firms, and the second chart examines the cost per ton relative to the 62% Fe benchmark. Of note is that some firms at the bottom of the second chart actually have a negative cost per ton if you factor in the quality of their product. This means that these firms would realize a profit margin in excess of the 62% Fe benchmark.

Ocean Equities: Junior Iron Ore Miners Operating Cost Per Ton

(Source: northland.eu)

Ocean Equities: Junior Miners Operating Cost Relative to the 62% Fe Benchmark

(Source: northland.eu)

One Caveat to Grade: Impurities

Almost all iron ore products including DRI, lumps, fines, pellets, and concentrate will have some amount of impurities in them. These impurities are typically phosphorus "P", silica "SiO2", and aluminum sulfate "AL2SO4". While a certain amount of these impurities is expected, a high level of impurities will reduce the value of the iron product and potentially could result in the steel maker refusing to purchase the product.

Steel manufacturers dislike high levels of impurities because it forces them to run their blast furnaces for a longer time when reducing the iron ore, or to use a higher temperature than they may otherwise use. As a consequence, the steel manufacturer will thus incur greater costs to produce steel from iron ore with high levels of impurities.

As mentioned earlier, it should be noted that higher levels of impurities are more typically found in hematite products because the hematite goes through a less rigorous beneficiation process. Investors should be sure to review impurity levels before making a decision to take a position in an iron ore firm. Typically, impurity levels will be published in the companies' regulatory filings or a feasibility study conducted by an independent contractor.

Conclusion

While iron ore mining has seen a renaissance in the last year, it is important that investors make wise, informed decisions about which companies they choose to invest in. Not all iron ore firms are created equal, and not all iron products will receive the benchmark price. Intelligent investors will pay close attention to the location of the mine, the cost per ton--including transportation of the iron to port--and the type and grade of the iron product the firm is selling.

Additional attention should be paid to the quality of management, whether or not the company has a joint venture partner to help with infrastructure costs and off-take agreements, as well as the financial strength of major customers. As always, investors are encouraged to do their own due diligence before taking a position in any of the firms mentioned in this article.