The Very Good Food Company (OTCQB:VRYYF) came to my attention as the second alternative meat IPO. While Beyond Meat (BYND) has seen its shares drop as growth stall, I still believe there is a ton of potential in this sector. The Very Good Food Company is much smaller so I wanted to see if it could be a good investment as the company scales up.

Just a brief background on the company, The Very Good Food Company is a Canadian based alternative meat company. The company sells a wide variety of plant-based meat substitutes such as burgers, sausages, steaks, and even BBQ ribs. Right now, the company can best be described as a start-up as it doesn’t really have much in the way of operations.

Company investor presentation (Email registration required)

The company sells and distributes its products through four main channels; its single “deli-style” retail establishment, its single company-owned restaurant, and one food truck used for festivals, the company’s e-commerce store, and the company’s wholesale partners. The company’s “deli-style” store called, ironically, the Butcher Shop is the primary retail outlet for the company. It showcases the company’s products, along with plant-based cheese made by locals. This retail outlet acts as a key marketing tool for the company.

The company also has a restaurant next to the Butcher Shop that serves customers the company’s products fully-cooked. The location serves as a test center and R&D center where management interacts with customers and learns about their preferences. During the fiscal year of 2019, the restaurant and food truck contributed 43% of the company’s gross revenue.

The company also has an e-commerce store where it sells its products individually as well as through a Monthly Meat Club subscription. In 2019, the company had 700 active subscribers to their meat club who receive monthly items from the company. The company hopes to turn this subscription service into a recurring income stream. The Very Good Food Company also distributes its product via the wholesale channel to grocery stores operating in the British Columbia region.

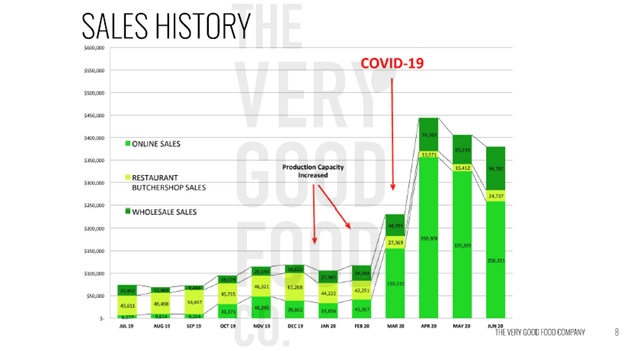

Quarterly results hint at explosive future growth

So why is a company with a single restaurant and retail location with an e-commerce site trading at a market cap of $249.8 million? Simply because the company is experiencing exponential growth. In Q2 2020, the company’s revenue increased by 395% year over year. More impressively, this result was achieved with the company's retail location and restaurant being closed due to COVID. I feel that the company can continue on this growth trajectory as the company’s products are well-reviewed.

The main limiting factor for the company is actually being able to get out more product to market. The company currently only has a single production facility running out of Victoria BC. The company has started to build out two new facilities in major markets namely Vancouver and California. The Victoria production facility has an annual production range of 1.3 million pounds of product. The Vancouver facility once completed will have 5x the production capacity. The California facility once completed will have even more production capacity at 25x the current Victoria facility.

Company investor presentation (Email registration required)

After closing our oversubscribed bought deal financing in early August, we are now able to move ahead with an accelerated expansion into the U.S. market. The California Facility is more than double the size of our future Vancouver facility and will be capable of substantially larger production volume. With the strong demand, we are currently experiencing for our products, finding a facility that could become operational quickly was key and being located on the doorstep of a key logistics partner made this location an excellent fit.

Article: The Very Good Butchers on California Expansion

The company also recently inked new wholesale distribution deals increasing its presence in grocery from 150 to over 200 locations. Despite having distribution deals with Sobey’s (TSE: EMP.A) and Whole Foods (AMZN) the company is still only in a limited geographic area. If successful though, the company can easily roll out to other stores. Sobey’s has 1500 locations all over North America.

The company competes against much larger firms in the industry including Beyond Meat, Impossible Foods, and other FMCG incumbents who are looking to jump in on the trend. Comparisons will undoubtedly be made to Beyond Meat and Impossible Foods. The Very Good Food Company boasts that it has a gross margin of 42% compared to Beyond Meat’s gross margin of 29.7%. However, these statements are misleading as the two companies operate on a totally different scale. The Very Good Food Company is still at the “start-up” stage with total assets of $6.8 million. This includes a cash balance of $3.5 million. I suspect the company would have to do many more equity raises in the future as it pursues its aggressive expansion plans.

I can see massive potential in this business. The framework of a successful company is all there. While subject to one’s personal taste, the product itself has had solid reviews. The company can follow in the playbook of Beyond Meat and Impossible Foods and start partnering with large groceries and restaurants. Alternatively, the company can go at it on its own as it already has a successful template for a restaurant/ deli business or e-commerce store. Whether or not the company achieves this will all boil down to the execution capability of management.

In terms of valuation, forecasting the company’s annual revenue by annualizing Q2 2020 revenue gives us revenue of $4.4 million against a market cap of $249 million. This implies a price to sales ratio of 56.8x which is on the expensive side. Take note though that the company is coming from a relatively low base and that we could see revenue explode as the company expands its geographical reach outside of Western Canada. Furthermore, alternative meat is forecasted to have a TAM of $30.9 billion in 2026 giving the company plenty of room to grow. While there may be other plant-based burger and the competition in that space is heating up, most of these products don’t taste that good.

The Very Good Food Company might have a winning formula as it has quite the following in Canada. Investing in this company is almost like investing in a stage 1 biotech firm in that it would either flame out or be very successful. I think they have all the ingredients for success. I have the company as a very high risk, very speculative buy.

Key Risks:

1. As mentioned above, this will all boil down to execution risk and management's capability. Running a single restaurant and production facility is radically different from running multiple production facilities targeting national distribution in the US/ Canada.

There are still some questions on how scaling would affect product quality and operations. For example, are there a lot of manual processes in place? How will the company ensure that quality is consistently at a high level? There is some pain involved in scaling operations. Just ask Tesla (TSLA).

2. The company might need to raise more capital to expand as it only has Total Assets of $6.8 million. Valuation is also pretty expensive considering the company's existing operations.

3. The company faces competition from much larger and better financed firms such as Beyond Meat and Impossible Foods. These companies already have brand recognition and partnerships in place making it potentially difficult for The Very Good Food Company to break into the industry.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in VRYYF over the next 72 hours.I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Caveat emptor! (Buyer beware.) Please do your own proper due diligence on any stock directly or indirectly mentioned in this article. You probably should seek advice from a broker or financial adviser before making any investment decisions. I don't know you or your specific circumstances, therefore, your tolerance and suitability to take risk may differ. This article should be considered general information, and not relied on as a formal investment recommendation.